Amend Complete Repair

Description

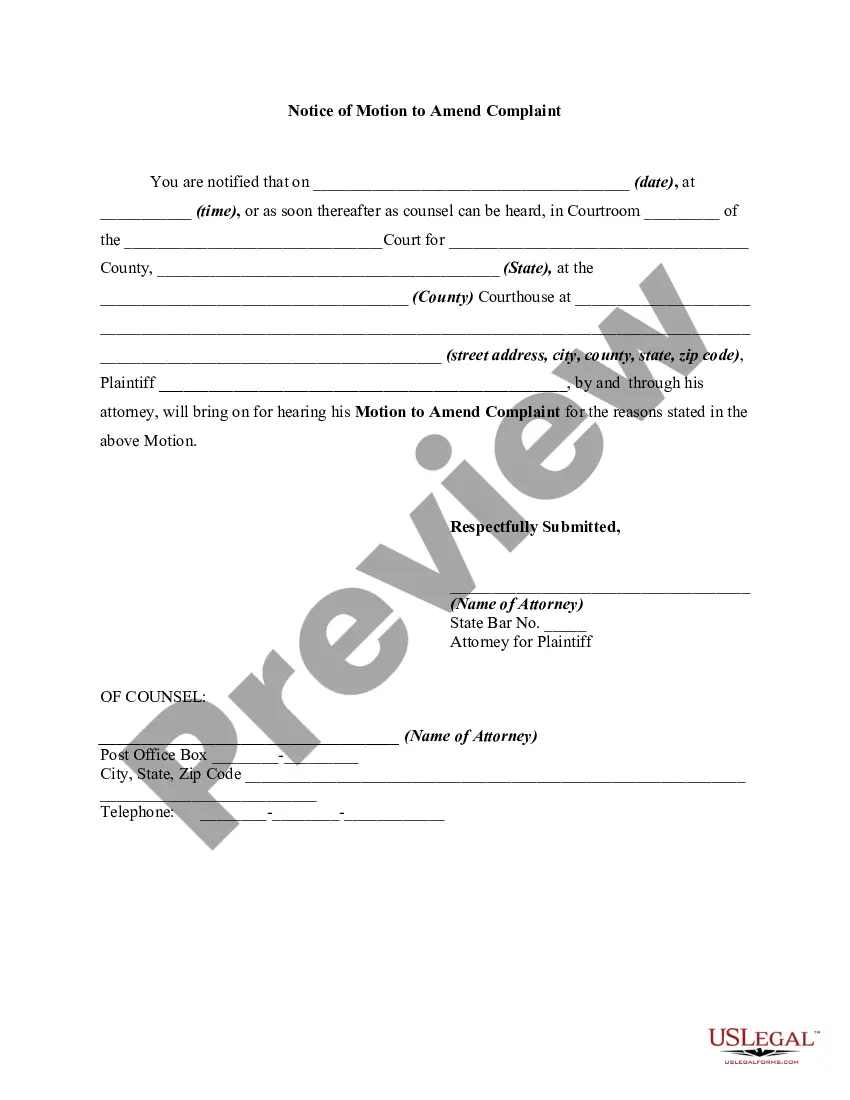

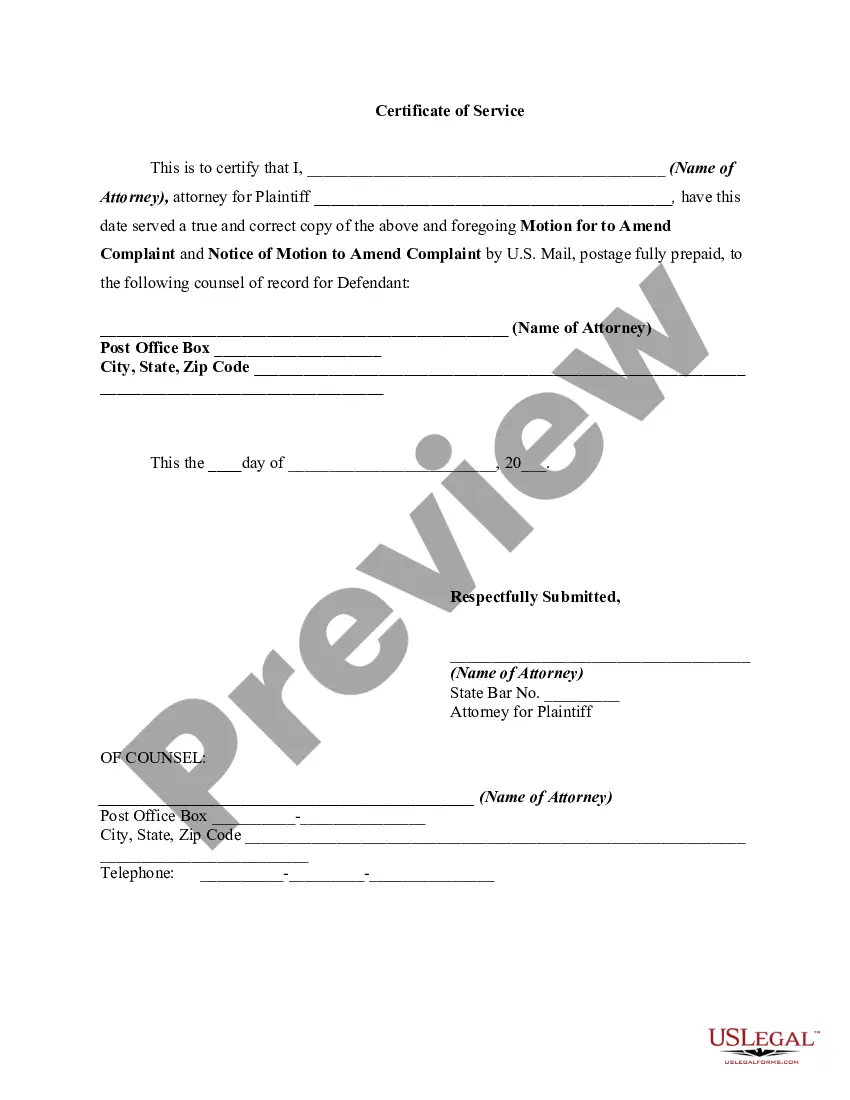

How to fill out Simple Motion To Amend Complaint And Notice Of Motion?

- If you're a returning user, log in to your account and download your desired form template by clicking the 'Download' button. Ensure your subscription is active; renew if necessary.

- For first-time users, start by previewing the form descriptions. Confirm that you've selected the correct template that aligns with your needs and local jurisdiction.

- If you identify inconsistencies, utilize the search feature to find the appropriate form. Select the right document to continue.

- Purchase the form by clicking 'Buy Now' and select a subscription plan that suits you. You’ll need to register an account for complete access.

- Complete your purchase by entering your payment details or logging in with your PayPal account.

- Finally, download your completed form. You can save it to your device and keep it accessible via the 'My Forms' section of your account.

By following these steps, you'll have the tools you need to amend complete repair documents quickly and accurately. US Legal Forms not only provides a robust selection of forms but also offers the support of premium experts to ensure your documents are legally sound.

Don't hesitate; streamline your paperwork process today by visiting US Legal Forms!

Form popularity

FAQ

The best way to amend your tax return involves gathering all relevant documents and using the correct form for amendments. Make sure to follow IRS guidelines carefully, ensuring that each change is clearly explained. To navigate this process smoothly and ensure accuracy, consider leveraging the resources available through USLegalForms, which specializes in guiding users on how to amend complete repair correctly.

Yes, many tax software programs now allow you to file an amended return electronically, making the process easier and quicker. However, not all forms qualify for electronic submission, so it's wise to verify this before proceeding. Services like USLegalForms offer user-friendly options and instructions that can help you understand how to amend complete repair electronically.

Filing an amended tax return does not inherently trigger an audit, but it can certainly prompt one if the changes raise red flags for the IRS. Factors like a significant refund or unusual deductions may be examined more closely. To ensure accuracy and compliance while amending your return, consider using USLegalForms, which can help you through the entire process of how to amend complete repair.

Generally, there is no penalty for filing an amended return if you are increasing your tax liability; in fact, it can help you avoid future issues. However, if you amend and end up owing additional taxes, you might be subject to interest or penalties. It’s important to stay informed, and platforms like USLegalForms can provide insights into your particular situation regarding how to amend complete repair.

To file an amended return effectively, start by obtaining the correct form for your tax year. Then, ensure that you provide all necessary information, addressing the specific changes that need adjustment. Many users find that utilizing a reliable service like USLegalForms can simplify this process, guiding you on how to amend complete repair accurately.

To file for the recovery rebate credit, you need to fill out the 1040 or 1040-SR and claim your credit based on your eligibility. Ensure you include any necessary documentation that supports your claim, as this strengthens your application. By following these steps, you achieve an amend complete repair to your financial documentation for the IRS.

Changing your filing status on a 1040X form involves entering your original status and selecting the new status on the form. Along with this change, provide a brief explanation in Part III detailing the reasons for your amendment. This approach ensures an amend complete repair, updating your tax situation correctly with the IRS.

To fill out the 1040X amended tax return, start by entering your basic personal information at the top of the form. Then, accurately report your original numbers, followed by any changes in the applicable sections. This clear documentation helps secure an amend complete repair, supporting the changes you've made effectively.

Yes, the IRS provides a worksheet specifically for the recovery rebate credit. You can use this worksheet to calculate your eligibility and the amount you are entitled to claim. Utilizing such resources aids in making an amend complete repair to your tax return, ensuring correct calculations.

Filling out a 1040X form for stimulus payments involves listing your original amounts and indicating the changes you are making. Make sure to reference the correct line items that associate with the stimulus payment and explain any discrepancies. By following these guidelines, you effectively achieve an amend complete repair, allowing the IRS to understand your situation better.