Amend By J^p^n

Description

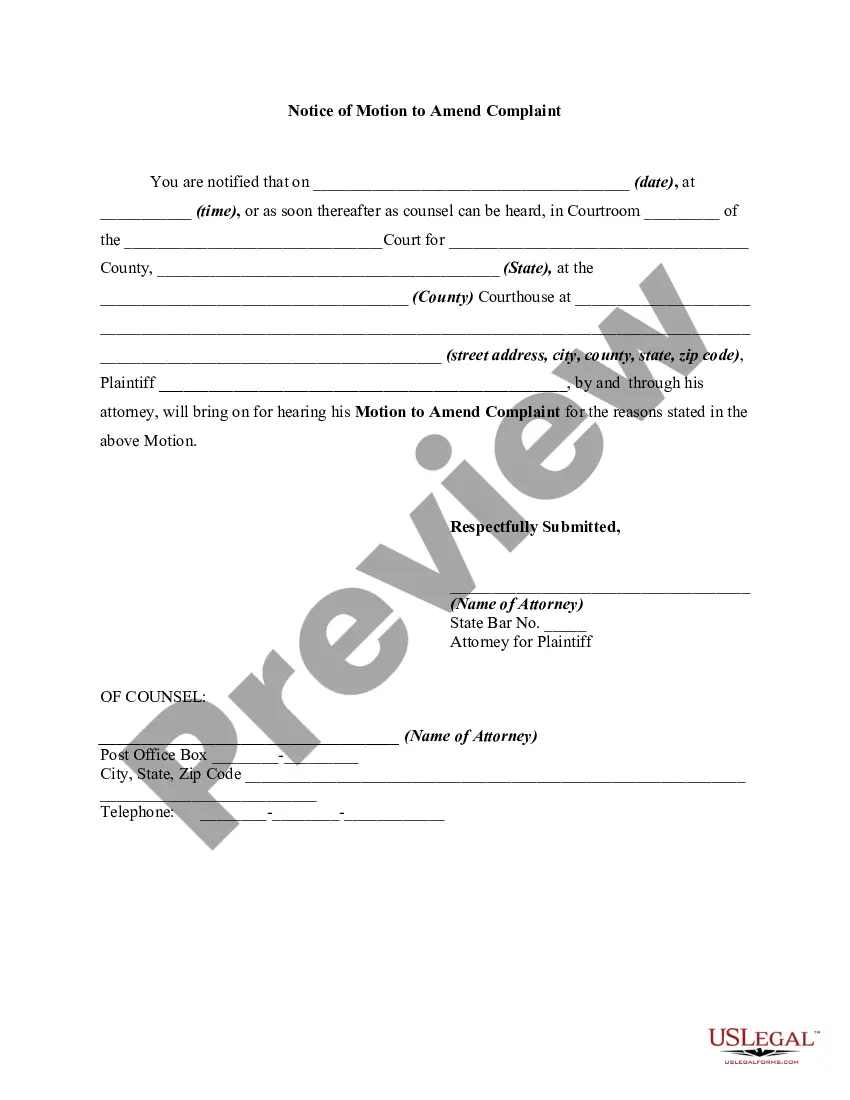

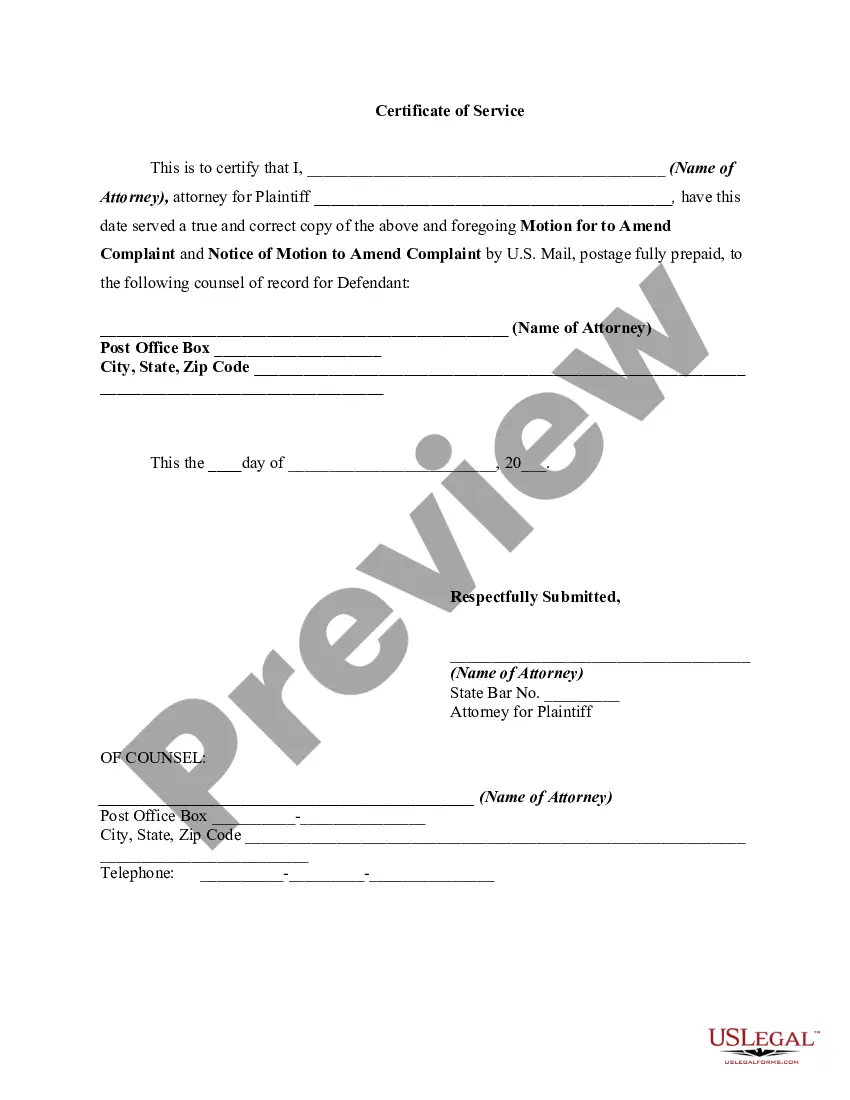

How to fill out Simple Motion To Amend Complaint And Notice Of Motion?

- If you're a returning user, log in to your account and locate the form template you wish to download from your profile by clicking the Download button. Verify that your subscription is active; otherwise, renew it based on your plan.

- For first-time users, begin by checking the Preview mode and the description of the form. Ensure it aligns with your needs and adheres to local jurisdiction requirements.

- If necessary, search for alternative templates by using the Search tab above to find the best fit. Once you find the correct form, proceed to the next step.

- Purchase the document by clicking on the Buy Now button, selecting your preferred subscription plan, and creating an account for library access.

- Complete your purchase by entering credit card information or using your PayPal account to finalize the subscription.

- Download the form and save it on your device, granting you access to it anytime through the My Forms menu.

By following these steps, you can efficiently navigate through US Legal Forms and ensure that your legal documentation is thorough and precise. The extensive library and expert support provided by the platform simplify the process, making it easier for anyone to access and utilize legal forms effectively.

Start your journey towards hassle-free legal document management today by visiting US Legal Forms!

Form popularity

FAQ

Generally, filing an amended tax return does not incur a penalty unless you owe additional taxes. It’s essential to file your amendment promptly to avoid issues with interest or penalties on unpaid taxes. UsLegalForms can assist you in navigating these complexities, helping you understand any potential implications of filing your amended return.

The best way to file an amended return depends on your situation, but starting by determining whether you can file electronically is key. For those who must mail their amended return, using a guided service like UsLegalForms can reduce errors. Always keep copies of your original return and the amendment for your records to ensure thoroughness.

Yes, the IRS is now allowing certain taxpayers to file their Form 1040X electronically, but eligibility varies. This shift makes it easier for many to amend their returns without the hassle of mailing. Explore UsLegalForms for resources that help you prepare Form 1040X in compliance with IRS standards, ensuring a smooth filing process.

TurboTax does provide a feature to file amended tax returns electronically for specific tax years. To take advantage of this option, you must follow TurboTax's instructions to ensure your amendment is correctly submitted. If you encounter challenges, consider using UsLegalForms for a clear and guided process to file your amendment effectively.

Yes, you can electronically file an amended return if your tax software allows it and is compatible with the IRS's requirements. However, many taxpayers still need to file their amended returns via mail. Always check with your tax software provider or UsLegalForms for guidance on your specific situation regarding electronic filing of amendments.

Currently, some taxpayers can file their amended returns electronically, but this depends on various factors including the tax software used. It’s important to verify if your software supports electronic filing for amended returns. Using UsLegalForms can simplify the process, ensuring you meet all necessary criteria to file electronically when available.

Yes, typically, amended tax returns must be mailed to the IRS. Unlike regular returns, amended returns cannot be filed electronically in all situations. However, it’s essential to check the latest IRS guidelines as they may change. With UsLegalForms, you can easily prepare your amended return to ensure accuracy before mailing.