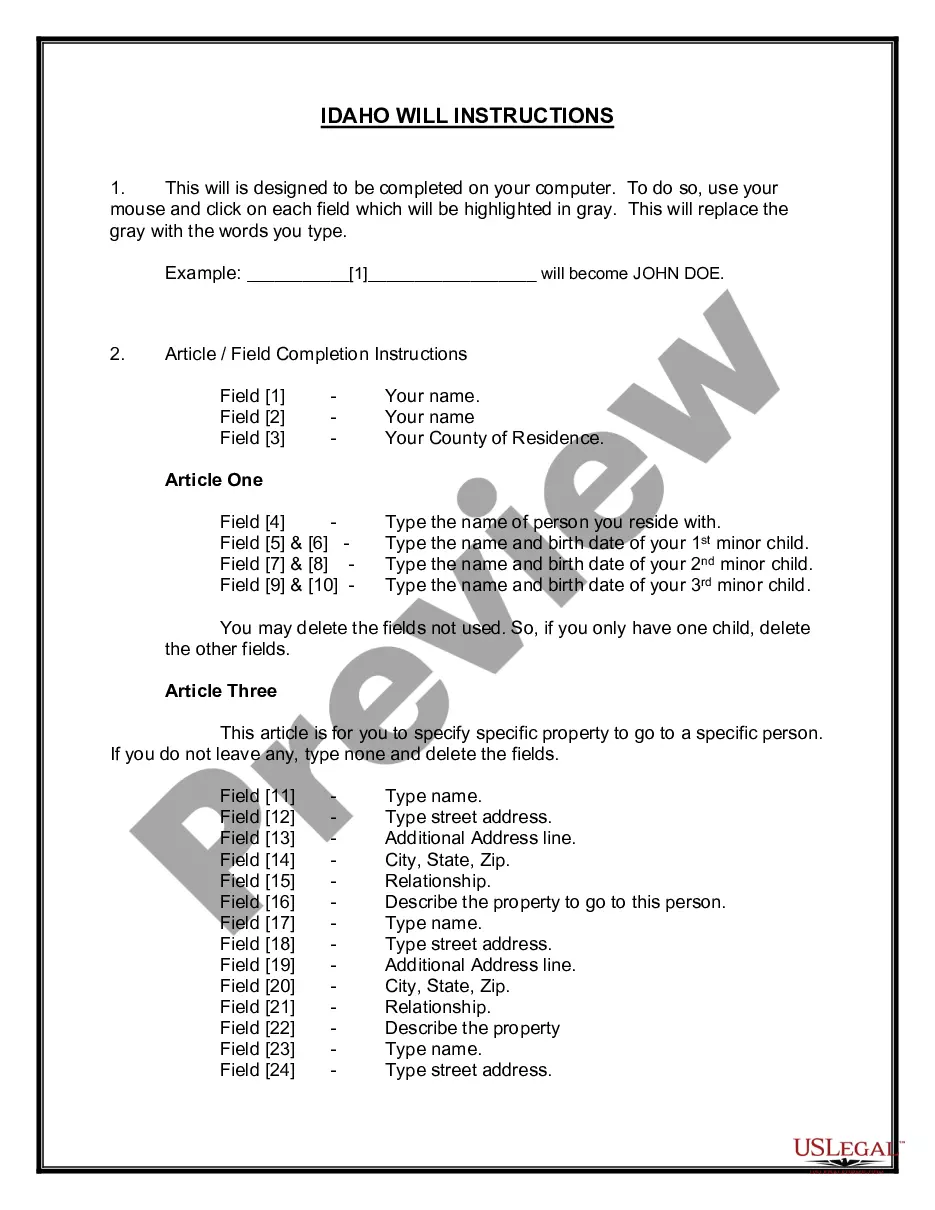

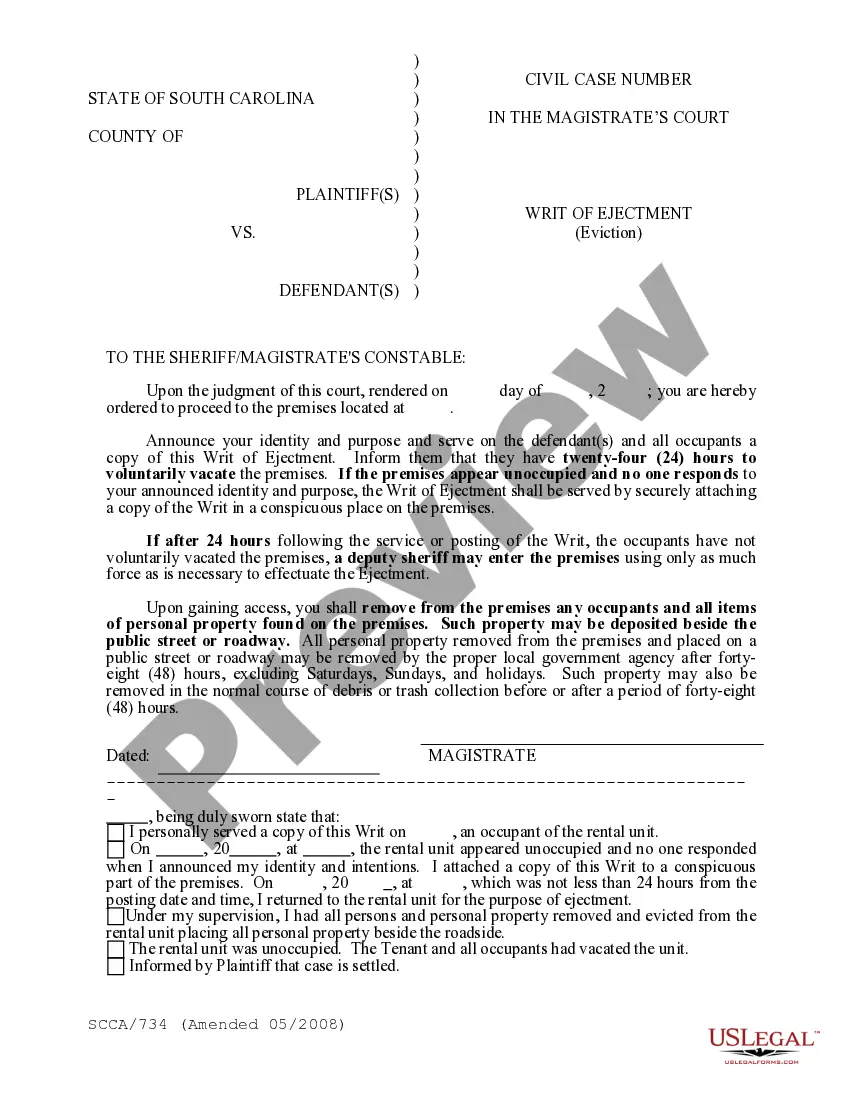

Completion Instructions

Description

How to fill out Notice By Owner Of Completion Of Construction Work?

It’s clear that you can’t transform into a legal expert instantly, nor can you quickly learn how to prepare Completion Instructions without possessing a unique skill set.

Assembling legal documents is an extended process that necessitates specific education and expertise.

So why not entrust the development of the Completion Instructions to the professionals.

Preview it (if this option is available) and review the supporting description to ascertain whether Completion Instructions is what you want.

If you need a different template, restart your search.

- With US Legal Forms, one of the most extensive legal template collections, you can find anything from court documents to templates for internal business communication.

- We understand the significance of compliance and adherence to federal and state laws and regulations.

- That’s why, on our platform, all forms are location-based and current.

- Here’s how to begin on our website and acquire the document you need in just a few minutes.

- Identify the document you need using the search bar at the top of the page.

Form popularity

FAQ

All employers must complete and retain Form I-9, Employment Eligibility Verification, for every person they hire for employment after Nov. 6, 1986, in the U.S. as long as the person works for pay or other type of payment.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

9 Form Instructions Line 1 ? Name. This should be your full name. ... Line 2 ? Business name. ... Line 3 ? Federal tax classification. ... Line 4 ? Exemptions. ... Lines 5 & 6 ? Address, city, state, and ZIP code. ... Line 7 ? Account number(s) ... Part I ? Taxpayer Identification Number (TIN) ... Part II ? Certification.

How to fill out a W-9 Enter your name. Write or type your full legal name as shown on your tax return. Enter your business name. ... Choose your federal tax classification. ... Choose your exemptions. ... Enter your street address. ... Enter the rest of your address. ... Enter your requester's information.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).