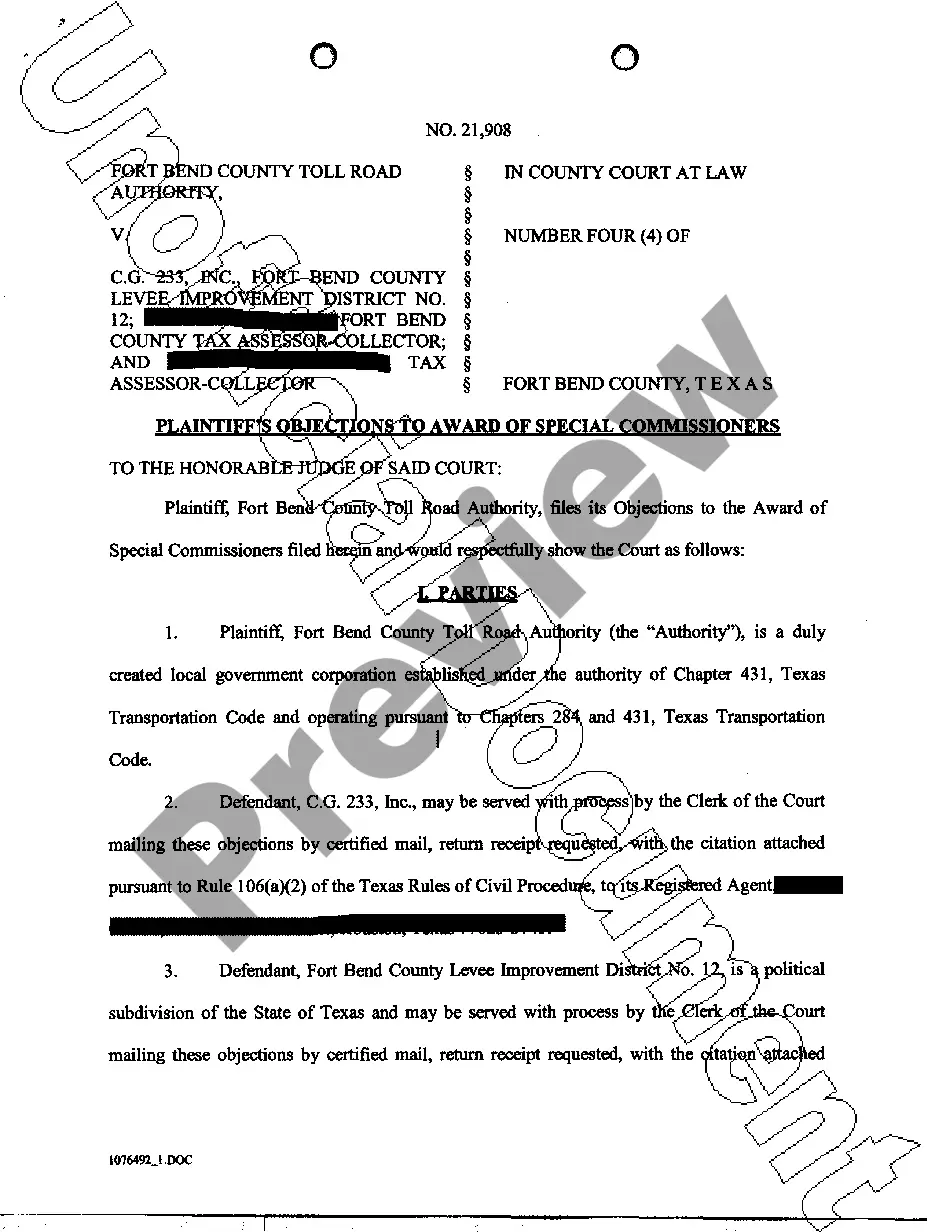

Notice Owner Lien Form Texas

Description

How to fill out Pre-Lien Notice To Owner Regarding Potential Mechanic's Lien For Services To Be Provided To General Contractor?

Managing legal documentation and processes can be a lengthy addition to your whole day.

The Notice Owner Lien Form Texas and similar documents typically require you to locate them and comprehend the best methods to fill them out accurately.

Thus, whether you are addressing financial, legal, or personal issues, utilizing a thorough and efficient online directory of forms readily available will be highly beneficial.

US Legal Forms is the premier online service for legal documents, featuring over 85,000 state-specific forms and numerous resources to help you finalize your paperwork swiftly.

Is this your initial time using US Legal Forms? Register and create an account quickly, and you will have access to the form directory and Notice Owner Lien Form Texas. Next, follow the steps outlined below to complete your form.

- Browse through the collection of relevant documents accessible to you with a single click.

- US Legal Forms offers state- and county-specific documents available for download at any time.

- Ensure your document management processes are safeguarded with a premium service that enables you to assemble any form within minutes without hidden fees.

- Simply Log Into your account, find Notice Owner Lien Form Texas, and obtain it instantly from the My documents section.

- You can also access previously stored forms.

Form popularity

FAQ

Yes, it's possible for someone to place a lien on your property without your immediate knowledge in Texas. When a creditor files a Notice Owner Lien Form Texas, they may not always notify you directly. This situation can happen, especially when the creditor believes they have a legal reason to claim the lien. To protect yourself, stay informed about any legal claims involving your property and utilize tools like USLegalForms to help manage and respond to such situations effectively.

Because a notice of intent to file a lien (in Texas) alerts the general contractor or owner that you are not being paid for your work and could publicly file a lien against the property in order to collect.

Even though sending a Notice of Intent to Lien is an optional (not required) step in the state of Texas, they are frequently successful at producing payment (without having to take the next step of filing a lien).

In order to file a Lien against a residential homestead Property, either you, or the General Contractor must: (1) have a written contract signed by the Property Owner (if they are a married couple, then both must sign the contract); (2) before the work begins; and (3) the contract must be filed with the County Clerk.

How does a creditor go about getting a judgment lien in Texas? To attach the lien, the creditor files the judgment with the county clerk in any Texas county where the debtor has real estate now (a home, land, etc.) or may have real estate in the future.

In Texas, the notice of intent to lien must be sent by USPS certified mail, or any other form of traceable delivery that confirms proof of receipt (keep the receipt for your records). The notice must go to both the owner of the property and the general contractor.