Real Estate Lien Release Form

Description

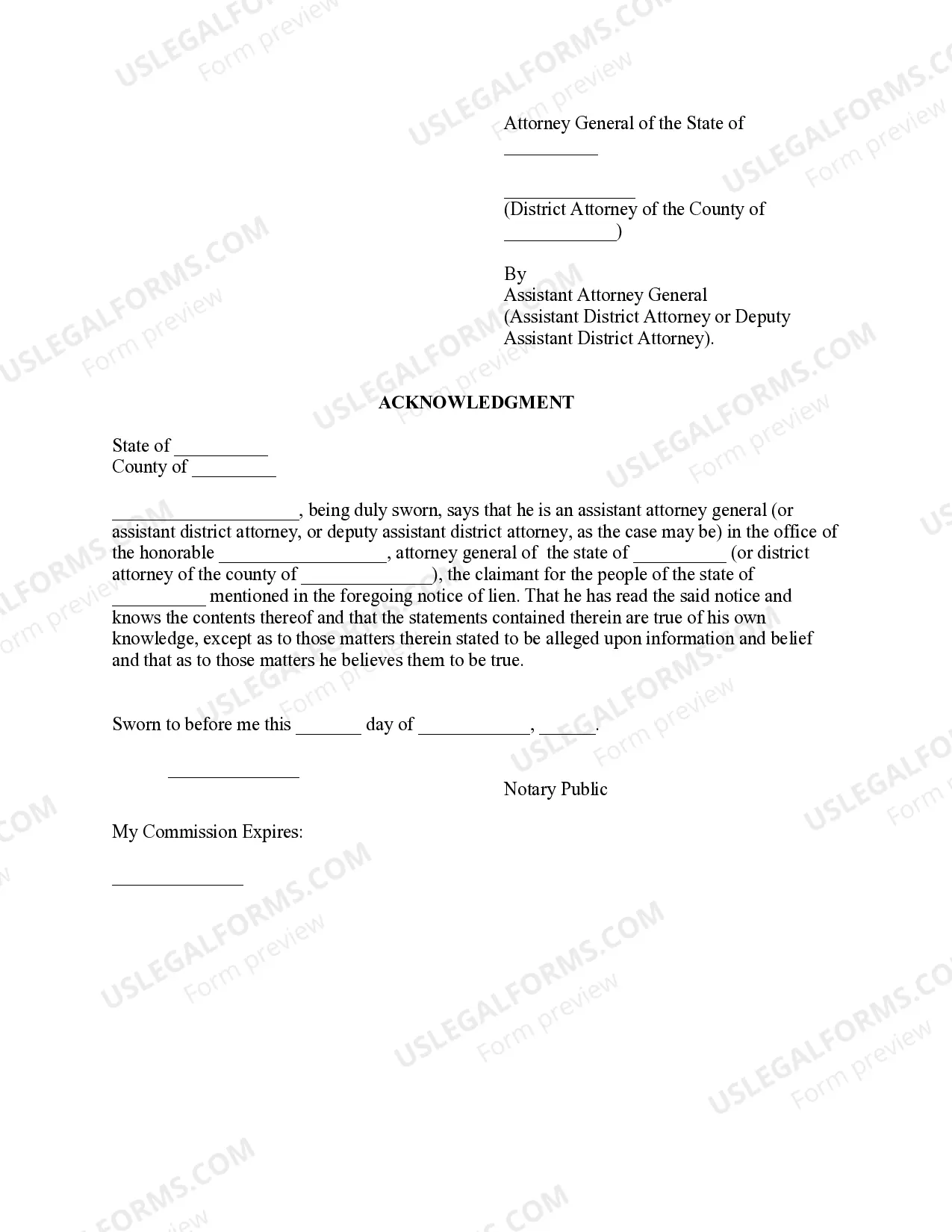

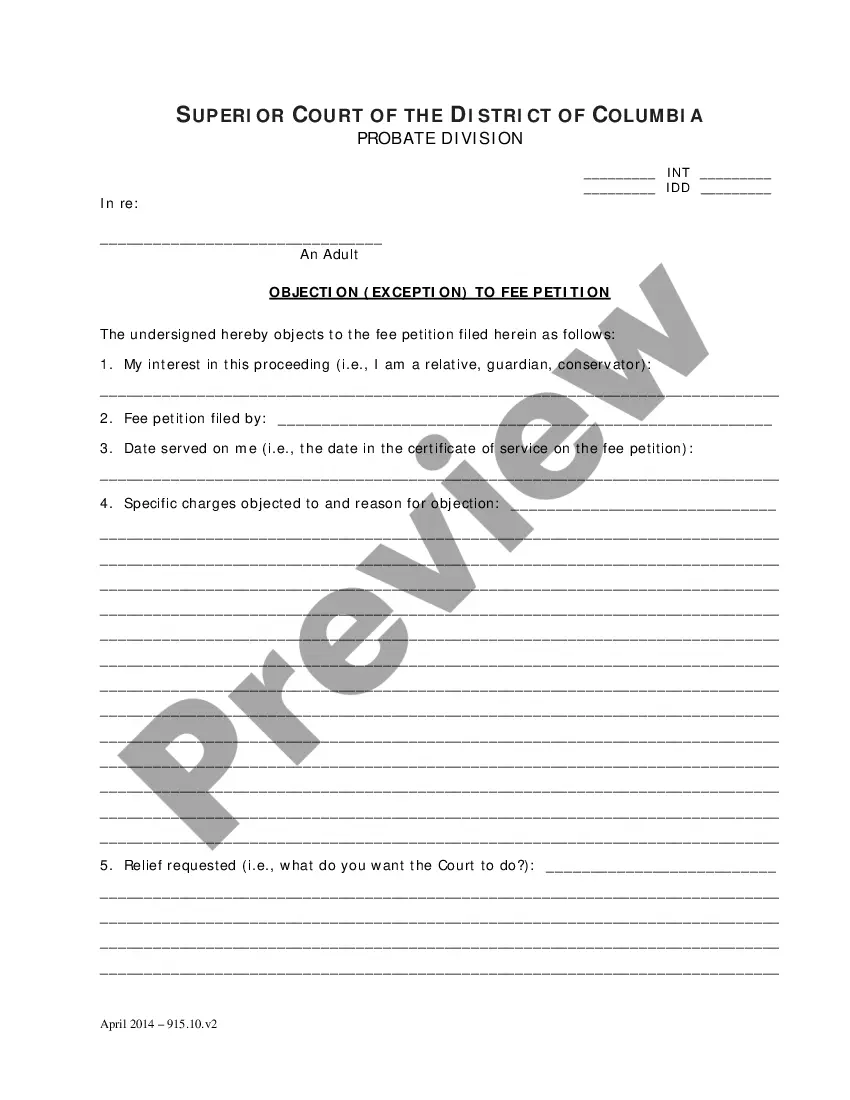

How to fill out Notice Of Lien On Real Estate For Criminal Bond?

Individuals typically link legal documentation with a complex process that only an expert can handle.

In a sense, this is accurate, as creating a Real Estate Lien Release Form demands a significant grasp of the relevant criteria, including state and county laws.

Nonetheless, with US Legal Forms, everything has become simpler: pre-made legal templates for various life and business scenarios specific to state laws are gathered in a single online repository and are now accessible to everyone.

Make your payment through PayPal or with a credit card. Choose the format for your template and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our library are reusable: after purchase, they are saved in your profile. You can access them anytime through the My documents tab. Explore all the benefits of using the US Legal Forms platform. Sign up today!

- US Legal Forms offers over 85,000 current forms categorized by state and area of application, so locating a Real Estate Lien Release Form or any other specific template just takes a few minutes.

- Previously registered users with an active subscription must sign in to their accounts and click Download to access the form.

- New users to the service will need to first create an account and subscribe before they can store any paperwork.

- Here is a detailed guide on how to obtain the Real Estate Lien Release Form.

- Review the page content carefully to ensure it meets your requirements.

- Read the form summary or check it using the Preview option.

- If the previous form does not meet your needs, search for another sample using the Search bar in the header.

- Click Buy Now when you locate the appropriate Real Estate Lien Release Form.

- Select a pricing plan that aligns with your needs and budget.

- Create an account or Log In to proceed to the payment section.

Form popularity

FAQ

Florida statutory lien waivers are not required to be notarized, and gain no practical benefit from notarization.

Property lien removal processMake sure the debt the lien represents is valid.Pay off the debt.Fill out a release-of-lien form.Have the lien holder sign the release-of-lien form in front of a notary.File the lien release form.Ask for a lien waiver, if appropriate.Keep a copy.

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

Judgment liens in Texas expire after ten years, as do federal tax liens, and both stay attached to the property even it if changes owners. A mortgage lien remains valid on a property until the debt is paid in full. Also, many liens may be renewed before they expire.

In Texas, a release must be filed to clear a deed of trust from title to real property after a loan has been repaid or otherwise satisfied. The payment or other satisfaction of the debt extinguishes the encumbrance, but a recorded release is required to remove the lien as a cloud on title (Ellis v. Waldrop, 656 S.W.