Retaining Consulting With 100

Description

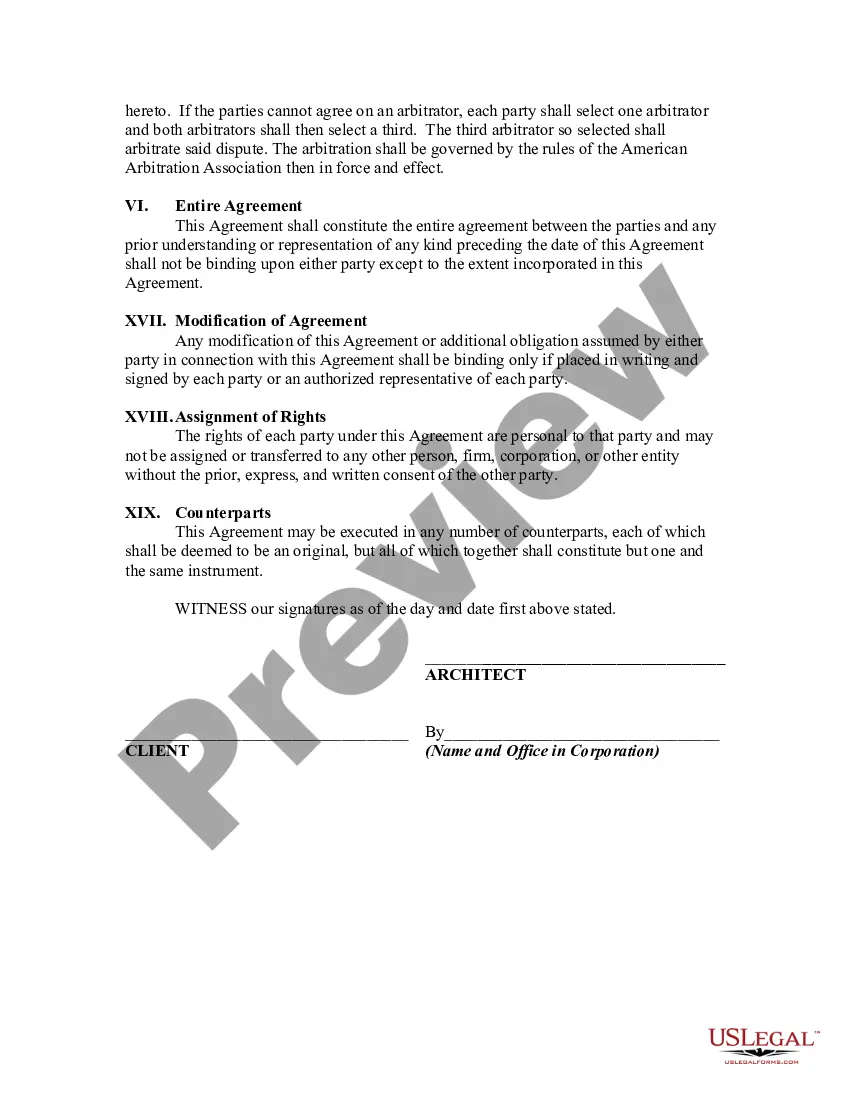

How to fill out Agreement Or Contract Retaining Architect For Consulting Purposes?

Finding a go-to place to take the most recent and appropriate legal samples is half the struggle of dealing with bureaucracy. Finding the right legal files demands precision and attention to detail, which is why it is very important to take samples of Retaining Consulting With 100 only from reputable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You may access and see all the information regarding the document’s use and relevance for your situation and in your state or county.

Consider the listed steps to finish your Retaining Consulting With 100:

- Utilize the catalog navigation or search field to find your template.

- Open the form’s information to check if it matches the requirements of your state and region.

- Open the form preview, if available, to make sure the form is the one you are interested in.

- Go back to the search and find the proper document if the Retaining Consulting With 100 does not match your needs.

- If you are positive about the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Select the pricing plan that fits your needs.

- Go on to the registration to complete your purchase.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Retaining Consulting With 100.

- Once you have the form on your gadget, you may modify it using the editor or print it and complete it manually.

Get rid of the inconvenience that comes with your legal documentation. Explore the comprehensive US Legal Forms collection where you can find legal samples, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

A retainer fee is a sum that a client pays to a consultant to secure their services. Clients usually pay these fees upfront before consulting services begin. Although many consultants require full payment before they begin working, a retainer fee can also be a small sum that clients pay to secure service.

You must file Form 1040 or Form 1040-SR as a self-employed consultant. You must attach Schedule C on which you've figured out your net profit or loss after accounting for deductible business expenses. Be sure to consult a tax attorney about any additional forms that may apply to you.

You must file Form 1040 or Form 1040-SR as a self-employed consultant. You must attach Schedule C on which you've figured out your net profit or loss after accounting for deductible business expenses. Be sure to consult a tax attorney about any additional forms that may apply to you.

Retainer fees are often based on the rates you would charge under other payment models. For instance, if you charge $100 per hour for your services and typically work 40 hours per week for clients, you would likely look to charge a $4,000 monthly retainer.

What to include in a consultant retainer contract? The project scope, goals, and desired outcomes. Key financial metrics used to determine success. Description of the services you will provide. Whether you are using pay for work or pay for access model. Expected return on investment (ROI) Responsibilities of both parties.