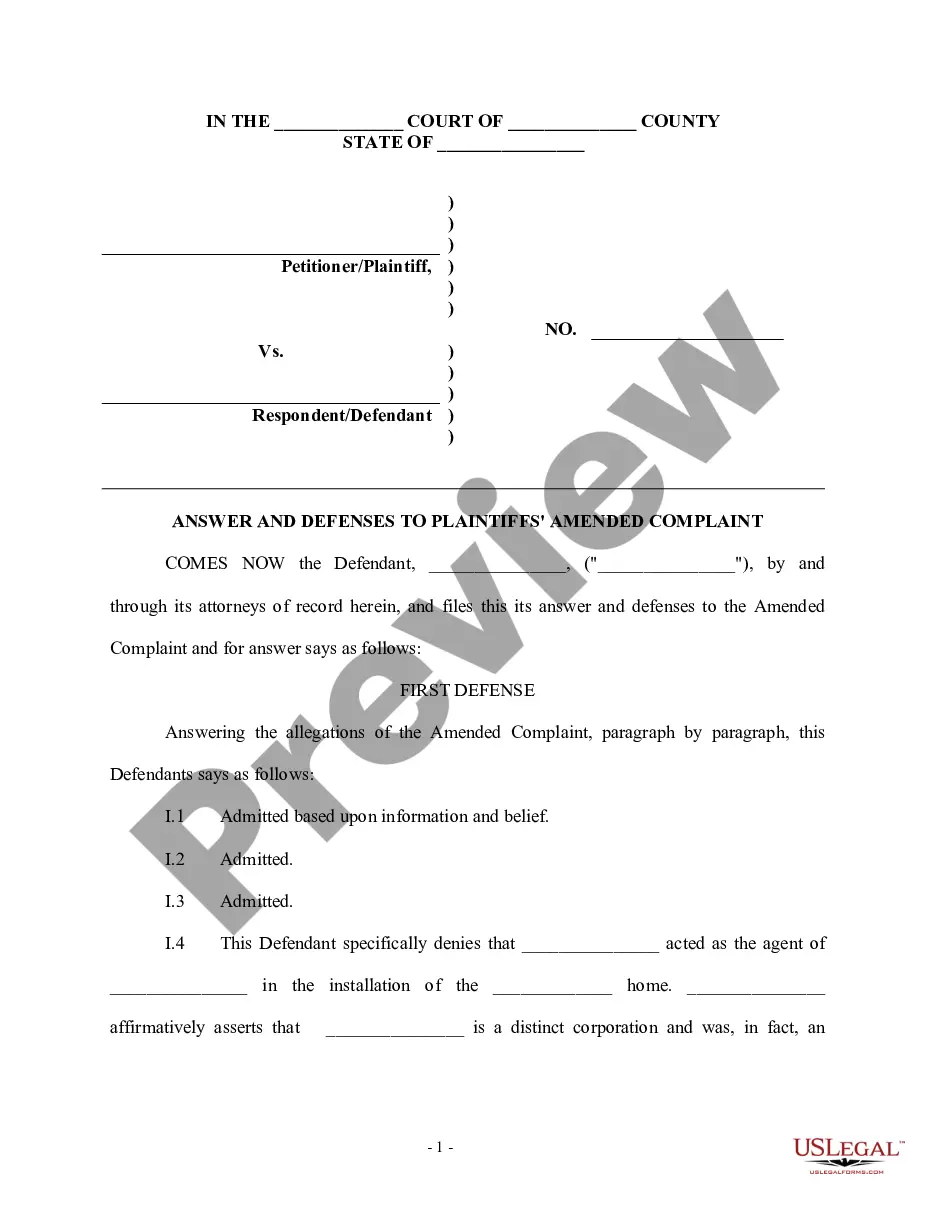

Answer To Debt Collection Lawsuit Example With Example

Description

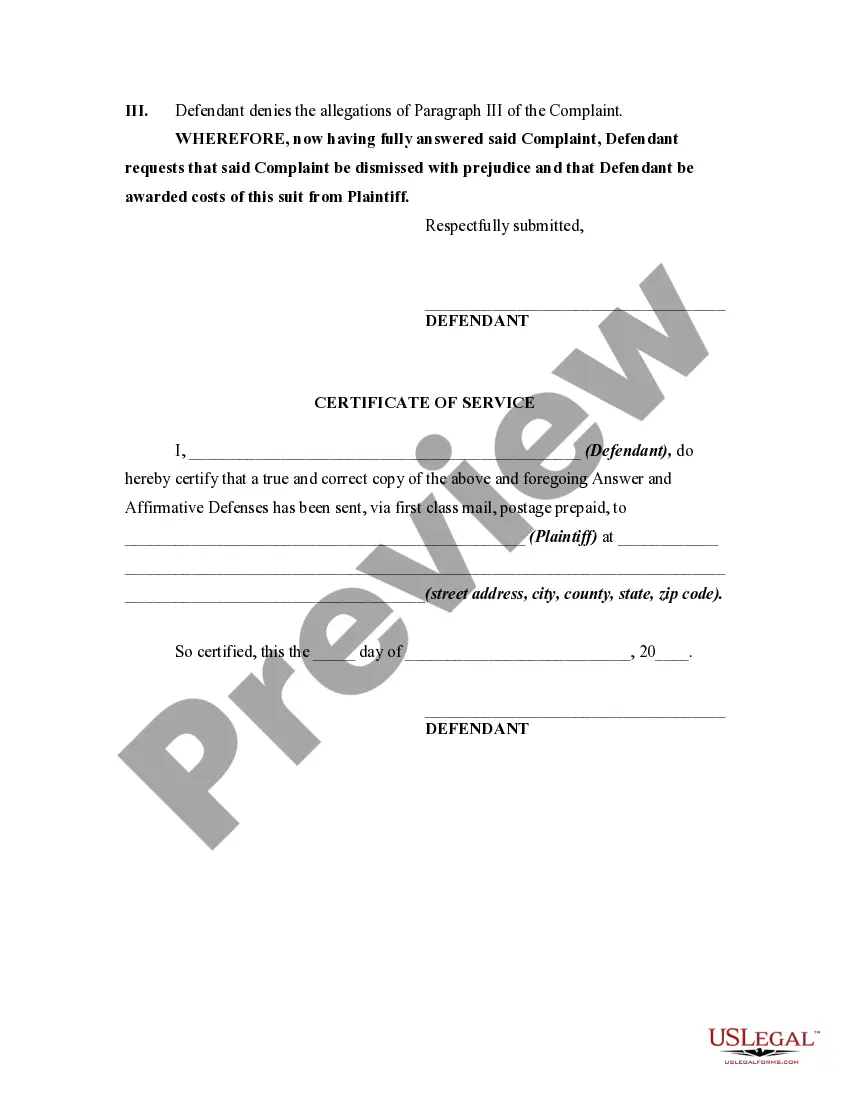

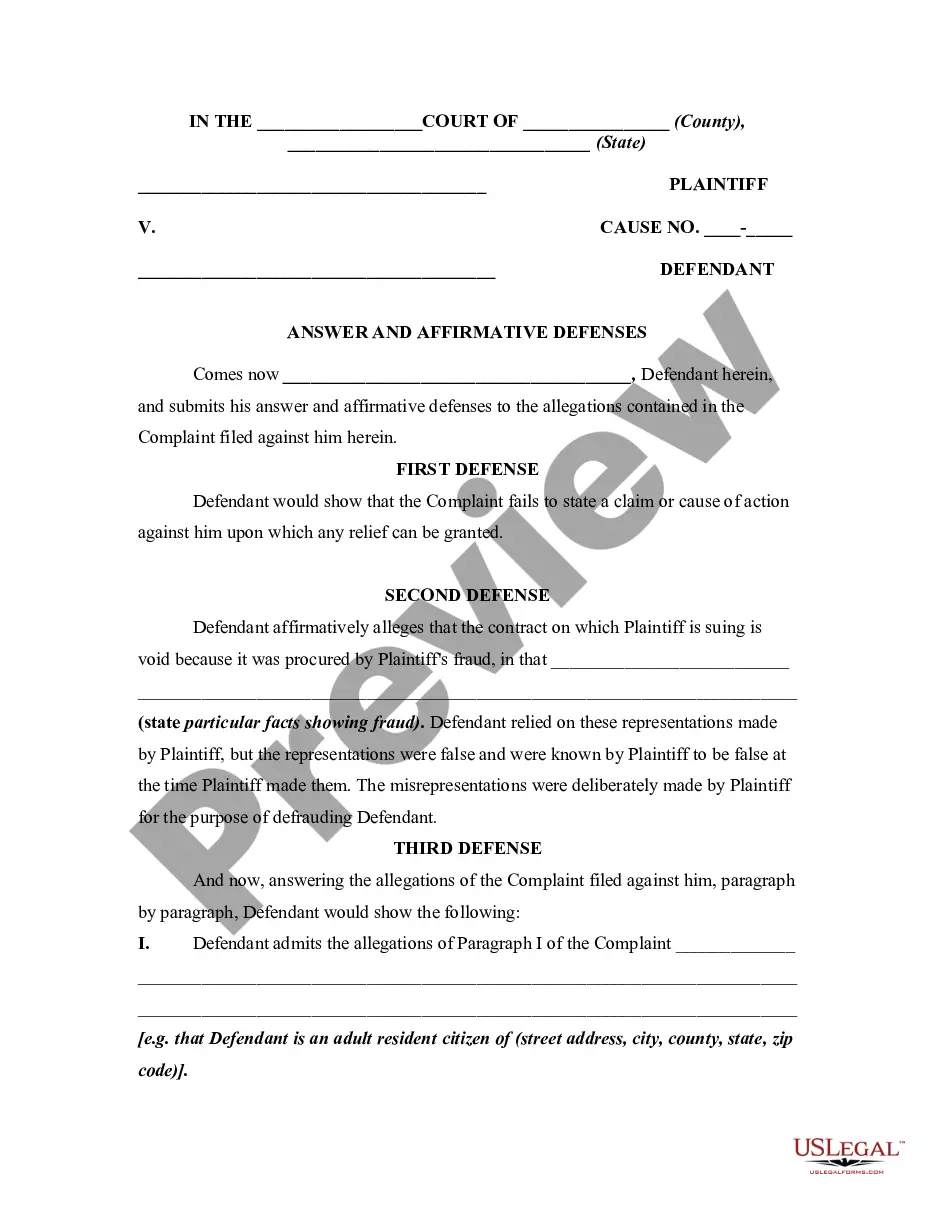

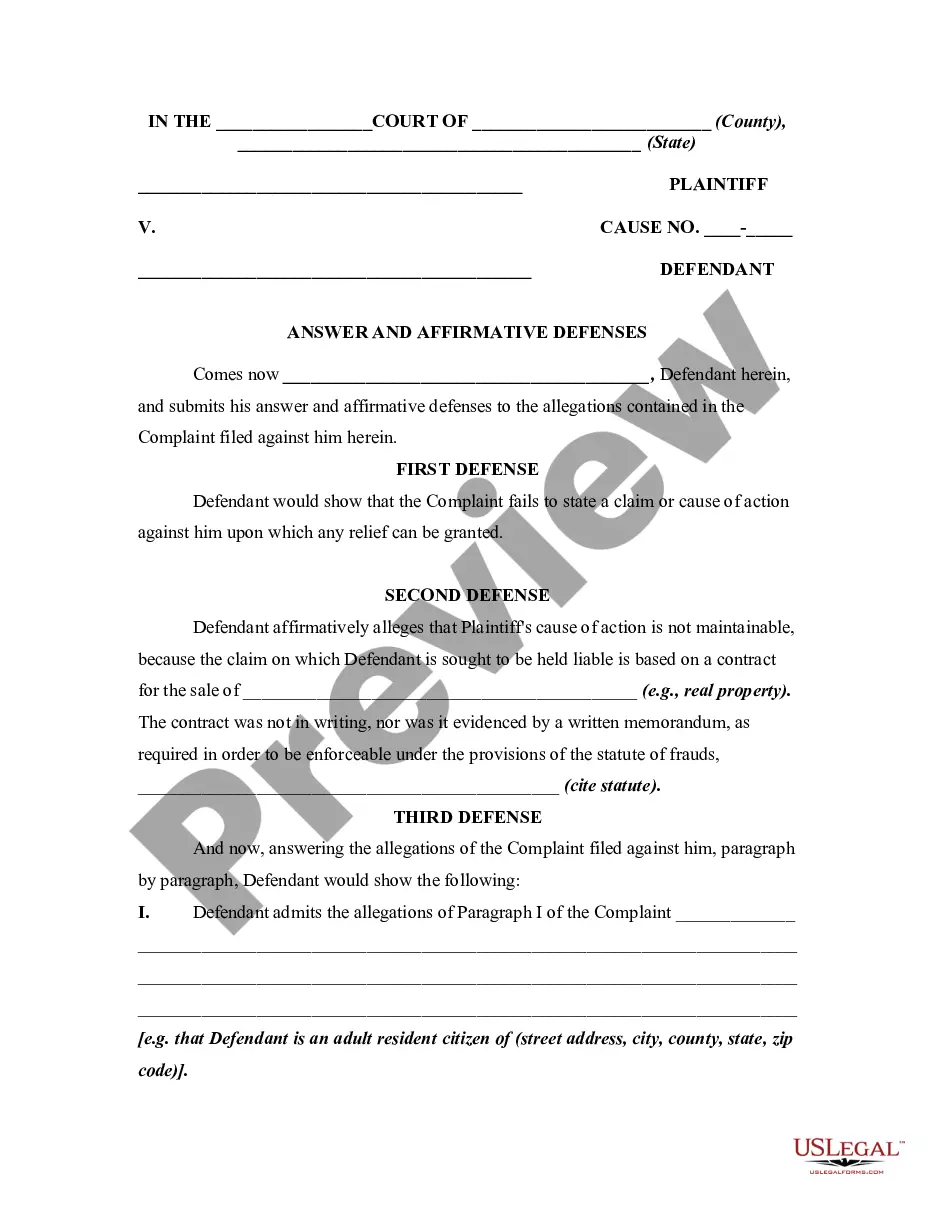

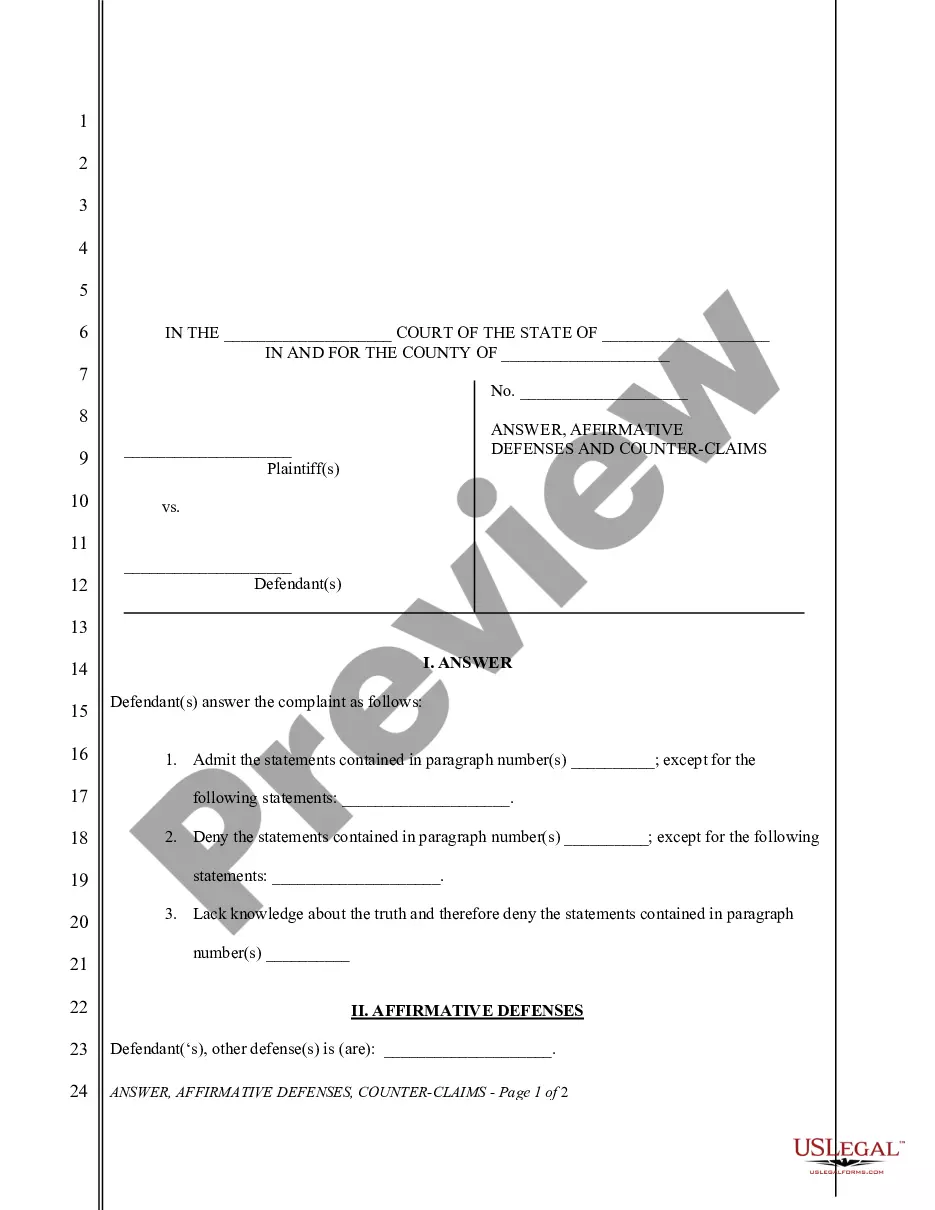

How to fill out General Form Of An Answer By Defendant In A Civil Lawsuit?

The Solution To Debt Collection Lawsuit Template Example On This Page is a reusable legal framework created by expert attorneys in accordance with federal and local laws and regulations. For over 25 years, US Legal Forms has offered individuals, businesses, and legal experts more than 85,000 authenticated, state-specific documents for any business and personal situation. It’s the quickest, easiest, and most reliable method to acquire the paperwork you require, as the service ensures bank-level data security and anti-malware safeguards.

Obtaining this Solution To Debt Collection Lawsuit Template Example will require you only a few straightforward steps.

Subscribe to US Legal Forms to have authenticated legal templates for all of life’s situations available at your fingertips.

- Search for the document you need and review it. Browse through the file you searched and preview it or check the form description to verify it meets your requirements. If it does not, utilize the search bar to find the appropriate one. Click Buy Now once you have found the template you require.

- Register and Log In. Choose the pricing plan that fits you and create an account. Use PayPal or a credit card for a quick transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the fillable template. Select the format you prefer for your Solution To Debt Collection Lawsuit Template Example (PDF, DOCX, RTF) and store the sample on your device.

- Complete and sign the documents. Print the template to fill it out manually. Alternatively, employ an online versatile PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature.

- Download your documents again. Utilize the same document again whenever necessary. Access the My documents section in your profile to redownload any previously acquired forms.

Form popularity

FAQ

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

You contacted me by [phone/mail], on [date] and identified the debt as [any information they gave you about the debt]. I do not have any responsibility for the debt you're trying to collect. If you have good reason to believe that I am responsible for this debt, mail me the documents that make you believe that.

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Explain your current situation and how much you can pay upfront. Also, provide them with a clear description of what you expect in return, such as the removal of missed payments or the account shown as paid in full on your report. Ask for a written confirmation after settling on an agreement.