Answer To Debt Collection Lawsuit Example For Students

Description

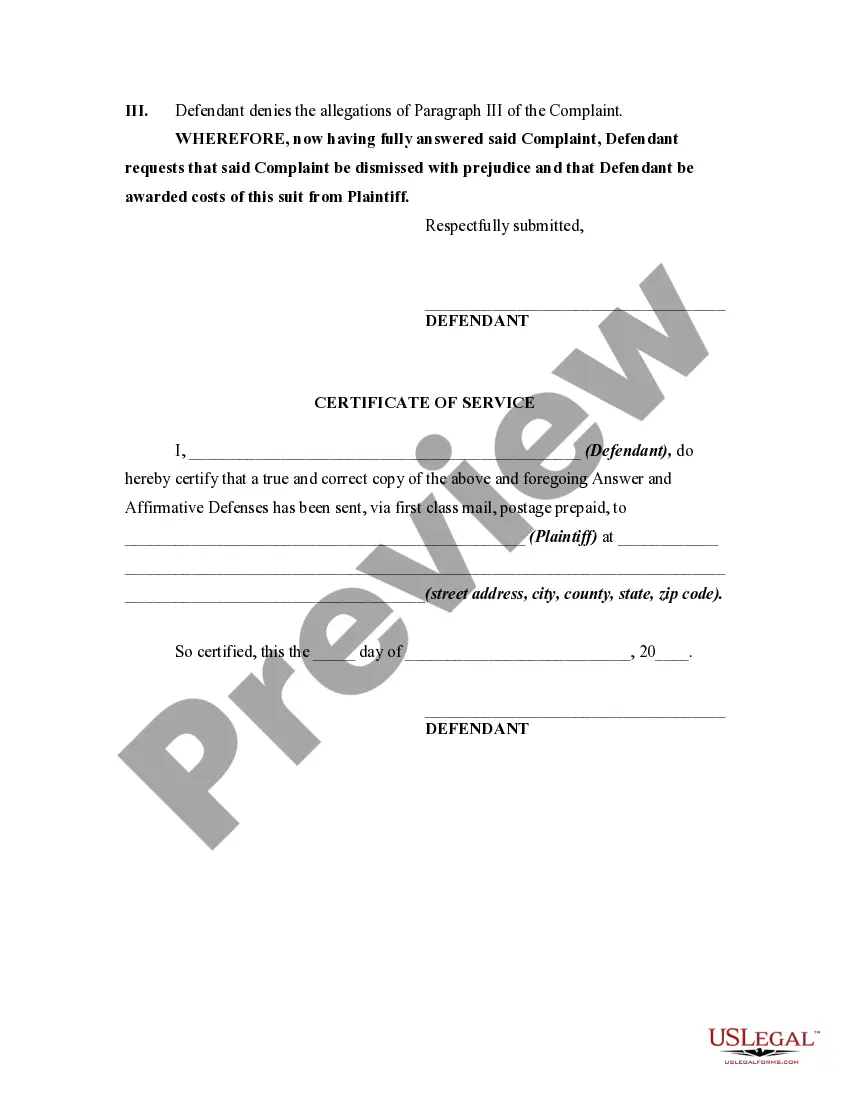

How to fill out General Form Of An Answer By Defendant In A Civil Lawsuit?

Regardless of whether for commercial reasons or personal matters, everyone must confront legal issues at some point in their life.

Completing legal documents requires meticulous care, beginning with selecting the correct template. For instance, if you choose an incorrect version of the Answer To Debt Collection Lawsuit Example For Students, it will be rejected upon submission. Thus, it is essential to obtain a reliable source of legal documents like US Legal Forms.

Once downloaded, you can fill out the form using editing software or print it and complete it by hand. With a vast US Legal Forms catalog available, you don’t need to waste time searching for the right template online. Utilize the library’s straightforward navigation to find the suitable form for any circumstance.

- Acquire the template you need by using the search bar or catalog navigation.

- Review the information of the form to confirm it aligns with your situation, jurisdiction, and area.

- Click on the preview of the form to inspect it.

- If it is the wrong document, return to the search feature to locate the Answer To Debt Collection Lawsuit Example For Students template you require.

- Download the file if it meets your specifications.

- If you already possess a US Legal Forms account, click Log in to retrieve previously saved documents in My documents.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the document format you desire and download the Answer To Debt Collection Lawsuit Example For Students.

Form popularity

FAQ

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

An affirmative defense is a defense that brings up new facts or issues not in the Complaint that, if true, would be a legal reason why the plaintiff should not win, or should win less than they're asking for. It is not a denial that you did what the plaintiff says you did.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.