Answer Civil Sample For Damages Philippines

Description

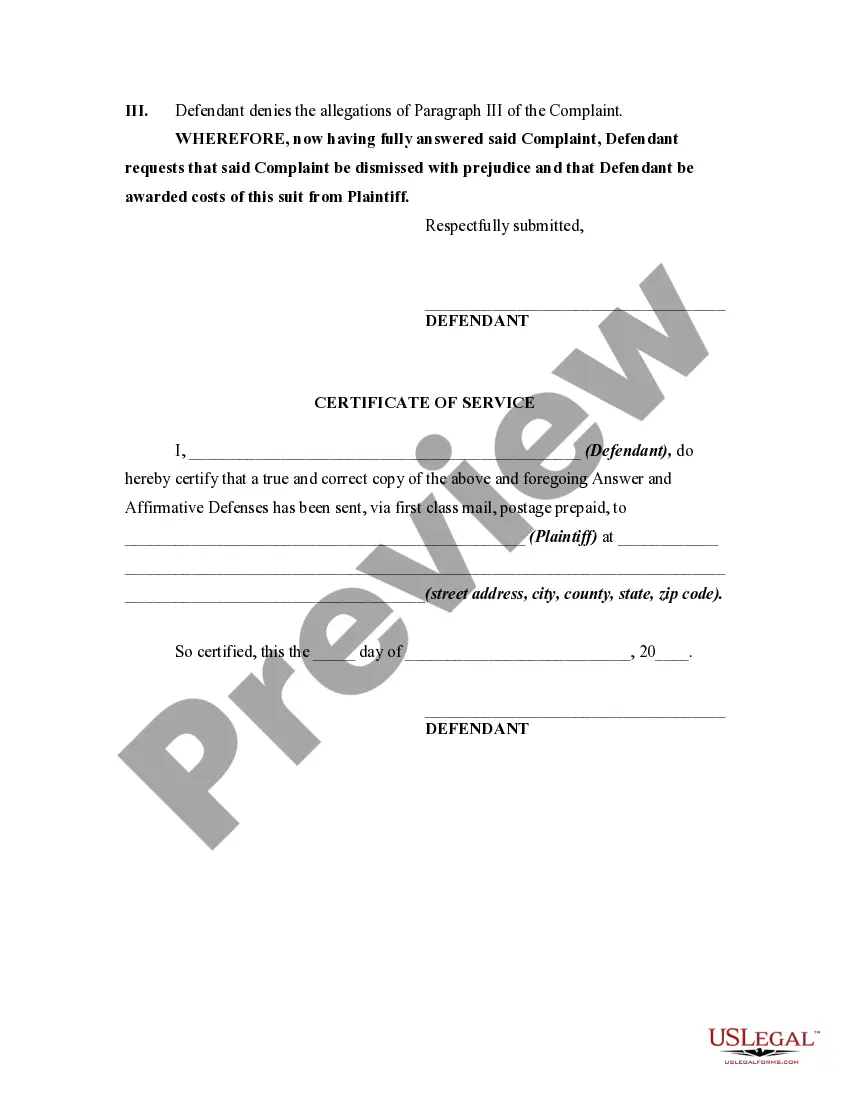

How to fill out General Form Of An Answer By Defendant In A Civil Lawsuit?

Managing legal documents can be daunting, even for seasoned professionals.

If you are seeking an Answer Civil Sample For Damages Philippines and lack the opportunity to search for the suitable and current version, the experience can be stressful.

Gain access to state- or county-specific legal and business documents.

US Legal Forms addresses any requirements you may have, from personal to business paperwork, all in one platform.

If it is your first experience with US Legal Forms, register an account to gain unlimited access to all features of the platform. Here are the steps to follow after finding the document you need.

- Utilize sophisticated tools to complete and manage your Answer Civil Sample For Damages Philippines.

- Access a valuable repository of articles, guides, and materials pertinent to your case and requirements.

- Save time and effort searching for the documents you need, and use US Legal Forms’ enhanced search and Review tool to find your Answer Civil Sample For Damages Philippines and obtain it.

- If you possess a membership, Log In to your US Legal Forms account, search for the document, and retrieve it.

- Check your My documents section to view the documents you have previously downloaded and to organize your files as you desire.

- A comprehensive online form directory could revolutionize the way anyone tackles these matters efficiently.

- US Legal Forms is a leading provider of digital legal documents, with over 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can.

Form popularity

FAQ

You may be able to get a personal loan without income verification if you pledge collateral, use a co-signer or have an excellent credit score. June 6, 2023, at p.m. Some people who need money fast to pay for unexpected expenses or large purchases turn to personal loans.

Proof of income may include pay stubs, employment letters or income tax returns, depending on your source of income. "Self-employed individuals may need to provide additional documentation such as business financial statements (profit and loss or income statement or business tax returns)," says Werner.

It may be possible to get a personal loan without documents in the cases mentioned below: Pre-approved personal loan offer from your bank. Pre-approved loan offers over and above your credit limit from your credit card issuers. Top-up loan offers from your lender.

How To Get a Personal Loan in 5 Easy Steps? Step 1: Determine your requirement. Figure out why you need a Personal Loan and how much you need. ... Step 2: Check loan eligibility. ... Step 3: Calculate monthly instalments. ... Step 4: Approach the bank. ... Step 5: Submit documents.

Documents required to apply for a personal loan Proof of age and identity - passport, Aadhaar card, Voter ID card, etc. Proof of residence - house registration certificate, sales deed, Aadhaar card, Voter ID card, etc. PAN Card. Proof of Income - Form 16, Salary slips, Bank statements, Income Tax Certificate, etc.

Lenders have varying criteria for borrowers seeking a $50,000 loan, but in general the process is similar to smaller loans. Borrowers will need to provide proof of employment or income, a favorable debt-to-income ratio and a credit score and history that meets the lender's minimum qualifications.

The ease of getting a $50,000 loan depends on your credit and a lender's specific approval requirements. Borrowers with higher credit scores are more likely to be approved for a broader range of loans and with better terms.

Documents such as IT returns, bank statements, or even an income certificate will suffice. If you and the lending company have a good professional relationship, you may not have to provide a salary slip.