An authorization letter for a bank is a written document that grants permission or authority to someone to perform specific banking transactions on behalf of the account holder. This letter serves as a legal proof of consent and enables the authorized person to act on behalf of the account holder with the bank. Keywords: authorization letter, bank, permission, authority, banking transactions, account holder, legal proof, consent, authorized person. There are several types of authorization letters for banks, catering to different needs and requirements. Some of these types include: 1. Bank Account Authorization Letter: This type of letter allows someone else, usually a family member, close friend, or business partner, to manage and transact on the account holder's bank account. It grants the authorized person access to deposit or withdraw funds, transfer money, pay bills, or perform other financial transactions on behalf of the account holder. 2. Loan Authorization Letter: When a borrower grants permission to another person, such as a spouse or relative, to handle loan-related matters on their behalf, a loan authorization letter is used. It permits the authorized individual to discuss and negotiate loan terms, sign loan documents, make loan payments, or request loan-related information from the bank. 3. Bank Authorization Letter for Property Transactions: In property-related matters, an authorization letter may be required to allow an agent, lawyer, or representative to handle banking affairs associated with real estate transactions. This includes transferring funds for property purchase/sale, mortgage payments, or receiving loan disbursements. 4. Safe Deposit Box Authorization Letter: If an account holder wants to grant access to their safe deposit box to another person, they can provide a safe deposit box authorization letter to the bank. This letter enables the authorized individual to access the box, retrieve items, deposit or withdraw assets, or manage the box's account. 5. Bank Authorization Letter for Business: Business owners often issue authorization letters to authorize specific employees or representatives to conduct banking activities on behalf of the company. This could involve making deposits or withdrawals, managing business accounts, initiating wire transfers, or handling payroll-related transactions. In summary, an authorization letter for a bank is a crucial document that grants permission to an authorized person to act on behalf of the account holder in a specific banking capacity. Through different types of authorization letters, individuals can delegate their banking responsibilities and ensure smooth financial operations.

Authorization Letter For Bank

Description

How to fill out Authorization Letter For Bank?

It’s obvious that you can’t become a legal professional overnight, nor can you grasp how to quickly prepare Authorization Letter For Bank without having a specialized background. Creating legal forms is a long venture requiring a specific education and skills. So why not leave the creation of the Authorization Letter For Bank to the professionals?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court papers to templates for in-office communication. We understand how important compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our website and obtain the form you require in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to figure out whether Authorization Letter For Bank is what you’re looking for.

- Begin your search over if you need any other form.

- Set up a free account and select a subscription plan to purchase the template.

- Choose Buy now. Once the transaction is through, you can get the Authorization Letter For Bank, fill it out, print it, and send or mail it to the necessary individuals or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your paperwork-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

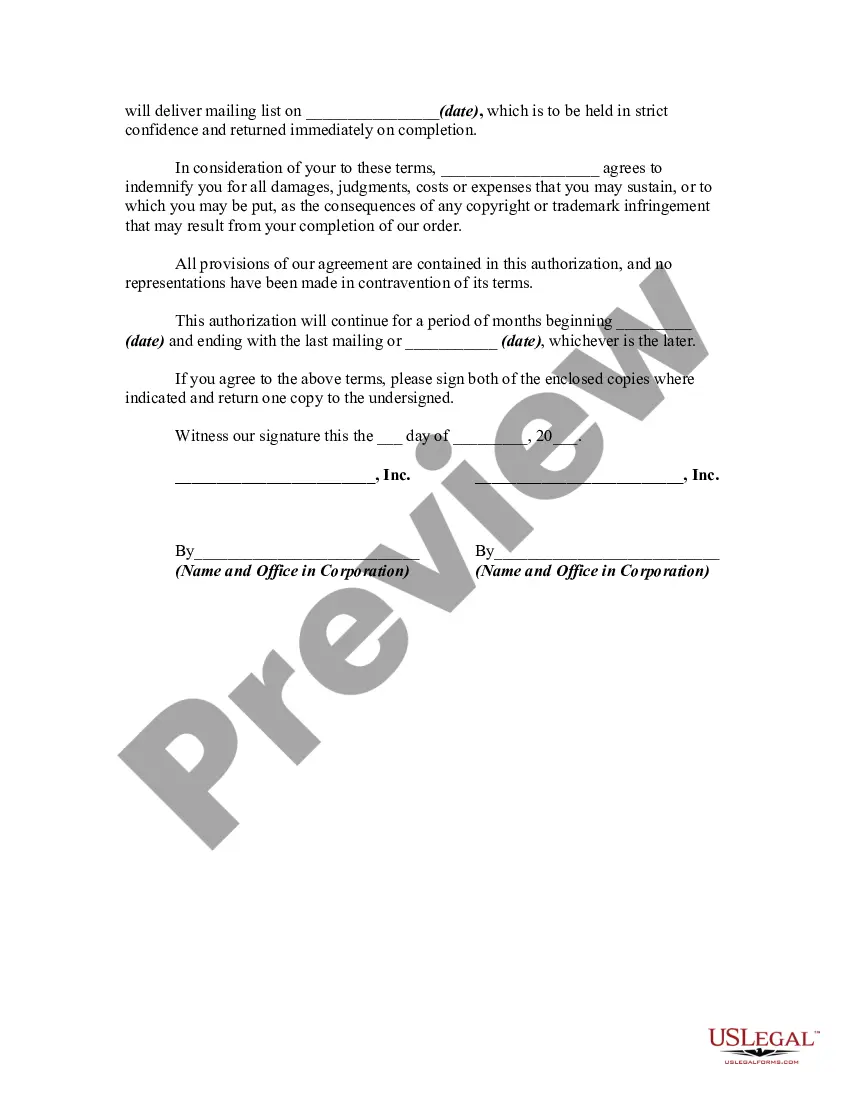

To write an authorization letter for bank transactions, start by including your name, address, and contact information at the top. Address the bank manager or relevant department, and state your intent clearly by including the account holder's details and the purpose of authorization. Make sure to specify the extent of authority granted, whether it includes withdrawals, deposits, or account inquiries. Finally, sign and date the letter, and consider using services like US Legal Forms for templates to ensure accuracy and compliance.

To write a letter of authorization on your behalf, you should start by stating your name and contact details at the top. Clearly identify the person you are authorizing and specify the exact permissions you are granting. Remember to include the date and your signature to make the letter legally valid. Utilizing platforms like USLegalForms can provide you with templates and guidance to streamline this process effectively.

When you write an authorization letter to a bank on behalf in Word, focus on a clear structure. Begin with an introduction that establishes the purpose of the letter, followed by the specifics of the authorization. Use concise language to articulate the powers you are granting, and conclude with your signature and contact information. A well-formatted Word document makes your letter look professional and credible.

To write an authorization letter to a bank on behalf in Word format, start with a formal header that includes your contact information and the date. Next, address the bank and include a clear subject line, such as 'Authorization Letter for Bank.' Fill in the necessary details regarding the authorized person and provide a statement of authorization. Finally, save the document for easy access and printing.

Writing an authorization letter to a bank requires you to include essential details like your account number, the bank's name, and the authorized individual's information. Provide a clear statement about the powers you are granting, the duration of the authorization, and sign the document for authenticity. Using a template can simplify this process, ensuring you cover all necessary points.

To authorize someone to act on your behalf, you need to create an authorization letter for bank transactions. This document should clearly state the person's name, your name, and the specific actions they are allowed to perform, such as managing your bank account or making withdrawals. Make sure to include the date and your signature to validate the letter.

To write a letter of authorization for a bank, start by addressing the bank and clearly stating your account information. Include the name of the person you are authorizing, their relationship to you, and a detailed description of what actions they can perform. Ensure you sign and date the letter; providing any requested identification can also be beneficial.

An example of written authorization is a letter that includes the writer's details, the name of the authorized party, and specific permissions granted. For instance, it could state, 'I authorize Name to access my bank account details for specific purposes.' This serves as a clear authorization letter for bank-related actions.

To authorize someone for a bank account, you typically need to complete a specific authorization letter for bank transactions. This may require using a bank-provided form or writing your own letter that includes relevant details and signatures. After submission, confirm the bank processes your request to ensure the authorization is active.

Writing a bank authorization letter involves clearly stating the purpose, including your personal details, the name of the person you are authorizing, and the scope of their authority. Make sure to use a professional tone and format the letter properly. This document serves as your official authorization letter for bank-related actions.