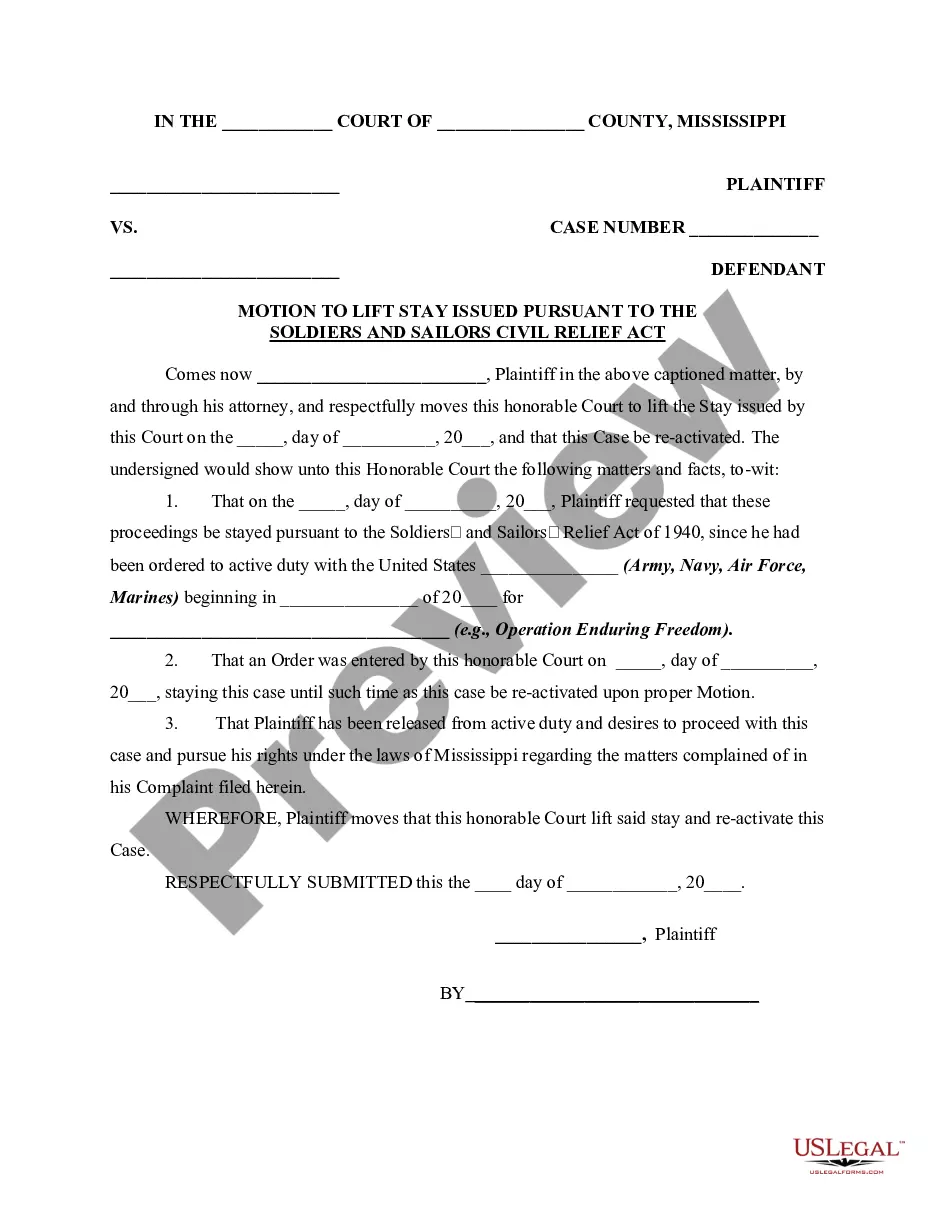

General Receipt Template With Revenue Stamp

Description

How to fill out General Form Of Receipt?

Obtaining legal document samples that meet the federal and local laws is a matter of necessity, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the correctly drafted General Receipt Template With Revenue Stamp sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by attorneys for any professional and life case. They are easy to browse with all files organized by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your form is up to date and compliant when acquiring a General Receipt Template With Revenue Stamp from our website.

Getting a General Receipt Template With Revenue Stamp is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, follow the instructions below:

- Take a look at the template using the Preview option or via the text description to ensure it meets your needs.

- Look for another sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your General Receipt Template With Revenue Stamp and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and fill out earlier obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

How to write a receipt - YouTube YouTube Start of suggested clip End of suggested clip So i will write for lock rental. Here with the circles. Most often it will be cash or check. But ifMoreSo i will write for lock rental. Here with the circles. Most often it will be cash or check. But if the student is paying in cash.

The receipt should include: The date. The dollar amount. Name of person paying for the transaction. Description of the service or product. Department name. Signature of the cash handler.

The cash receipt book holder will complete the information at the top of the cash receipt: LOCATION, DATE, RECEIVED FROM, AND AMOUNT. Indicate in the appropriate box on the cash receipt the form of payment: coin or currency, check, or money order.

No matter how you're making your receipt, every receipt you issue should include: The number, date, and time of the purchase. Invoice number or receipt number. The number of items purchased and price totals. The name and location of the business the items have been bought from. Any tax charged. The method of payment.

Typically it will show: the date and time of the purchase. the number of items purchased and price totals. the name and location of the business the items have been bought from. Any VAT charged. method of payment. returns policy.