Payment Due Letter To Client

Description

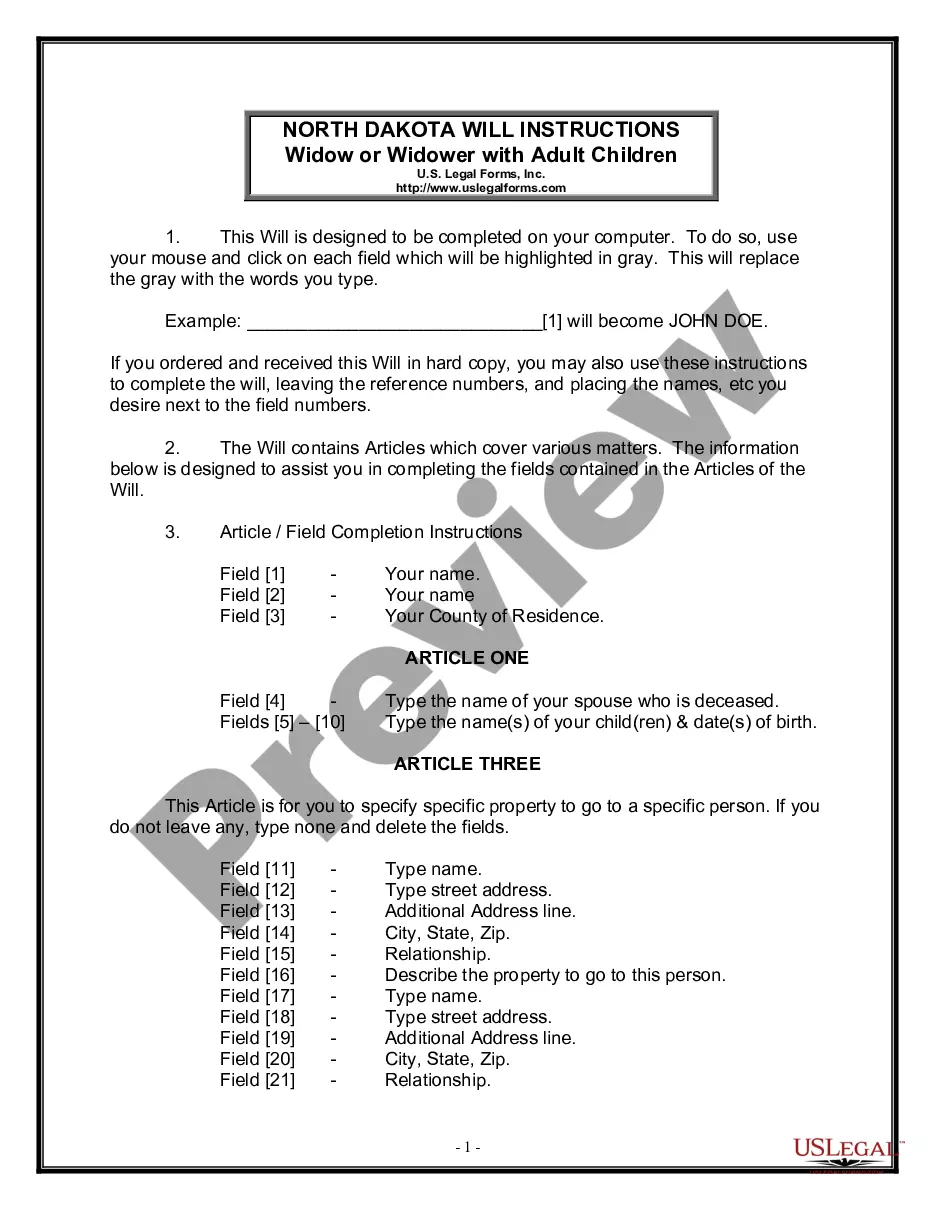

How to fill out Sample Letter For Past Due Balance?

It’s clear that you cannot become a legal expert instantly, nor can you swiftly learn how to draft a Payment Due Letter To Client without having a specialized background.

Drafting legal documents is a lengthy undertaking that necessitates specific education and expertise.

So why not entrust the drafting of the Payment Due Letter To Client to the professionals.

Preview it (if this feature is available) and review the supporting description to confirm whether the Payment Due Letter To Client is what you need.

Start your search anew if you require a different template.

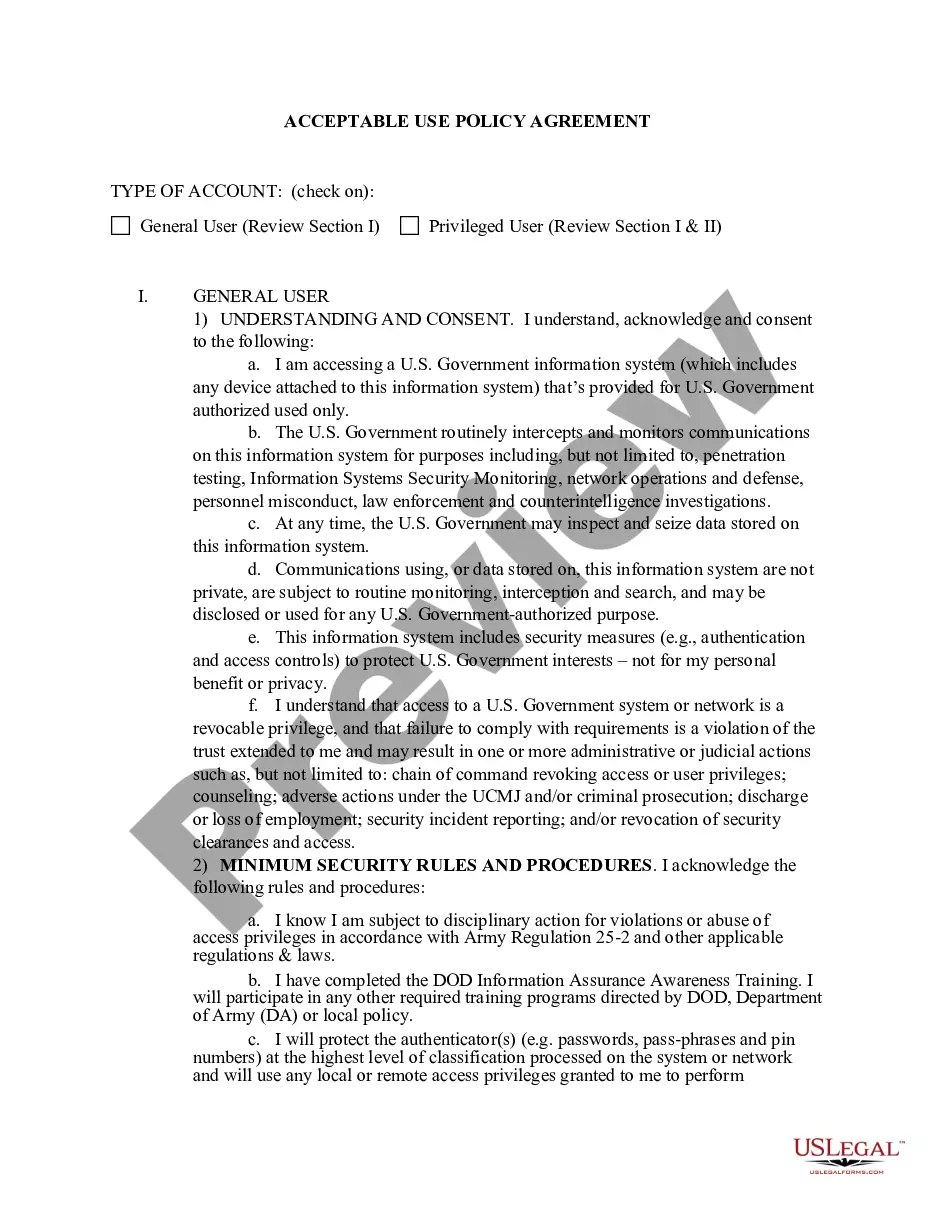

- With US Legal Forms, one of the most comprehensive legal document repositories, you can discover everything from court papers to templates for internal communication.

- We recognize how vital it is to follow and comply with federal and state regulations.

- That’s why, on our site, all documents are location-specific and current.

- Begin using our platform and get the document you need in just a few minutes.

- Search for the form you want by utilizing the search bar at the top of the webpage.

Form popularity

FAQ

A surviving spouse or child may receive a special lump-sum death payment of $255 if they meet certain requirements. Generally, the lump-sum is paid to the surviving spouse who was living in the same household as the worker when they died.

The easiest way to request a replacement SSN card is online with a personal my Social Security account. You can go to .ssa.gov/ssnumber and answer a few questions to find out the best way to apply.

Form SSA-1724-F4 is also known as the Claim for Amounts Due in the Case of a Deceased Social Security Recipient. People should file this Form when a deceased relative was due to receive a payment from the Social Security Administration before their death.

How to Fill Out Form SSA-561-U2. If you choose to fill out the paper form, it can be downloaded from the ?Appeal a Decision? page on the SSA website. You'll need to provide your name, your Social Security Number (SSN), your claim number (if it differs from your SSN) and the decision or action that you wish to appeal.

It is called Representative Payee Report of Benefits and Dedicated Account, SSA-6233-BK. You should keep these records (e.g. bank statements and canceled checks) along with receipts for two years from the time you complete the form.

General information for recording statements on the SSA-795. Use an SSA-795 whenever a signed statement is required or desirable, except when we request some other form or questionnaire or we can readily adapt for the statement. Prepare an SSA-795 using the claimant's own words whenever possible.

You must have worked and paid Social Security taxes in five of the last 10 years. If you also get a pension from a job where you didn't pay Social Security taxes (e.g., a civil service or teacher's pension), your Social Security benefit might be reduced.

How can I get a form SSA-1099/1042S, Social Security Benefit Statement? Using your personal my Social Security account, and if you don't already have an account, you can create one online. ... Calling us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, am ? pm.