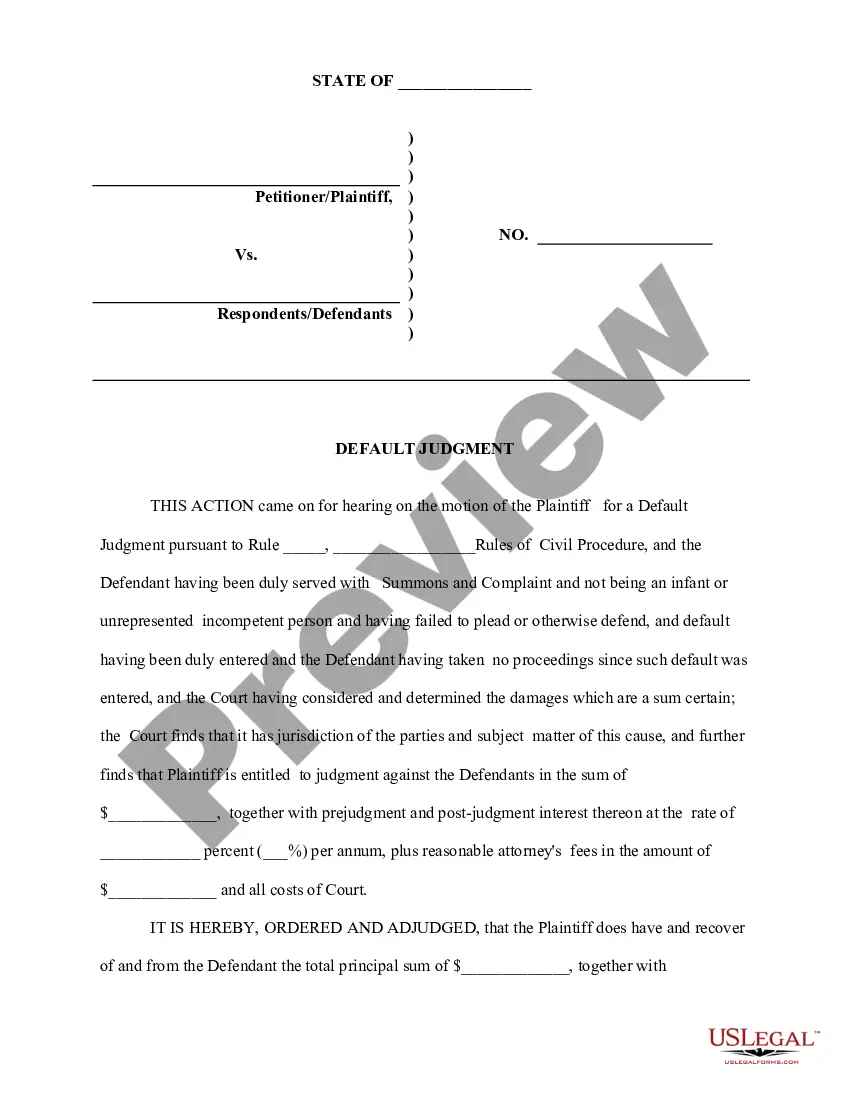

Requisition For Default Judgment Sample

Description

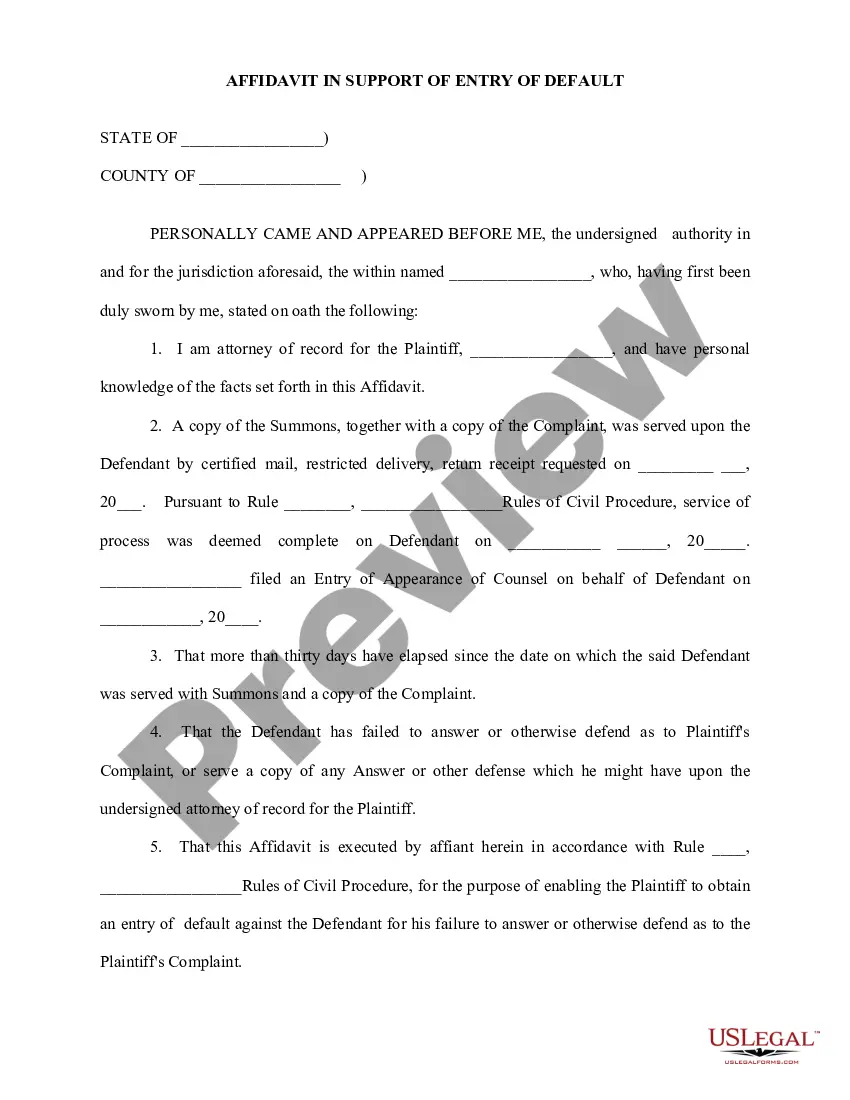

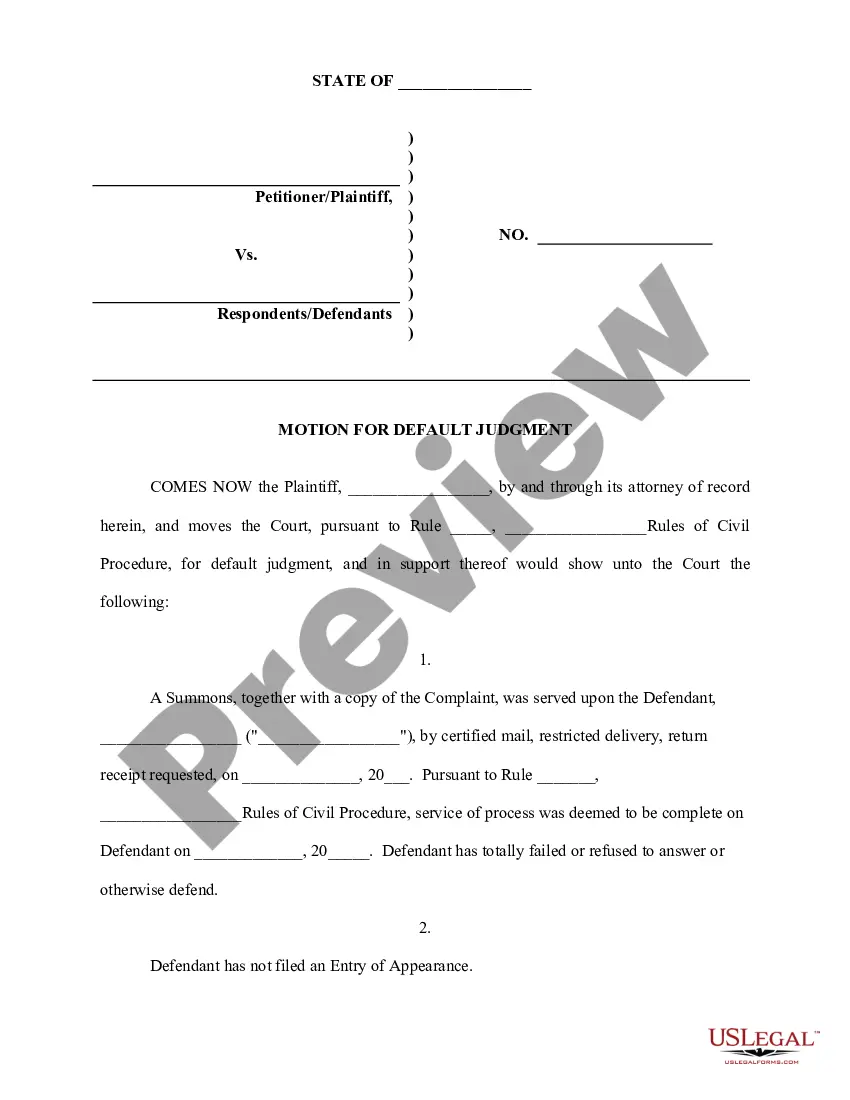

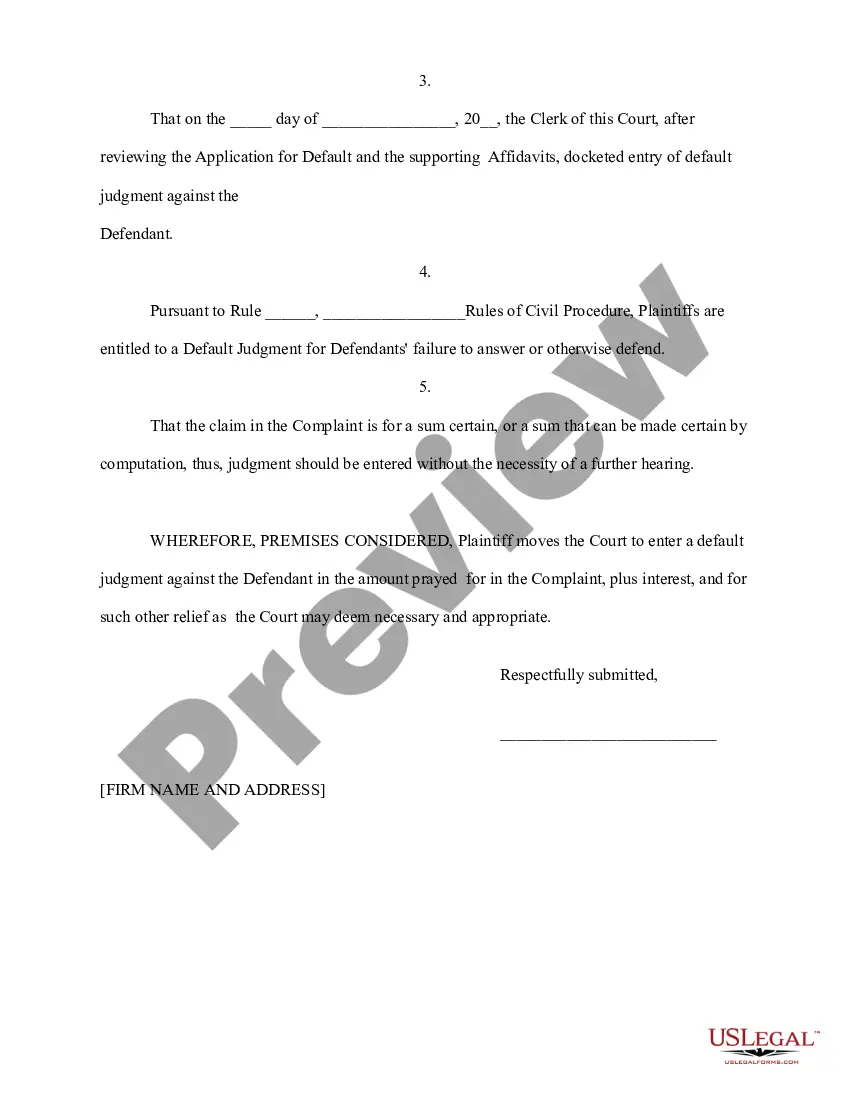

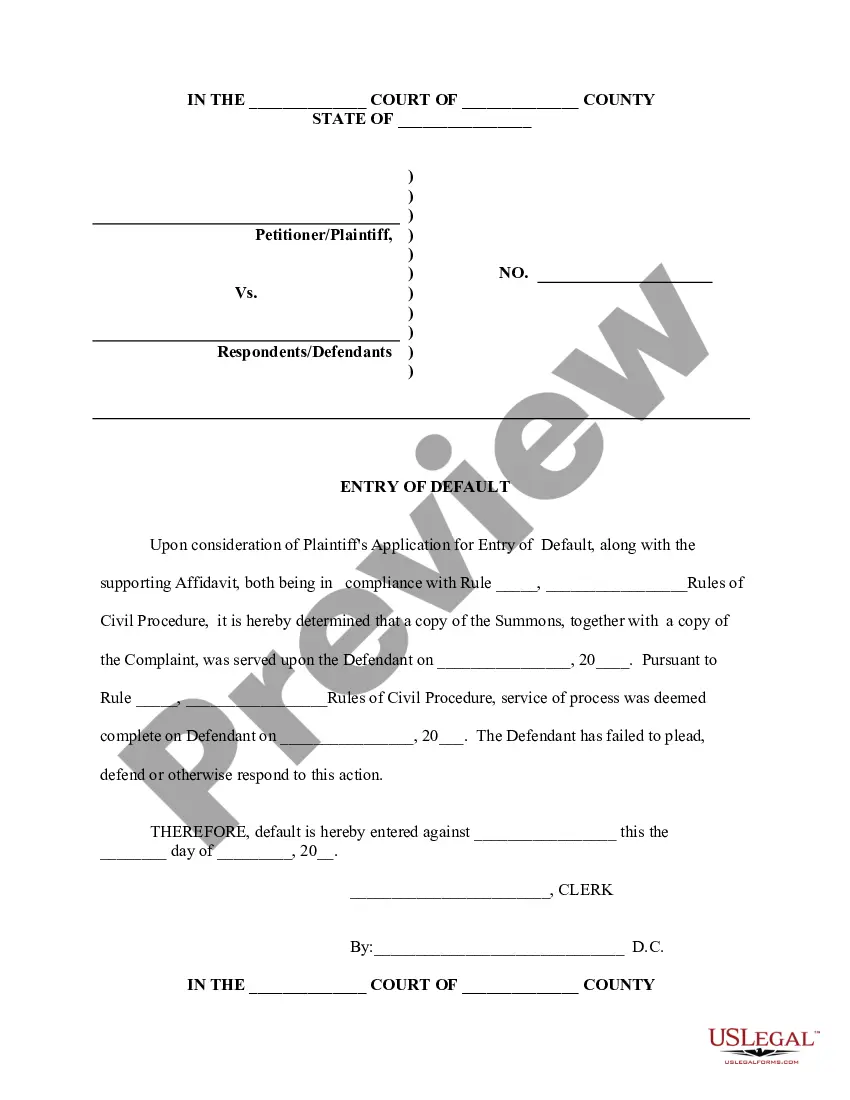

How to fill out Application For Entry Of Default - Affidavit - Motion - Entry Of Default - Default Judgment?

The Request For Default Judgment Example shown on this page is a reusable official template created by experienced attorneys in compliance with national and local laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 validated, state-specific forms for any professional and personal need. It’s the fastest, simplest, and most dependable method to secure the documents you require, as the service guarantees high-level data protection and anti-malware security.

Use the same document again whenever necessary. Access the My documents section in your profile to redownload any previously downloaded forms.

- Search for the document you require and examine it.

- Browse through the file you searched and preview it or review the form summary to confirm it meets your needs. If it does not, use the search bar to find the appropriate one. Click Buy Now when you have found the template you require.

- Choose a subscription plan that fits you and create an account. Use PayPal or a credit card for quick payment. If you already possess an account, Log In and verify your subscription to proceed.

- Select the format you want for your Request For Default Judgment Example (PDF, Word, RTF) and download the sample to your device.

- Print the template to fill it out by hand. Alternatively, use an online multi-functional PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature.

Form popularity

FAQ

A default judgment typically remains on your credit report for up to seven years. This duration can severely affect your creditworthiness and ability to secure new loans. Utilizing resources such as a requisition for default judgment sample can empower you with the knowledge to navigate credit situations involving judgments and work towards improving your financial standing.

You may find out about a default judgment through court documents or notices from the plaintiff. Additionally, checking your credit report can often reveal any judgments listed against you. It's beneficial to understand a requisition for default judgment sample to better grasp what to look for and address potential issues promptly.

A default judgment can significantly impact your finances and reputation. It usually means you lost the case without occurring in court, resulting in a judgment against you. Familiarizing yourself with a requisition for default judgment sample can illuminate risks associated with default judgments and help you navigate your situation more effectively.

A default judgment is generally viewed as negative because it can occur without your input, leading to unfavorable outcomes. It can affect your credit score and create challenges in the future. Understanding a requisition for default judgment sample can help you recognize the implications and respond proactively to avoid such outcomes.

Negotiating a default judgment often involves reaching out to the opposing party to discuss the terms. You can present your reasons for the default and potentially offer a settlement or payment plan. Having a clear requisition for default judgment sample can help you understand the typical terms involved in these situations, making negotiation smoother.

To make a default judgment, you need to file a request with the court if the other party fails to respond or appear. This process involves submitting relevant documents, including a requisition for default judgment sample, to help formalize the request. Understanding the necessary steps and guidelines can significantly affect the outcome of your judgment.

Beating a default judgment typically involves presenting a solid case to the court, demonstrating why you missed the initial hearing. Showing evidence, such as a requisition for default judgment sample, can enhance your claims and help you articulate your reasons clearly. Always consult legal advice to strengthen your position and the chance of a successful outcome.

To beat a default judgment, you must act quickly. You can file a motion to vacate the judgment, often outlining valid reasons for your absence during the court date. By using a requisition for default judgment sample, you can ensure that your motion is well-structured and increases your chances of success during this critical phase.

Typically, you might consider offering a settlement amount between 20% to 50% of the judgment amount. The specific percentage can vary based on your financial capability and the creditor's willingness to settle. Utilizing a requisition for default judgment sample can help you formulate an effective offer that clearly communicates your intentions.

Yes, it is possible to negotiate a default judgment. If you have not been able to appear in court, try contacting the creditor or their representative to discuss your situation. Presenting a requisition for default judgment sample can also assist you in understanding the options available and the best approach to communicate with the creditor.