Guardian Litem Application With Resume

Description

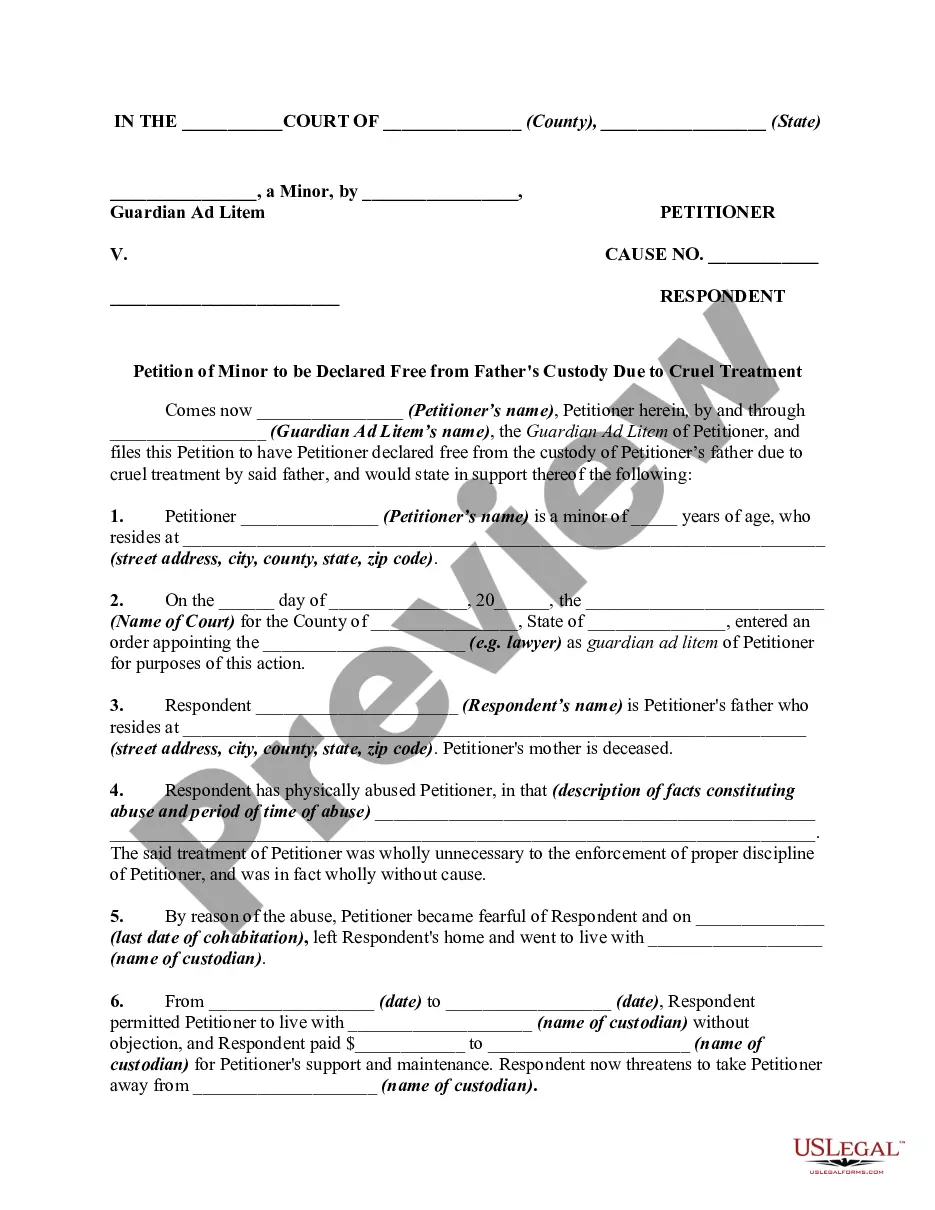

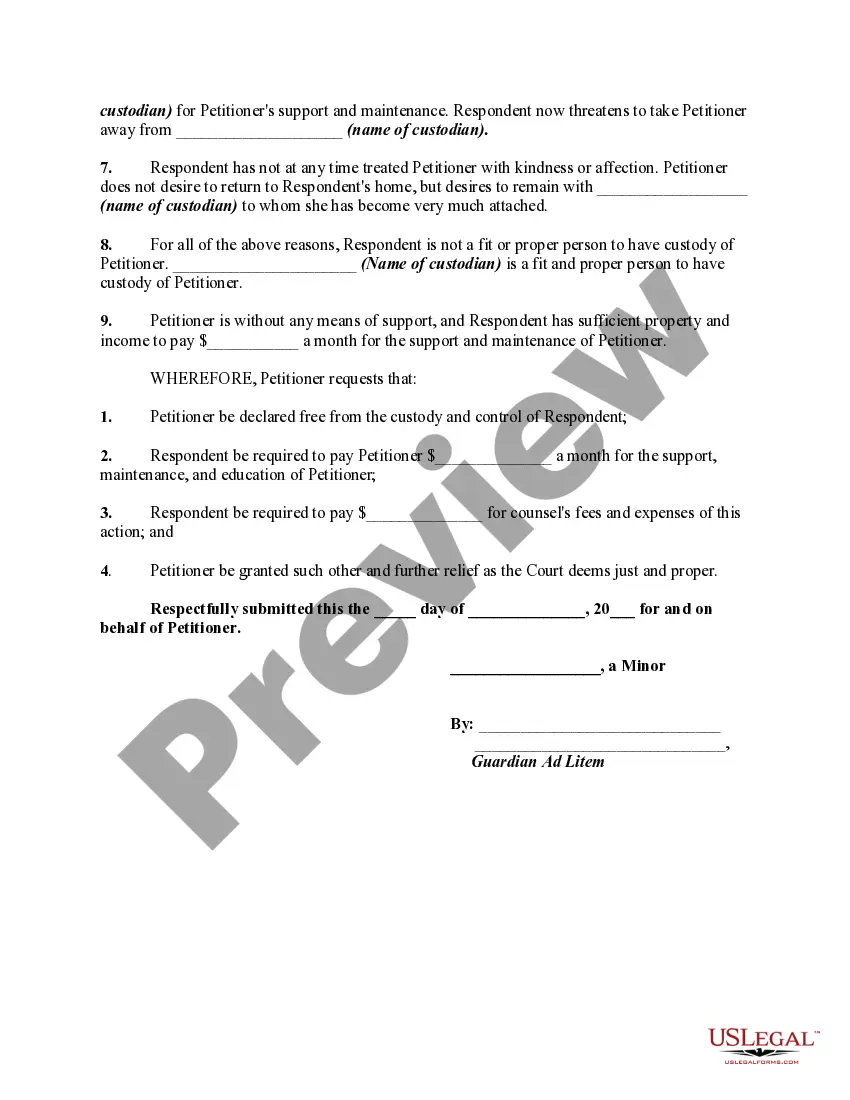

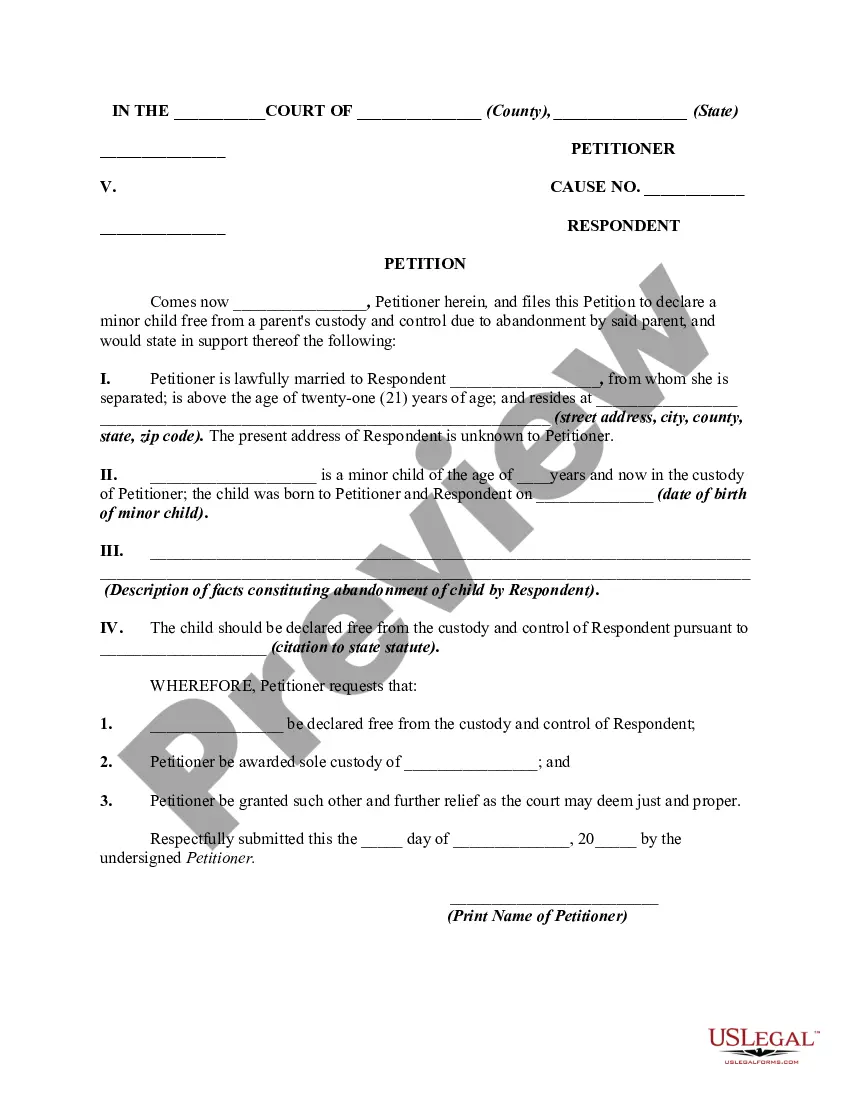

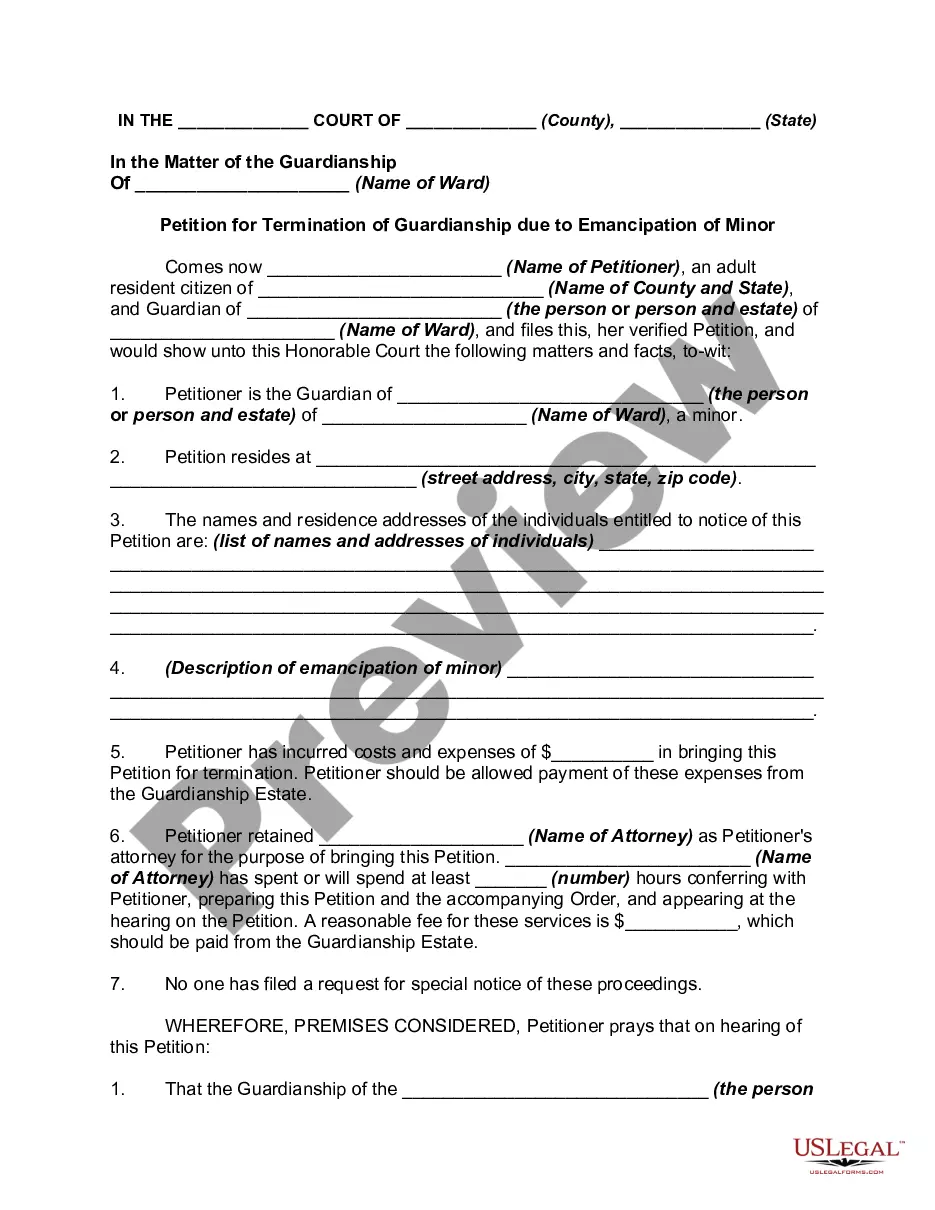

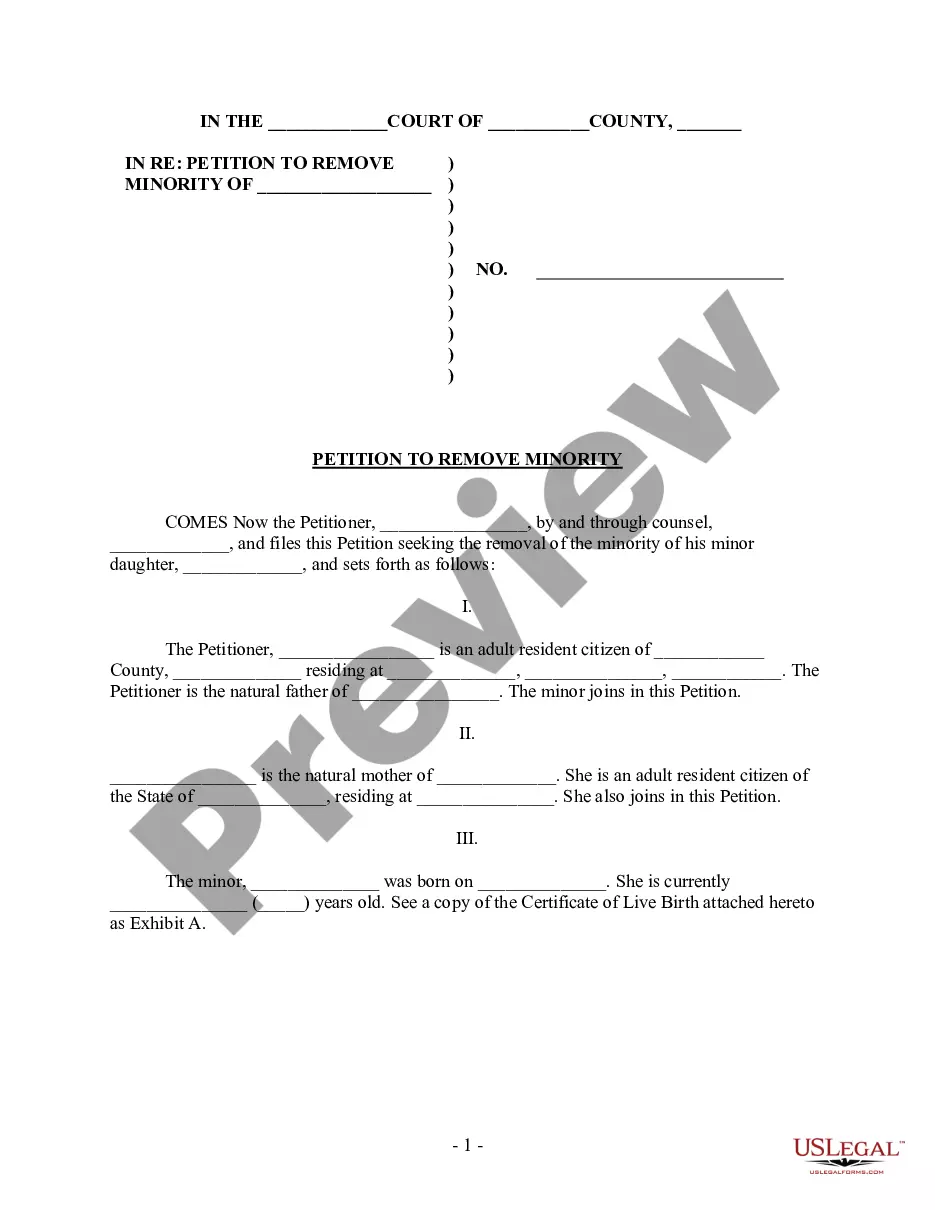

How to fill out Petition Of Minor By Guardian Ad Litem To Be Declared Free From Father's Custody Due To Cruel Treatment - Release Of Parental Rights?

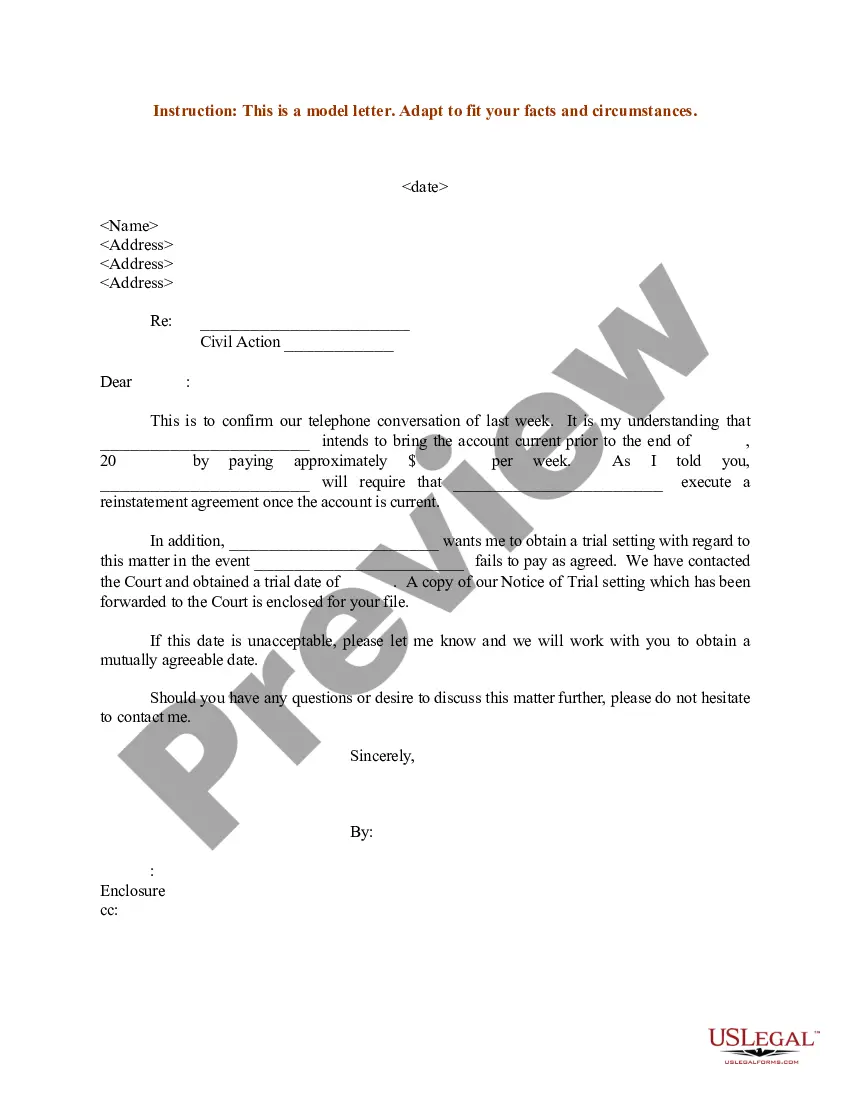

The Guardian Litem Application Including Resume presented on this page is a versatile legal document developed by expert attorneys in accordance with federal and state laws and guidelines.

For over 25 years, US Legal Forms has supplied individuals, groups, and legal practitioners with more than 85,000 authenticated, state-specific documents for various commercial and personal scenarios.

Subscribe to US Legal Forms to have credible legal templates for all of life’s circumstances readily available.

- Search for the required document and review it.

- Browse through the sample you searched and preview it or assess the form description to ensure it meets your needs. If it does not, utilize the search bar to locate the appropriate one. Click 'Buy Now' once you have identified the template you require.

- Subscribe and sign in.

- Select the pricing option that fits you and establish an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable document.

- Choose the format you desire for your Guardian Litem Application Including Resume (PDF, DOCX, RTF) and download the template onto your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form with a legally-recognized electronic signature.

- Redownload your documents as needed.

- Utilize the same document whenever necessary. Navigate to the 'My documents' tab in your profile to redownload any forms you have previously saved.

Form popularity

FAQ

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.

Both the Courts and several years of case law hold that the actual mortgage is a nullity. It is the note that controls the ownership of the loan, and by operation of fiction, whoever holds the note will hold an equity right to foreclosure irrespective of who holds or has the mortgage.

In real estate wholesaling, an assignment fee is a financial obligation from one party (the ?assignor?) who agrees to transfer their contractual obligations to another party (the ?assignee.?) In layman's terms, the assignment fee is the fee paid by the end buyer to the real estate wholesaler.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.