Sole Proprietorship Cost

Description

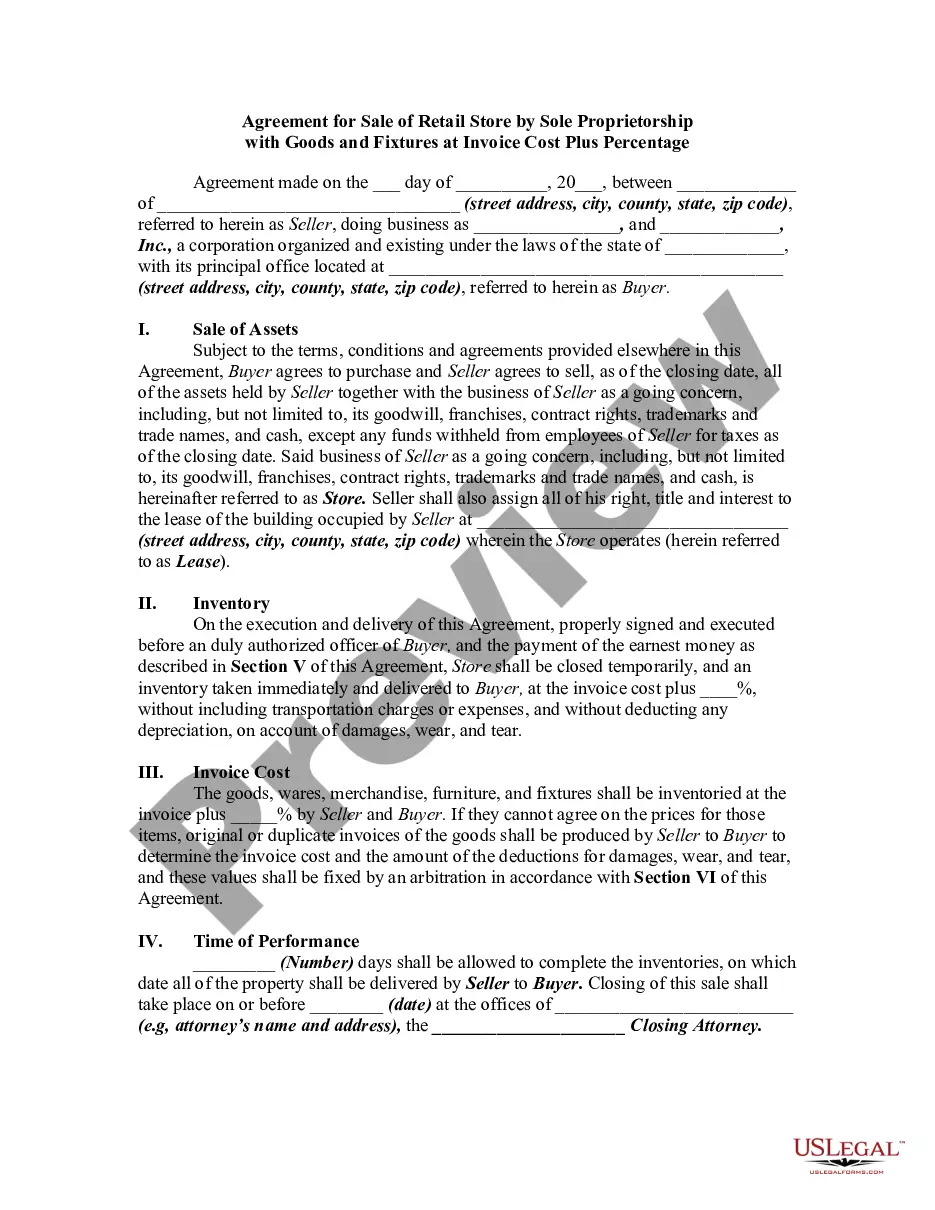

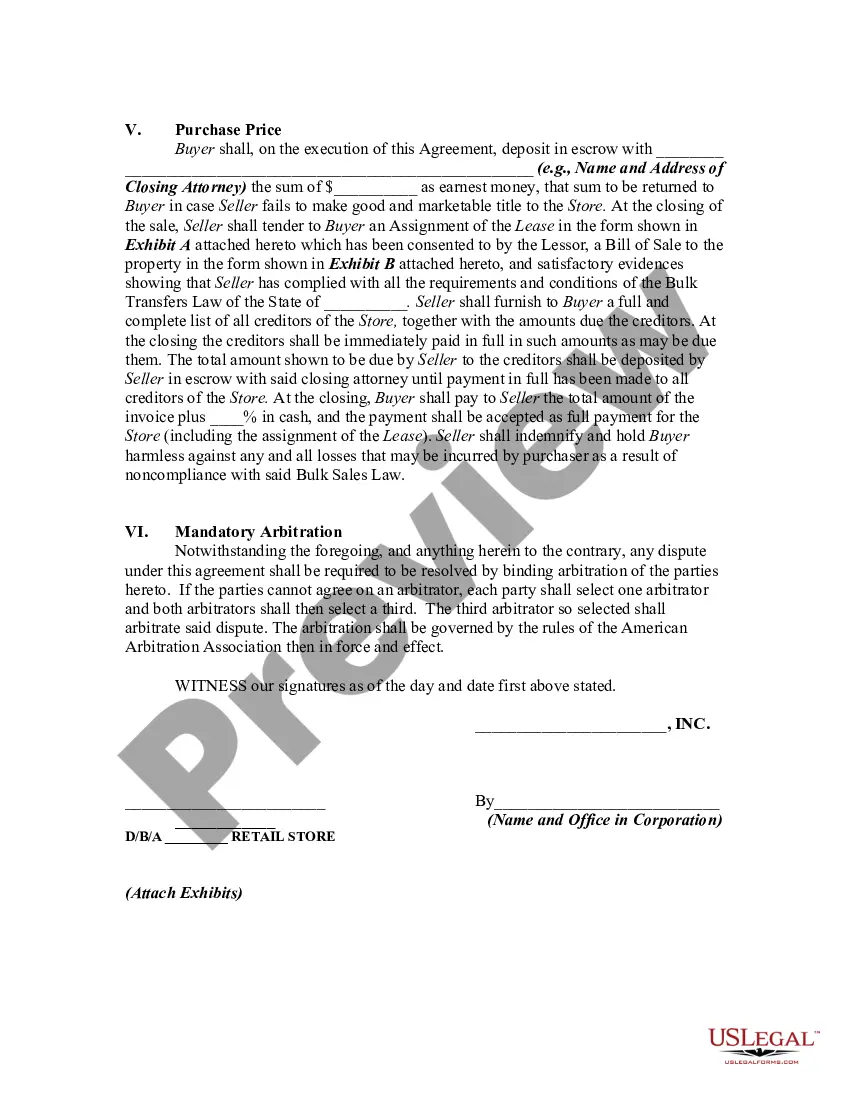

How to fill out Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

Managing legal documentation and tasks can be a lengthy addition to your day.

Sole Proprietorship Expenses and documents like it often necessitate that you search for them and find the best method to fill them out correctly.

For that reason, if you are handling financial, legal, or personal affairs, having a comprehensive and accessible online repository of forms at your disposal will greatly assist you.

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific documents and various tools to help you finalize your paperwork promptly.

Are you using US Legal Forms for the first time? Register and create a free account in a few moments and you’ll gain access to the form library and Sole Proprietorship Expenses. Then, follow the steps below to finalize your form: Ensure you have the correct document using the Preview feature and reviewing the form details. Select Buy Now when ready, and choose the subscription option that suits you. Click Download, then fill out, eSign, and print the document. US Legal Forms has 25 years of experience assisting clients with their legal documentation. Locate the form you need today and streamline any process effortlessly.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms provides you with state- and county-specific documents available at any time for download.

- Protect your document management processes with a high-quality service that enables you to create any form within minutes without additional or hidden fees.

- Simply Log In to your account, locate Sole Proprietorship Expenses and obtain it instantly from the My documents section.

- You can also retrieve previously saved documents.

Form popularity

FAQ

To cover your federal taxes, saving 30% of your business income is a solid rule of thumb. ing to John Hewitt, founder of Liberty Tax Service, the total amount you should set aside to cover both federal and state taxes should be 30-40% of what you earn.

As long as your expenses are "ordinary and necessary," in the parlance of the Internal Revenue Service, you can claim them on your tax return. In addition to health insurance, common deductions include equipment, utilities, subscriptions, travel, and capital assets.

The tax rate for a sole proprietorship where the owner is a non-resident individual (this slab applies irrespective of the age of the proprietor). 5% of the total income above ? 2, 50,000. ? 12,500 + 20% of total income above 5,00,000. ? 1,12,500 + 30% of the total income above ? 10,00,000.

As a sole proprietor, determining how much you should pay yourself can be tricky, as there are no set rules or guidelines?it's up to you, the business owner, to decide what's appropriate. One way to think about it is to consider how much you would need to pay someone else to do the work you do.

Advantages of a sole proprietorship In fact, ing to the SBA, it's the simplest and least expensive business type you can establish. Let's take a look at a few additional key advantages. Taxes: You don't need to separate taxes for your business. Any profit you make is simply treated as your own income.