Trial New Jury Without

Description

How to fill out Motion For New Trial?

Locating a reliable source to obtain the latest and pertinent legal templates is a significant part of navigating bureaucratic processes.

Identifying the correct legal documents requires precision and meticulousness, which is why it is essential to obtain samples of Trial New Jury Without solely from trustworthy sources, such as US Legal Forms. A faulty template can squander your time and delay the issue at hand.

Once you have the form on your device, you can modify it using the editor or print it out and fill it in manually. Eliminate the stress that comes with your legal paperwork. Browse the extensive US Legal Forms library where you can discover legal templates, evaluate their relevance to your situation, and download them instantly.

- Utilize the library navigation or search bar to locate your template.

- Review the form’s description to verify if it meets the criteria of your state and county.

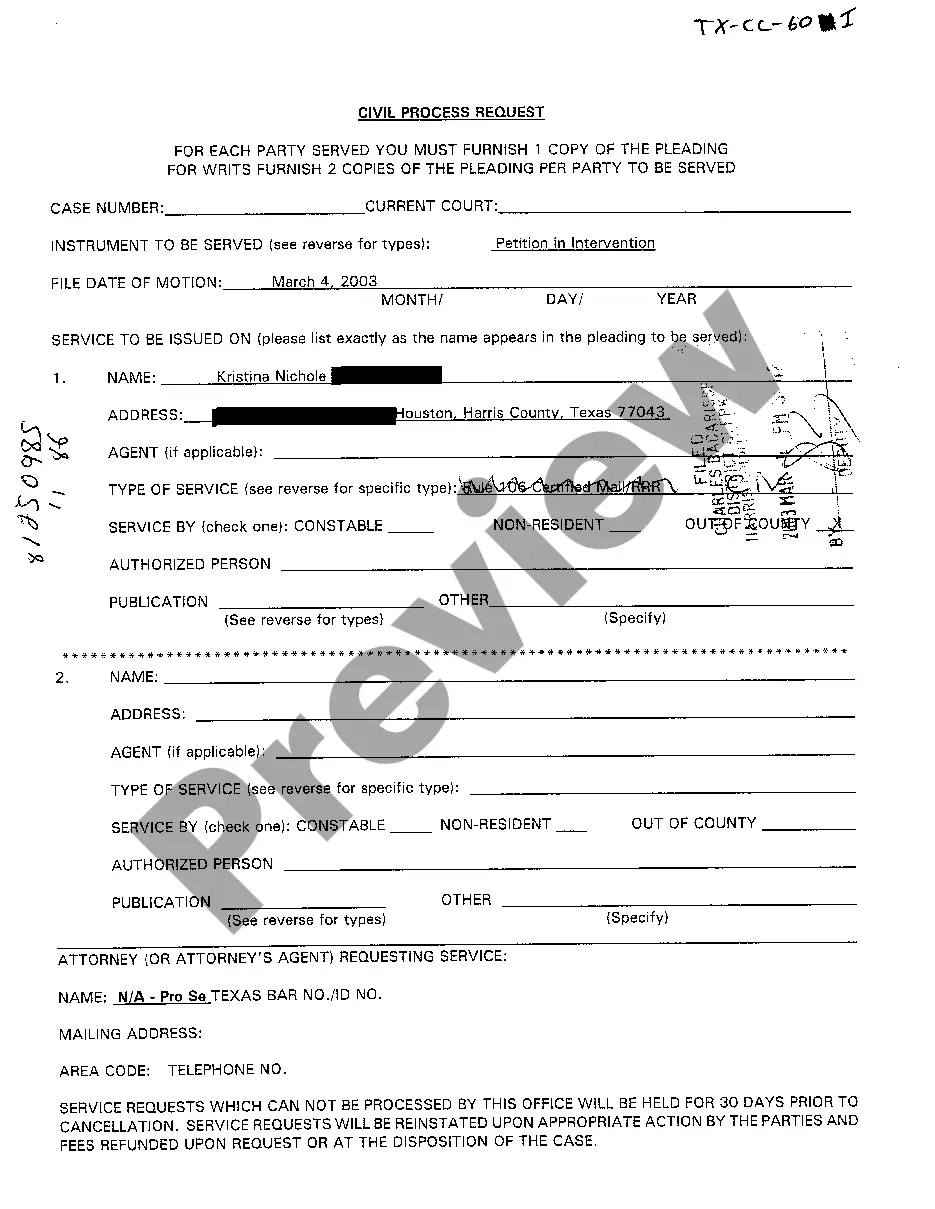

- Access the form preview, if available, to confirm the template is what you are looking for.

- Continue your search and seek the appropriate document if the Trial New Jury Without does not fit your needs.

- If you are confident in the form’s relevance, download it.

- If you are a registered customer, click Log in to verify and retrieve your selected templates in My documents.

- If you do not possess an account yet, click Buy now to acquire the template.

- Select the pricing option that best fits your needs.

- Proceed to the registration to complete your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Trial New Jury Without.

Form popularity

FAQ

North Dakota Century Code Section 30.1-08-02(2) requires that a Holographic Will must be hand written by the testator and dated and signed by the testator.

Steps to Create a Will in North Dakota Decide what property to include in your will. Decide who will inherit your property. Choose an executor to handle your estate. Choose a guardian for your children. Choose someone to manage children's property. Make your will. Sign your will in front of witnesses.

3. A proceeding to contest an informally probated will and to secure appointment of the person with legal priority for appointment in the event the contest is successful may be commenced within the later of twelve months from the informal probate or three years from the decedent's death.

The will must also be in writing and signed by the owner or by someone in the owner's presence and at the owner's direction. In addition, the will must be signed by two witnesses within a reasonable time after witnessing the owner's signing or the owner's acknowledgement of that signature or the will.

In North Dakota, real estate can be transferred via a TOD deed, otherwise known as a beneficiary deed. This deed permits a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

Generally speaking, if you die without a will in North Dakota, your spouse will be entitled to a large share of your assets. However, whether you have other heirs, such as children, parents, or siblings, may affect how large a share they receive.