Rent Receipts For Hra Template

Description

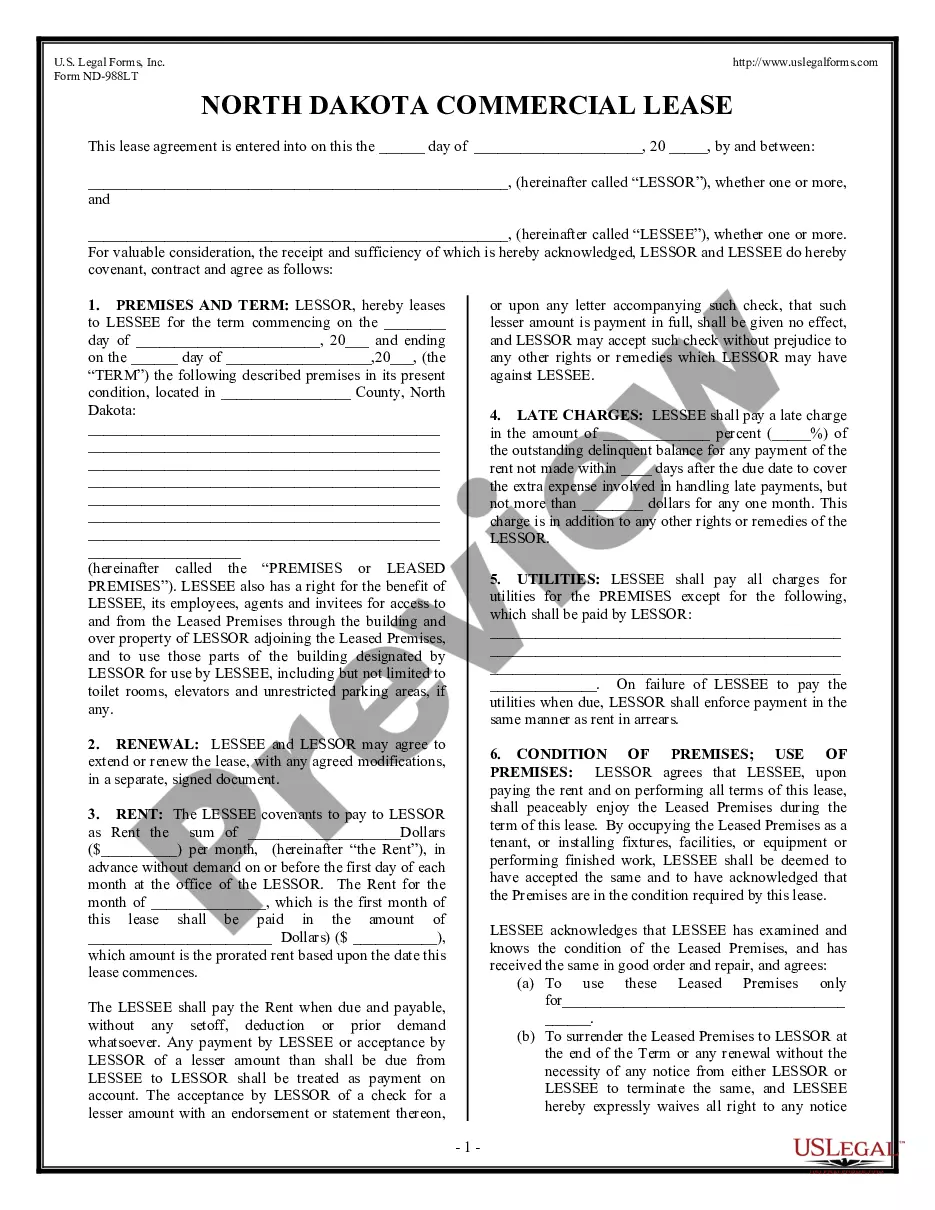

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

Whether for corporate goals or personal matters, everyone must handle legal situations at some stage in their existence.

Completing legal documents requires meticulous care, starting with selecting the appropriate form template.

With an extensive catalog from US Legal Forms available, you will never have to waste time searching for the suitable template online. Utilize the library’s user-friendly navigation to discover the right form for any situation.

- Locate the template you require using the search box or catalog navigation.

- Review the form’s description to ensure it fits your circumstances, state, and area.

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search feature to find the Rent Receipts For Hra Template sample you need.

- Download the template when it fulfills your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously stored files in My documents.

- If you haven’t created an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the account registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the document format you desire and download the Rent Receipts For Hra Template.

- Once it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Corporate bylaws are legally required in Illinois. Illinois statute §805 ILCS 5/2.20 requires that bylaws be adopted either by shareholders at the first shareholder meeting or by directors at the initial director meeting.

The California Corporations Code does not explicitly state that corporations must have corporate bylaws. However, the necessity of bylaws is implied in several places, including CA Corp Code § 213, which requires corporations to keep a copy of their bylaws on file at their principal executive office.

Answer and Explanation: Yes, bylaws are contracts between an organization and its members. This is because a member of an organization can sue the organization if bylaws are not followed.

A corporation makes your business a distinct entity. In other words, it separates your business assets from your personal assets. Worried because you are the only person in your company? That is just fine; one person or multiple people can own a corporation.

Corporate bylaws are legally required in Hawaii. Usually, the board of directors will adopt bylaws at the first organizational meeting.

Corporations are required to have not less than three directors unless (1) shares have not been issued, then the number can be one or two, (2) the corporation has one shareholder, then the number can be one or two, or (3) the corporation has two shareholders, then the number can be two.

The bylaws of a company are the internal rules that govern how a business is run. They're set out in a formal written document adopted by a corporation's board of directors and summarize important procedures related to decision-making and voting.

Bylaws generally define things like the group's official name, purpose, requirements for membership, officers' titles and responsibilities, how offices are to be assigned, how meetings should be conducted, and how often meetings will be held.

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.

Some examples of S-Corporation By-Laws which may appear on a company's records are: Annual meetings are to be held for the purpose of electing a governing board of directors for the upcoming year. A quorum of six directors is needed in order to proceed with voting or other transactional business.