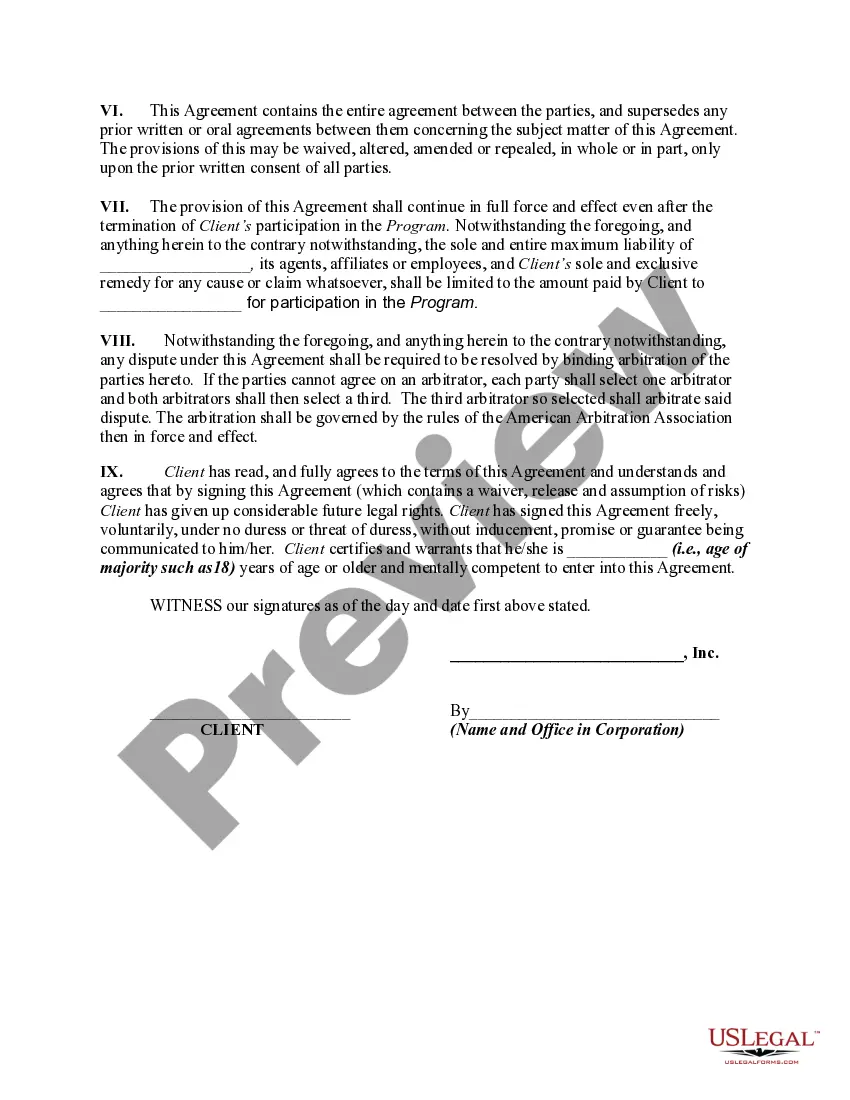

Agreement Participate Form For Payment

Description

How to fill out Agreement To Participate In Fitness And Dietary Program?

There’s no longer a need to squander time looking for legal documents to satisfy your local state stipulations.

US Legal Forms has gathered all of them in one place and enhanced their accessibility.

Our platform provides over 85k templates for any business and personal legal matters categorized by state and area of application.

Utilize the search bar above to look for another sample if the current one is not suitable. Click Buy Now next to the template title when you identify the correct one. Choose the most appropriate subscription plan and create an account or Log In. Complete the payment for your subscription using a card or via PayPal to continue. Select the file format for your Agreement Participate Form For Payment and download it to your device. Print your form to fill it out manually or upload the sample if you prefer to utilize an online editor. Creating formal documents in compliance with federal and state laws and regulations is quick and effortless with our library. Test US Legal Forms today to keep your documents organized!

- All forms are expertly crafted and verified for authenticity, so you can be confident in acquiring an up-to-date Agreement Participate Form For Payment.

- If you are familiar with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents whenever necessary by accessing the My documents tab in your profile.

- If you've never used our service before, the process will involve a few more steps to finalize.

- Here’s how new users can locate the Agreement Participate Form For Payment in our collection.

- Review the page content thoroughly to confirm it contains the sample you need.

- To accomplish this, use the form description and preview options if available.

Form popularity

FAQ

How to Write a Simple Payment Contract LetterThe date that the agreement was signed and thus going into effect.The date of the first payment.The date when each payment after will be made.A grace period, if any.When a payment is considered late.

Generally, to be legally valid, most contracts must contain two elements:All parties must agree about an offer made by one party and accepted by the other.Something of value must be exchanged for something else of value. This can include goods, cash, services, or a pledge to exchange these items.

Here are the steps to write a letter of agreement:Title the document. Add the title at the top of the document.List your personal information.Include the date.Add the recipient's personal information.Address the recipient.Write an introduction paragraph.Write your body.Conclude the letter.More items...?

Generally, participation agreements involve one or more participants who purchase an interest in the underlying loan, but a single lender, the lead lender, retains control over the loan and manages the relationship with the borrower.

Generally, participation agreements involve one or more participants who purchase an interest in the underlying loan, but a single lender, the lead lender, retains control over the loan and manages the relationship with the borrower.