Limited Between Partners For Venture Capital

Description

How to fill out Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

It’s clear that you cannot become a legal expert instantly, nor can you learn to swiftly compose Limited Between Partners For Venture Capital without possessing a specialized skill set.

Drafting legal documents is a lengthy process that demands specific training and expertise. So why not entrust the creation of the Limited Between Partners For Venture Capital to the professionals.

With US Legal Forms, one of the most extensive legal document collections, you can find anything from court filings to templates for internal communication.

You can regain access to your documents from the My documents section at any time. If you are a current customer, you can simply Log In, and find and download the template from the same section.

Regardless of the intended use of your forms—whether financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Identify the document you require using the search bar at the top of the page.

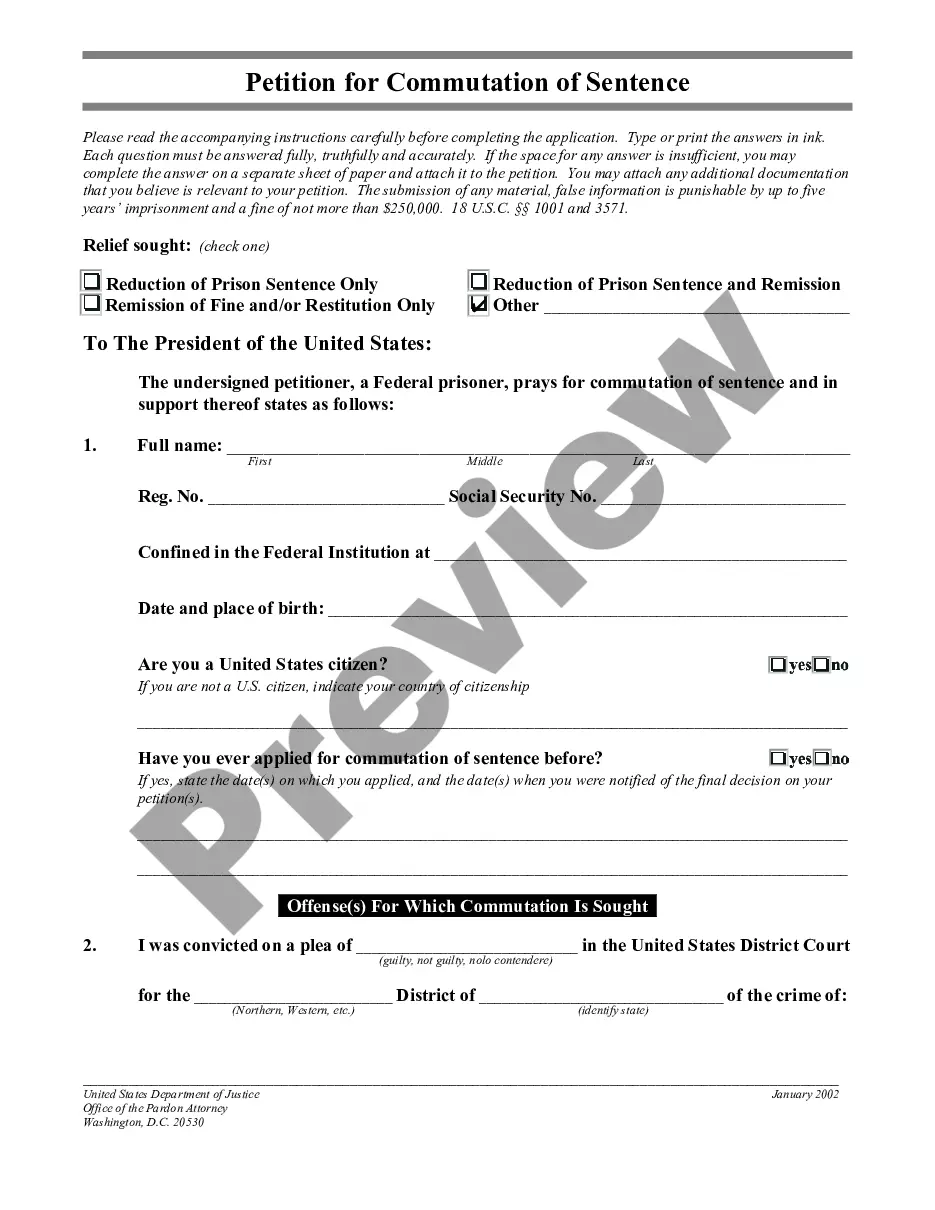

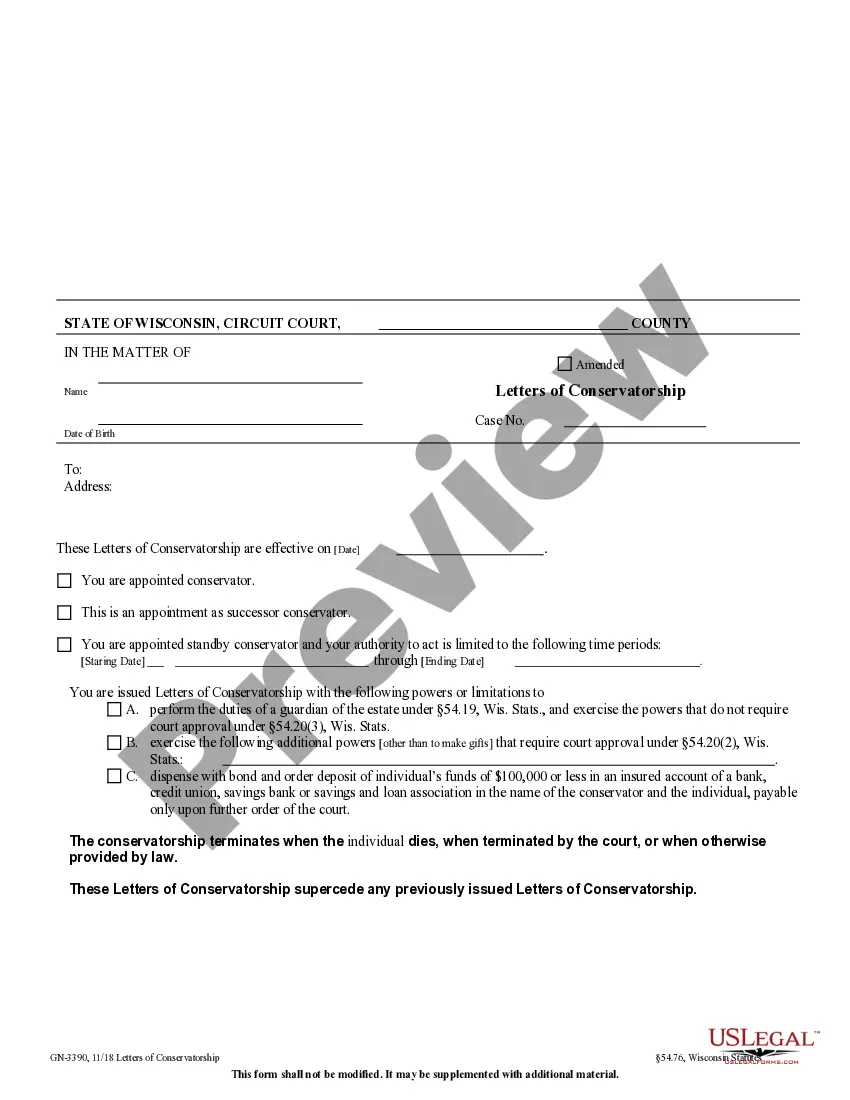

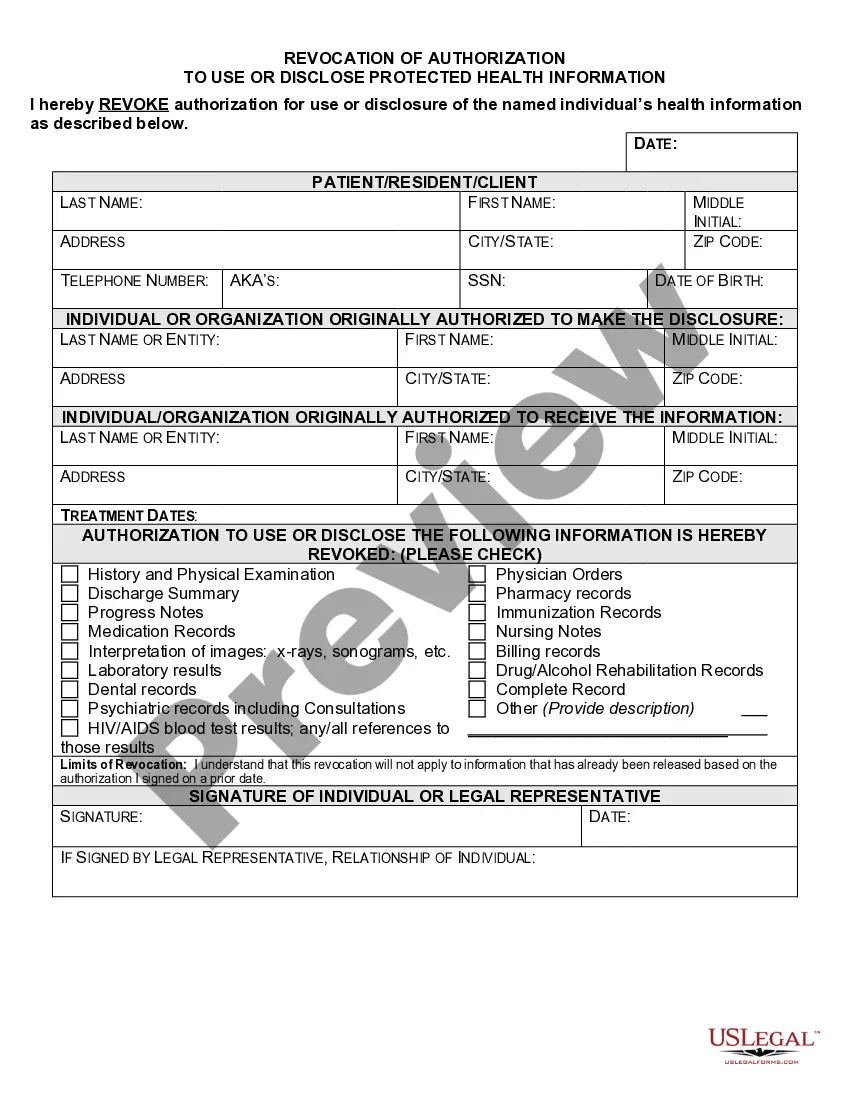

- Preview it (if this option is available) and review the accompanying description to see if Limited Between Partners For Venture Capital aligns with your needs.

- Start your search again if you need another document.

- Create a free account and select a subscription plan to purchase the template.

- Click Buy now. After the payment is completed, you can obtain the Limited Between Partners For Venture Capital, fill it out, print it, and deliver it or send it by mail to the intended recipients or organizations.

Form popularity

FAQ

The best places to find LPs are from hobbies, existing communities, cap tables of existing portfolio companies and online platforms (like LinkedIn, Twitter, blogs etc).

With a venture capital fund, a limited partner is the investor who supplies the capital. These LPs can be individuals or legal entities. Often, LPs are institutional investors, such as pension funds, college endowments, trusts, insurance companies, health care systems, family offices, and sovereign wealth funds.

Overall, becoming an LP in a typical VC fund requires money, knowledge of the risks and possible rewards, a long-term investment horizon, and a willingness to play a passive role. By meeting these requirements, investors can become LPs in a VC fund and benefit from the potential big returns.

Leverage existing relationships: Reach out to your existing network of investors, entrepreneurs, and industry contacts to see if they can introduce you to potential LPs. Work with placement agents: Placement agents are firms that specialize in helping venture capital firms raise capital from institutional investors.

How many limited partners can a venture fund have? There is no limit on the number of Limited Partners that are investing in a venture fund. The numbers range from 10 to even 100 LPs in a venture fund. The average is about 10 to 20 LPs depending on the size of the fund and the amount of money to raise.