Motion Child Support With Taxes

Description

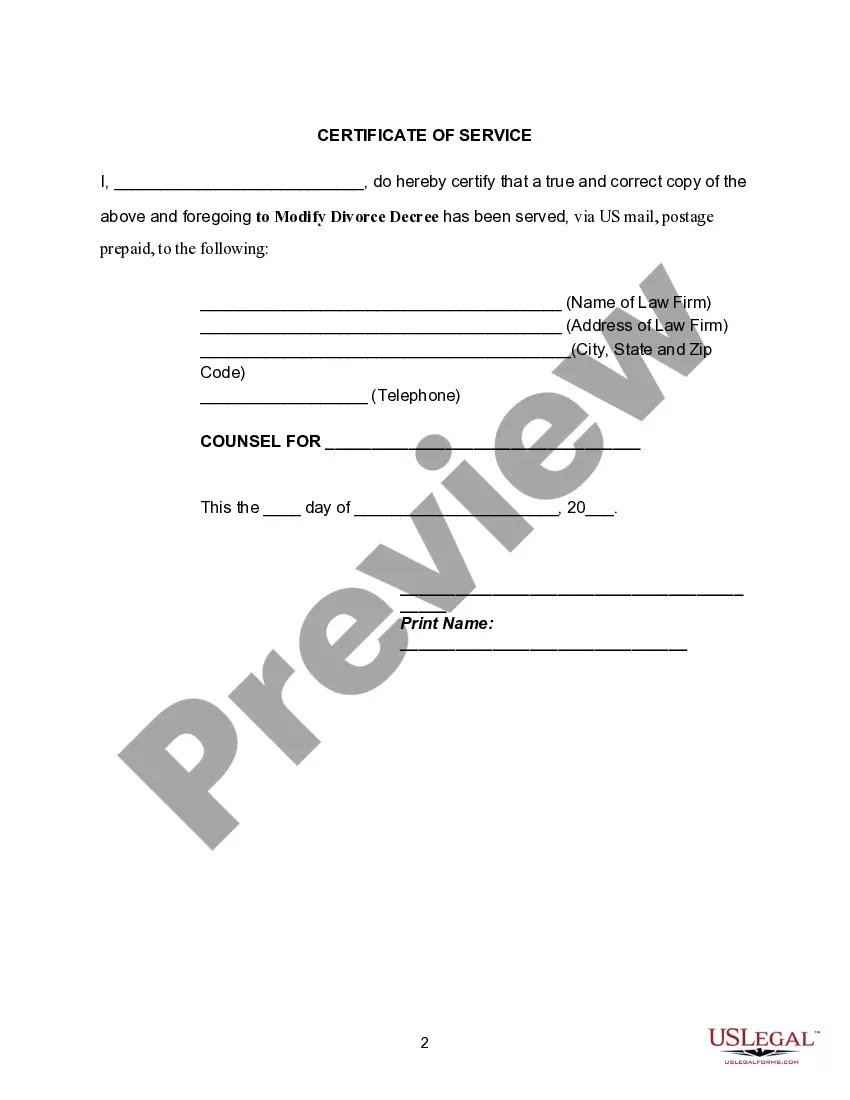

How to fill out Motion To Modify Or Amend Divorce Decree To Provide For Increase In Amount Of Child Support?

It’s well-known that you cannot become a legal authority instantly, nor can you quickly learn how to draft Motion Child Support With Taxes without possessing a specialized background. Crafting legal documents is a lengthy procedure necessitating specific education and expertise. So why not entrust the creation of the Motion Child Support With Taxes to the experts.

With US Legal Forms, one of the most extensive legal template collections, you can discover everything from court documents to templates for internal business communication. We recognize how vital compliance and adherence to federal and local laws and regulations are. That’s why, on our site, all templates are location-specific and current.

Here’s how you can begin using our website and acquire the form you need in just minutes.

You can regain access to your documents from the My documents tab at any moment. If you’re an existing client, you can simply Log In, and find and download the template from the same tab.

Regardless of the intent of your documents—be it financial and legal, or personal—our website has you covered. Try US Legal Forms today!

- Locate the form you require by utilizing the search bar at the top of the page.

- View it (if this option is available) and review the accompanying description to ascertain whether Motion Child Support With Taxes is what you’re looking for.

- Initiate your search again if you need another template.

- Sign up for a free account and select a subscription plan to purchase the template.

- Click Buy now. Once the payment is processed, you can download the Motion Child Support With Taxes, complete it, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

You can claim a child as a dependent if he or she is your qualifying child. Generally, the child is the qualifying child of the custodial parent. The custodial parent is the parent with whom the child lived for the longer period of time during the year.

Bear in mind that in order for you to claim a child as a dependent, your child has to: be your child (or adoptive or foster child), sibling, niece, nephew or grandchild; be under age 19, or under age 24 and a full-time student for at least five months of the year; or be permanently disabled, regardless of age;

Yes. The person doesn't have to live with you in order to qualify as your dependent on taxes. However, the person must be a relative who meets one of the following relationship test requirements: Your child, grandchild, or great-grandchild.

For tax purposes, the custodial parent is usually the parent the child lives with the most nights. If the child lived with each parent for an equal number of nights, the custodial parent is the parent with the higher adjusted gross income (AGI).

If you file jointly and your spouse has a debt (this can be a federal, state income tax, child support, or spousal support debt) the IRS can apply your refund to one of these debts, which is known as an ?offset.? The agency can also take a collection action against you for the tax debt you and your spouse owe, such as ...