Form Child Support Withholding

Description

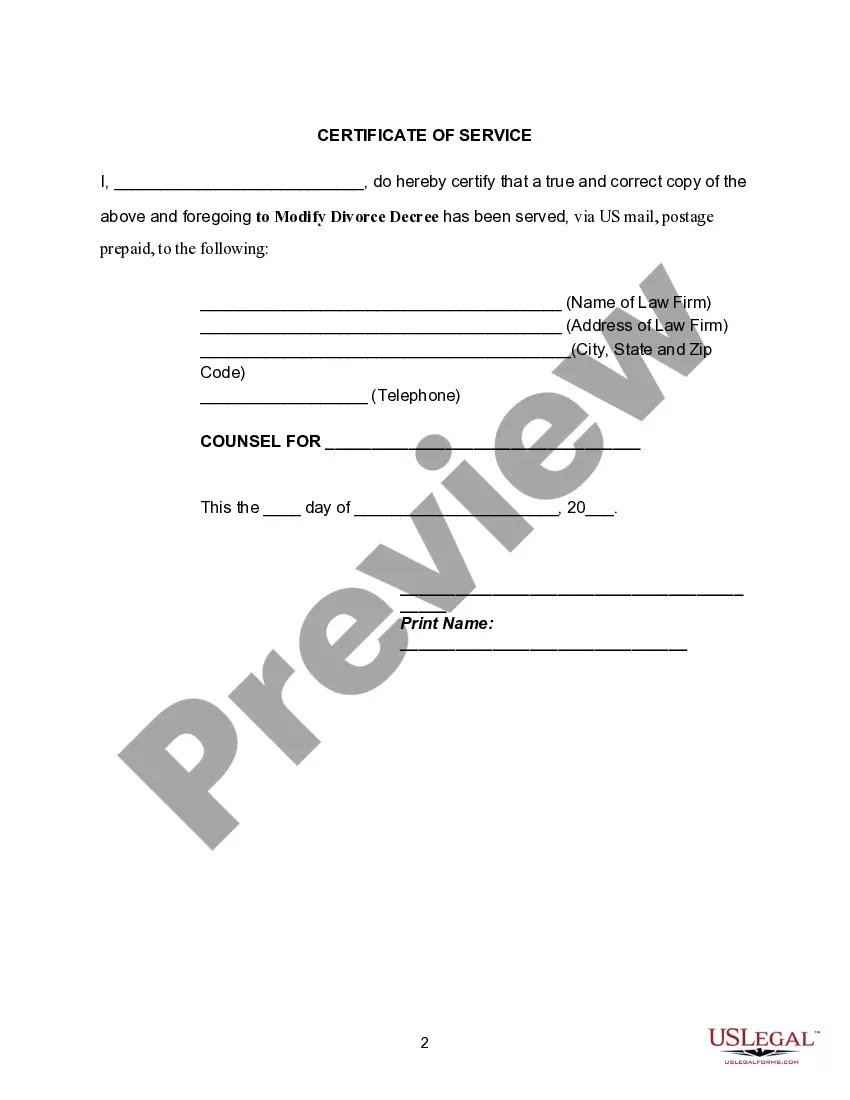

How to fill out Motion To Modify Or Amend Divorce Decree To Provide For Increase In Amount Of Child Support?

It’s clear that you cannot become a legal authority instantly, nor can you understand how to swiftly prepare Form Child Support Withholding without possessing a specialized background.

Drafting legal documents is a lengthy process that demands specific training and abilities.

So why not entrust the preparation of the Form Child Support Withholding to the professionals.

Preview it (if this option is available) and review the supporting description to determine whether Form Child Support Withholding is what you’re seeking.

Create a free account and select a subscription plan to buy the form.

- With US Legal Forms, one of the most comprehensive legal template collections, you can obtain anything from court documents to templates for in-office correspondence.

- We understand how vital compliance and adherence to federal and local regulations are.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how to get started with our website and acquire the document you need in just minutes.

- Locate the form you require by utilizing the search bar at the top of the page.

Form popularity

FAQ

WITHHOLDING LIMIT The amount withheld for support may not exceed fifty percent (50%) of the employee's/income recipient's net wages or other income. (T.C.A. § 36-5-501(a)(1)) It is the employer's responsibility to determine when the 50% level is met.

When combined monthly parental income is greater than $28,250, the guideline says parents should pay the highest basic child support obligation (listed on page 71 of the Child Support Guidelines), plus a percentage of their income over $28,250: One child: 6.81 percent. Two children: 7.22 percent.

The applicable CCPA withholding limit for this employee can be found on the income withholding order and is 55% ($1000 x 0.55 = $550). Since $400 does not exceed the CCPA withholding limit, the employer must withhold $400 from this lump sum payment.

Your company (employer) receives an "Order to Withhold Income for Child Support? from the Child Support Division. Your payment amount is deducted from your paycheck. Your employer sends the payment directly to us (each pay period). We process your payment and send it to the custodial parent.

The Federal limit is 50% of the disposable income if the obligor is supporting another family and 60% of the disposable income if the obligor is not supporting another family. However, that 50% limit is increased to 55% and that 60% limit is increased to 65% if the arrears are greater than 12 weeks.