Abandoned Property Personal Withholding

Description

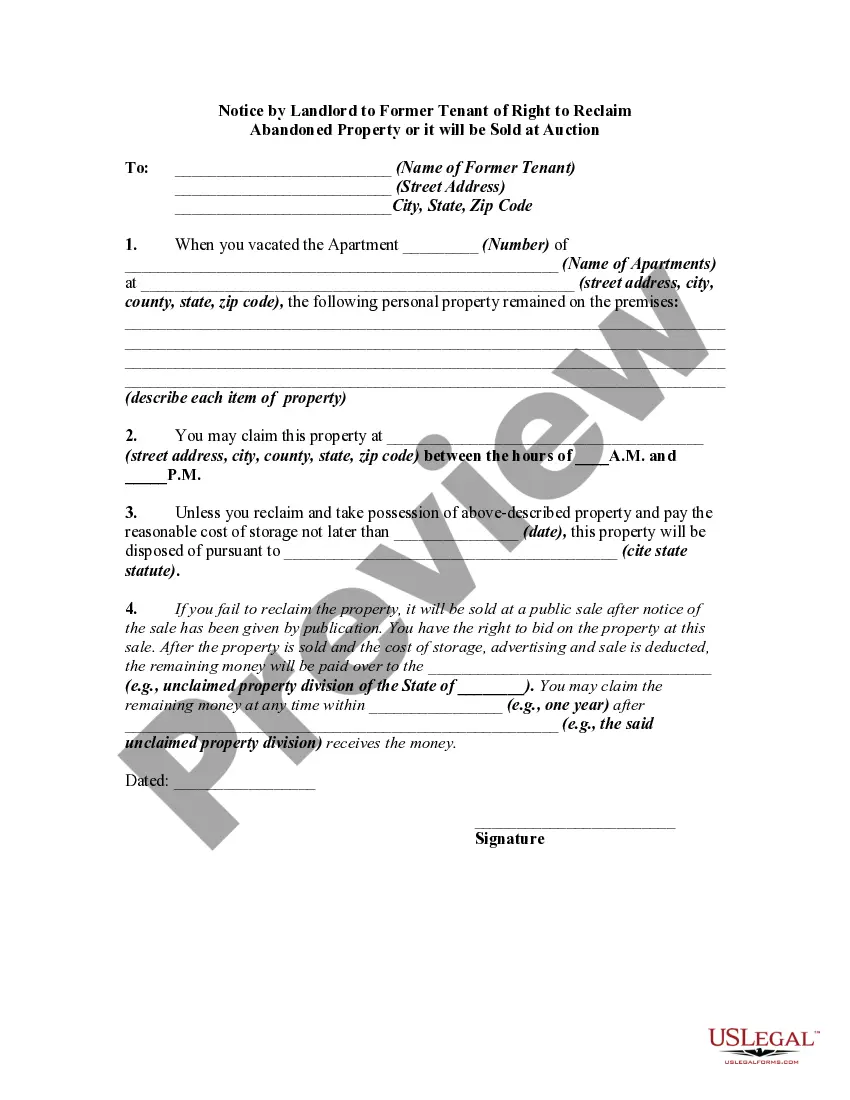

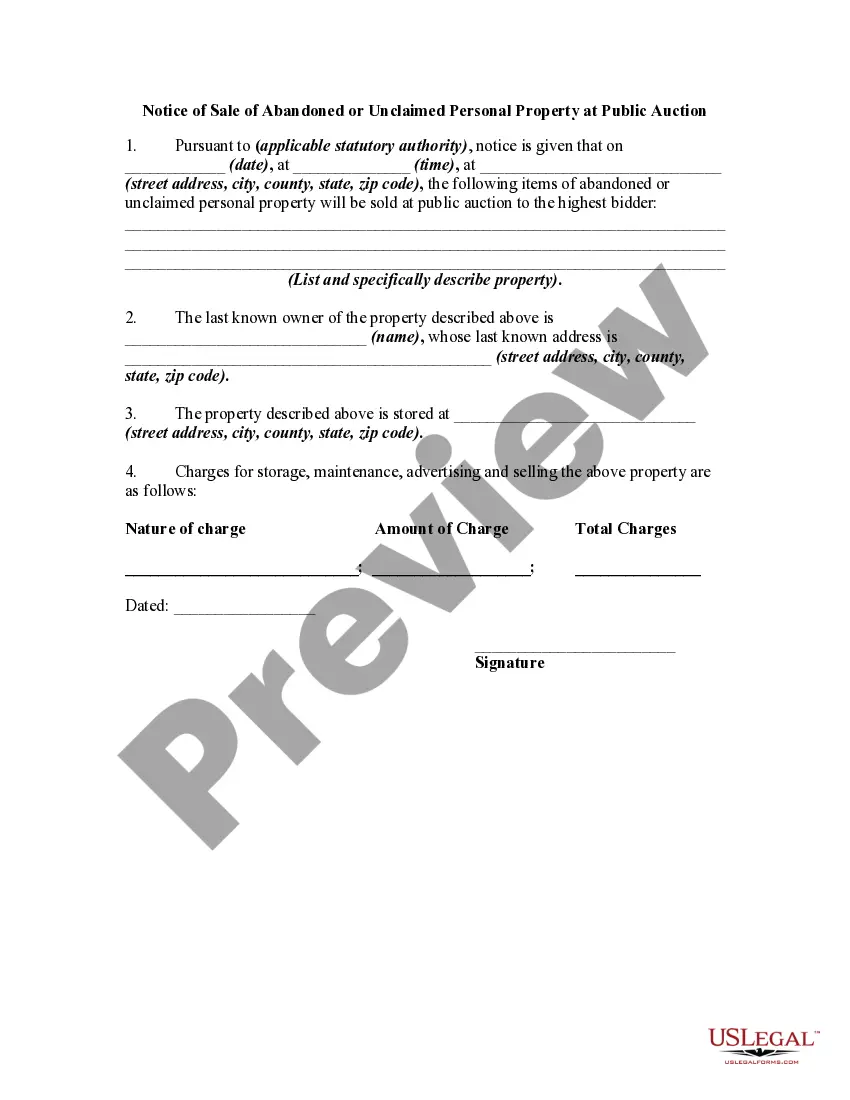

How to fill out Notice Of Sale Of Abandoned Or Unclaimed Personal Property At Public Auction - Abandonment?

Utilizing legal document examples that adhere to federal and state regulations is crucial, and the internet provides a variety of selections.

However, what is the benefit of wasting time hunting for the appropriate Abandoned Property Personal Withholding template online if the US Legal Forms digital library has gathered such resources in one location.

US Legal Forms is the largest digital legal repository boasting over 85,000 editable templates crafted by lawyers for every professional and personal scenario.

Review the template using the Preview feature or through the written description to confirm it aligns with your requirements.

- They are straightforward to navigate with all documents organized by state and intended use.

- Our specialists stay updated with legal modifications, ensuring you can consistently trust that your form is current and adheres to regulations when obtaining an Abandoned Property Personal Withholding from our site.

- Acquiring an Abandoned Property Personal Withholding is quick and easy for both existing and new users.

- If you have an account with an active subscription, Log In and download the document sample you require in the desired format.

- For newcomers to our platform, follow the instructions below.

Form popularity

FAQ

In Iowa, the time frame for someone’s property to be considered abandoned varies based on the type of property. Typically, personal property can be classified as abandoned after three to five years of inactivity, depending on the specific circumstances. However, you must follow the legal procedures for claiming such property. Utilizing resources like US Legal Forms can streamline your process related to abandoned property personal withholding and ensure you meet all legal requirements.

The law on abandoned property in Iowa specifies that property is deemed abandoned if it is left without any indication of intent to reclaim it. Various types of property, including real estate and personal possessions, can fall under this classification. The law requires that efforts be made to locate the owner before declaring the property abandoned. Familiarizing yourself with abandoned property personal withholding can help you navigate these complex legalities.

The abandoned property law in Iowa establishes rules for managing property left unattended or unclaimed. This law protects property owners and helps clarify how to handle possessions if the original owner cannot be located. Under this law, unclaimed property may eventually be transferred to the state. Understanding abandoned property personal withholding ensures compliance with these regulations.

The form for abandonment of property tax varies by state, but commonly, you will use a specific abandonment form that your local tax authority provides. This form typically allows you to request a review or a waiver of any outstanding property taxes. Utilizing the USLegalForms platform can help you find the right form for handling abandoned property personal withholding issues effectively.

To report abandoned assets on your tax return, use Form 1040 and include them as a capital loss if applicable. Clearly outline the details involved with the abandoned property to ensure proper documentation. If you require assistance, USLegalForms provides resources for filing abandoned property personal withholding accurately.

You should report abandonment losses on Form 1040, under the 'Other Income' section, as part of your annual tax filing. You will need to provide details about the property and any relevant dates. Seeking guidance through a platform like USLegalForms can help clarify the process related to abandoned property personal withholding.

Claiming unclaimed property that belongs to someone else can lead to legal complications. If the rightful owner comes forward, they may seek the return of their property, which could involve legal action. It is vital to ensure that you only claim what is yours, especially when navigating abandoned property personal withholding matters.

While abandoned property and unclaimed property are similar, they are not identical. Abandoned property typically refers to items left behind, while unclaimed property involves financial assets that have not been claimed after a certain period. Understanding these distinctions is crucial for individuals dealing with abandoned property personal withholding situations.

In Tennessee, abandoned property refers to any tangible or intangible asset that the owner has not claimed or used for a specific period. This may include items like bank accounts, uncashed checks, and personal belongings. It is important to understand the laws surrounding abandoned property personal withholding, as it impacts property management and tax implications.

To write off a worthless asset, you need to demonstrate that the asset no longer holds value and document the loss accurately. This process often entails recording the asset’s sale or disposal on your tax return. If you are facing issues with abandoned property personal withholding, uslegalforms can assist you in navigating the write-off process effectively.