Child Custody Holiday Schedule Examples

Description

How to fill out Agreement For Consent Judgment Granting Sole Custody Of Minor Child To Father?

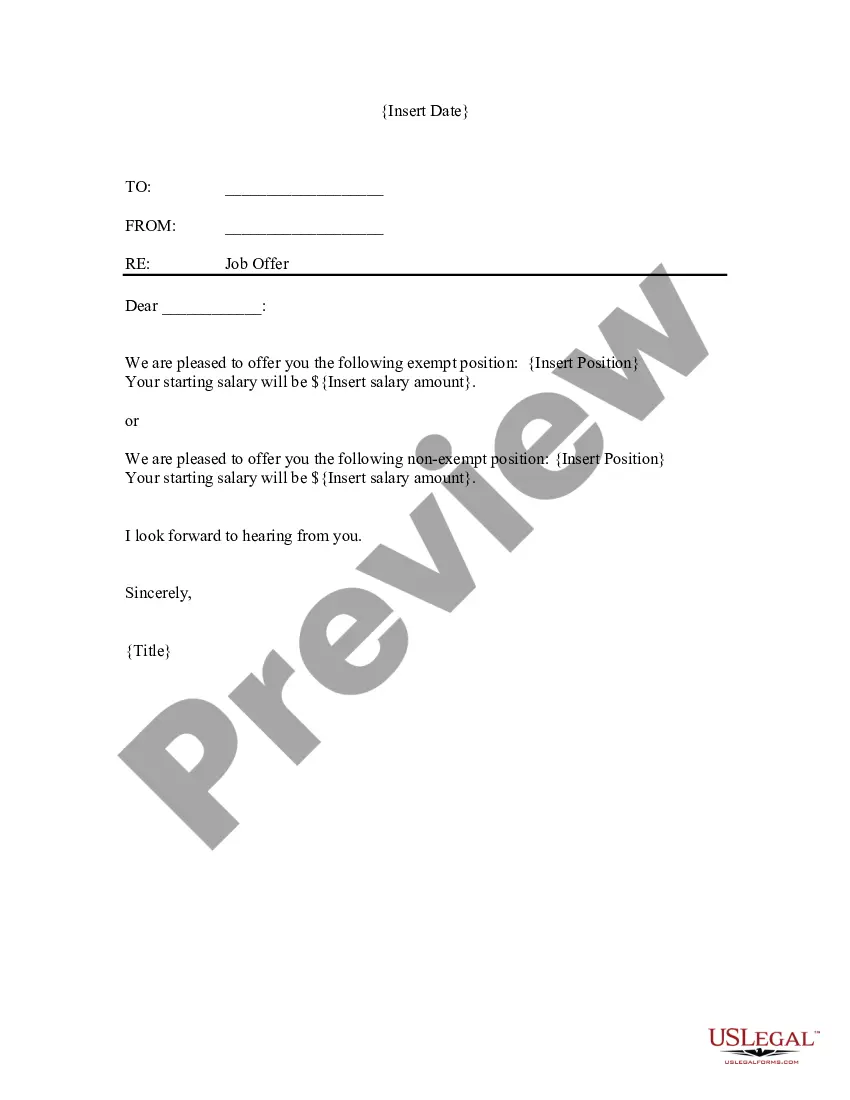

The Child Custody Holiday Schedule Samples you observe on this page is a versatile formal framework crafted by professional attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 validated, state-specific documents for any professional and personal scenario. It’s the quickest, easiest, and most trustworthy method to acquire the materials you require, as the service guarantees the utmost level of data protection and anti-malware security.

Register with US Legal Forms to have confirmed legal templates for all of life’s situations at your fingertips.

- Search for the document you need and review it.

- Browse through the file you searched and preview it or assess the form description to ensure it meets your needs. If it doesn’t, use the search feature to find the suitable one. Click Buy Now once you have found the template you require.

- Register and Log In.

- Choose the pricing plan that suits your needs and create an account. Use PayPal or a credit card for a swift payment. If you already have an account, Log In and check your subscription to proceed.

- Obtain the editable template.

- Select the format you desire for your Child Custody Holiday Schedule Samples (PDF, Word, RTF) and download the sample to your device.

- Complete and sign the documents.

- Print the template to fill it out manually. Alternatively, use an online multi-functional PDF editor to swiftly and accurately fill out and sign your form with a legally-binding electronic signature.

- Download your documents again.

- Utilize the same document once more whenever necessary. Access the My documents tab in your profile to redownload any previously saved forms.

Form popularity

FAQ

In Ohio, the cost for comprehensive estate plan drafting can range from $550 to $4250, depending on the complexity of your estate and the attorney's experience. The cost of creating a will in Ohio can range from $150 to $850. A trust in Ohio typically costs between $550 and $2950.

Maximum Amount ($) ? For relief from administration, $35,000 (R.C. § 2113.03(A)(1)) or $100,000 if the decedent is survived by a spouse who is named in their will or their spouse is entitled to receive their full estate per R.C.

Ohio small estate affidavit The petition form must be filed with the court. For even smaller estates in Ohio ? less than $40,000 if there is a surviving spouse, or $5,000 if there is no surviving spouse ? a summary release procedure can be used instead. File a petition with the court to begin.

What Qualifies As A Small Estate In Ohio? An Ohio estate qualifies as a small estate if the value of the probate estate is: $35,000 or less; OR. $100,000 or less and the entire estate goes to the decedent's surviving spouse whether under a valid will or under intestacy.

Ohio law allows for certain small estates to be handled in less time, and with less paperwork. If an estate is eligible, one may submit an Application to Relieve from Administration or a Summary Release from Administration to settle an estate.

A small estate could comprise of assets worth less than around £10,000. This would mean they wouldn't own their house and any assets they do have would be items left after passing.

Release from Administration ? There is a surviving spouse who is the sole beneficiary and the estate is worth no more than $100,000, or there is no surviving spouse and the estate is worth no more than $35,000.

Every state sets different rules about what qualifies as a small estate, which is defined by its dollar value. The collection of the decedent's assets may need to be worth less than $50,000 to be considered small or may be able to be worth as much as $150,000, depending on the state law and what assets are counted.