Title Liability Company For Dummies

Description

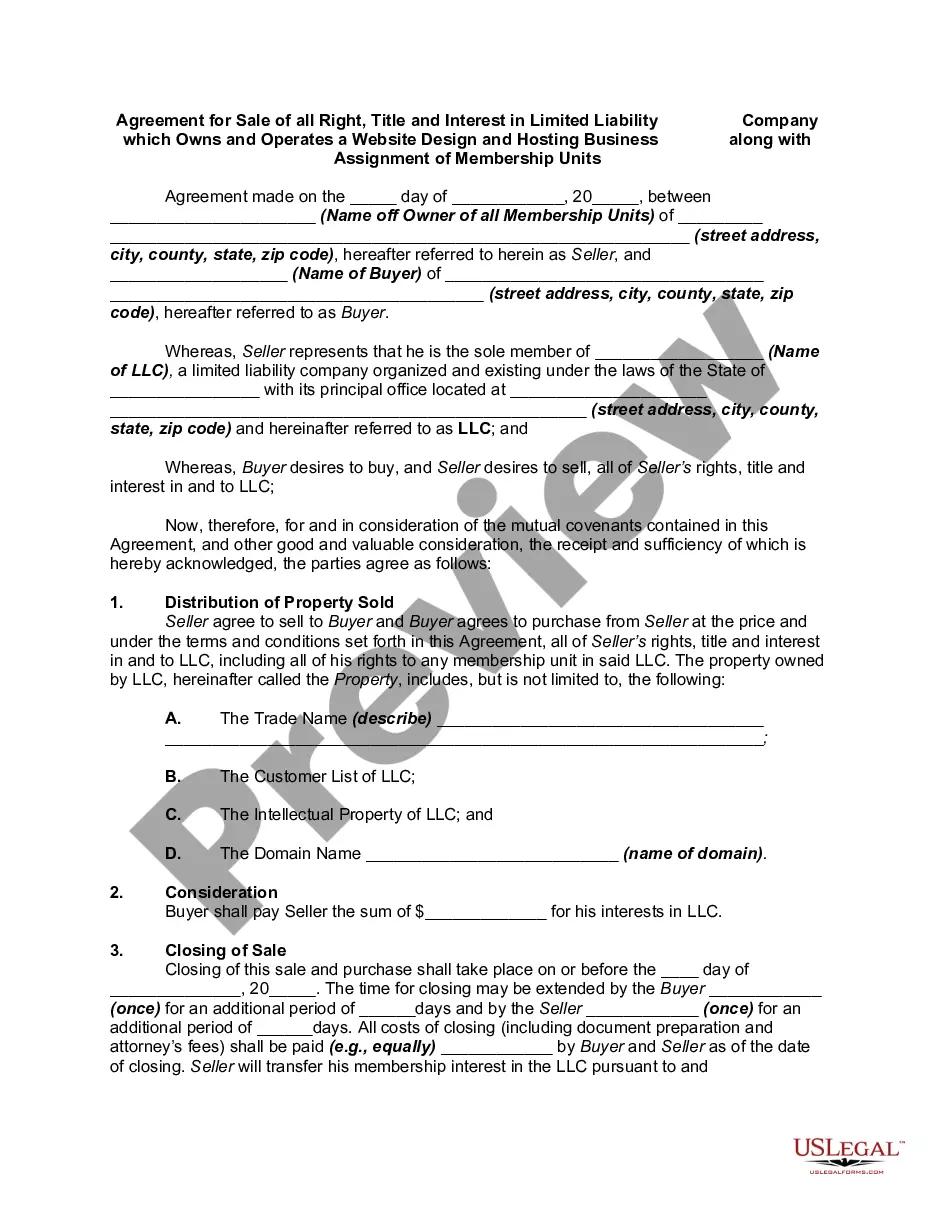

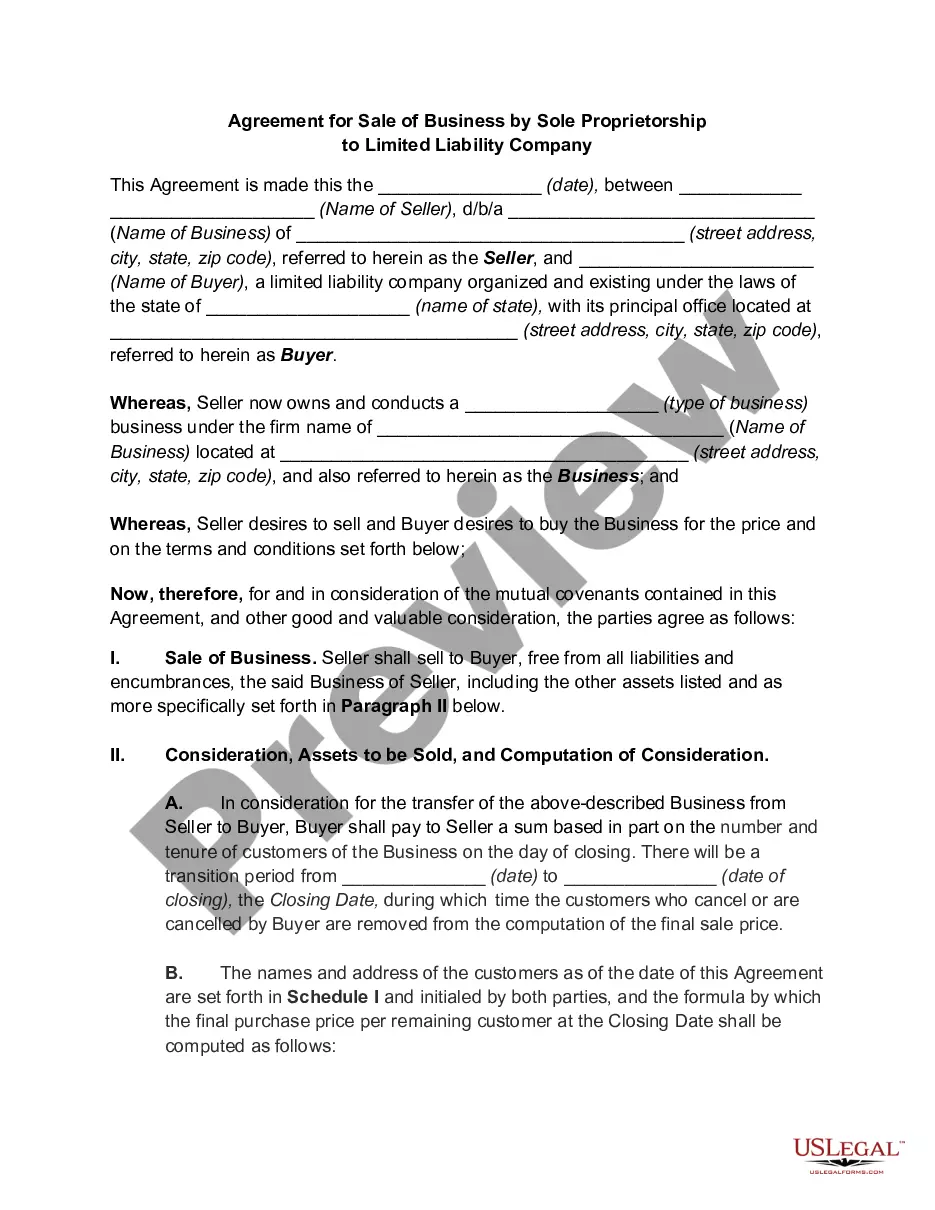

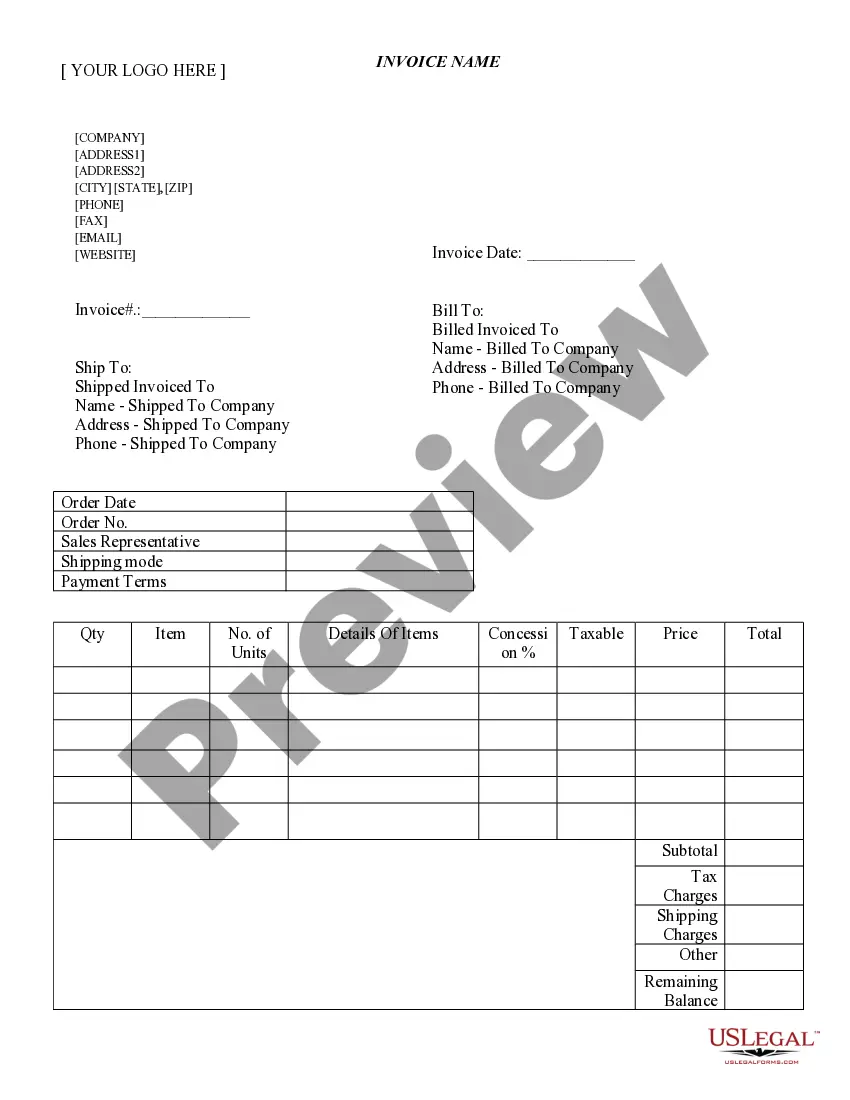

How to fill out Agreement For Sale Of All Rights, Title And Interest In Limited Liability Company LLC?

Managing legal documents and processes can be a lengthy addition to your overall day.

Title Liability Company For Dummies and similar forms often require you to search for them and comprehend the optimal way to fill them out correctly.

Consequently, whether you are addressing financial, legal, or personal affairs, utilizing a comprehensive and user-friendly online repository of forms at your disposal will greatly benefit you.

US Legal Forms is the leading online resource for legal templates, providing more than 85,000 state-specific forms along with numerous tools to help you complete your documents swiftly.

Is this your initial experience with US Legal Forms? Register and establish your account in just a few minutes to gain access to the form library and Title Liability Company For Dummies. Then, follow these steps to complete your form: Ensure you have the correct document by utilizing the Preview feature and reviewing the form description. Click Buy Now when you're ready, and choose the subscription plan that best fits your needs. Click Download, then fill out, sign, and print the document. US Legal Forms has 25 years of experience helping users manage their legal documents. Obtain the form you need today and streamline any process effortlessly.

- Explore the collection of pertinent documents available to you with just a single click.

- US Legal Forms offers state- and county-specific forms accessible at any time for downloading.

- Protect your document management processes with a top-notch service that enables you to prepare any form in minutes without extra or concealed charges.

- Simply Log In to your account, search for Title Liability Company For Dummies, and obtain it immediately from the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

Limited liability companies are one of the most flexible business entities. They allow you to choose how to distribute the profits, decide who manages the day-to-day business affairs, and decide how the profits will be taxed. They also offer a lot in terms of liability protection.

A Limited Liability Company or LLC is like a corporation regarding limited liability, and it's like a partnership regarding the flexibility of dividing profit among the owners. An LLC can elect to be treated either as a partnership or as a corporation for federal income tax purposes.

How to form an LLC Step 1: Choose a state in which to form your LLC. ... Step 2: Choose a name for your LLC. ... Step 3: Choose a registered agent. ... Step 4: Prepare an LLC operating agreement. ... Step 5: File your LLC with your state. Step 6: Obtain an EIN. ... Step 7: Open a business bank account.

Key takeaways. LLC stands for limited liability company, which means its members are not personally liable for the company's debts. LLCs are taxed on a ?pass-through? basis ? all profits and losses are filed through the member's personal tax return.

LLC stands for limited liability company, which means its members are not personally liable for the company's debts. LLCs are taxed on a ?pass-through? basis ? all profits and losses are filed through the member's personal tax return.