Report False Person With Social Security

Description

How to fill out Letter To Report False Submission Of Deceased Person's Information?

It’s obvious that you can’t become a legal professional overnight, nor can you figure out how to quickly prepare Report False Person With Social Security without the need of a specialized background. Creating legal documents is a time-consuming venture requiring a specific education and skills. So why not leave the creation of the Report False Person With Social Security to the professionals?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court documents to templates for internal corporate communication. We know how important compliance and adherence to federal and local laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s start off with our platform and get the document you require in mere minutes:

- Discover the document you need with the search bar at the top of the page.

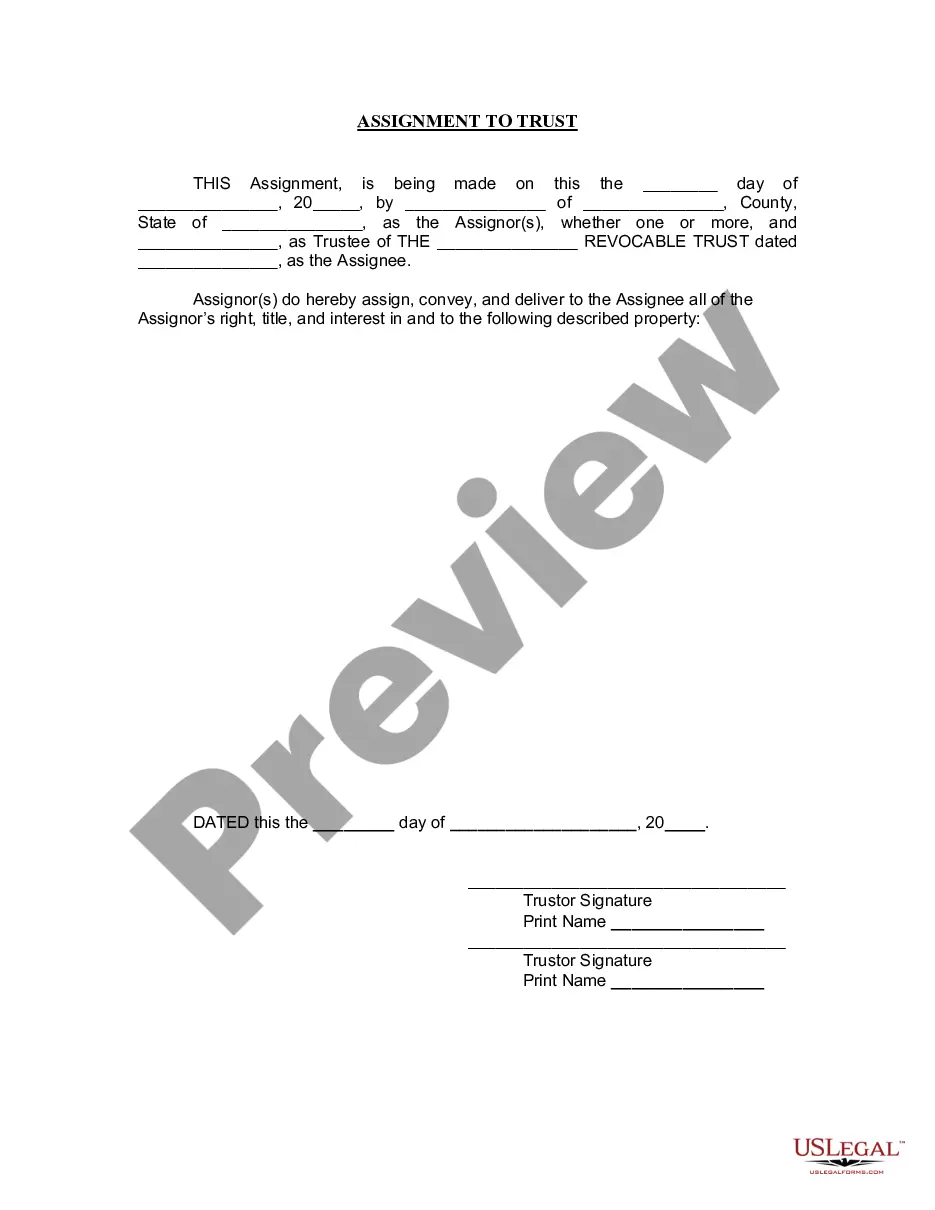

- Preview it (if this option available) and read the supporting description to figure out whether Report False Person With Social Security is what you’re searching for.

- Start your search again if you need a different template.

- Set up a free account and select a subscription option to buy the template.

- Choose Buy now. Once the transaction is complete, you can download the Report False Person With Social Security, complete it, print it, and send or send it by post to the designated individuals or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your paperwork-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Report fraud, waste or abuse involving the Social Security or SSI programs to our Office of the Inspector General. Or, report anonymously by: Calling our toll-free number at 1-800-269-0271 (TTY 1-866-501-2101), Monday through Friday from 10 a.m. to 4 p.m. ET.

Notify the IRS and the Social Security Administration. Contacting the IRS online at .irs.gov/uac/Identity-Protection or by phone at 800-908-4490 can help you avoid employment fraud and prevent someone else from accessing your tax refund.

Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes. Order free credit reports annually from the three major credit bureaus (Equifax, Experian, and TransUnion).

Self Lock is the unique feature that lets you protect your identity in E-Verify and Self Check by placing a "lock" in E-Verify on your Social Security number (SSN). This helps prevent anyone else from using your SSN for an E-Verify case.

If you know your Social Security information has been compromised, you can request to Block Electronic Access. This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778).