Liability Employer Buy With Money

Description

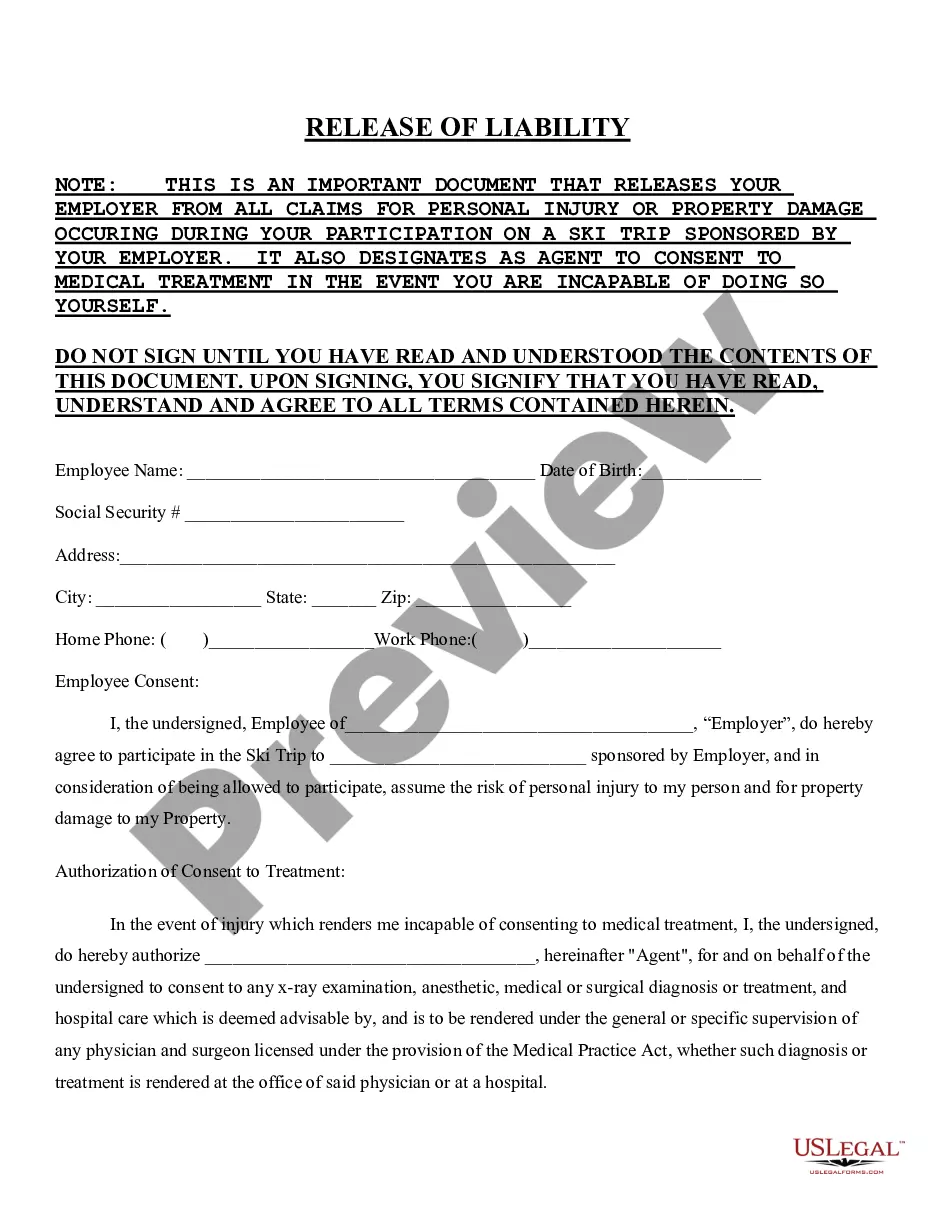

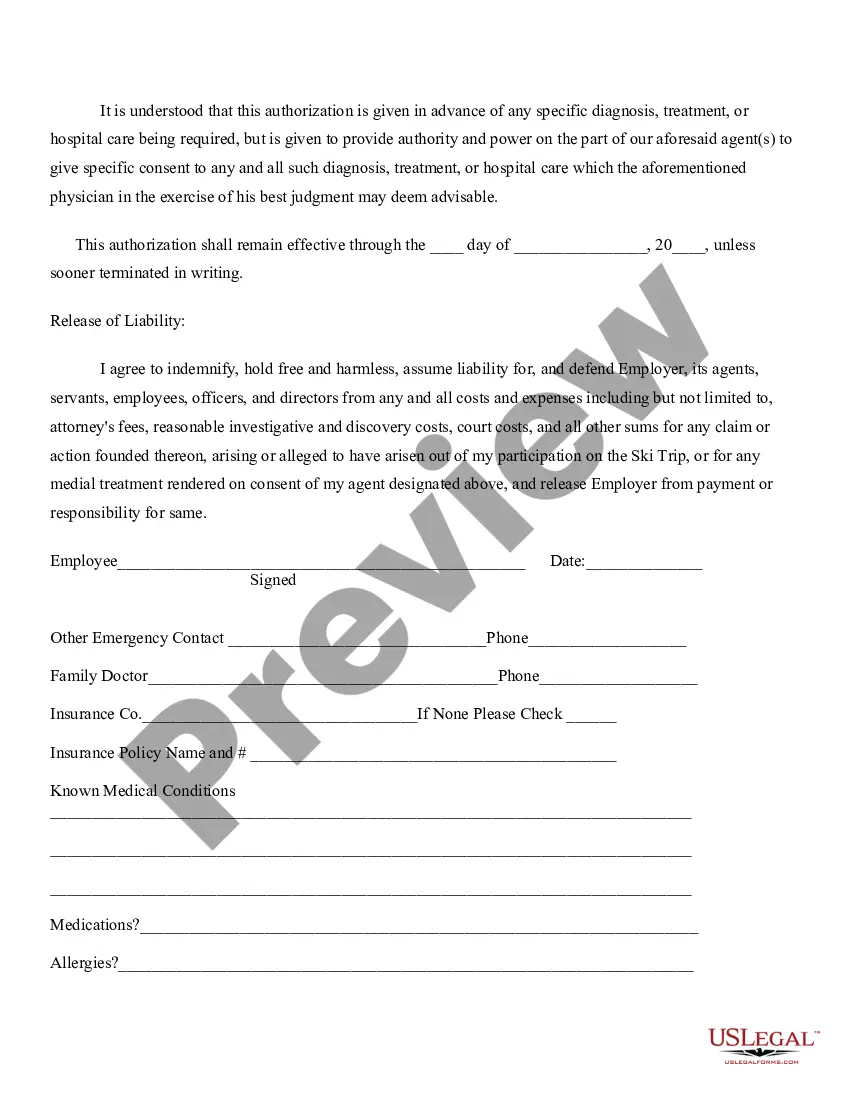

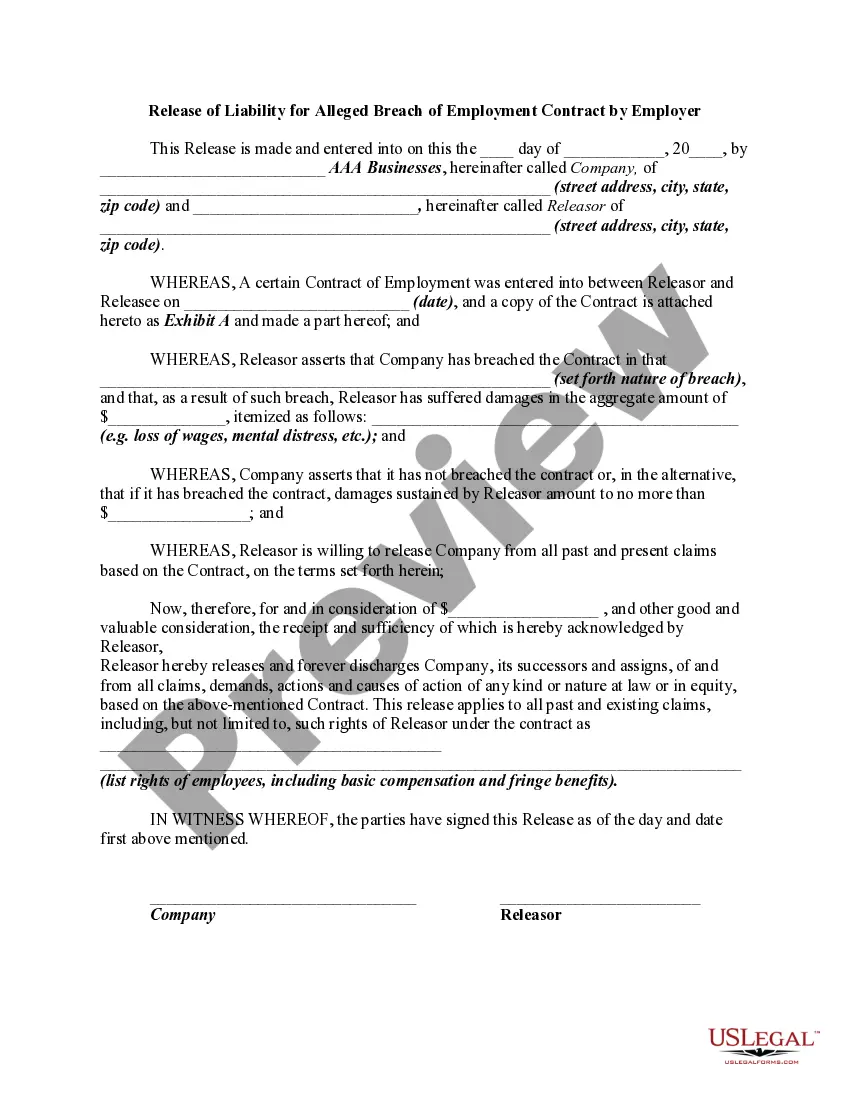

How to fill out Release Of Liability Of Employer - Ski Trip?

Handling legal papers and procedures might be a time-consuming addition to the day. Liability Employer Buy With Money and forms like it often need you to look for them and navigate how you can complete them correctly. For that reason, regardless if you are taking care of economic, legal, or personal matters, using a thorough and convenient online library of forms when you need it will go a long way.

US Legal Forms is the number one online platform of legal templates, boasting more than 85,000 state-specific forms and a number of resources to help you complete your papers effortlessly. Explore the library of pertinent papers available with just a single click.

US Legal Forms gives you state- and county-specific forms offered at any time for downloading. Safeguard your papers managing operations using a top-notch services that lets you prepare any form within minutes without having extra or hidden fees. Just log in in your profile, identify Liability Employer Buy With Money and download it immediately in the My Forms tab. You may also gain access to previously saved forms.

Would it be your first time using US Legal Forms? Sign up and set up up a free account in a few minutes and you’ll get access to the form library and Liability Employer Buy With Money. Then, adhere to the steps listed below to complete your form:

- Be sure you have the proper form using the Review option and looking at the form information.

- Choose Buy Now when ready, and choose the monthly subscription plan that suits you.

- Select Download then complete, eSign, and print the form.

US Legal Forms has 25 years of expertise supporting consumers manage their legal papers. Find the form you want right now and enhance any process without having to break a sweat.

Form popularity

FAQ

If an employer does not withhold deductions, or if it makes deductions but does not remit them, it becomes liable for the amount that should have been remitted. The CRA can go as far as taking legal action, such as garnishing your salary or other sources of income or seizing and selling property.

Regardless of whether you got paid $5 or $500, income is income, and it should all be reported. Your tax preparer can help you to figure out how much of it is actually taxable. Do you have more questions about 1099 forms? Clergy Financial Resources can help with our Pro Advisor service.

You are required to include the make, model and year of the vehicle and total kilometres driven. Eligible motor vehicle expenses include fuel, maintenance, repairs, license, registration, insurance, capital cost allowance, interest, leasing. You can also specify the expense.

Statutory and supplementary benefits in Canada are additional costs to an employee's gross salary. On average, Canadian employee benefits typically cost 15% of payroll for a smaller company and as high as 30% for a larger business.

The remuneration is more than $500. if you provide current employees with taxable group term life insurance benefits, you must report the amounts on a T4 slip, even if the total of all remuneration paid in the calendar year is less than $500.