Business Purchase Agreement With Seller Financing

Description

How to fill out Business Purchase Agreement With Seller Financing?

There’s no further justification to squander time searching for legal documents to meet your local state requirements.

US Legal Forms has compiled all of them in a single location and enhanced their accessibility.

Our website provides over 85k templates for various business and personal legal situations categorized by state and purpose.

Executing formal documentation under federal and state laws and regulations is quick and easy with our library. Give US Legal Forms a try now to keep your documentation organized!

- All forms are correctly crafted and validated for authenticity, ensuring you can confidently acquire a current Business Purchase Agreement With Seller Financing.

- If you are acquainted with our service and already possess an account, make sure your subscription is active before obtaining any templates.

- Log In to your account, choose the document, and click Download.

- You can also access all saved documents whenever necessary by selecting the My documents tab in your profile.

- If you've never used our service before, the procedure will require a few additional steps to finalize.

- Here's how new users can find the Business Purchase Agreement With Seller Financing in our library.

- Examine the page content closely to confirm it contains the sample you need.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

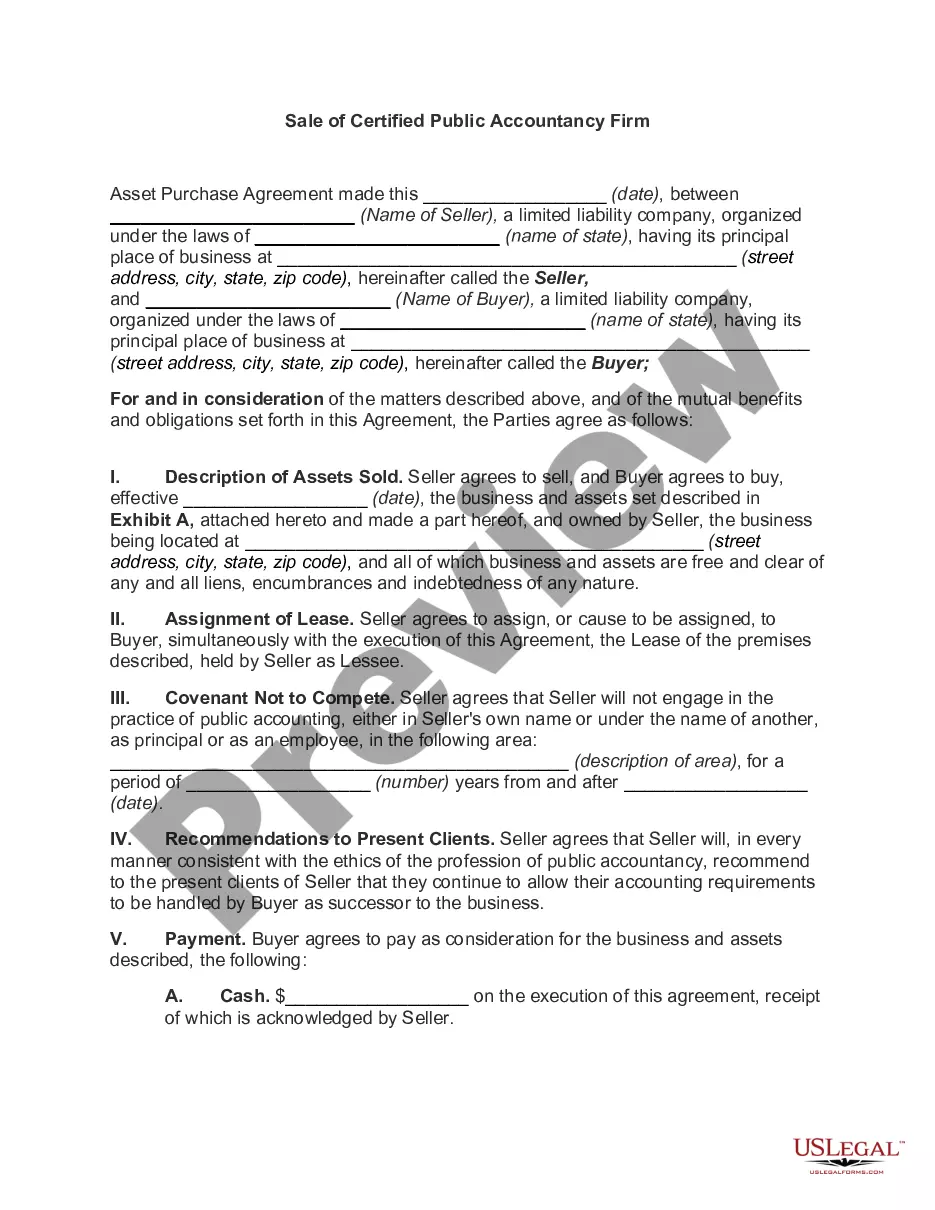

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

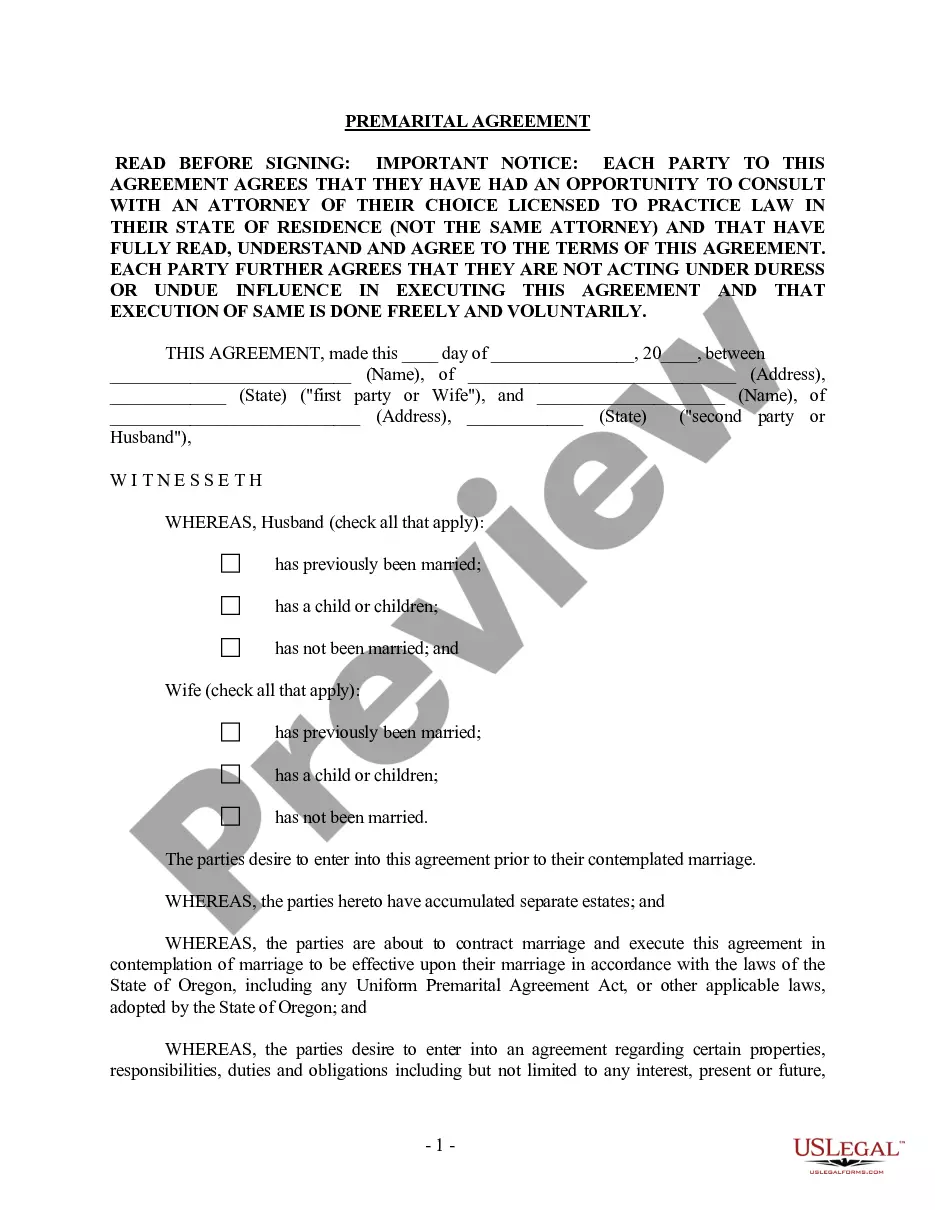

How to write a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...

Here are three main ways to structure a seller-financed deal:Use a Promissory Note and Mortgage or Deed of Trust. If you're familiar with traditional mortgages, this model will sound familiar.Draft a Contract for Deed.Create a Lease-purchase Agreement.

The seller's financing typically runs only for a fairly short term, such as five years, with a balloon payment coming due at the end of that period.