Written Request For Tax Clearance With Bank

Description

How to fill out Sample Letter For Request For Tax Clearance Letter?

Whether for business purposes or for individual affairs, everybody has to manage legal situations sooner or later in their life. Completing legal papers needs careful attention, beginning from choosing the proper form template. For instance, when you pick a wrong version of the Written Request For Tax Clearance With Bank, it will be turned down once you send it. It is therefore important to get a trustworthy source of legal files like US Legal Forms.

If you have to obtain a Written Request For Tax Clearance With Bank template, follow these simple steps:

- Get the sample you need using the search field or catalog navigation.

- Check out the form’s information to make sure it fits your case, state, and region.

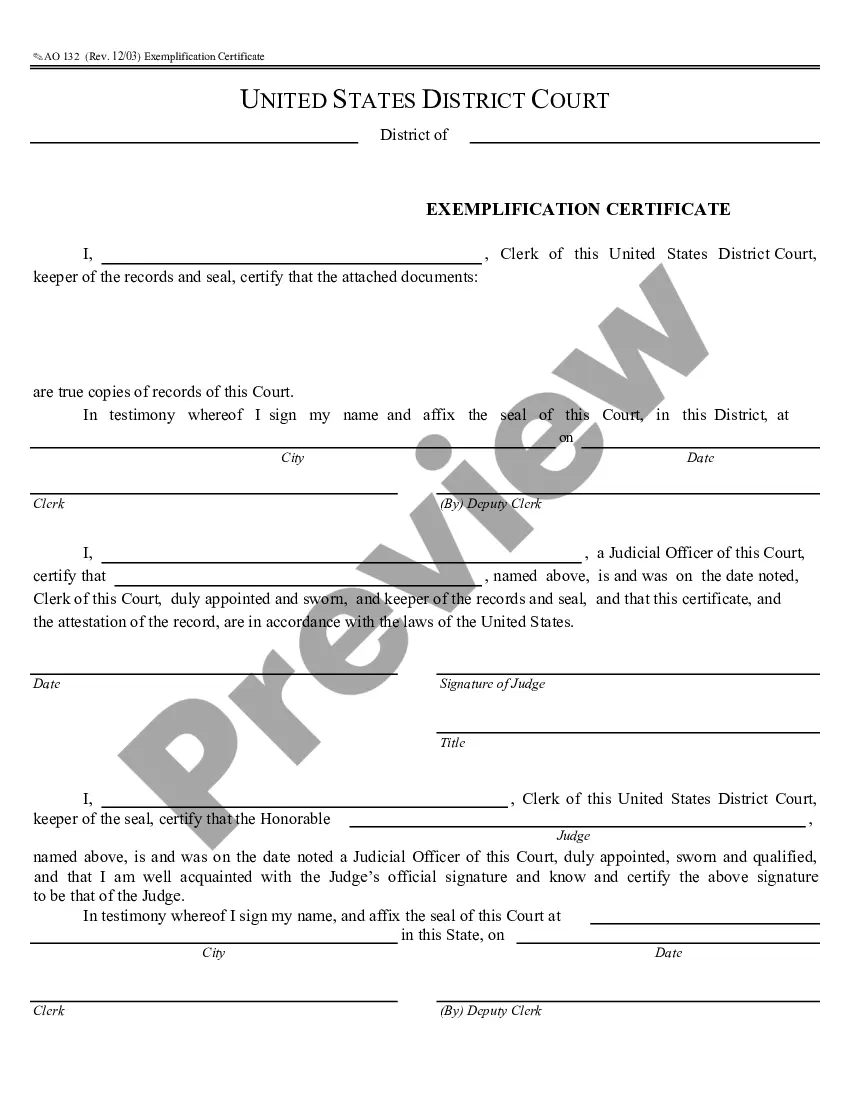

- Click on the form’s preview to examine it.

- If it is the incorrect document, get back to the search function to locate the Written Request For Tax Clearance With Bank sample you require.

- Get the file if it matches your requirements.

- If you already have a US Legal Forms account, just click Log in to gain access to previously saved documents in My Forms.

- In the event you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the proper pricing option.

- Complete the account registration form.

- Pick your transaction method: you can use a bank card or PayPal account.

- Choose the document format you want and download the Written Request For Tax Clearance With Bank.

- Once it is saved, you are able to complete the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time searching for the right sample across the web. Take advantage of the library’s straightforward navigation to find the correct form for any occasion.

Form popularity

FAQ

Clearance certificates demonstrate that a business or person is currently compliant with all tax liabilities and does not owe any outstanding tax. Clearance certificates are required in many situations, such as in estate planning or the closing or transfer of a business.

A clearance certificate confirms that all tax liabilities of an individual or entity have been paid. The certificate is applicable upon the sale of a business, transfer of ownership, or the death of an individual.

Tax Clearance for Corporations: Agency:Pennsylvania Department of RevenueForm:Form PA REV-181: Application for Tax ClearanceAgency Fee:$0Turnaround:1-2 monthsNotes:When dissolving or withdrawing a business, a tax clearance certificate application must be filed with the Department of Revenue and the Department of Labor.

A tax clearance is required by the Secretary of State if a corporation's charter is administratively dissolved and the corporation wishes to be reinstated, or if the corporation is filing Articles of Voluntary Dissolution, Withdrawal, Termination, or Merger.

To receive a tax clearance certificate when shutting down a business, a business must file all returns to date and a final franchise and excise tax return through the date of liquidation or the date on which the business ceased operations in Tennessee.