Irrevocable Trust Agreement Form

Description

How to fill out Trust Agreement - Irrevocable?

There's no longer a requirement to squander time hunting for legal documents to adhere to your local state regulations.

US Legal Forms has gathered all of them in one location and simplified their accessibility.

Our website provides over 85,000 templates for any business and personal legal matters organized by state and area of utilization.

Utilize the search bar above to look for an alternative sample if the current one does not meet your requirements. Click Buy Now next to the template title once you identify the suitable one. Choose the most appropriate pricing plan and either create an account or Log In. Complete the payment for your subscription using a credit card or via PayPal to proceed. Select the file format for your Irrevocable Trust Agreement Form and download it to your device. Print your form to fill it out manually or upload the sample if you prefer to utilize an online editor. Completing official documentation under federal and state regulations is quick and easy with our library. Give US Legal Forms a try now to keep your records organized!

- All forms are expertly drafted and confirmed for legitimacy, so you can be assured of acquiring an up-to-date Irrevocable Trust Agreement Form.

- If you are acquainted with our platform and already possess an account, you need to verify that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documentation whenever necessary by accessing the My documents tab in your profile.

- If you are new to our platform, the process will require additional steps to finalize.

- Here's how new users can locate the Irrevocable Trust Agreement Form in our catalog.

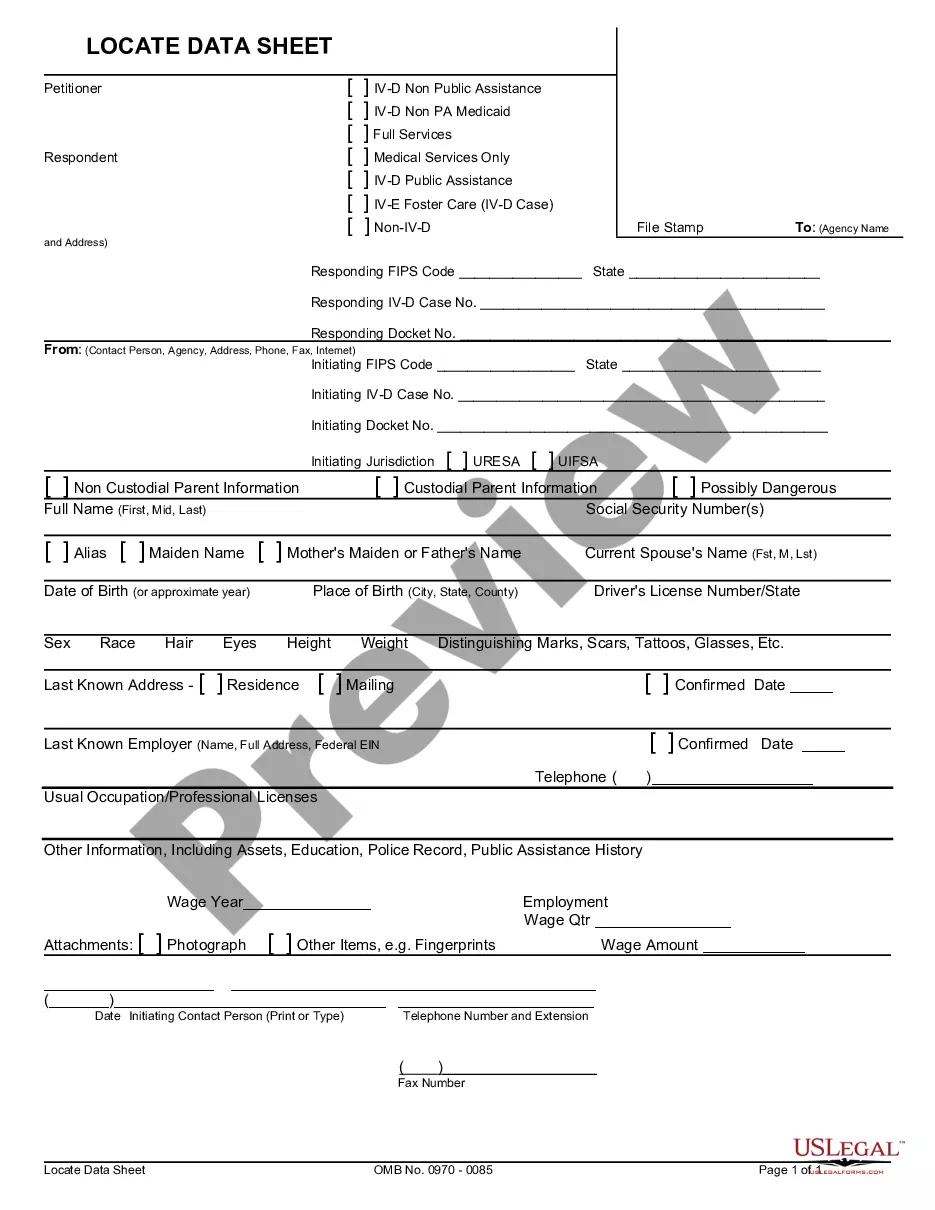

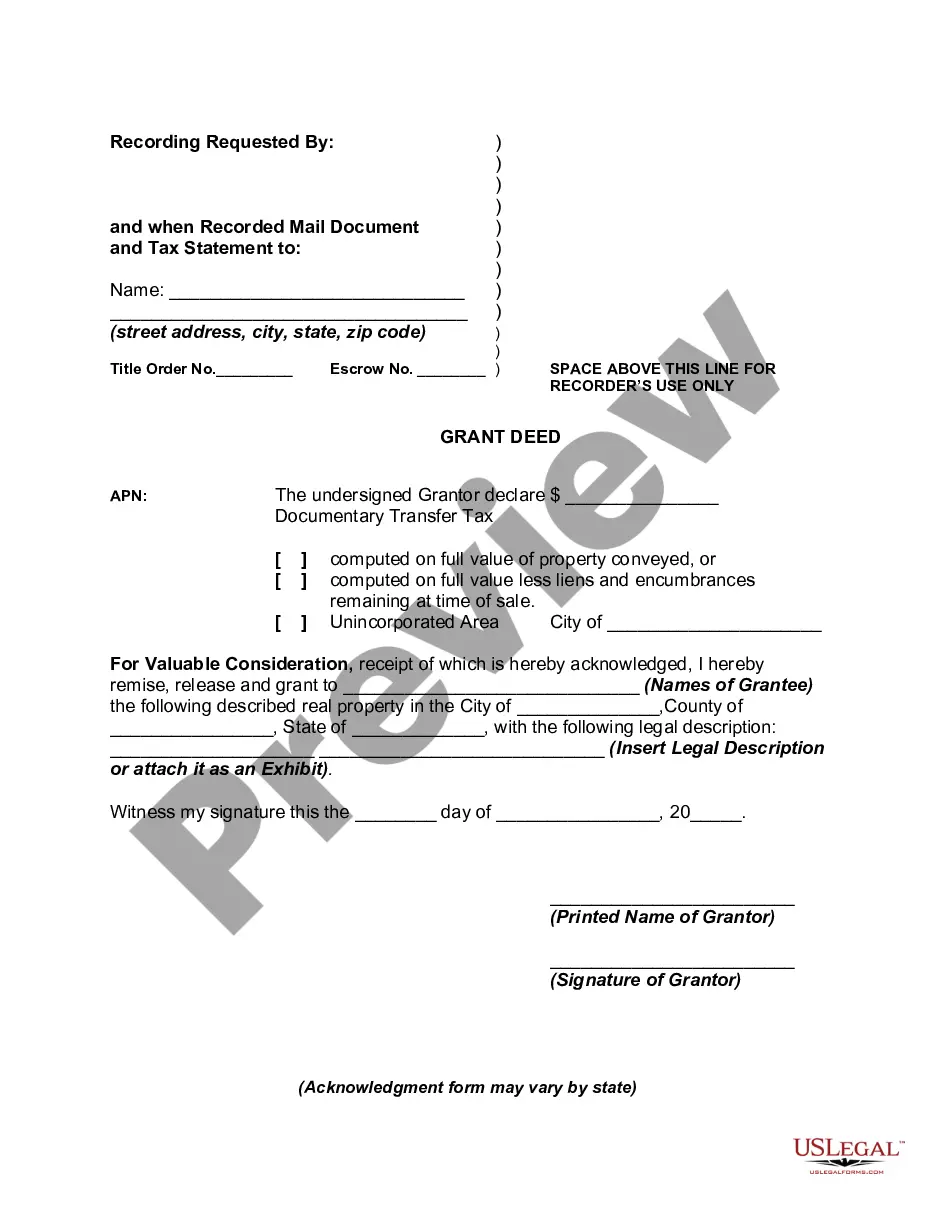

- Examine the page content closely to ensure it includes the sample you need.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

The trustee is required to obtain a W-9 to verify grantor's taxpayer identification number. This method is most commonly used with revocable trusts which are also grantor trusts for income tax purposes.

The person creating the trust loses control and possession of the asset.Plan the purpose and scope of the irrevocable trust.Choose a trustee.Prepare an irrevocable trust agreement.Obtain a taxpayer identification number for the trust from the Internal Revenue Service.More items...

If you set up an irrevocable trust, you must fill out a W-9 form so that the IRS can grant you a taxpayer identification number for your trust. Provide the name of the trust at the top of the form where the IRS asks for a name. Do not put the name of the trustee in this space, just the name of the trust.

With an Irrevocable Trust, once you have transferred the ownership of the house to the trust, it's irrevocable, meaning you are never supposed to be able to take it back. The trust will own that house for the rest of your life.

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.