Special Needs Trust Form With Decimals

Description

How to fill out Trust Agreement - Family Special Needs?

The Special Needs Trust Form With Decimals displayed on this page is a versatile legal template created by expert attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners more than 85,000 validated, state-specific forms for any business and personal situation. It’s the fastest, easiest, and most reliable way to obtain the documents you require, as the service ensures bank-level data security and anti-malware measures.

Register for US Legal Forms to access verified legal templates for all of life’s circumstances at any time.

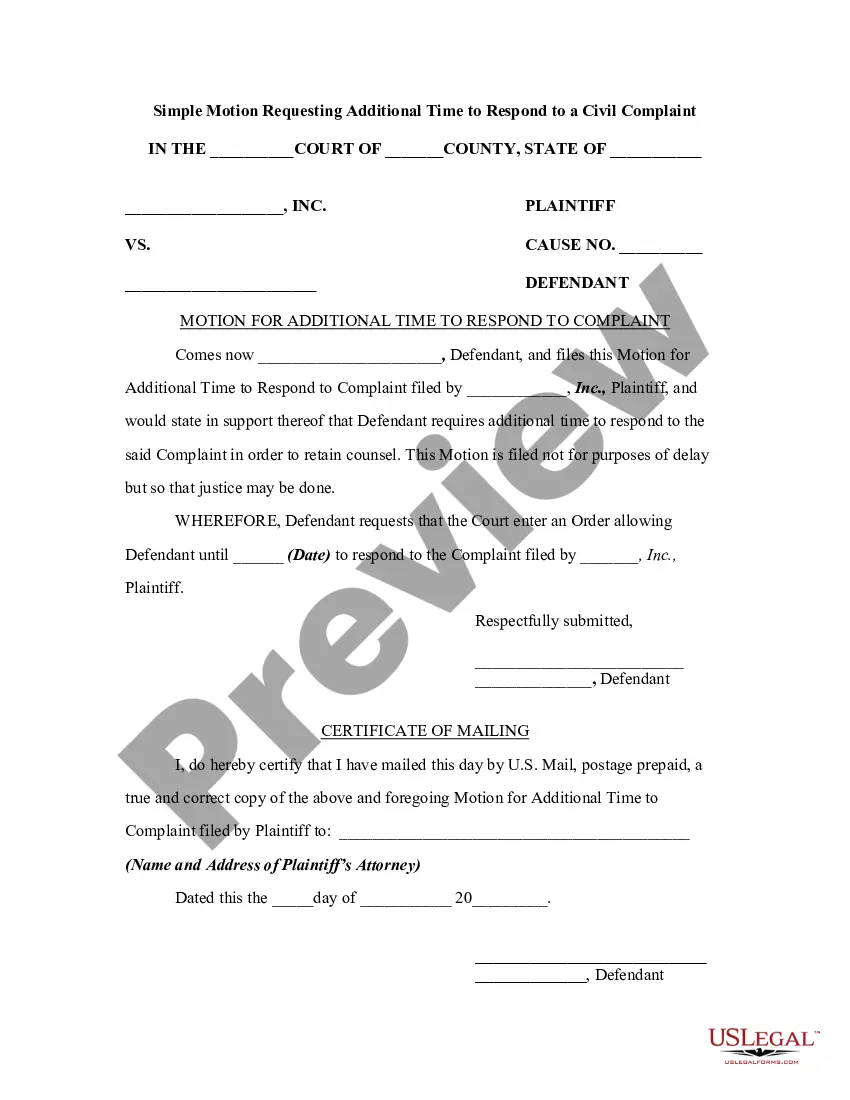

- Search for the document you require and review it.

- Browse the sample you looked for and preview it or examine the form description to confirm it meets your requirements. If it doesn't, utilize the search feature to find the suitable one. Click Buy Now when you locate the template you need.

- Choose a subscription plan and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Select the format you want for your Special Needs Trust Form With Decimals (PDF, DOCX, RTF) and save the document on your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature.

- Redownload your documents as needed.

- Utilize the same document again whenever necessary. Navigate to the My documents tab in your profile to redownload any previously downloaded forms.

Form popularity

FAQ

Trust tax brackets differ from individual tax brackets and can reach higher rates more quickly. Currently, trusts are taxed at higher rates on income over specific thresholds. When filing using a special needs trust form with decimals, consider these brackets to ensure accurate financial planning.

The common abbreviation for a special needs trust is SNT. This term can often be seen in legal documentation and discussions surrounding the trust's establishment. To create a well-formed special needs trust form with decimals, understanding this abbreviation can provide clarity.

Yes, a special needs trust requires its own tax identification number, also known as an Employer Identification Number (EIN). This number is necessary for filing taxes and managing trust finances. When you prepare a special needs trust form with decimals, make sure to include the EIN for proper documentation.

One downside of a special needs trust is the complexity of its management and the potential costs involved. Additionally, if not structured correctly, it might limit eligibility for certain public benefits. When using a special needs trust form with decimals, be careful to account for all factors to minimize these risks.

Yes, a special needs trust generally needs to file a tax return if it earns income. This requirement helps maintain compliance with tax laws. So, if you're managing a special needs trust form with decimals, you must address these tax filings properly.

To file taxes on a special needs trust, you would typically use IRS Form 1041. This form allows you to report the trust's income, deductions, and credits. If you utilize a special needs trust form with decimals, you should ensure all figures are accurate and clearly reported.

Yes, in most cases, a trust must file a tax return to report income generated by its assets. This requirement applies regardless of the type of trust. If you are dealing with a special needs trust form with decimals, it's important to understand the tax reporting obligations associated with it.

Qualified disability trusts receive certain tax benefits under IRS regulations. They may deduct income that is used for the beneficiary's support and can also be taxed at lower rates. Understanding how these trusts work will guide you in filling out a special needs trust form with decimals correctly. For clarity on your specific situation, seeking advice from a tax professional who specializes in trusts can be very beneficial.

There is no specific minimum amount required to establish a special needs trust. However, it’s essential to consider the costs of setting up and maintaining the trust in relation to the intended benefits for the beneficiary. Typically, many experts recommend having at least a few thousand dollars in the trust to ensure it can effectively provide for the beneficiary's needs. Utilizing a special needs trust form with decimals can help you correctly organise and allocate funds within the trust.

The tax form used for a special needs trust is Form 1041, U.S. Income Tax Return for Estates and Trusts. This form allows the trust to report its income and deductions. If you manage a special needs trust, you will often need to fill out this special needs trust form with decimals accurately to maintain compliance and avoid penalties. It’s advisable to work with a knowledgeable accountant or legal advisor to guide you through this process.