Associate Trust Officer Salary

Description

How to fill out Trust Agreement - Family Special Needs?

Whether for commercial purposes or personal matters, everyone must handle legal issues at some stage in their life.

Filling out legal documents requires meticulous care, starting from choosing the correct form template.

With a comprehensive US Legal Forms collection available, you don’t need to waste time searching for the suitable template online. Utilize the library’s easy navigation to find the right form for any occasion.

- Locate the template you require by utilizing the search feature or catalog browsing.

- Review the form’s details to confirm it aligns with your case, jurisdiction, and area.

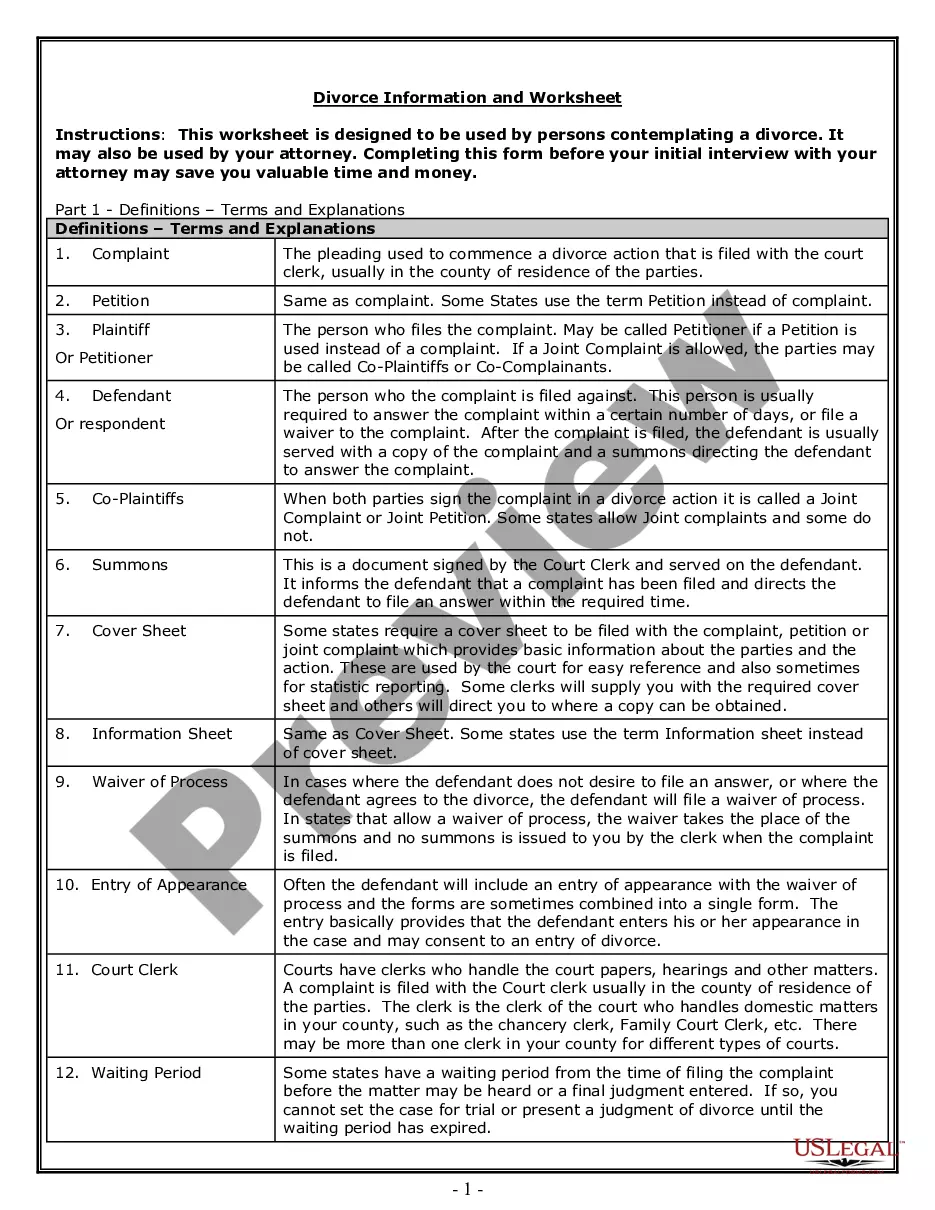

- Click on the preview of the form to examine it.

- If it is the wrong document, return to the search function to find the Associate Trust Officer Salary template you need.

- Download the file if it meets your specifications.

- If you possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you have not created an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the account registration form.

- Choose your preferred payment method: you can opt for a credit card or PayPal account.

- Select the document format you desire and download the Associate Trust Officer Salary.

- After downloading, you can complete the form using editing software or print it and complete it manually.

Form popularity

FAQ

The role of a trust officer involves overseeing trust accounts and managing investments on behalf of clients. They serve as a liaison between clients, beneficiaries, and financial institutions, ensuring that all parties comply with legal agreements. Understanding the associate trust officer salary is important for those considering this career path, as it highlights the value of the skills and responsibilities involved. Utilizing US Legal Forms can provide trust officers with the necessary documentation and guidance to excel in their roles.

An associate trust officer is a financial professional who assists in managing trust accounts and ensuring compliance with legal regulations. They help clients with estate planning, investment management, and the distribution of assets according to the terms of the trust. The associate trust officer salary reflects their expertise in navigating complex financial situations. By leveraging platforms like US Legal Forms, professionals in this field can access essential resources to enhance their knowledge and service offerings.

The salary for a trust associate typically aligns closely with the associate trust officer salary. You can expect to see figures ranging from $40,000 to $60,000 per year, depending on various factors like location and experience. As you develop your skills and expertise, your earning potential will likely increase. This role offers a pathway to rewarding career advancement opportunities within the financial sector.

The associate trust officer salary can vary based on factors such as location, experience, and the employing institution. On average, most associate trust officers earn between $45,000 and $65,000 annually. As you gain experience and take on more responsibilities, your salary potential may increase significantly. Understanding these dynamics can help you make informed career decisions.

An associate trust officer plays a vital role in managing client accounts and ensuring compliance with legal regulations. They assist clients in wealth management, investment strategies, and estate planning. By providing personalized service, these professionals help clients navigate complex financial decisions. Ultimately, their work contributes to securing clients' financial futures.

The salary of a Trust Officer can vary significantly, but it generally falls within the range of the associate trust officer salary guidelines. Factors influencing this include the officer's level of experience, the complexity of the trust accounts managed, and the geographical location. Many Trust Officers also enjoy bonuses and other incentives based on performance. Understanding these aspects can help you gauge the financial rewards of this career path.

Trust associates typically earn a competitive wage that closely aligns with the associate trust officer salary benchmark. On average, you can expect a salary range that varies based on location, experience, and the specific firm. Many trust associates also receive benefits, which enhance their overall compensation package. By researching these figures, you can better understand what to anticipate in this role.

When filling in salary expectations, consider your experience, skills, and the average associate trust officer salary in your region. Research industry standards to provide a realistic figure that reflects your worth. You can use resources like US Legal Forms to find salary surveys and industry reports that help you understand the market. This preparation will ensure you present a confident and informed expectation.