Alabama Family Trust With Multiples

Description

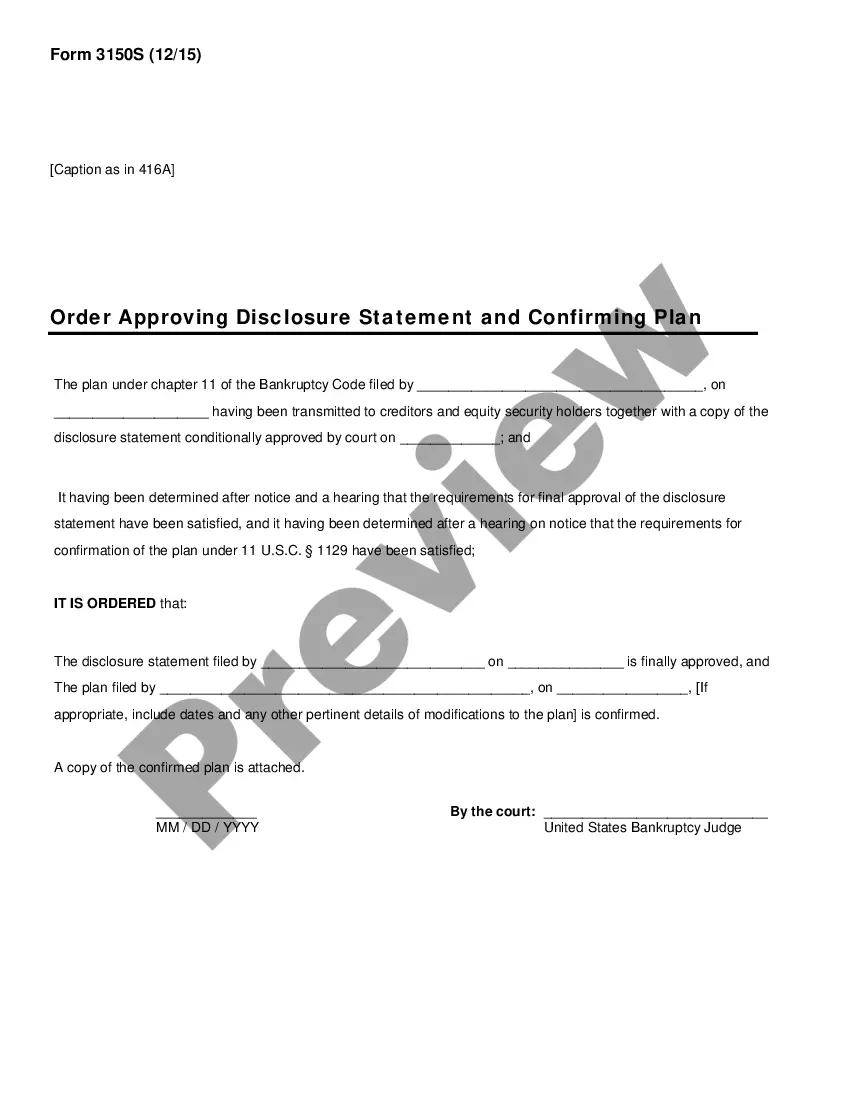

How to fill out Trust Agreement - Family Special Needs?

It’s widely known that you cannot become a legal specialist instantly, nor can you learn how to swiftly create Alabama Family Trust With Multiples without possessing a dedicated background.

Drafting legal documents is a lengthy process that demands specific training and expertise. So why not entrust the formulation of the Alabama Family Trust With Multiples to the professionals.

With US Legal Forms, one of the most extensive libraries of legal templates, you can find everything from court documents to office communication templates. We understand how vital it is to comply with federal and state laws and regulations. That’s why, on our platform, each form is tailored to your location and is current.

Click Buy now. Once the payment is complete, you can access the Alabama Family Trust With Multiples, fill it out, print it, and send or mail it to the necessary individuals or organizations.

You can revisit your forms from the My documents tab anytime. If you’re already a client, you can simply Log In and locate and download the template from the same section. No matter your document's aim—be it financial, legal, or personal—our site has you covered. Explore US Legal Forms today!

- Begin by visiting our website to obtain the form you need in just minutes.

- Identify the document you’re looking for using the search bar located at the top of the page.

- If available, preview it and review the accompanying description to determine if Alabama Family Trust With Multiples is what you need.

- If you require a different document, restart your search.

- Sign up for a free account and choose a subscription plan to acquire the template.

Form popularity

FAQ

Disadvantages of a Family Trust You must prepare and submit legal documents, which the court charges a fee to process. The second financial disadvantage of a family trust is the lack of tax benefits, especially when it comes to filing income taxes. When the grantor dies, the trust must file a federal tax return.

Alabama Family Trust (Alabama Family Trust Statute) provides for the establishment of a trust that disburses funds to supplement the care, support, and treatment of the designated disabled person or beneficiary in a way that complements any governmental entitlements.

To create your own living trust in Alabama, you need to first create or have the trust document created for you. It must include the name of the trustee and list your beneficiary or beneficiaries. This legal document must then be signed by the settlor in front of a notary public who will notarize the signature.

A family trust, or a discretionary trust, is an alternate investment structure to company. It is usually set up for creating or holding wealth to benefit multi-generational family members. At the creation of a family trust, there must have three group of people: settlor, trustee and beneficiary.

As you might expect, a family trust lists your family members as the beneficiaries. So that means your children, grandchildren, siblings, aunts and uncles, cousins or any other family members can be a beneficiary. Family trusts can also include spouses.