3rd Party Special Needs Trust Form With Decimals

Description

How to fill out Trust Agreement - Family Special Needs?

Creating legal documents from the ground up can occasionally feel a bit daunting. Certain situations may require extensive research and substantial financial investment.

If you're in search of a more straightforward and cost-effective method for preparing the 3rd Party Special Needs Trust Form With Decimals or any other documentation without unnecessary complications, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously assembled for you by our legal experts.

Utilize our website whenever you need trusted and dependable services through which you can effortlessly find and download the 3rd Party Special Needs Trust Form With Decimals. If you’re familiar with our services and have already created an account with us, simply Log In to your account, locate the template, and download it or re-download it anytime in the My documents section.

Ensure that the form you select adheres to the laws and regulations of your state and county. Choose the most suitable subscription option to obtain the 3rd Party Special Needs Trust Form With Decimals. Download the form, then complete, validate, and print it. US Legal Forms has an excellent reputation and over 25 years of expertise. Join us now and make form completion an easy and efficient process!

- Not registered yet? No problem.

- Setting it up and exploring the library takes only a few minutes.

- However, before proceeding to download the 3rd Party Special Needs Trust Form With Decimals, consider these recommendations.

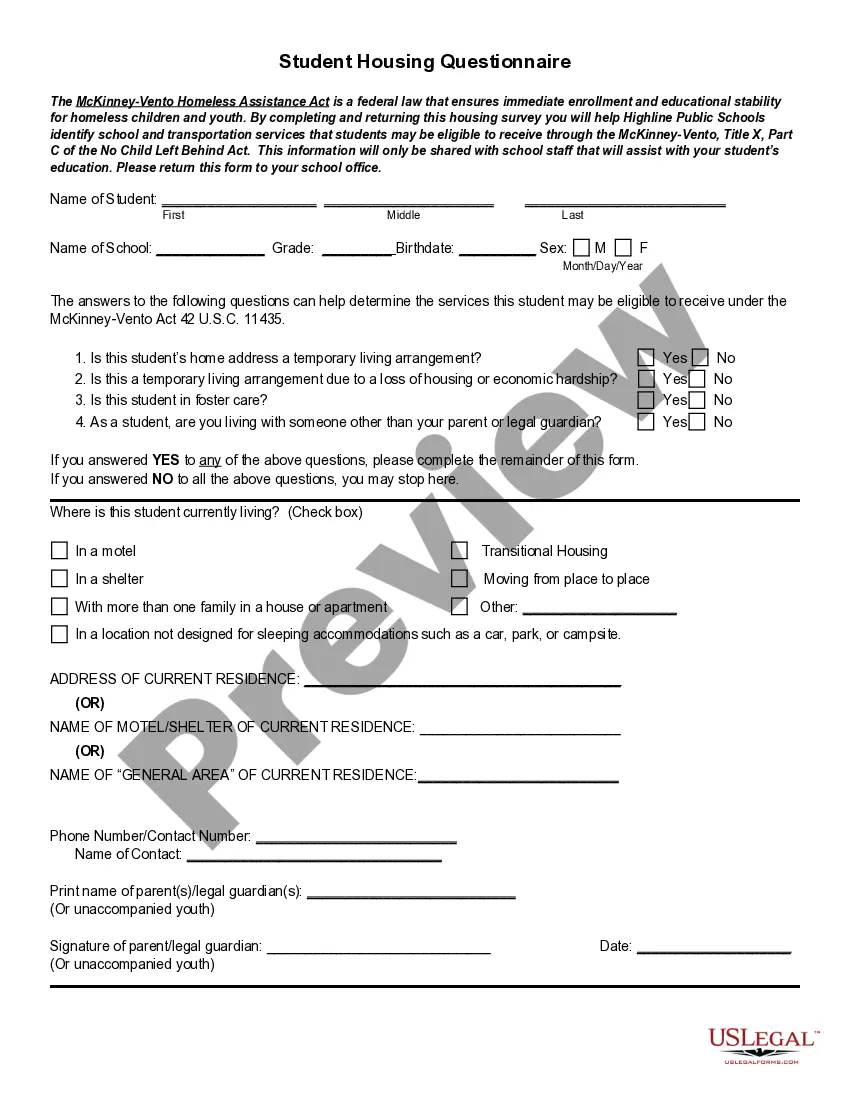

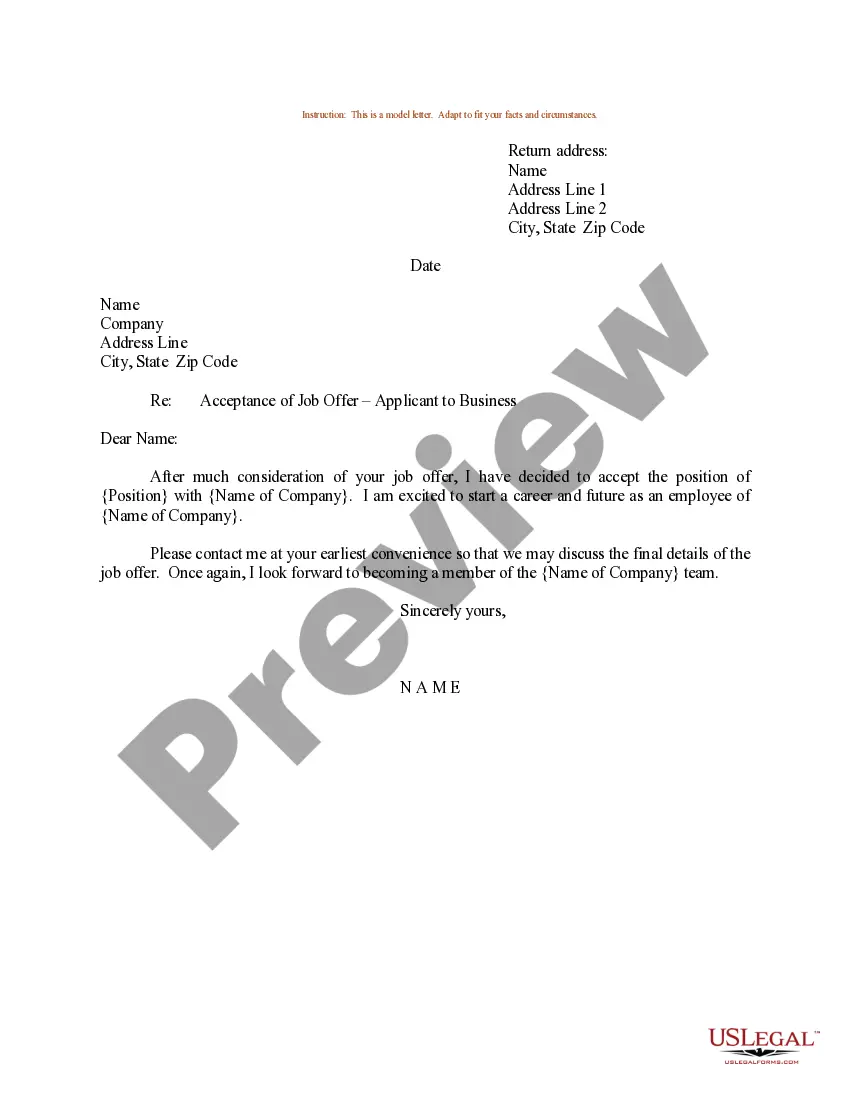

- Examine the document preview and descriptions to confirm that you have located the document you need.

Form popularity

FAQ

A special needs trust (SNT) is a trust that will preserve the beneficiary's eligibility for needs-based government benefits such as Medicaid and Supplemental Security Income (SSI). Because the beneficiary does not own the assets in the trust, he or she can remain eligible for benefit programs that have an asset limit.

The income beneficiary is the surviving spouse who wants you to make significant distributions to him or her and invest trust assets in his or her business. The remainder beneficiaries want less income to go the surviving spouse and do not want a risky investment to be made in the business of the income beneficiary.

Pooled trusts give people with disabilities a way to access vital health benefits while utilizing the excess funds they deposit into the trust to pay for items and services not covered by those benefits. In ance with Federal statute, first party pooled trust accounts close upon the death of the beneficiary.

party trustee has no personal ties or biases that could affect their decisionmaking. This means decisions are based on the best interests of the trust and its beneficiaries rather than any personal feelings that might come into play with family members.

As you consider these types of trustees ?family trustee, corporate trustee, or private professional fiduciary?it is important that the choice you make maximizes the benefits of the trustee relationship and gives your family the expertise and personalized care you expect from a trustee.