Compensation For Executive Director Of Nonprofit

Description

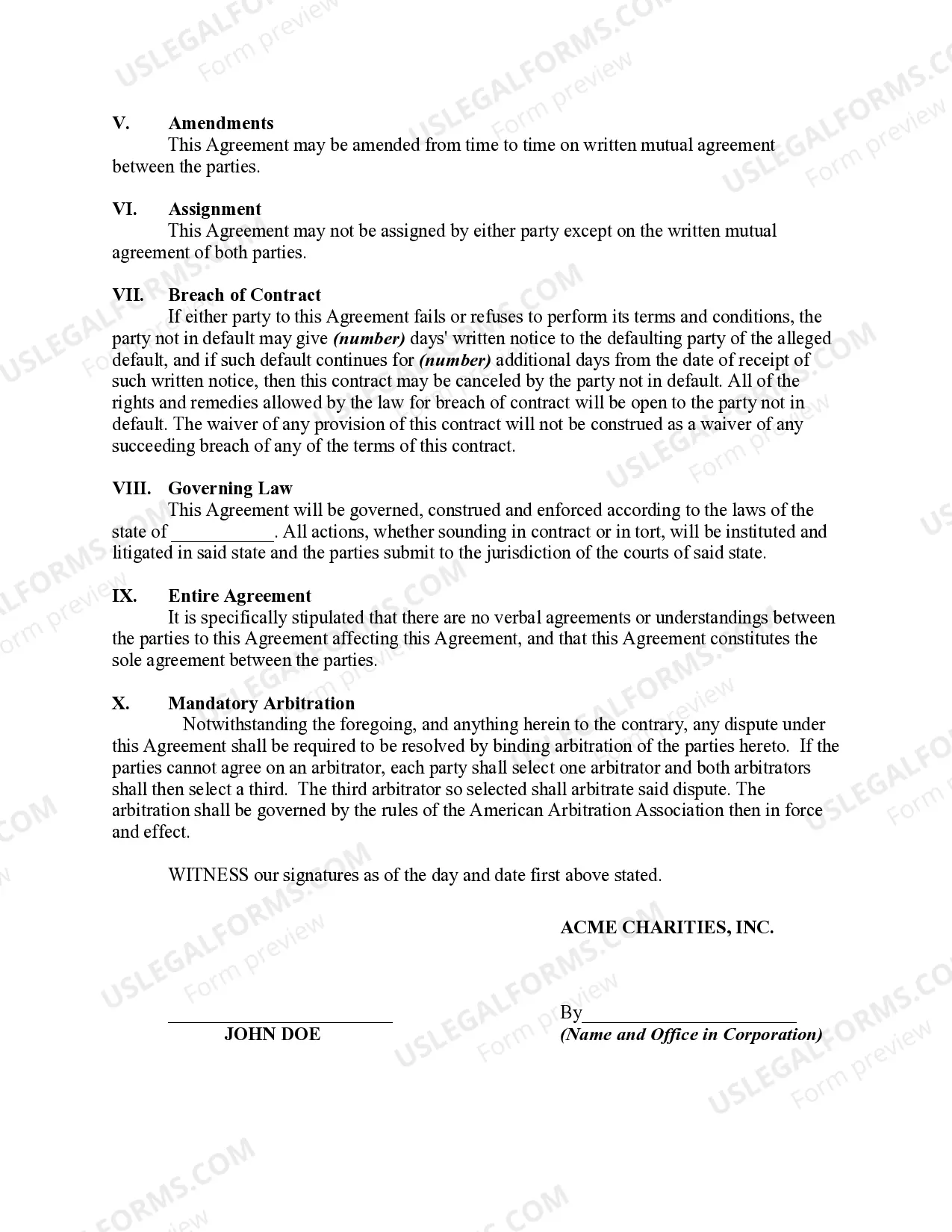

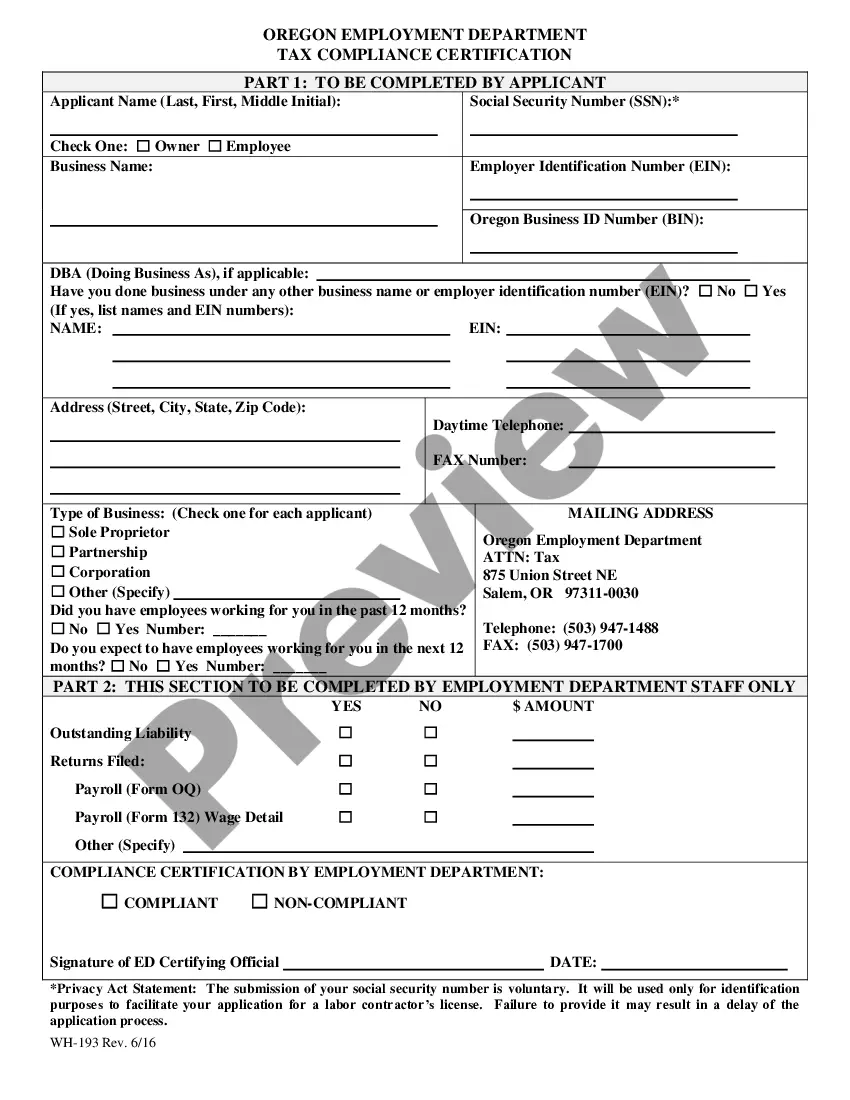

The contract will often be an express written contract. In other words, the duties of the employee will be specifically set forth in writing in the contract. The attached form is a sample agreement between a nonprofit corporation and an executive director.

Form popularity

FAQ

Remunerating a non-executive director requires careful consideration of several factors, including the organization’s financial health and compliance with legal standards. Compensation for executive director of nonprofit should reflect the director's expertise and contribution while remaining within the budgetary constraints of the organization. It is advisable to establish a transparent compensation policy and regularly review this to ensure fairness and clarity. You can find comprehensive templates and strategies for developing such policies on UsLegalForms.

The highest position in a nonprofit is often referred to as the executive director or sometimes the president. This role requires strong leadership skills and a deep understanding of the organization’s mission. The compensation for the executive director of a nonprofit is typically aligned with industry standards, ensuring that the organization attracts and retains competent leadership.

A typical non-profit hierarchy includes the board of directors at its top, followed by the executive director. Below the executive director are various program managers and staff who handle the day-to-day operations. This structure ensures clear lines of authority and accountability, particularly in decisions about the compensation for the executive director of a nonprofit.

The highest position in a non-profit organization is usually the executive director or chief executive officer (CEO). This individual is responsible for the operational leadership of the organization, guiding its strategic direction. Their compensation package is often structured to reflect their responsibilities and the organization's financial capacity, particularly regarding the compensation for the executive director of a nonprofit.

Non-executive directors in nonprofits are often compensated through stipends or reimbursement for expenses incurred while performing their duties. The method of compensation varies greatly among nonprofits, depending on their size and resources. Organizations must ensure that these compensation packages are reasonable and not excessive, especially when considering the compensation for the executive director of a nonprofit.

The most effective corporate structure for a nonprofit is typically a 501(c)(3) status. This structure allows organizations to receive tax-deductible donations and grants, helping to fund their missions. Additionally, the compensation for the executive director of a nonprofit must comply with regulations to maintain this status, ensuring accountability and transparency.

In a non-profit organization, the board of directors holds the most authority. They oversee the organization's mission and ensure it aligns with its goals. Importantly, the compensation for the executive director of a nonprofit is determined by the board, who also evaluates the director's performance and impact on the organization.

The executive director of a nonprofit oversees daily operations, ensures the organization fulfills its mission, and manages staff and resources effectively. This role includes developing strategies, fundraising, and representing the nonprofit to the community and stakeholders. Understanding the compensation for executive director of nonprofit roles is crucial, as it reflects the responsibilities and expectations tied to the position. Platforms like USLegalForms can help organizations outline appropriate compensation packages and structure for executive directors.

Being a non-executive director can be rewarding, as it allows for strategic input without the daily operational responsibilities. This role can enhance your understanding of nonprofit governance and provide valuable experience that enhances resumes. Furthermore, non-executive directors often receive compensation for their contributions, which can be beneficial for those looking to either supplement income or contribute to their nonprofit experience. For those considering the compensation for executive director of nonprofit roles, this experience can be a stepping stone.

Non-executive directors bring a wealth of experience and independent judgment to an organization, enhancing decision-making and strategy. They also help maintain accountability and provide valuable insights that can improve the organization's performance. By understanding the compensation for executive directors of nonprofits, you can better appreciate the role non-executive directors play, as their insights can significantly impact how effectively an organization utilizes its resources.