Bx-201

Description

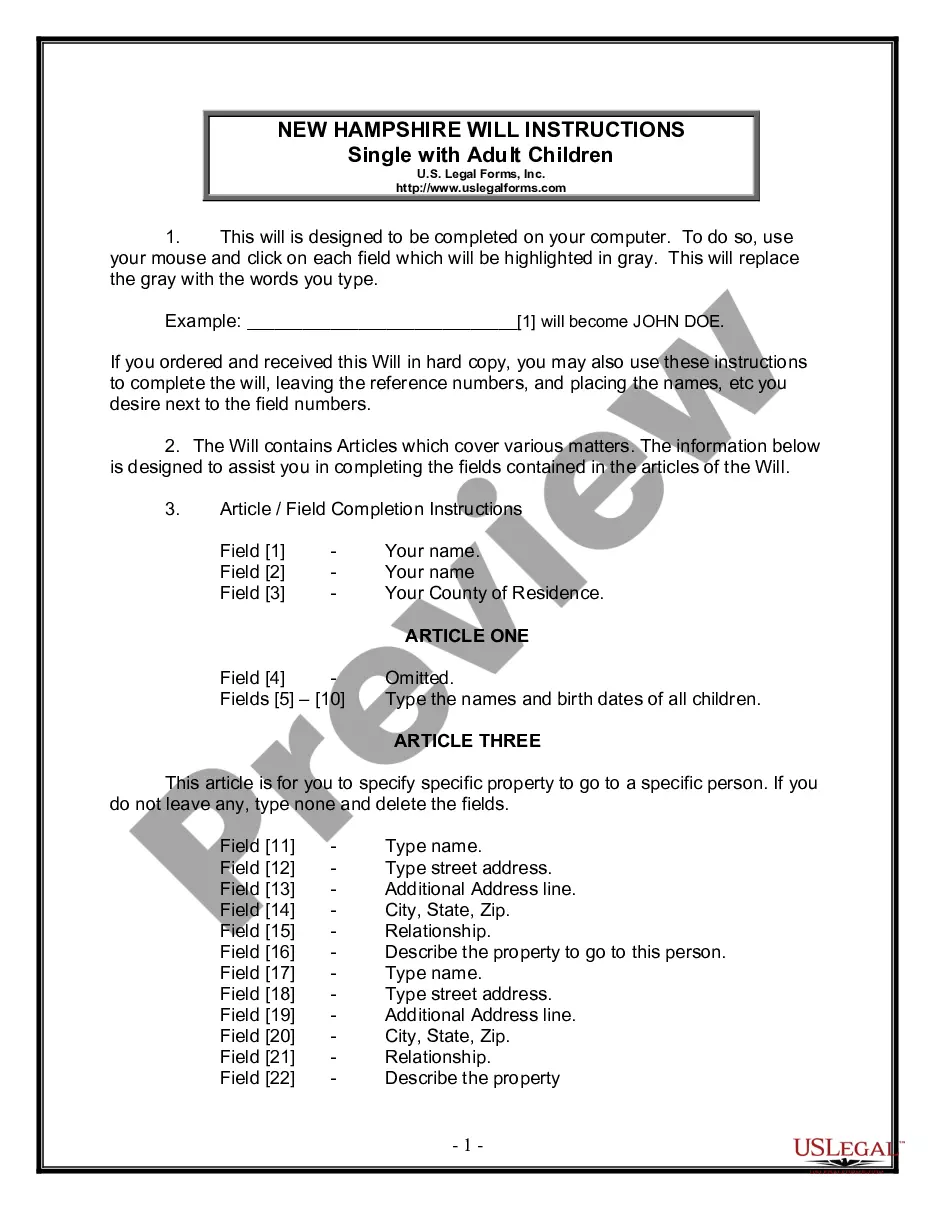

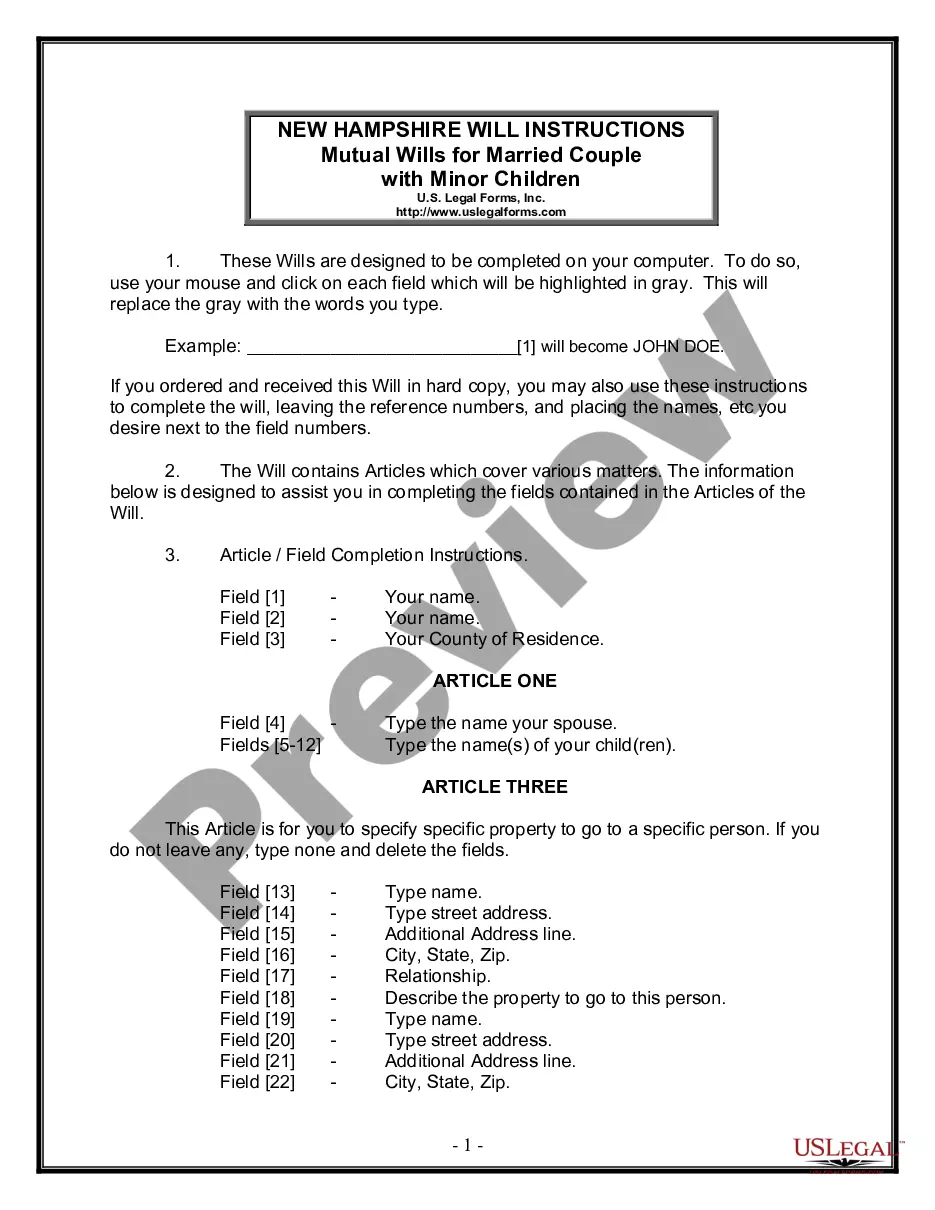

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Seller To Finance Part Of Purchase Price?

- If you're an existing user, log in to your account and ensure your subscription is active before downloading the template you need by clicking the Download button.

- For new users, begin by checking the Preview mode and description of the Bx-201 form to confirm it aligns with your requirements and local jurisdiction.

- If necessary, utilize the Search tab above to find alternative forms that better fit your needs. Make sure the selected document meets all necessary criteria.

- Purchase the Bx-201 form by clicking on the Buy Now button and choosing a subscription plan that works for you. Registration is required to access the library.

- Complete your transaction by entering your payment details, either via credit card or PayPal, to finalize your subscription.

- Download the Bx-201 template and save it to your device. Access it anytime through the My Forms section of your profile.

By following these steps, you can easily obtain the necessary legal forms, including Bx-201, from US Legal Forms.

Start utilizing the service today and ensure your documents are accurate and legally sound with the aid of US Legal Forms' extensive resources.

Form popularity

FAQ

Individuals who are non-U.S. residents and receive income from U.S. sources typically need to fill out the W-8BEN form. This includes foreign investors, students, and professionals. For anyone unsure about their requirements, exploring Bx-201 can help clarify who must complete this essential form.

An SSN is not required for the W8BEN form if you are a non-resident alien without one. Instead, you can provide a foreign tax identification number or other relevant identification. For more details about the necessary information, refer to the comprehensive guidelines offered by Bx-201.

If you do not fill out the W-8BEN form, you may face higher withholding rates on income received from U.S. sources. Without this form, the payer may assume that you are a U.S. citizen, resulting in potentially unnecessary taxation. Understanding the importance of Bx-201 can provide you with insights into tax compliance and benefits you may qualify for.

To fill out a withholding exemption form, you should first understand your eligibility for exemption based on your tax situation. Fill in your personal details and the reason for claiming the exemption clearly. For further guidance, the Bx-201 platform offers resources to help clarify your options and effectively navigate the process.

Filling out a W8BEN form involves writing your name and address at the top, followed by your country of citizenship. Then, enter your taxpayer identification number and verify if you qualify for benefits under any tax treaty. Utilizing Bx-201 can enhance your understanding and accuracy when filling out this form.

To complete a W-8BEN form, begin by entering your name, country of citizenship, and address. Next, provide your foreign taxpayer identification number if applicable. This form helps you claim reduced withholding rates, so make sure to refer to the guidelines on Bx-201 for any specific regulations related to your situation.

To fill out a withholding allowance form, start by gathering your personal information and your employment details. You will need to provide information about your filing status and any dependents you want to claim. For assistance, consider using resources on Bx-201, which may simplify your process.

Mail your New York State estimated taxes to the address listed on the payment voucher. The address can vary based on your payment method, so consult the voucher instructions for accuracy. Timely mailing of your estimated taxes is crucial to avoid penalties. Bx-201 provides easy access to the correct mailing information necessary for your estimated tax payments.

To mail your amended tax return, simply follow the instructions provided on the specific form for your state and federal returns. Each form typically includes exact mailing addresses based on your circumstances, whether you are due a refund or need to make a payment. Properly attaching any required documentation is important. Using Bx-201 can clarify the mailing steps for your amended return.

When you're ready to submit your NY form IT-201, send it to the address provided in the form instructions. Usually, the address varies based on your payment status, so ensure you check this detail carefully. Correct filing ensures that your tax obligations are met without unnecessary delays. Leveraging Bx-201 can guide you in filing this form correctly.