Sole Proprietorship For Uber

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Purchase Price Contingent On Audit?

- Log in to your existing US Legal Forms account and click the Download button to obtain the necessary form template. Ensure your subscription is active; if not, renew it based on your selected plan.

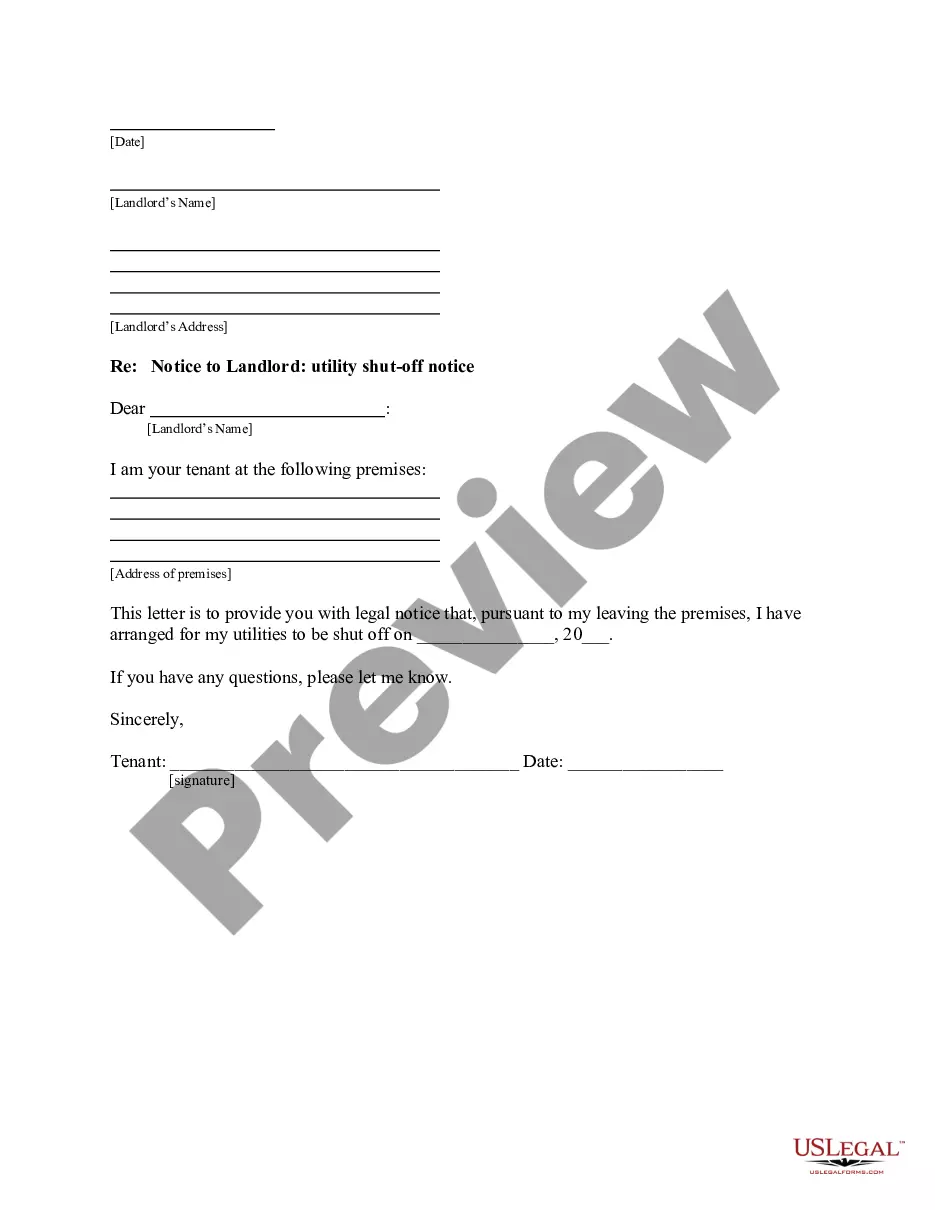

- If you are a new user, start by checking the Preview mode and description of the form. Verify that it meets your needs and aligns with your jurisdiction's requirements.

- If the initial form isn't suitable, utilize the Search feature to find other templates that match your criteria. Proceed once you find the correct form.

- Purchase the document by selecting the Buy Now button and choose the subscription plan that best fits your needs. An account registration is necessary to access the library resources.

- Complete your payment using your credit card or PayPal. After purchasing, you will be able to download the document.

- Save the template on your device. You can also access it later in the My Forms section of your profile for future reference.

In conclusion, creating a sole proprietorship for Uber is an efficient way to manage your ride-sharing business. With US Legal Forms, you gain access to an extensive collection of over 85,000 legal forms, ensuring you have the right documents at your fingertips.

Start your journey today by visiting US Legal Forms and securing your sole proprietorship documents now!

Form popularity

FAQ

You can easily access your Uber tax information through the Uber driver app. Once you log in, navigate to the earnings section where you can download your tax documents for the year. If you have questions or need specific documents, you can contact Uber support. Accessing this information is vital for accurately reporting your taxes as a sole proprietor for Uber.

To fill out your Uber taxes, start by gathering all your earnings and expense records from your driving activities. Use the IRS Schedule C to report your income and deduct relevant expenses, which may lighten your tax burden. As a sole proprietor for Uber, it’s important to calculate your net profit accurately. Consider utilizing platforms like US Legal Forms for guidance in completing your tax forms properly.

Failing to file your Uber taxes can lead to serious consequences, including penalties and interest charges on unpaid taxes. As a sole proprietor for Uber, the IRS expects you to report your earnings, even if you don’t receive a tax form from the company. Ignoring your tax obligations can also result in tax liens or other legal actions. It's crucial to stay compliant to avoid these complications.

Filling out your Uber tax information starts with verifying your earnings through the Uber app. When you drive, keep accurate records of your expenses, as you can deduct eligible costs. For a sole proprietorship for Uber, you'll typically report your income on Schedule C of your personal tax return. Make sure to complete your forms accurately to avoid any issues with the IRS.

Choosing between an LLC and operating as an individual for Uber mainly depends on your personal circumstances. While a sole proprietorship for Uber is simpler in terms of taxes and administration, forming an LLC can provide liability protection. If you foresee potential business risks, an LLC might be the better choice, safeguarding your personal assets. Always consider your options carefully, and consult with a legal expert if needed.

Yes, an Uber driver typically operates as a sole proprietor. This means you run your Uber business as an individual, without forming a separate business entity. As a sole proprietor for Uber, you’re personally responsible for all aspects of your business, including taxes and liabilities. This setup establishes you as an independent contractor, allowing you to use your vehicle for ride-sharing.

Yes, you can operate under your business name while driving for Uber. If you have a registered business, such as an LLC or a sole proprietorship for Uber, you can use that name to promote your services. This adds professionalism to your operation and may help attract more passengers.

Uber operates as a corporation, specifically Uber Technologies, Inc. When you drive for Uber, you are not entering into a partnership with the company. Instead, you are an independent contractor managing your own sole proprietorship for Uber, which allows you flexibility in choosing when and how often to work.

Whether you should open an LLC for Uber depends on your specific situation. Forming an LLC can provide liability protection, which means you would not be personally responsible for debts and legal issues that arise from your Uber activities. Additionally, an LLC might offer potential tax benefits, making it a valuable option if you plan to drive for Uber long-term.

Yes, driving for Uber typically falls under the category of a sole proprietorship for Uber drivers. This means that you operate your own business as an individual without forming a separate legal entity. As a sole proprietor, you have full control over your earnings and can simplify your tax filings, but you are also personally liable for any debts incurred while driving.