Business Audit With A

Description

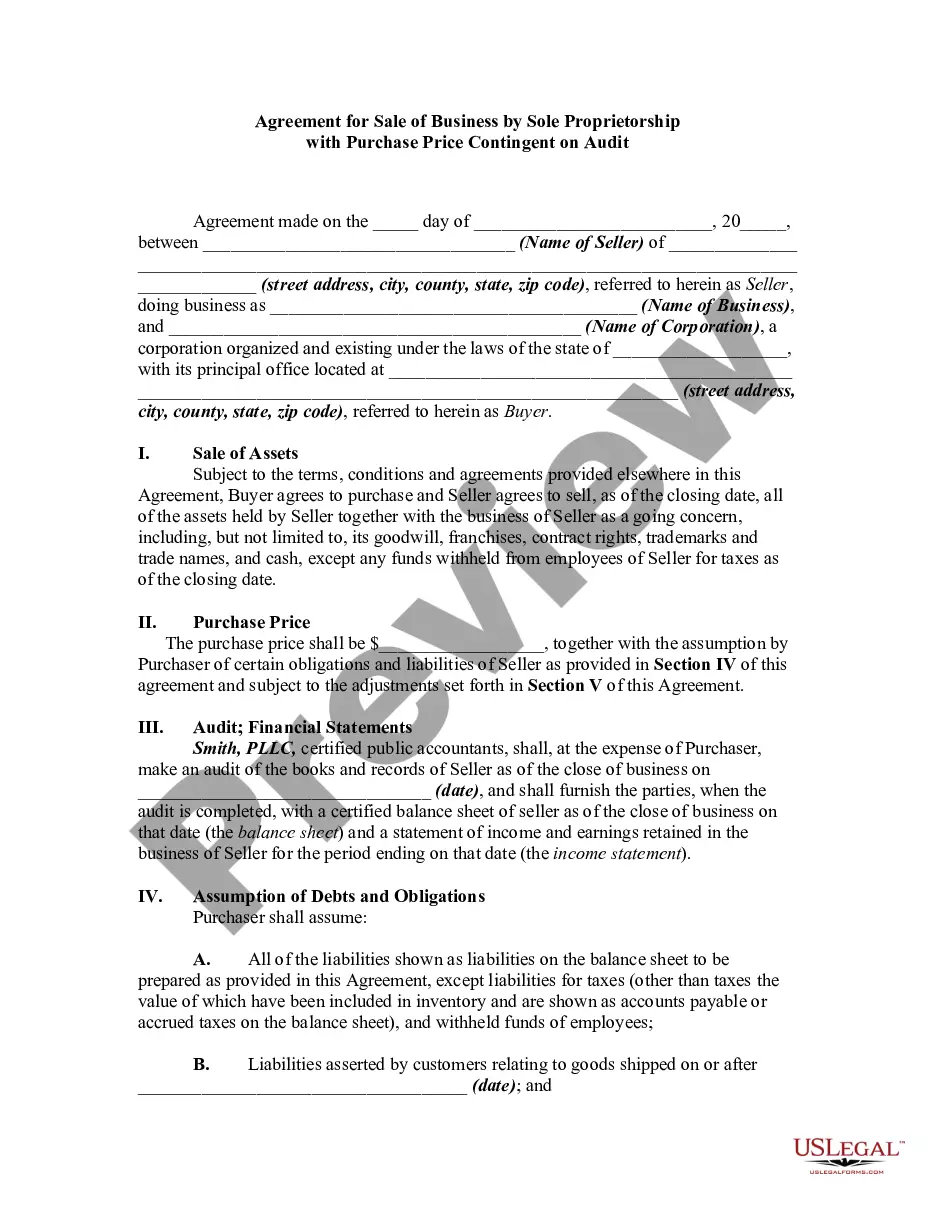

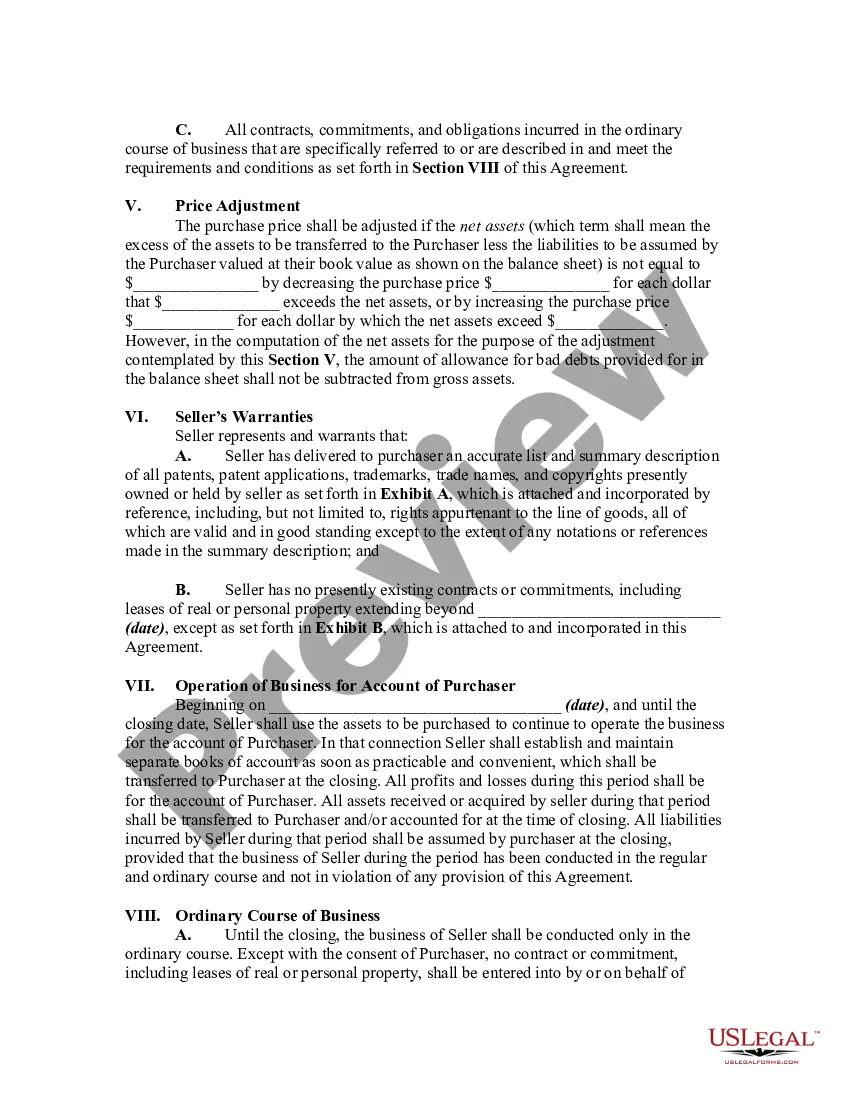

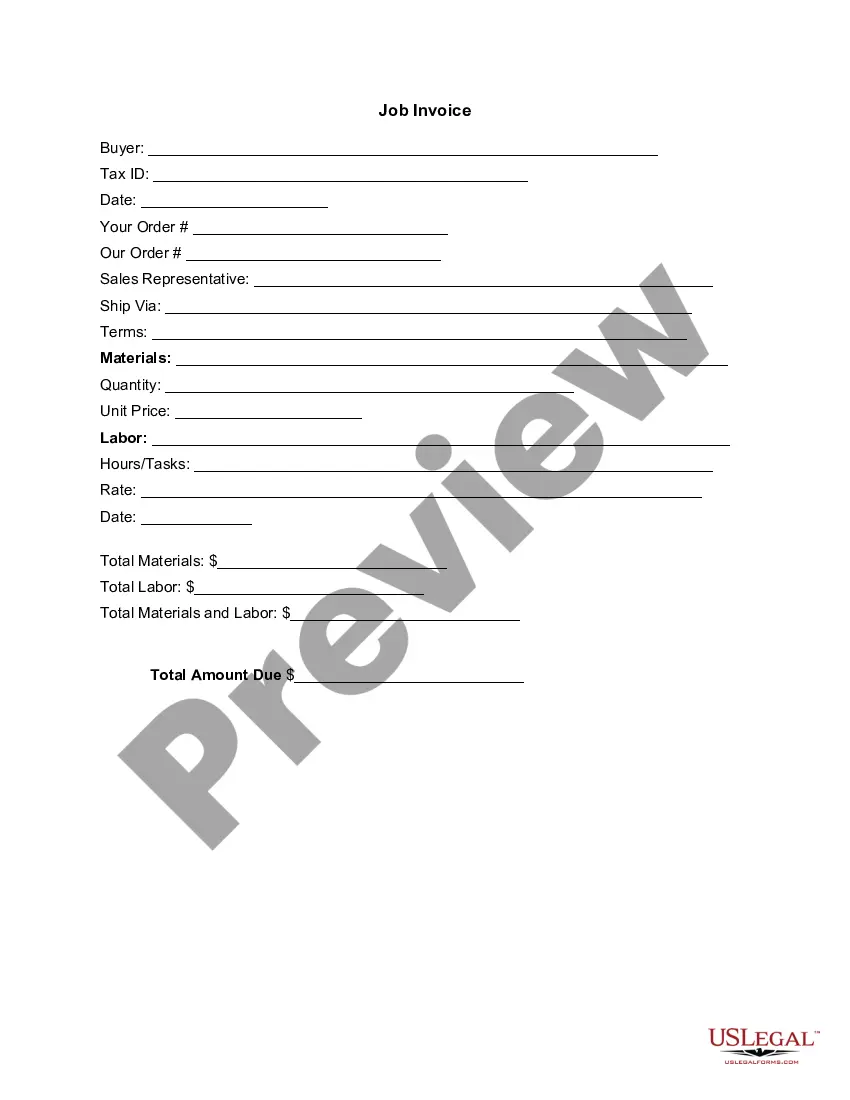

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Purchase Price Contingent On Audit?

- Log in to your US Legal Forms account if you are an existing user. Check your subscription status and ensure it is active.

- For first-time users, begin by reviewing the form descriptions and Preview mode to identify the correct document that fits your needs and jurisdiction.

- If necessary, search for alternative templates using the Search tab to find a form that addresses your specific requirements.

- Purchase the selected document by clicking the Buy Now button and choosing a subscription plan that suits you. Registration will grant you access to the entire library.

- Complete your purchase by entering your payment details. You can choose to pay via credit card or PayPal.

- Download your form onto your device for completion. You can also access your forms anytime in the My Forms section of your account.

In conclusion, utilizing US Legal Forms for your business auditing needs allows for quick and efficient access to a wide range of legal documents. This platform not only saves you time but also ensures that you have professionally crafted forms at your fingertips.

Start your journey to effortless legal form completion today!

Form popularity

FAQ

To audit your business, start by reviewing your financial statements, tax returns, and receipts for accuracy. Examine all income and expense reports closely to identify any discrepancies. Developing a systematic approach can save time and reduce stress. Also, consider utilizing uslegalforms to guide you through the auditing process and ensure compliance with all regulations.

During a business audit, the IRS checks various aspects, including your financial records, tax returns, and specific transactions. They seek to ensure that your reported income matches documentation and that all deductions are legitimate. This thorough review can be daunting; however, preparing with proper tools from uslegalforms can boost your confidence during the audit process.

Several red flags stand out that could trigger an IRS audit, including underreporting of income, unusual or excessive deductions, and discrepancies between your reported income and third-party reports. Consistency in records is vital, as any irregularities can lead to increased scrutiny. Staying informed on these factors can help, and uslegalforms offers tools to help streamline your accounting practices.

To report a business for potential audit, you can file a complaint with the IRS if you suspect tax fraud or significant discrepancies in reported income. It's crucial to provide detailed information regarding your concerns. However, ensure that you have valid reasons to avoid potential legal repercussions. For reporting and compliance guidelines, consider resources offered by uslegalforms.

An IRS audit for a business can be triggered by various factors, such as unusual income fluctuations or excessive claims for deductions. If your tax return shows extreme losses or charitable donations that don't match income levels, this may warrant further investigation. Utilizing accurate accounting practices helps minimize these risks. Explore resources available on uslegalforms for better tax compliance.

In a small business audit, the IRS examines business financial records to verify reported income and deductions. They may request documentation like bank statements, invoices, and receipts. You can expect either a correspondence audit, conducted through mail, or a field audit at your business location. Preparing with uslegalforms can simplify this process and ensure you have everything in order.

Various factors can trigger an IRS business audit, such as inconsistencies in financial statements or discrepancies on tax returns. High deductibles compared to income can also raise red flags. If you operate in an industry prone to audits, you may experience a higher likelihood of scrutiny. It is wise to stay informed and prepared with reliable resources, like those found at uslegalforms.

During a business audit, the IRS focuses on several key areas, including income reporting, expense deductions, and compliance with tax laws. They review your financial records to ensure accuracy and legitimacy. Maintaining thorough documentation can significantly ease the audit process. Trust uslegalforms to help you gather and organize necessary paperwork.

To get a business audited, you must first identify what type of audit you need, such as a compliance audit, financial audit, or operational audit. Next, you can engage a qualified auditor or an auditing firm who specializes in your industry. This professional will typically review your business records, processes, and financial statements to ensure compliance and identify any areas for improvement. US Legal Forms can assist you in preparing the necessary documentation and forms for a smooth business audit with a focus on accuracy and compliance.

Typically, professional auditors should have licensing and certification to conduct audits. However, if you are auditing your own business, you do not need a specific license. It is essential, though, to understand the principles involved in auditing for your self-assessment to be valid. Using solutions like USLegalForms can provide you with guidelines to help you navigate the process confidently.