Audit Busines

Description

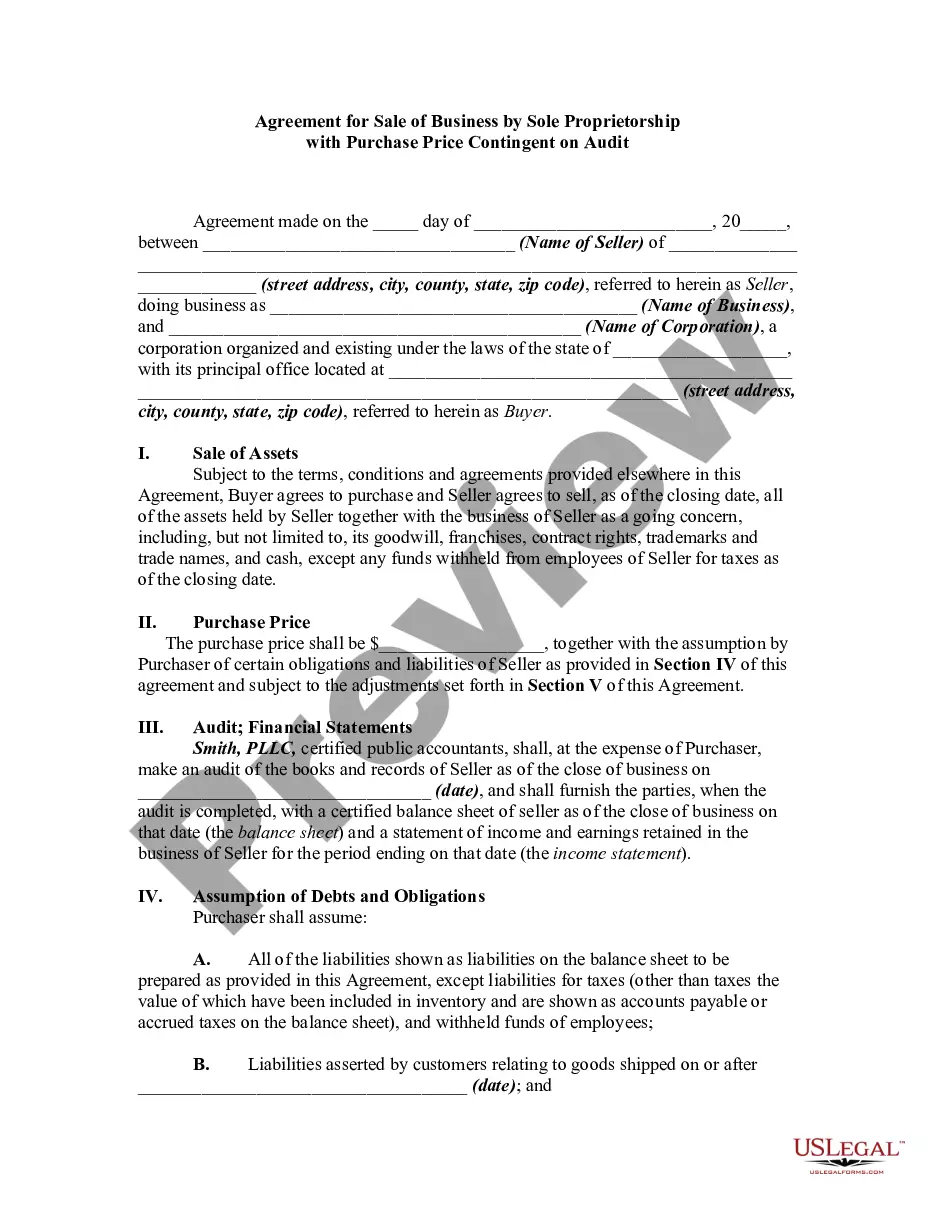

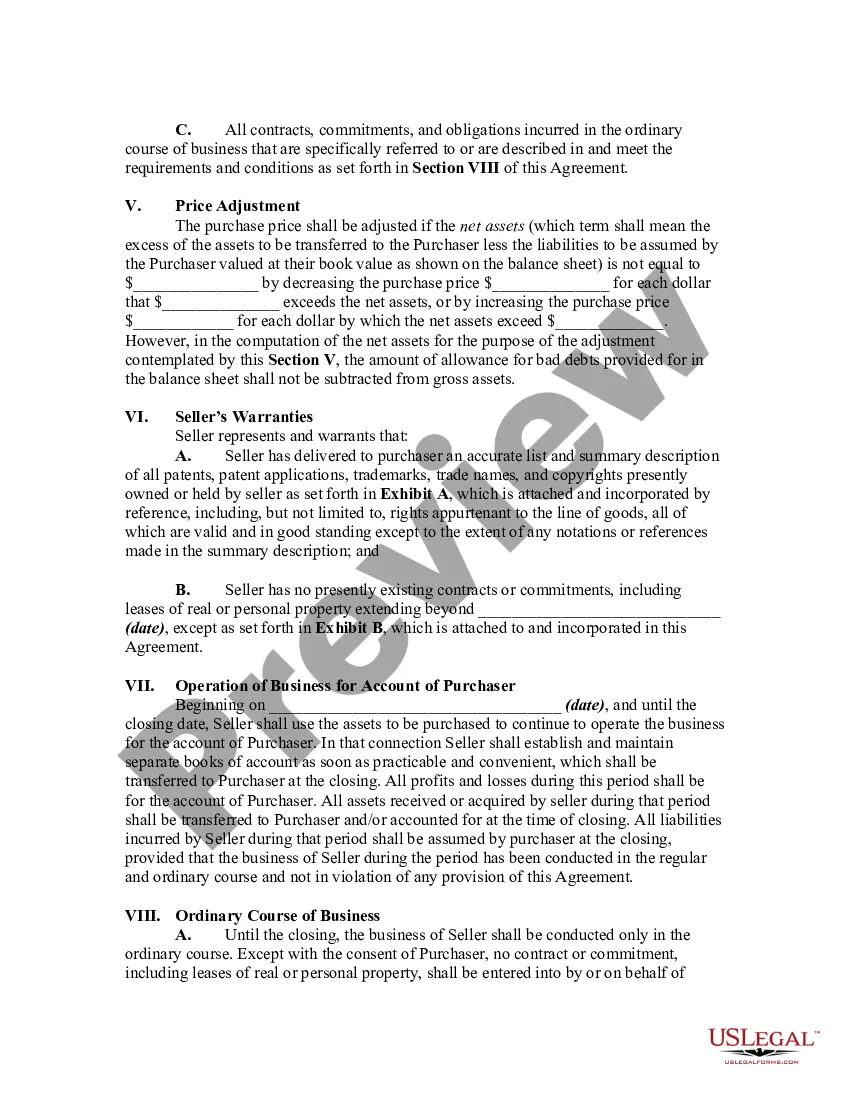

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Purchase Price Contingent On Audit?

- Visit the US Legal Forms website and log in to your account if you're a returning user. Ensure your subscription is active; renew it if necessary.

- If you are new to the service, browse the extensive library to find the relevant audit forms. Utilize the preview mode to assess each form's description and ensure it meets your requirements.

- If the initial forms don’t meet your needs, use the search tab to find alternative templates that align with your jurisdiction.

- Select your desired document by clicking the 'Buy Now' button. Choose your preferred subscription plan and create an account to access the full library.

- Complete your purchase by entering your payment information, either through a credit card or PayPal.

- After purchasing, download the completed template to your device, allowing you access to your form anytime through the 'My Forms' section in your profile.

In conclusion, utilizing US Legal Forms to audit your business can significantly simplify the process, ensuring you have access to a variety of legally sound forms. Take advantage of this extensive resource to help facilitate your business audit effectively.

Start your journey today and discover how easy it is to manage your legal documentation with US Legal Forms!

Form popularity

FAQ

The 5 C's of reporting are Clear, Concise, Complete, Correct, and Courteous. These principles guide auditors in crafting reports that communicate findings effectively. Adhering to these C's ensures that your audit reports provide valuable insights that are easily understood within the audit busines.

The five elements of an audit finding include the condition, criteria, cause, effect, and recommendation. Together, these elements help auditors convey their observations clearly and persuasively. Understanding these components will enhance your results in the audit busines and provide valuable insights to stakeholders.

Filling out an audit checklist requires you to review each item and provide thorough documentation of your findings. Start by gathering the necessary information and answering each question accurately. Using a comprehensive checklist is crucial in the audit busines as it ensures that you cover all essential areas during the audit.

The 5 C's of audit include Client, Context, Criteria, Conditions, and Conclusions. Each C represents a critical aspect of the audit process, providing a framework to analyze and report findings effectively. This structured approach is essential for auditors in the audit busines aiming to produce high-quality results.

The 5 C's in audit stand for Completeness, Consistency, Clarity, Conformity, and Control. These elements enhance the quality and reliability of your findings in the audit busines. By focusing on these C's, auditors can ensure their reports meet professional standards and client expectations.

Writing a business audit involves outlining your audit objectives, scope, and methodology. After gathering data from various departments, present your findings clearly and concisely, emphasizing key insights. Utilizing platforms like uslegalforms can help streamline the documentation process to make your audit more effective.

To audit a company as a beginner, start by reviewing the company's financial statements and internal controls. Familiarize yourself with regulations and standards relevant to the audit busines. A structured approach will guide your audit; using tools like audit checklists can simplify this methodology and ensure thoroughness.

The 5S of auditing are Sort, Set in order, Shine, Standardize, and Sustain. These principles help streamline auditing processes and improve efficiency in the audit busines. By implementing these steps, you create a systematic approach to organizing the auditing procedures, leading to better results.

Yes, you can report a business to the IRS for potential auditing. By providing detailed information about the business's activities or discrepancies, you alert the IRS to investigate further. Partnering with platforms like USLegalForms can simplify the reporting process, ensuring all necessary documentation is properly completed.

An IRS audit for a business may be triggered by irregularities in financial reporting, excessive deductions, or being flagged in comparison to industry norms. Additionally, new or unusual transactions can raise a red flag. Understanding these triggers can help maintain compliance and minimize the risk of an audit business.