Sole Proprietorship

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Leased Premises?

- Begin by visiting the US Legal Forms website and log in to your account if you're a returning user. Ensure your subscription is active before proceeding.

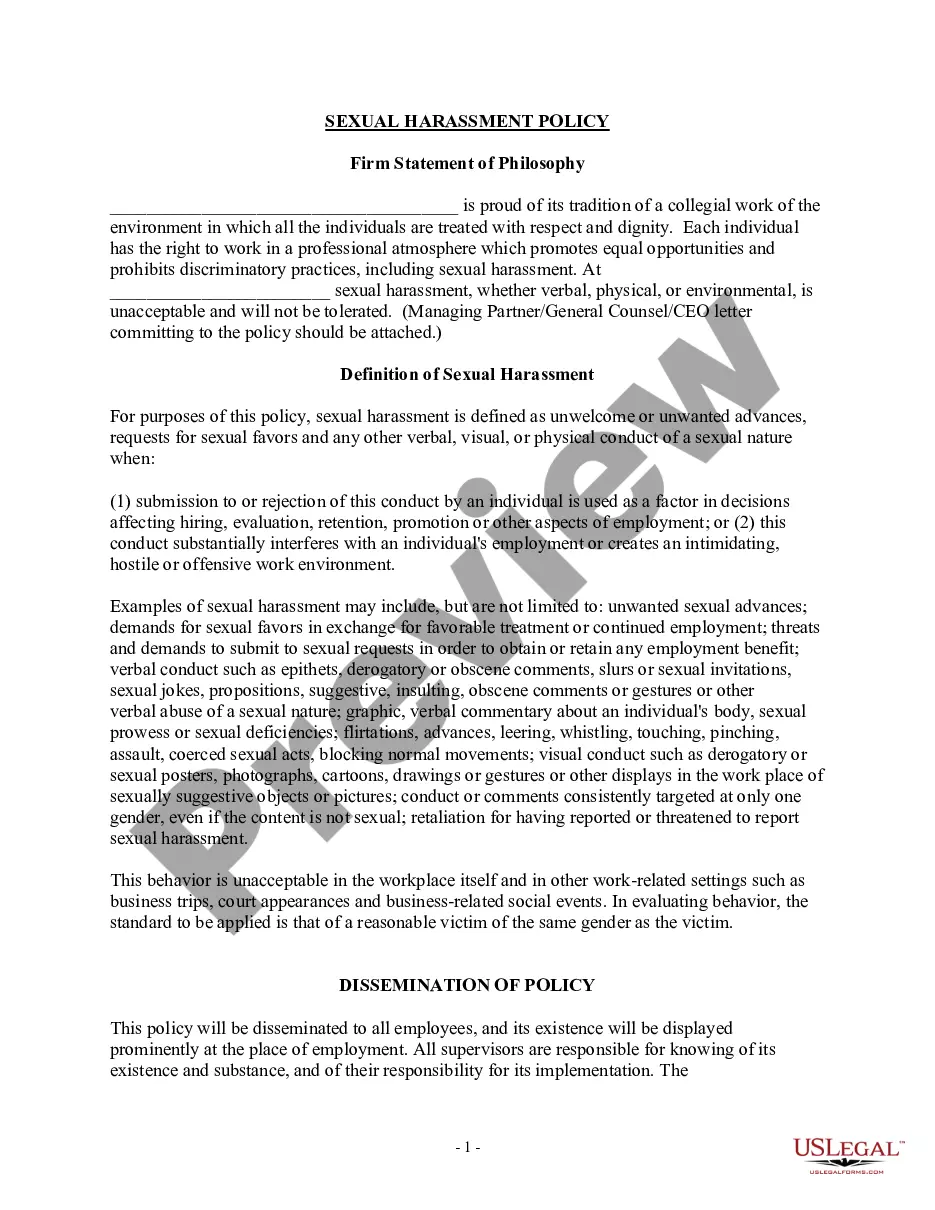

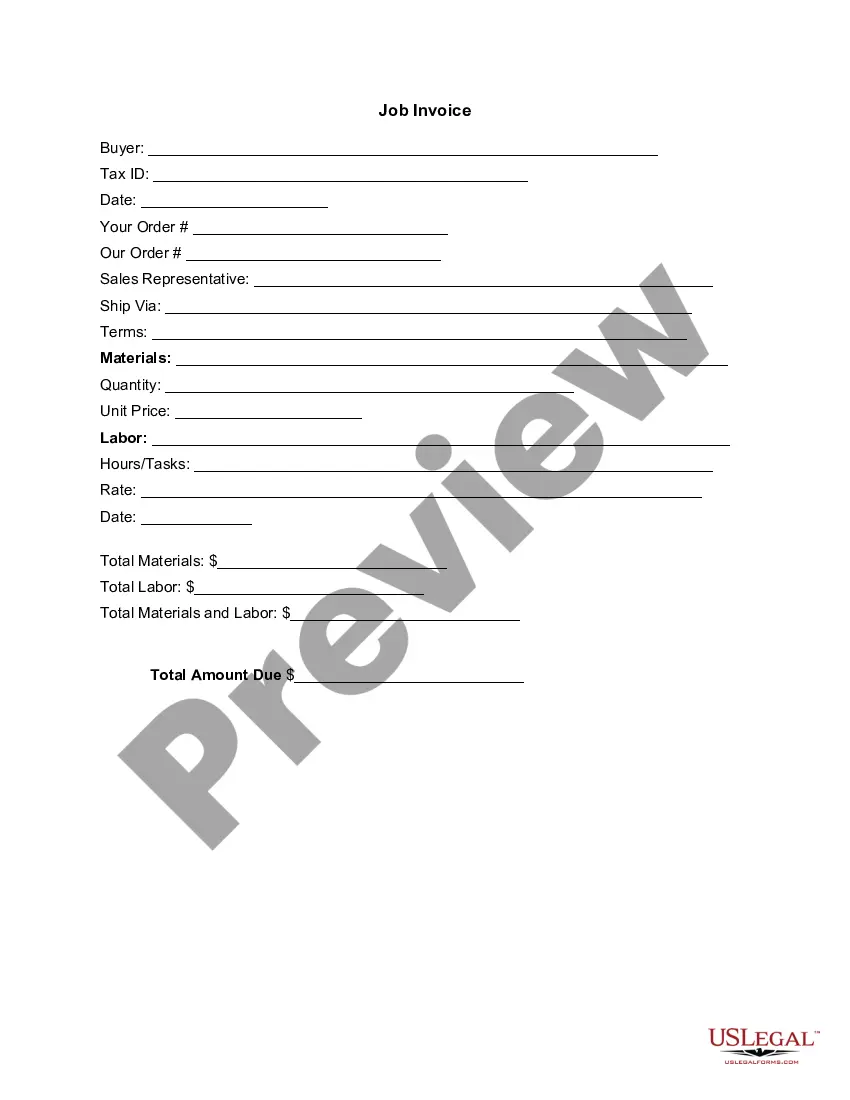

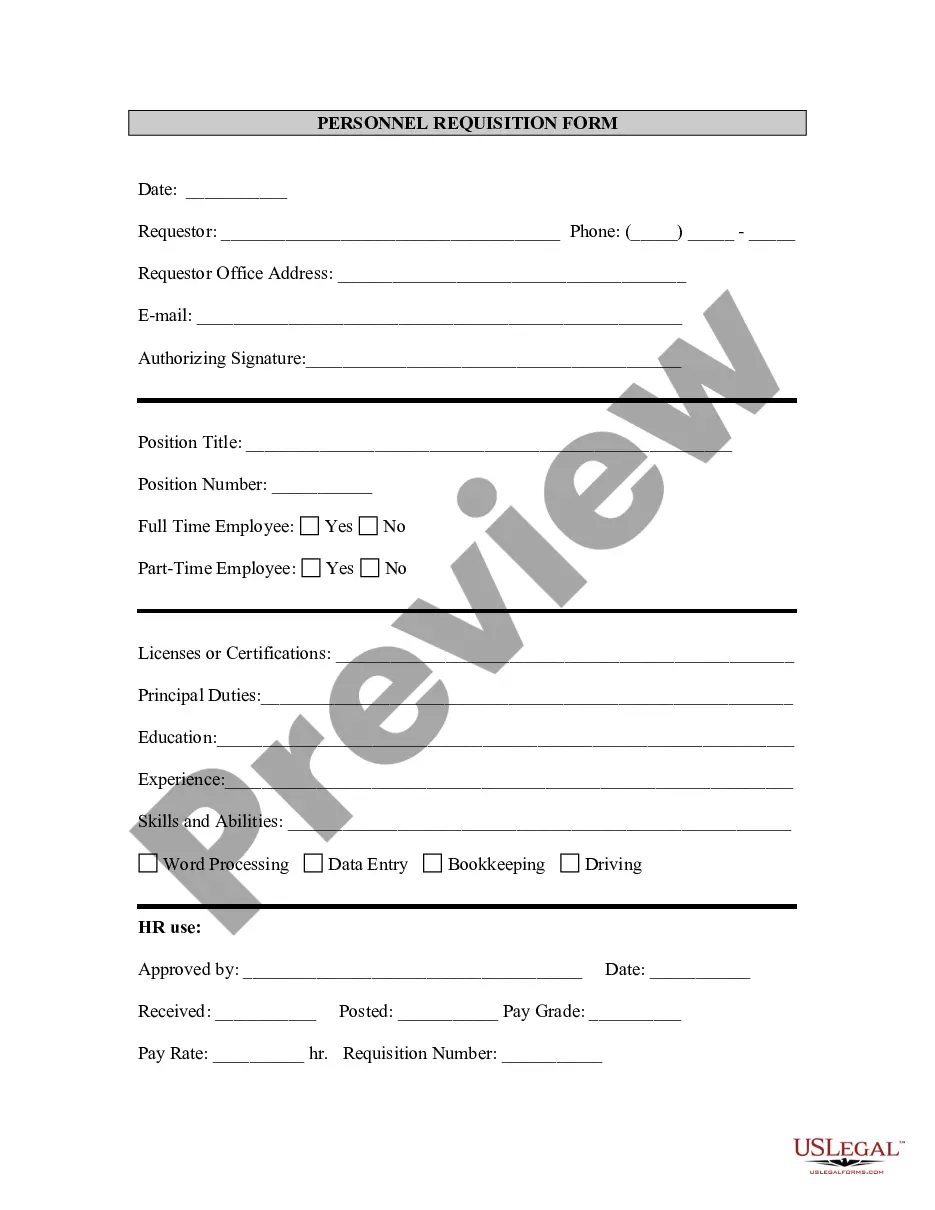

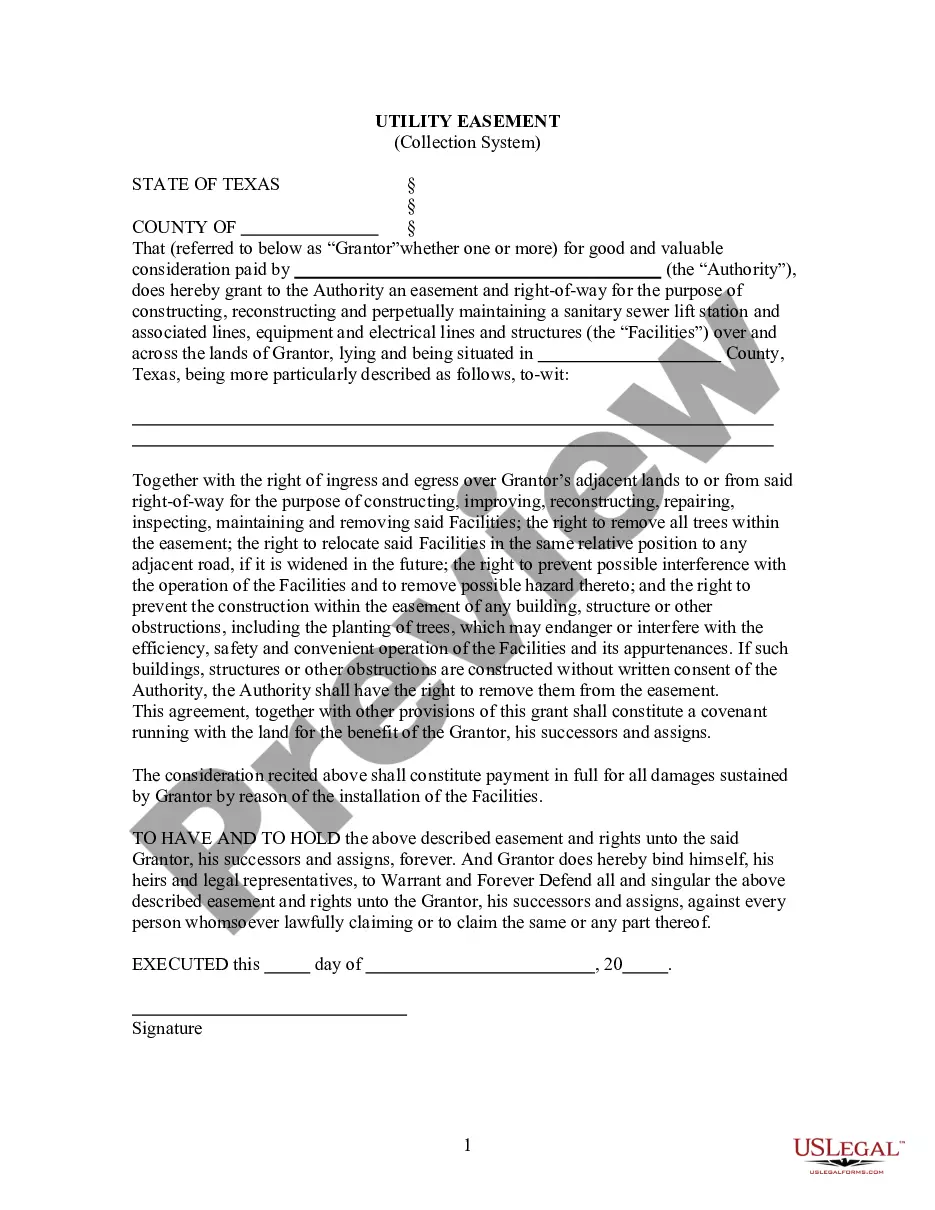

- If this is your first time, take a look at the form previews and descriptions to ensure you select the correct sole proprietorship template that fits your jurisdiction.

- Should you not find the right document, utilize the search feature to explore additional templates, ensuring you have the appropriate form.

- Select 'Buy Now' for your chosen document. This requires you to create an account to access the full library.

- Complete the purchase by entering your payment information, either via credit card or PayPal, confirming your subscription.

- Once your transaction is complete, download your form to your device. You can later find it anytime in the 'My Forms' section of your account.

US Legal Forms simplifies the process of obtaining essential legal documents, providing a comprehensive library that exceeds competitors in terms of quantity and affordability.

Start your journey towards establishing your sole proprietorship today with US Legal Forms! Access our library now and ensure your legal documents are both accurate and compliant.

Form popularity

FAQ

A common example of a sole proprietor is a freelance writer who works independently for various clients. This individual does not have a formal business structure like an LLC; instead, they manage their business affairs and report income directly on their taxes. Other examples include photographers, consultants, and home-based artisans. Each operates independently, maintaining full control over their work and business decisions.

Filing as a sole proprietorship typically requires minimal paperwork. Generally, you only need to register your business name if it differs from your legal name and apply for any necessary local licenses. Additionally, you will report your business income on your personal tax return using Schedule C. Using platforms like US Legal Forms can simplify the filing process by providing the necessary templates and guidance.

Whether to be an LLC or a sole proprietorship depends on your business needs. A sole proprietorship offers simplicity and direct control, which some entrepreneurs prefer. However, an LLC provides personal liability protection and may provide certain tax benefits. Ultimately, consider your risk tolerance and financial goals when making this decision.

Establishing yourself as a sole proprietorship involves simple steps. First, decide on a name for your business and register it if required by your state. Then, obtain any necessary licenses or permits to operate legally. Finally, keep good records of your income and expenses, as this will help you with taxes and financial management.

To set yourself up as a sole proprietor, start by choosing a business name that reflects your brand. Next, check your state's requirements for registering the business name, if applicable. You may also need to obtain any necessary licenses or permits, depending on your location and type of business. Lastly, consider opening a separate bank account for your business to keep your finances organized.

The primary difference between an LLC and a sole proprietorship lies in liability protection. An LLC provides personal liability protection, safeguarding personal assets from business debts, while a sole proprietorship does not offer such protection. Additionally, LLCs may have more complex tax requirements compared to the simpler tax structure of a sole proprietorship. When evaluating these options, it might be helpful to explore resources like uslegalforms to understand your legal obligations.

The disadvantages of a sole proprietorship include unlimited personal liability, reduced funding options, lack of expertise in crucial operational areas, challenges in accessing employee benefits, difficulty in creating business continuity plans, limited market presence, and the complexity of transitioning to more advanced business structures later. Each of these factors can impact the growth and sustainability of your business, which is essential to consider.

The primary risk of a sole proprietorship is the exposure to unlimited personal liability, meaning you could lose personal assets in business-related lawsuits. Financial instability can arise from the challenge of securing loans or investments. Additionally, the pressure of managing every aspect of the business alone can lead to burnout. It's crucial to understand these risks and consider how platforms like uslegalforms can help mitigate some legal complexities.

Being a sole proprietor can be a good idea if you value independence and wish to maintain complete control over your business operations. This business structure offers simplicity in terms of setup and management. However, it’s essential to weigh the risks, such as personal liability and potential difficulties in obtaining funding. For some, the benefits outweigh the drawbacks, especially when you utilize platforms like uslegalforms to ensure compliance.

Examples of sole proprietors include freelance graphic designers who manage their clientele independently, independent consultants offering specialized advice, small retail shop owners, authors self-publishing their work, and plumbers operating their own businesses. Each of these individuals enjoys the flexibility of being a sole proprietor while also facing unique challenges. This structure allows them to control their work environment and business decisions.