Charitable Lead Trust Rules

Description

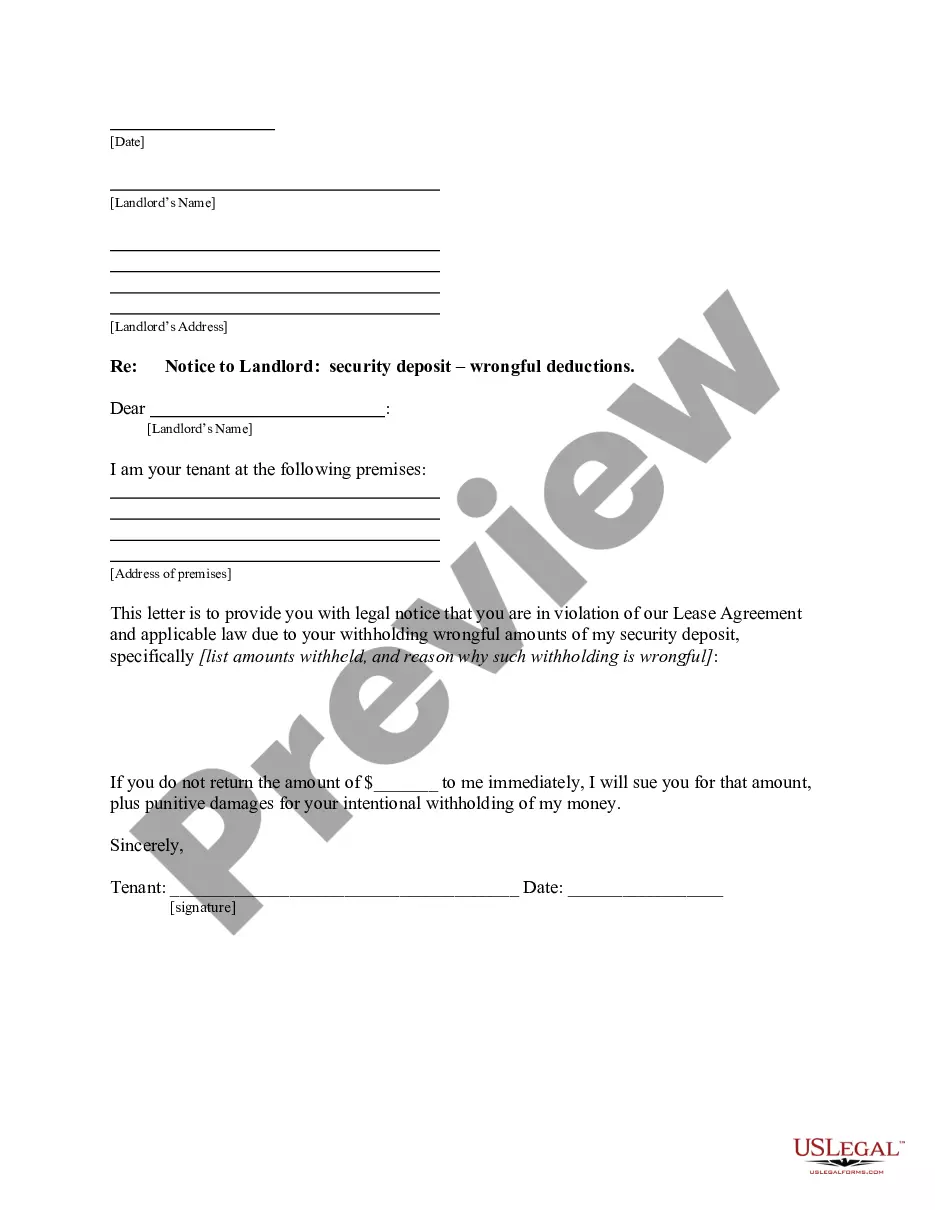

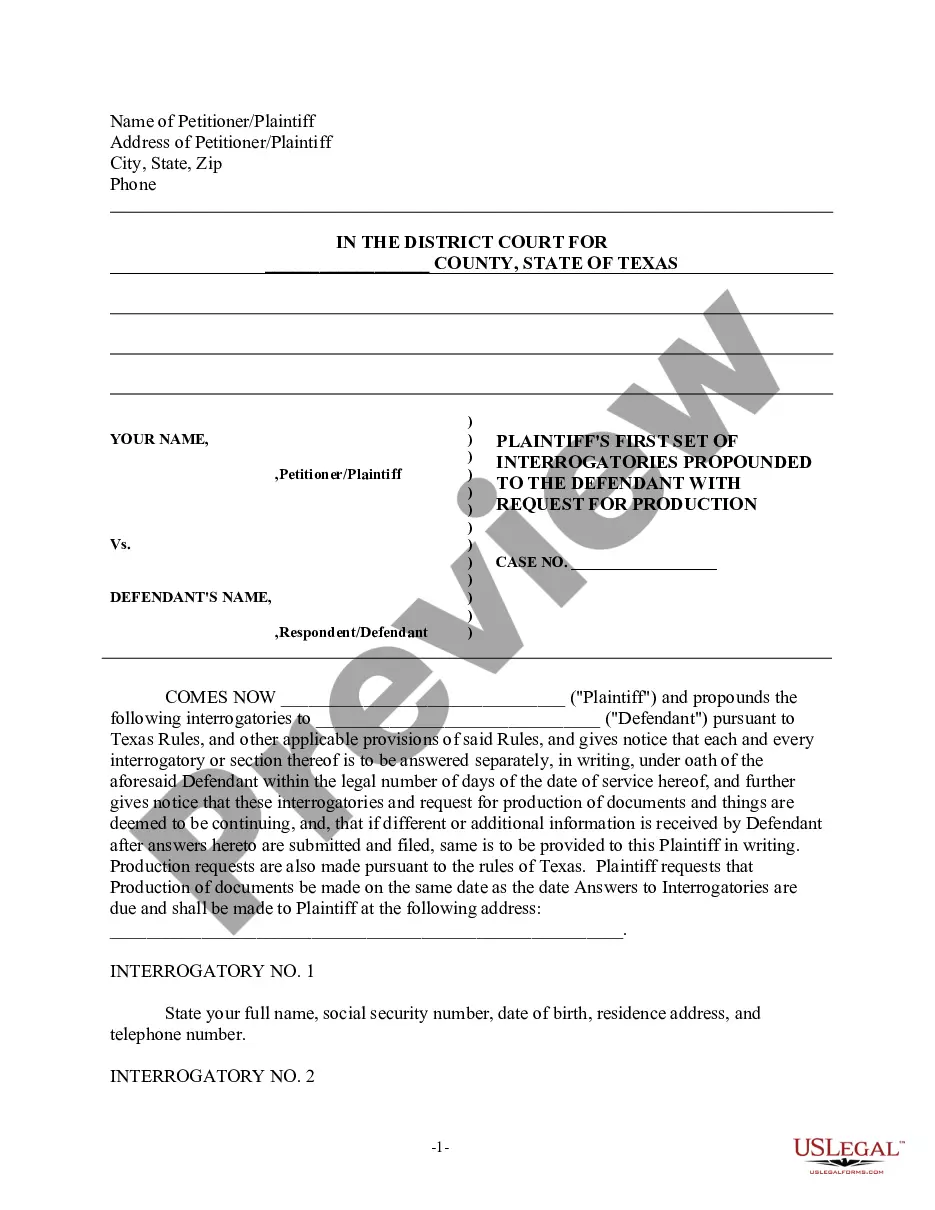

How to fill out Charitable Inter Vivos Lead Annuity Trust?

- Log in to your US Legal Forms account or create a new one for first-time users.

- Search for the specific form you require by checking the preview mode and description to ensure it meets your jurisdiction's requirements.

- If necessary, utilize the search function for additional templates that suit your needs.

- Select the desired document and opt for the 'Buy Now' option, choosing a subscription plan that works for you.

- Complete your purchase using a credit card or PayPal, ensuring you have valid account information.

- Download the completed form directly to your device and access it anytime through the 'My Forms' section of your profile.

By using US Legal Forms, you benefit from an extensive library containing over 85,000 fillable legal forms and packages. This ensures you have more resources at your disposal than with other services.

Don't hesitate to start your legal document journey with US Legal Forms today. Empower yourself with the tools to create accurate and legally sound forms.

Form popularity

FAQ

Generally, a charitable lead trust is not included in the gross estate of the grantor if it meets certain charitable lead trust rules. This means that if the trust is set up correctly, it can reduce potential estate taxation. It’s always beneficial to work with legal and tax experts to navigate these intricacies effectively. Platforms such as USLegalForms provide helpful resources to assist you in understanding these requirements better.

In a charitable lead trust, capital gains are generally not taxed at the time of the trust's sale of assets. This is because the assets are held in trust for a charitable organization, which often enjoys tax-exempt status. You should keep in mind, however, that any income generated from the assets may be subject to taxation. Understanding these aspects can help you make informed decisions about charitable lead trust rules and their implications on your financial planning.

A charitable lead trust offers several benefits, including immediate tax deductions and a way to support your favorite charities. By following charitable lead trust rules, you can secure a predictable income stream for chosen organizations while ultimately transferring remaining assets to your heirs. Additionally, these trusts can reduce your estate tax exposure. Utilizing platforms like uslegalforms can simplify the creation and management of these trusts, ensuring you make informed decisions.

The maximum term for a charitable lead trust is generally 20 years. These charitable lead trust rules allow for short or long durations, but exceeding 20 years is not permitted under current regulations. This flexibility provides you with options to design a trust that aligns with your financial and philanthropic goals. Understanding this timeframe can help you plan your charitable contributions effectively.

The minimum term for a charitable lead trust is usually two years, although it can vary depending on specific circumstances. The total term must comply with charitable lead trust rules to ensure eligibility for tax benefits. It’s wise to consult legal advice for tailored guidance on your situation.

While a charitable remainder trust offers many benefits, it is not without downsides. For instance, you may have limited control over assets during the trust term, and trust management costs can accumulate. Always consider these aspects alongside charitable lead trust rules to make informed decisions.

Yes, a charitable lead trust must file Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. This form reports income generated by the trust during its taxable year. Understanding these specifics is vital for compliance with charitable lead trust rules.

A charitable lead trust works by transferring assets into a trust that pays a charity regularly over a specified term. Once this term ends, the remaining assets usually go to your heirs or designated beneficiaries. Familiarizing yourself with charitable lead trust rules will ensure you make the most of this option.

A charitable lead annuity trust (CLAT) distributes a fixed amount to charity each year for a set duration. After this term, the remaining assets transfer to your beneficiaries. Following the charitable lead trust rules can help maximize your tax benefits while fulfilling philanthropic goals.

A charitable lead trust allows you to support a charity while also benefiting your estate. It provides financial support to a designated charity for a specific period, after which the remaining assets return to you or your beneficiaries. Understanding charitable lead trust rules is crucial for effective estate planning.