Promissory Note For Unsecured Loan

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

No longer is there a need to devote hours searching for legal documents to satisfy your local state mandates. US Legal Forms has compiled all of them in one location and enhanced their accessibility.

Our platform provides over 85,000 templates for any business and personal legal matters categorized by state and purpose.

All forms are expertly crafted and confirmed for accuracy, ensuring you receive a contemporary Promissory Note For Unsecured Loan.

Click Buy Now beside the template name once you discover the correct one. Select the most appropriate pricing plan and create an account or Log In. Complete your purchase via credit card or PayPal to move forward. Choose the file format for your Promissory Note For Unsecured Loan and save it to your device. Print your form for manual completion or upload the sample if you prefer to use an online editor. Creating formal documents in compliance with federal and state regulations is quick and straightforward with our library. Experience US Legal Forms today to keep your paperwork organized!

- If you are acquainted with our service and have an account, please verify your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever needed by accessing the My documents tab in your profile.

- If this is your first experience with our service, the procedure will take a few additional steps to finalize.

- Here’s how new users can find the Promissory Note For Unsecured Loan in our collection.

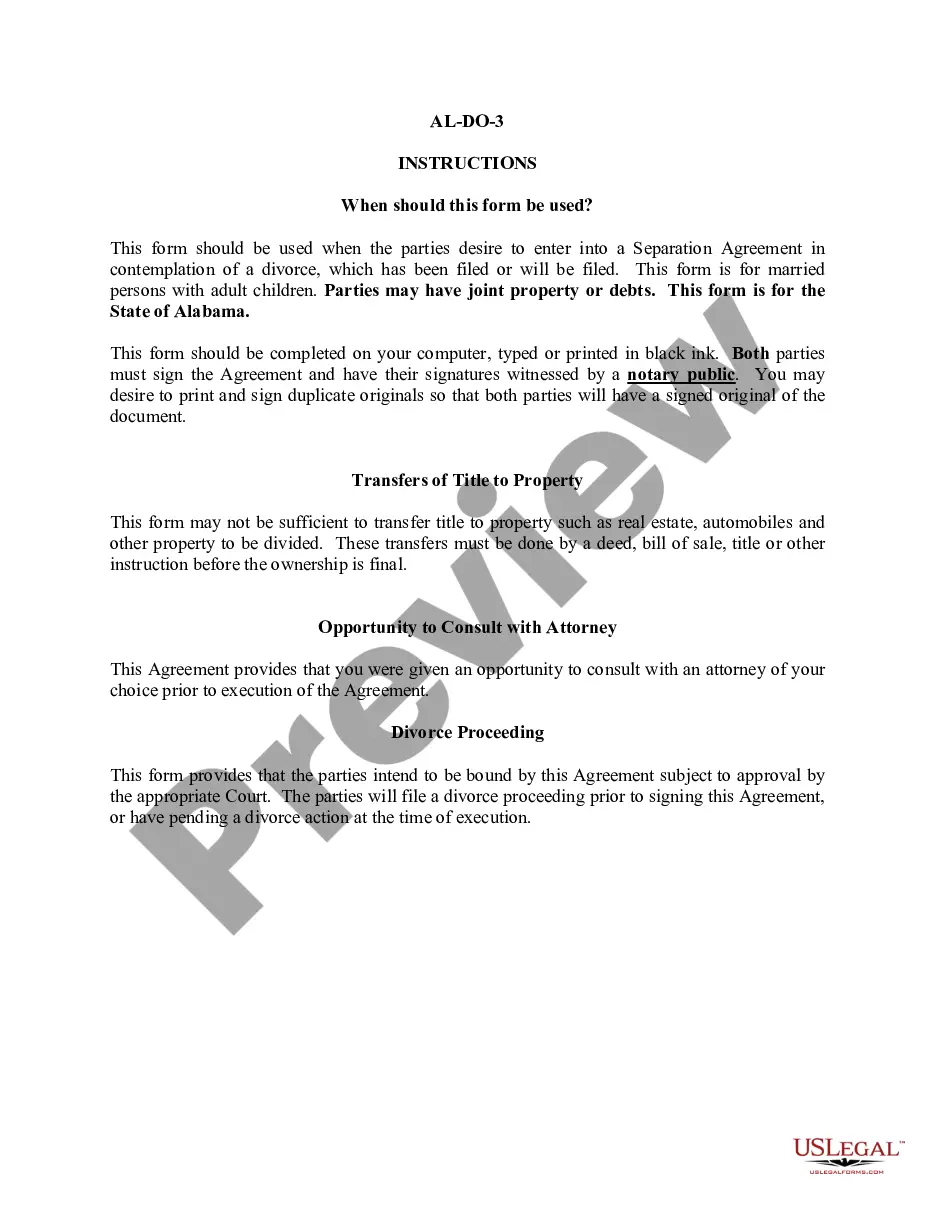

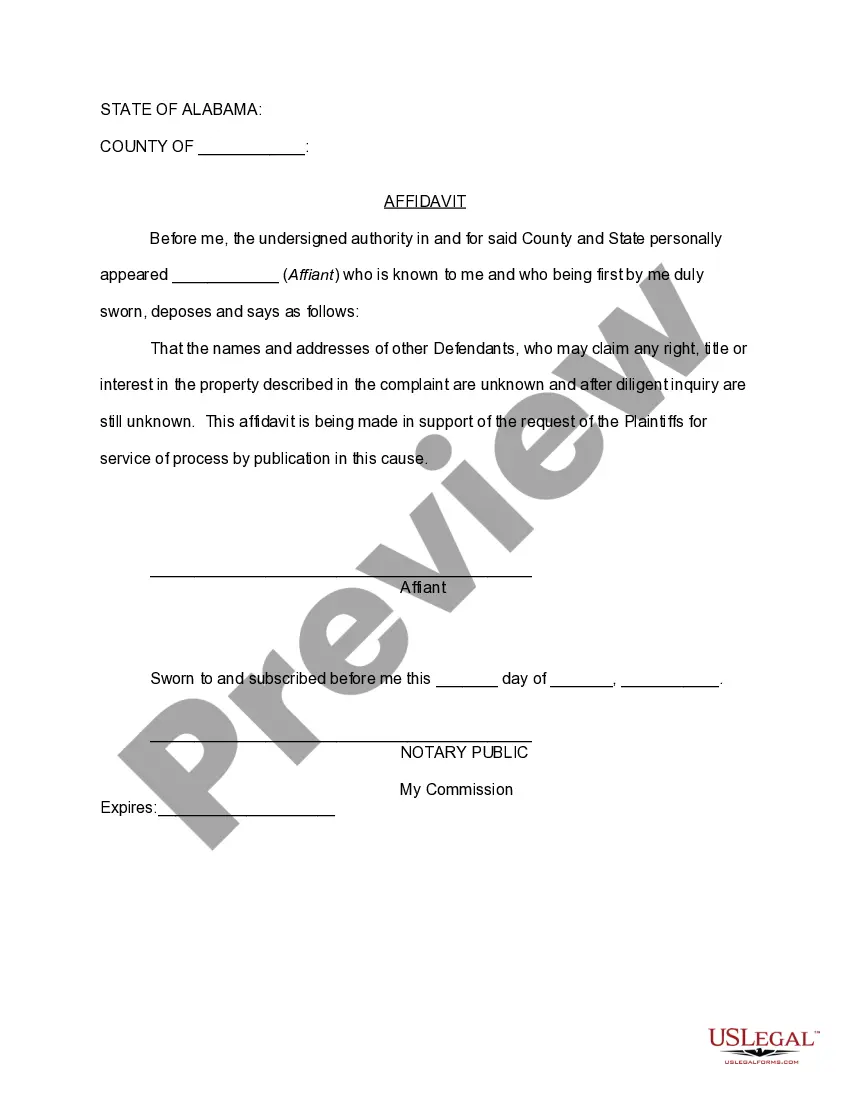

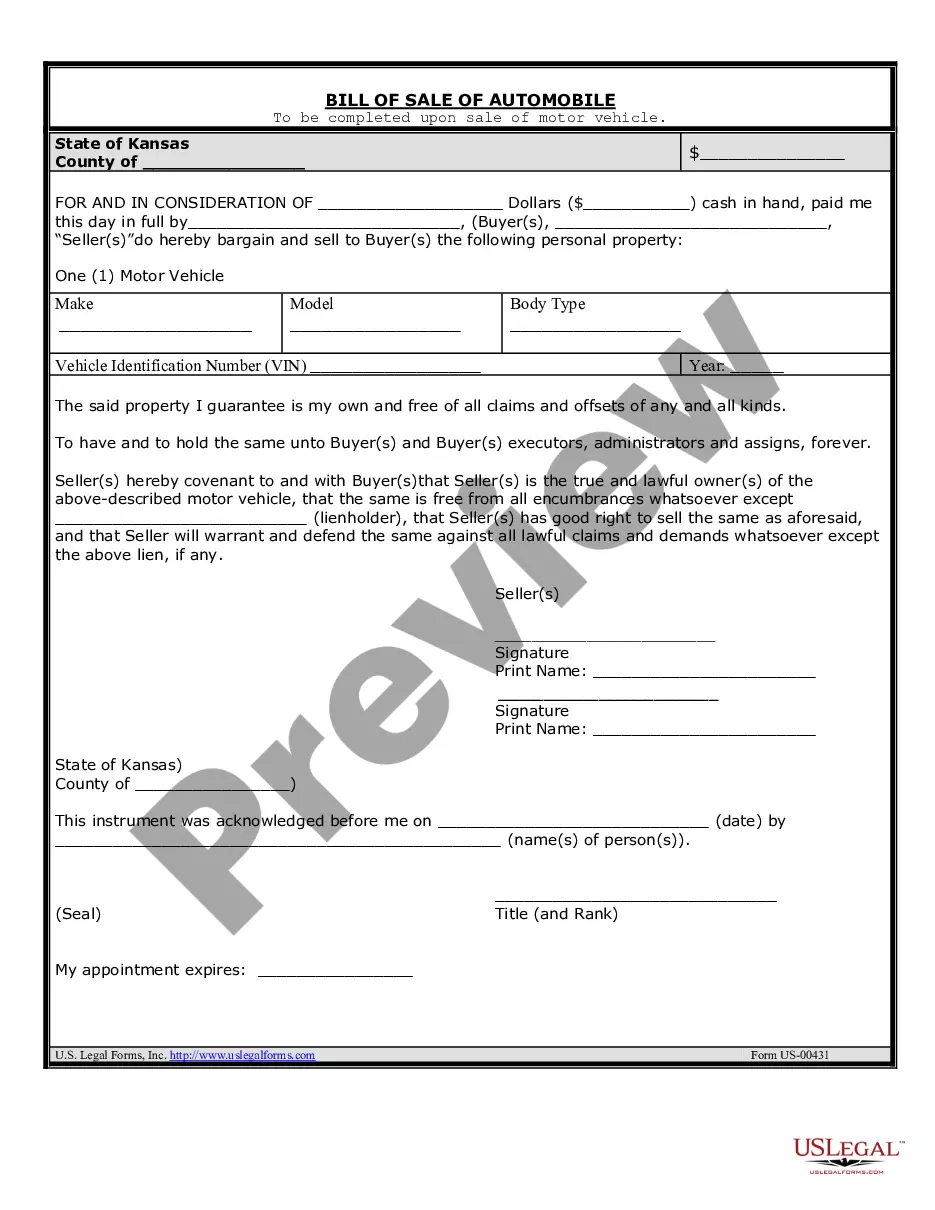

- Examine the page content closely to confirm it includes the sample you need.

- Utilize the form description and preview options if available to do so.

- Use the search bar above to find another template if the one you previously viewed didn't meet your needs.

Form popularity

FAQ

Unsecured Promissory NotesAn unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

An unsecured promissory note is a legally binding contract between two parties where one party agrees to pay the other a certain amount of money at a specific time in the future. The reason it is called 'unsecured' is because the borrower does not want to pledge any assets as collateral for the loan.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.