Straight Note Vs Installment Note

Description

How to fill out Promissory Note With Installment Payments?

Managing legal documents and tasks can be a lengthy addition to your entire day.

Straight Note Vs Installment Note and similar forms typically necessitate that you locate them and comprehend the optimal way to fill them out correctly.

Consequently, whether you are addressing financial, legal, or personal issues, having a comprehensive and effortless online library of documents available to you will greatly assist.

US Legal Forms is the top online platform for legal templates, featuring over 85,000 state-specific documents and various tools that will enable you to complete your paperwork swiftly.

Is it your first experience using US Legal Forms? Register and create a free account in a few minutes, and you will gain access to the form library and Straight Note Vs Installment Note. Then, follow the steps below to complete your document: Make sure you have found the correct document by using the Review feature and reading the document description. Choose Buy Now when ready, and select the subscription plan that fits your needs. Select Download then complete, eSign, and print the document. US Legal Forms has twenty-five years of experience helping clients manage their legal documents. Discover the document you need today and streamline any process without difficulty.

- Explore the collection of relevant documents at your disposal with just a single click.

- US Legal Forms gives you access to state- and county-specific documents available for download at any time.

- Safeguard your document management processes by utilizing a premium service that allows you to assemble any form within minutes without any additional or undisclosed fees.

- Simply Log In to your account, search for Straight Note Vs Installment Note and obtain it immediately within the My documents section.

- You can also access forms you have previously downloaded.

Form popularity

FAQ

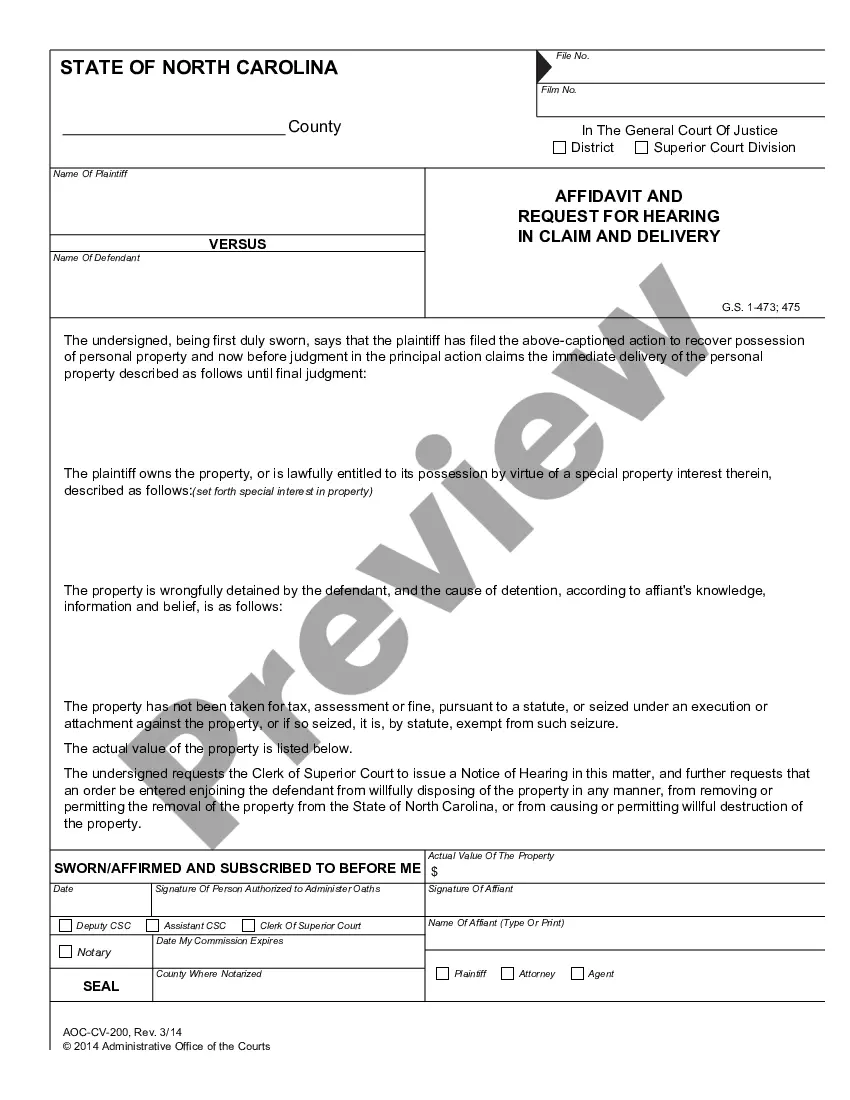

To fill out a promissory note, start by including the names and addresses of both the borrower and lender. Specify the principal amount, interest rate, payment schedule, and maturity date. Utilizing a template from US Legal Forms can simplify this process, ensuring you include all necessary details while understanding the implications of straight note vs installment note.

The main difference lies in the payment structure. A straight note requires only interest payments during the term, with the principal due at the end. An amortized note, on the other hand, includes both principal and interest in regular installments throughout its duration. Understanding straight note vs installment note helps clarify your financing options.

When looking at straight note vs installment note, the primary difference lies in the payment structure. A straight note typically requires one lump sum payment of interest throughout the term, with the principal amount due at the end. In contrast, an installment note involves periodic payments consisting of both principal and interest, spreading the financial burden over time. Understanding these differences can help you make informed financial decisions, and platforms like USLegalForms offer valuable resources to clarify these concepts.

There are several ways that the borrower can pay off the money that was borrowed. One type of note is called a straight note or a term loan, these two terms meaning the same thing, where the borrower pays interest only. This is typical on a short-term construction loan that may be only in effect for say six months.

Straight Notes - YouTube YouTube Start of suggested clip End of suggested clip A straight note calls for the entire amount of its principle to be paid in a single lump sum due atMoreA straight note calls for the entire amount of its principle to be paid in a single lump sum due at the end of a period of time. There are no periodic payments of principle. As with an installment.

Installment Note ? most common, where monthly payments are a set amount for principal and interest throughout the term of the Note. Interest only Note ? monthly payments are interest only and principal is paid only at maturity. Straight Note ? payment of interest and principal are due at one time in one lump sum.

An installment note is a form of promissory note calling for payment of both principal and interest in specified amounts, or specified minimum amounts, at specific time intervals. This periodic reduction of principal amortizes the loan.

An installment note is a loan agreement that allows a borrower to pay back a debt in regular payments, or installments, over a period of time. It usually involves a lender and a borrower, with the terms of repayment stated in writing. The note is signed by both parties to confirm the loan agreement and its terms.