Promissory Note Without Interest

Description

How to fill out Promissory Note With Installment Payments?

Dealing with legal papers and processes can be a lengthy addition to your day.

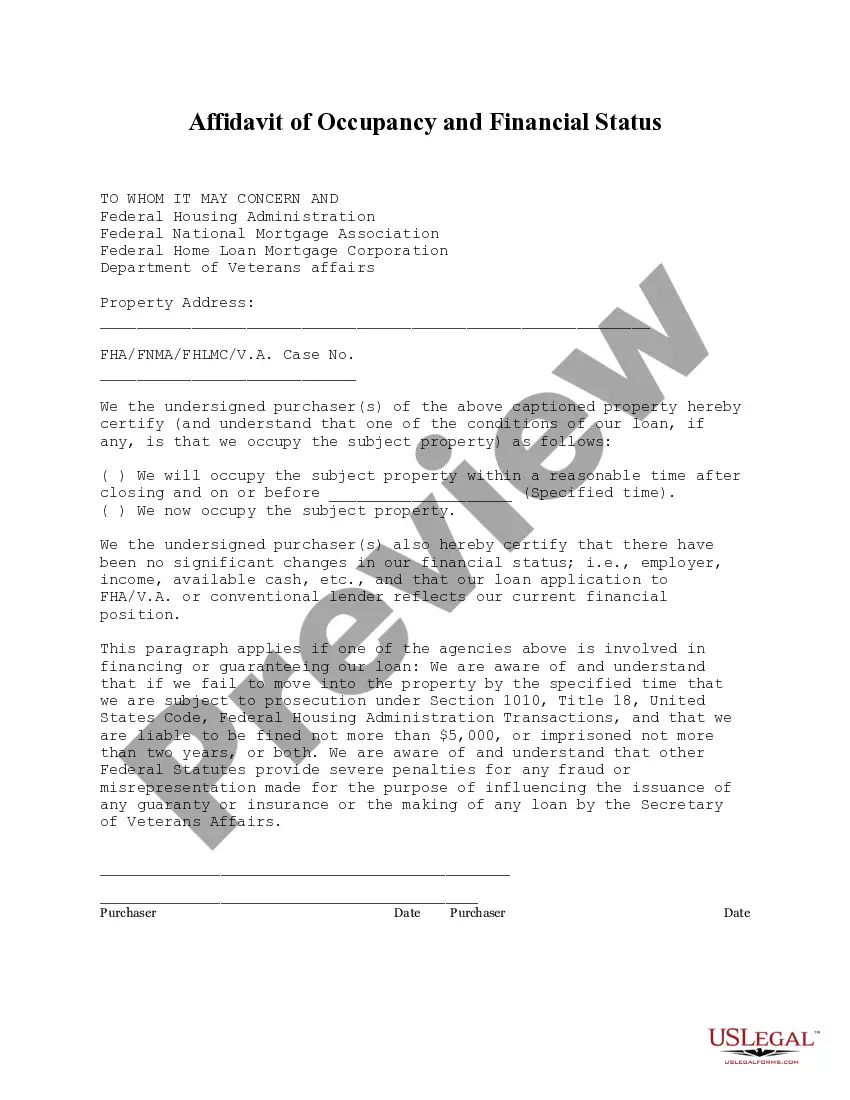

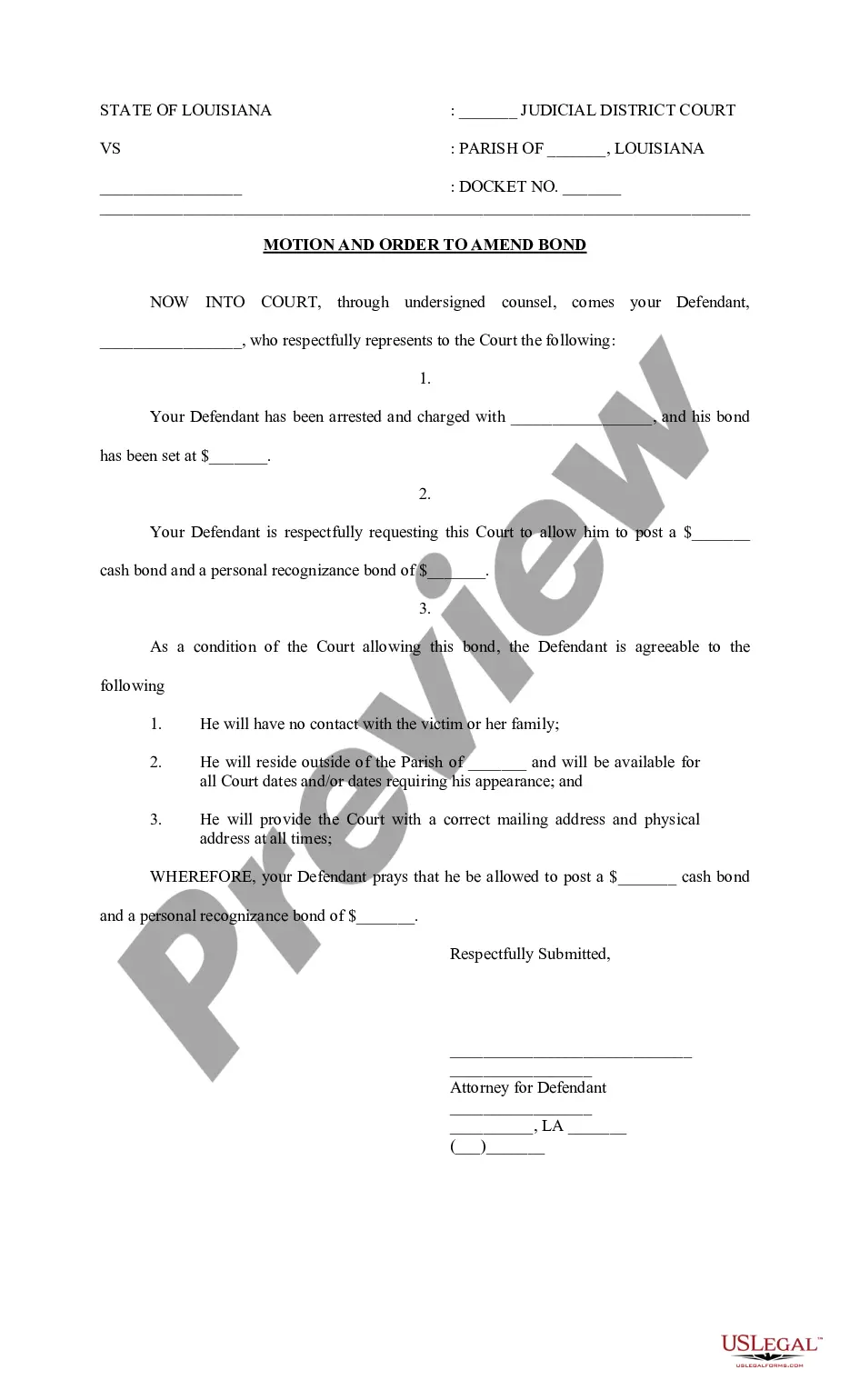

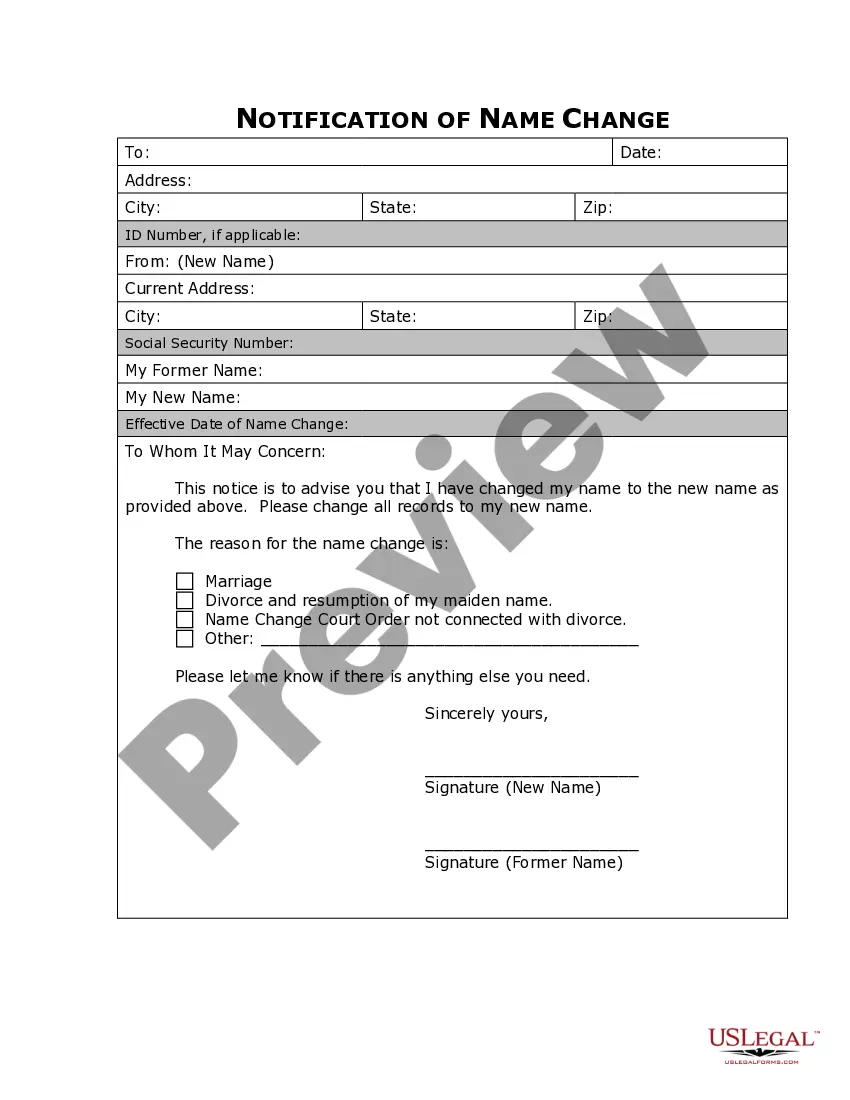

Promissory Note Without Interest and similar documents typically necessitate searching for them and figuring out how to fill them out correctly.

For this reason, whether you are managing financial, legal, or personal affairs, utilizing a comprehensive and functional online library of forms when necessary will greatly assist you.

US Legal Forms is the leading online platform for legal templates, featuring more than 85,000 state-specific documents and various tools to help you complete your paperwork swiftly.

Is this your first time using US Legal Forms? Sign up and create your account in just a few minutes to gain access to the form library and Promissory Note Without Interest. Then, follow the steps below to finalize your form: Ensure you have located the correct form by using the Review feature and checking the form details. Click Buy Now when prepared, and select the subscription plan that suits you best. Click Download then fill out, eSign, and print the form. US Legal Forms boasts 25 years of experience assisting clients in managing their legal documents. Acquire the form you need today and simplify any process without effort.

- Explore the collection of suitable documents available to you with just one click.

- US Legal Forms offers you state- and county-specific documents ready for download at any time.

- Enhance your document management procedures with a reliable service that enables you to create any form in minutes without additional or hidden charges.

- Simply Log In to your account, find Promissory Note Without Interest and obtain it directly from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

As to element (1), promissory notes (and contracts) both require consideration. Consideration is typically anything of value promised to another when making a contract/promissory note. One defense to a breach of contract or breach of promissory note suit, then, is that the contract/note did not have consideration.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

To be legally enforceable, a promissory note must meet multiple legal conditions. Moreover, it must contain both an offer of agreement and an acceptance of agreement. All contracts state the type of services or goods rendered and indicate how much they cost.

Most formal promissory notes will include interest, but it is not a requirement for a legally valid promissory note. If you do not want to charge your friend or family member interest, then make the loan interest-free or use 0% as your interest rate.