Assignment Of Promissory Note With Loan

Description

How to fill out Promissory Note Assignment And Notice Of Assignment?

Whether for business purposes or for personal affairs, everybody has to manage legal situations sooner or later in their life. Filling out legal paperwork requires careful attention, beginning from picking the appropriate form template. For example, when you pick a wrong edition of a Assignment Of Promissory Note With Loan, it will be turned down once you send it. It is therefore essential to get a dependable source of legal papers like US Legal Forms.

If you have to obtain a Assignment Of Promissory Note With Loan template, follow these easy steps:

- Get the template you need by using the search field or catalog navigation.

- Examine the form’s information to ensure it suits your case, state, and county.

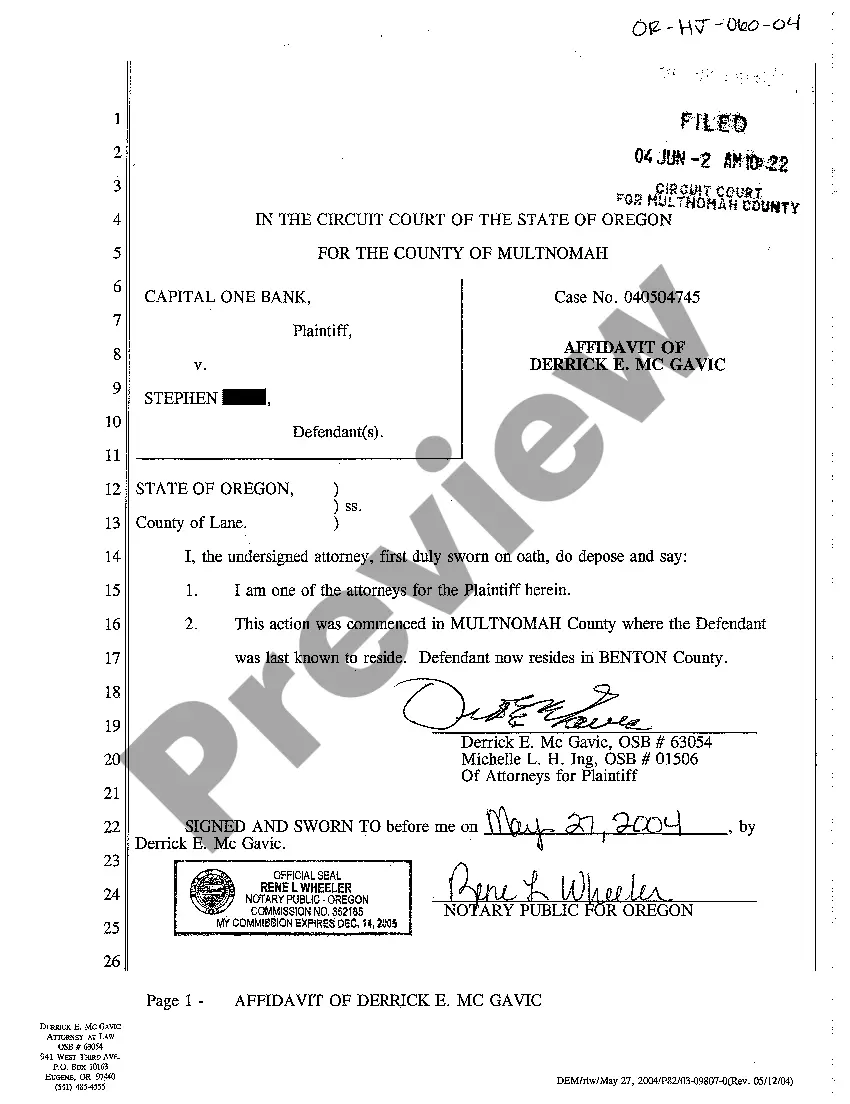

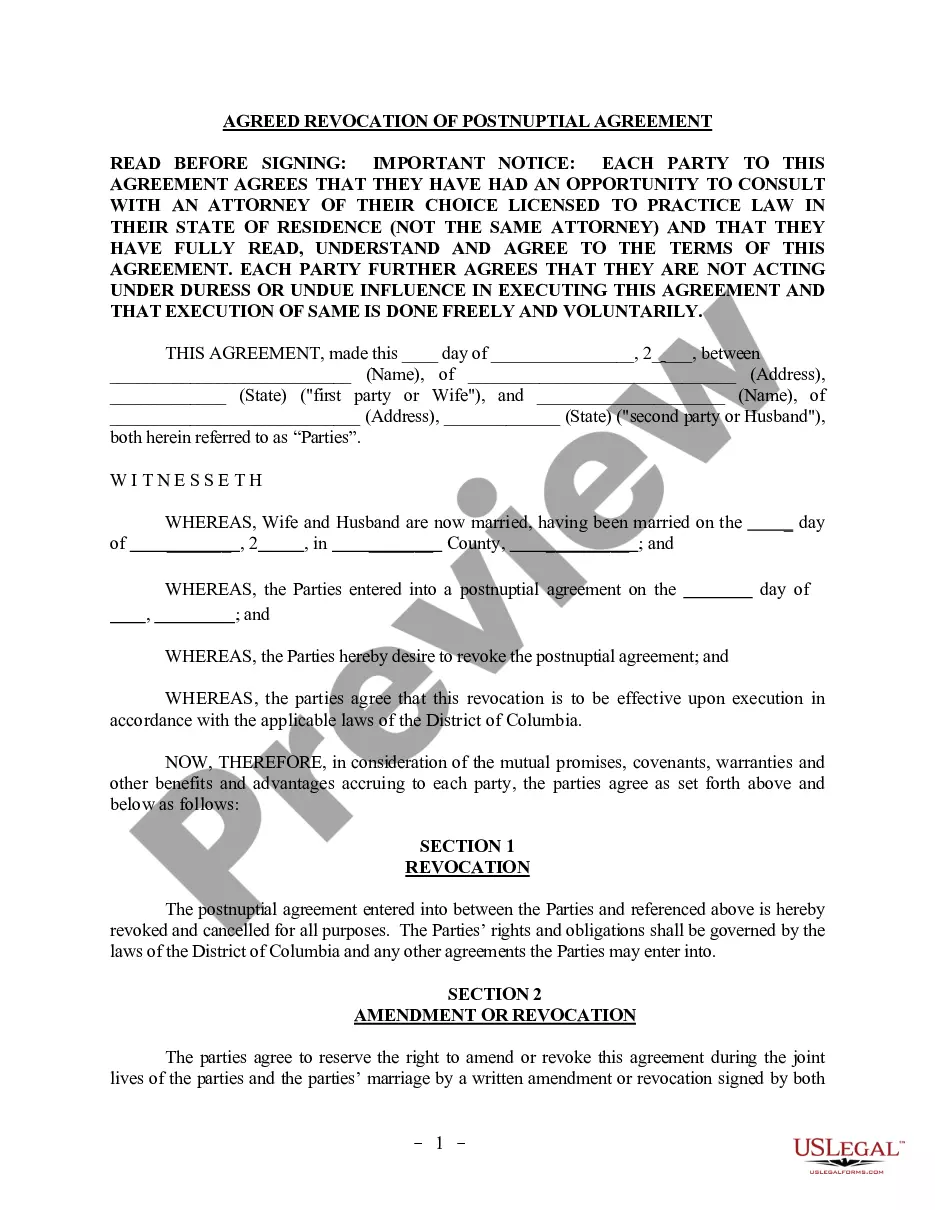

- Click on the form’s preview to examine it.

- If it is the incorrect document, go back to the search function to locate the Assignment Of Promissory Note With Loan sample you require.

- Get the template if it matches your needs.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved templates in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Select the correct pricing option.

- Complete the account registration form.

- Select your payment method: you can use a bank card or PayPal account.

- Select the document format you want and download the Assignment Of Promissory Note With Loan.

- After it is saved, you are able to complete the form with the help of editing software or print it and complete it manually.

With a large US Legal Forms catalog at hand, you do not need to spend time looking for the right template across the web. Use the library’s simple navigation to find the correct template for any situation.

Form popularity

FAQ

The purpose of the mortgage is to provide collateral for the debt that's evidenced by the promissory note. Banks and mortgage companies frequently sell and buy home loans from each other. An "assignment" is the document that's the legal record of this transfer from one entity to another.

(1) The Lender may assign all or part of the guaranteed portion of the loan to one or more Holders by using the Assignment Guarantee Agreement. The Lender must retain title to the Promissory Note.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

If you are the borrower, issue the promissory note to the institution or individual that needs it to obtain a loan for you. This should be done with an addendum stating the assignment of your rights or the completion of the assignment paperwork required by the lender.