Assignment Of Promissory Note Sample Format

Description

How to fill out Promissory Note Assignment And Notice Of Assignment?

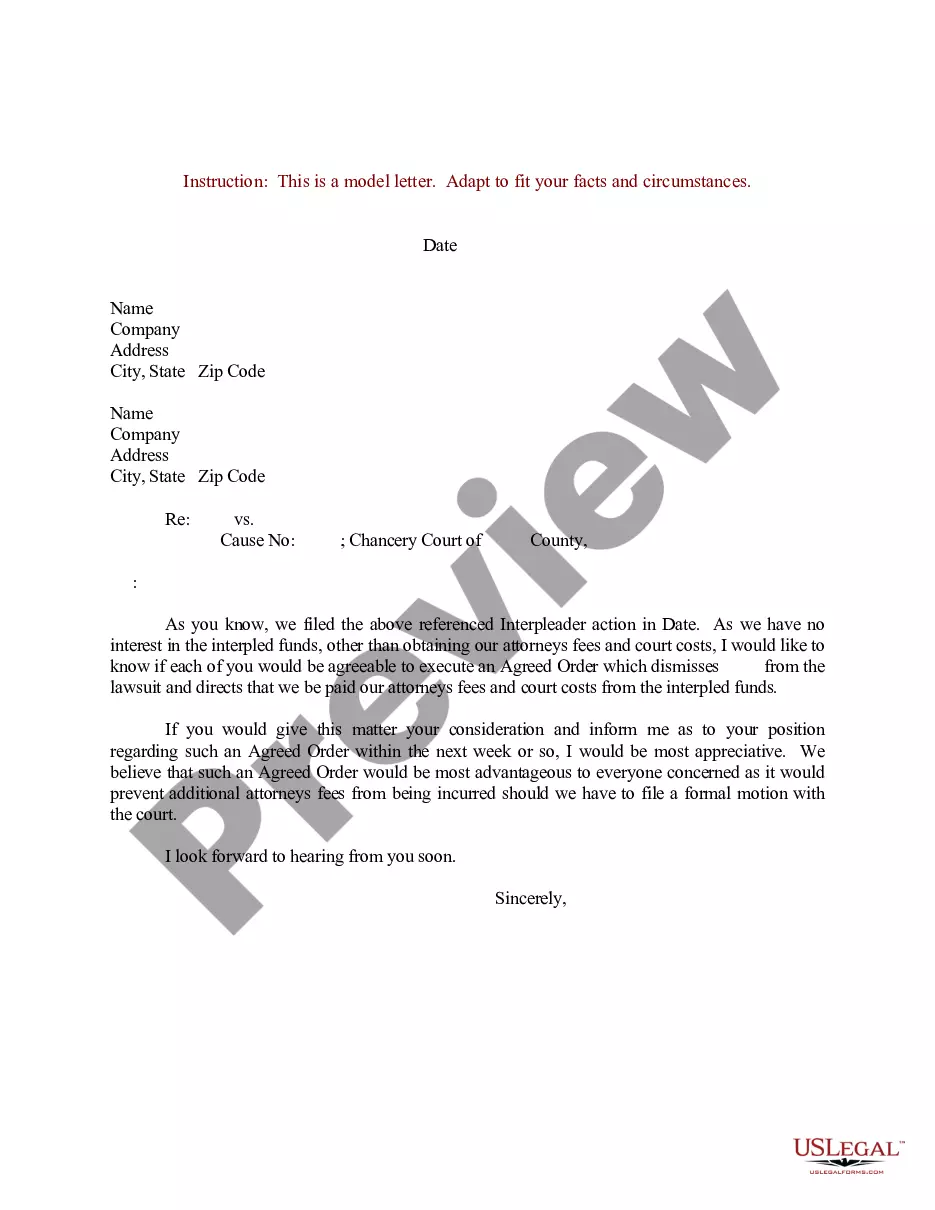

The Assignment Of Promissory Note Sample Format displayed on this page is a reusable official template created by expert attorneys in compliance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 authenticated, state-specific documents for any commercial and personal situation. It’s the quickest, easiest, and most dependable method to acquire the paperwork you require, as the service ensures bank-level information security and anti-malware safeguards.

Register for US Legal Forms to access verified legal templates for all of life's situations at your fingertips.

- Browse for the document you require and review it.

- Sign up and Log In.

- Obtain the editable template.

- Complete and sign the document.

- Download your paperwork again.

Form popularity

FAQ

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

If you are the borrower, issue the promissory note to the institution or individual that needs it to obtain a loan for you. This should be done with an addendum stating the assignment of your rights or the completion of the assignment paperwork required by the lender.

(1) The Lender may assign all or part of the guaranteed portion of the loan to one or more Holders by using the Assignment Guarantee Agreement. The Lender must retain title to the Promissory Note.

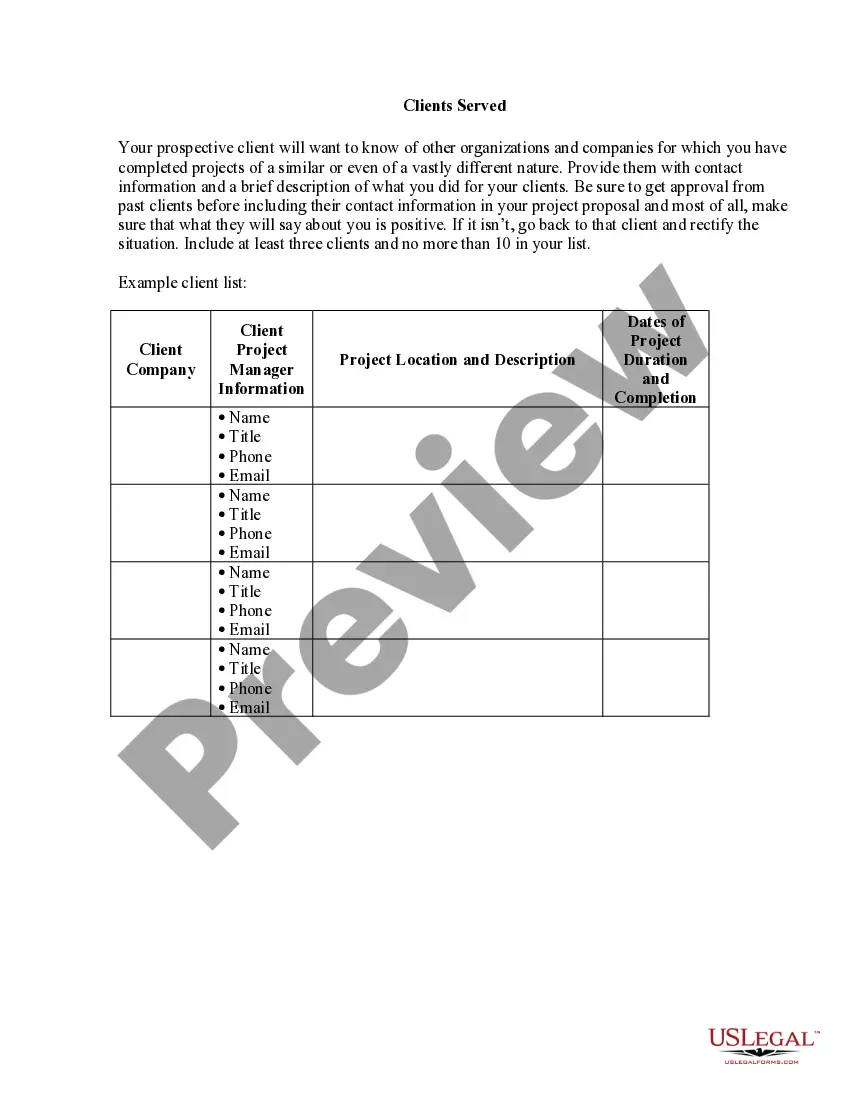

Names of all Parties Involved ? Such a document must include the names of the payee, drawee, and holder. Address and Contact Details ? Should include the residential address and phone number of all parties involved. Promissory Note Amount ? It must show the sum that is outstanding and must be repaid as per the note.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.