Venta Bienes Terreno Fortaleza

Description

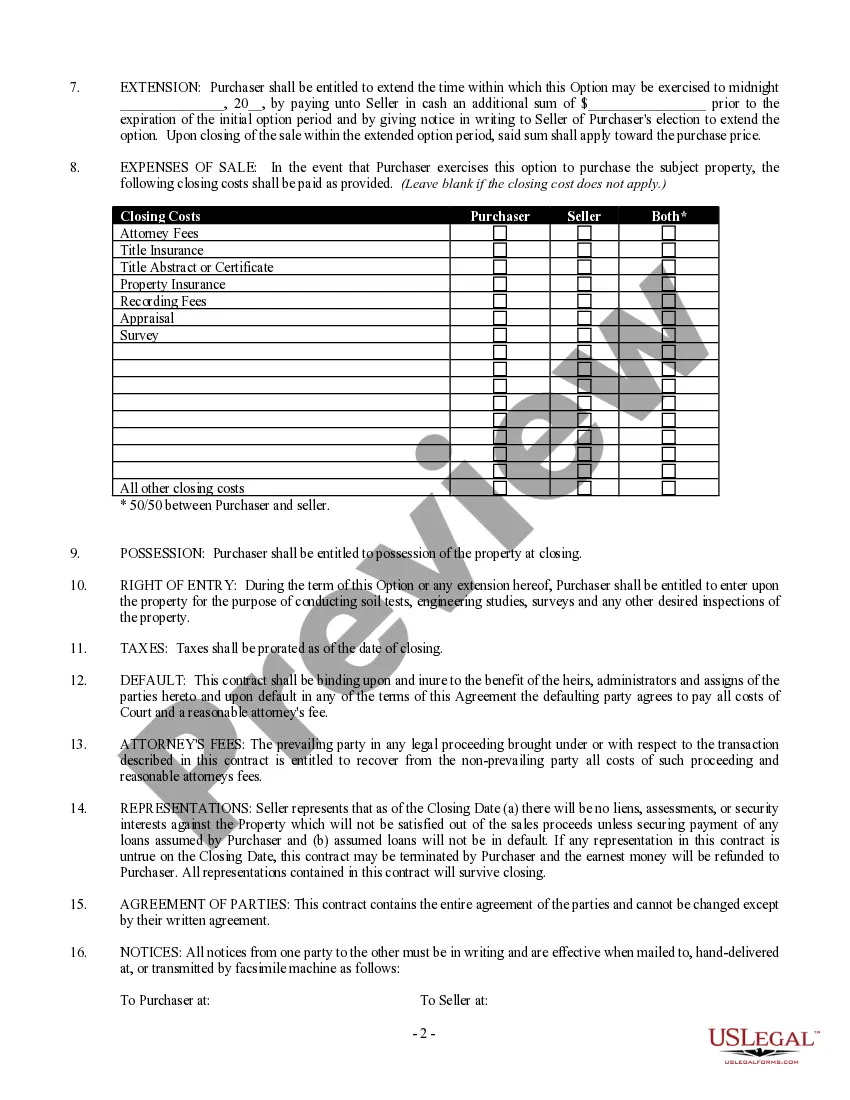

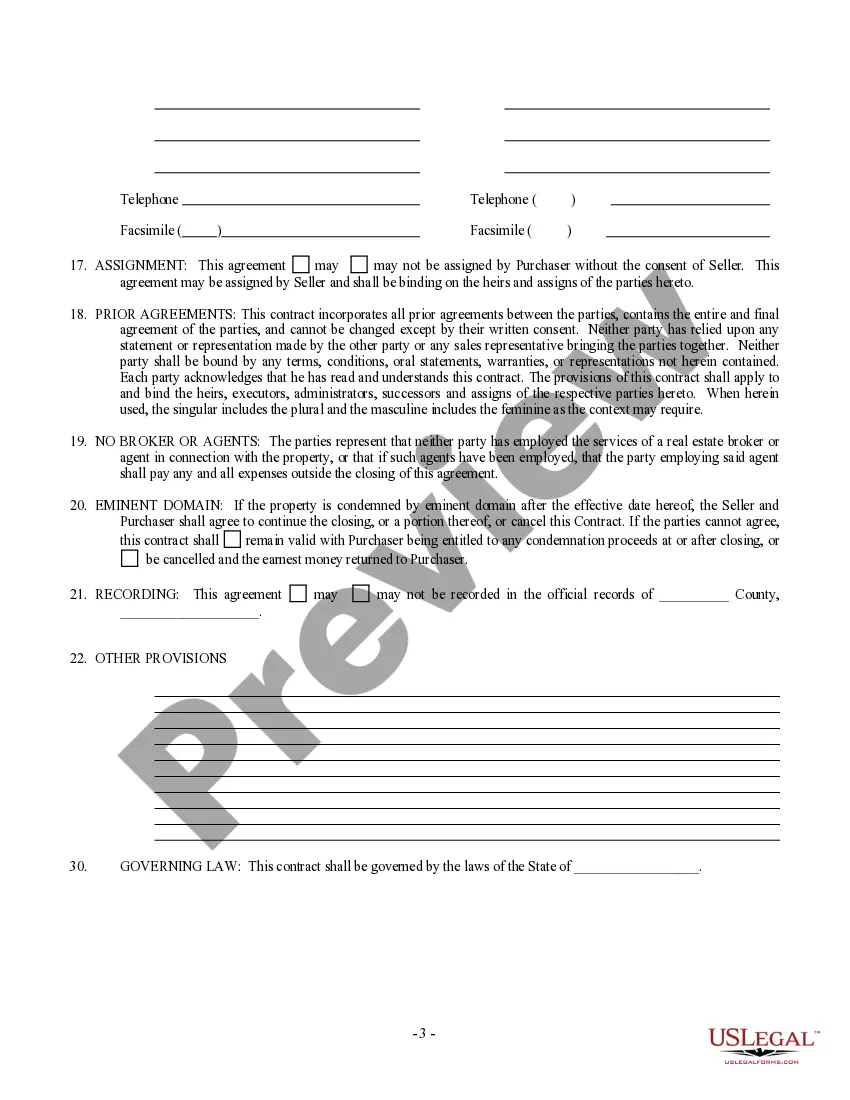

How to fill out Option For The Sale And Purchase Of Real Estate - Residential Lot Or Land?

Whether for professional objectives or personal issues, all individuals must handle legal situations eventually in their lives.

Completing legal documentation requires meticulous care, starting with selecting the appropriate form example.

With a vast collection of US Legal Forms available, you don't need to waste time searching for the suitable example online. Utilize the library’s simple navigation to locate the right form for any circumstance.

- Acquire the sample you need by using the search bar or catalog browsing.

- Review the form’s details to ensure it suits your situation, state, and locality.

- Click on the form’s preview to inspect it.

- If it is not the right document, return to the search feature to find the Venta Bienes Terreno Fortaleza sample you need.

- Download the template if it aligns with your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access your previously saved templates in My documents.

- If you haven't created an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing choice.

- Complete the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the file format you desire and download the Venta Bienes Terreno Fortaleza.

- Once downloaded, you can complete the form using editing software or print it and finish it manually.

Form popularity

FAQ

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

If you can't repay your debt, it's often passed to a debt collection agency. These agencies can use your credit report to understand your financial situation and decide how to collect the money owed. How this affects your score. Debt collector searches are classed as hard searches.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that limits the actions of third-party debt collectors who are attempting to collect debts on behalf of another person or entity.

How to Request Debt Verification. To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

Legally, a debt collector has to send you a debt verification letter within five days of their first contact with you. And if not, you should ask for one.

It is the purpose of this subchapter to eliminate abusive debt collection practices by debt collectors, to insure that those debt collectors who refrain from using abusive debt collection practices are not competitively disadvantaged, and to promote consistent State action to protect consumers against debt collection ...

The FDCPA prohibits debt collectors from contacting debtors before a.m. or after p.m., but it does not prohibit debt collectors from contacting debtors on holidays or weekends unless they know or have reason to know that doing so would be ?inconvenient? to the debtor.

Under this Act (Title VIII of the Consumer Credit Protection Act), third-party debt collectors are prohibited from using deceptive or abusive conduct in the collection of consumer debts incurred for personal, family, or household purposes.