Uniform Transfers With No Fee

Description

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

Whether for commercial objectives or personal affairs, everyone must navigate legal circumstances at some time in their life.

Completing legal paperwork demands meticulous care, beginning with choosing the appropriate form template.

Complete the account registration form. Select your payment method: you may use a credit card or PayPal account. Choose the file format you prefer and download the Uniform Transfers With No Fee. Once it is saved, you can fill out the form using editing software or print it and fill it out manually. With an extensive US Legal Forms catalog at your disposal, you won’t need to waste time searching for the correct sample online. Utilize the library’s straightforward navigation to find the appropriate form for any situation.

- For instance, if you select an incorrect version of the Uniform Transfers With No Fee, it will be rejected once you submit it.

- Thus, it is crucial to obtain a reliable source of legal documents like US Legal Forms.

- If you need to obtain a Uniform Transfers With No Fee template, follow these straightforward steps.

- Locate the sample you require by using the search bar or catalog browsing.

- Review the form’s description to ensure it aligns with your circumstances, state, and area.

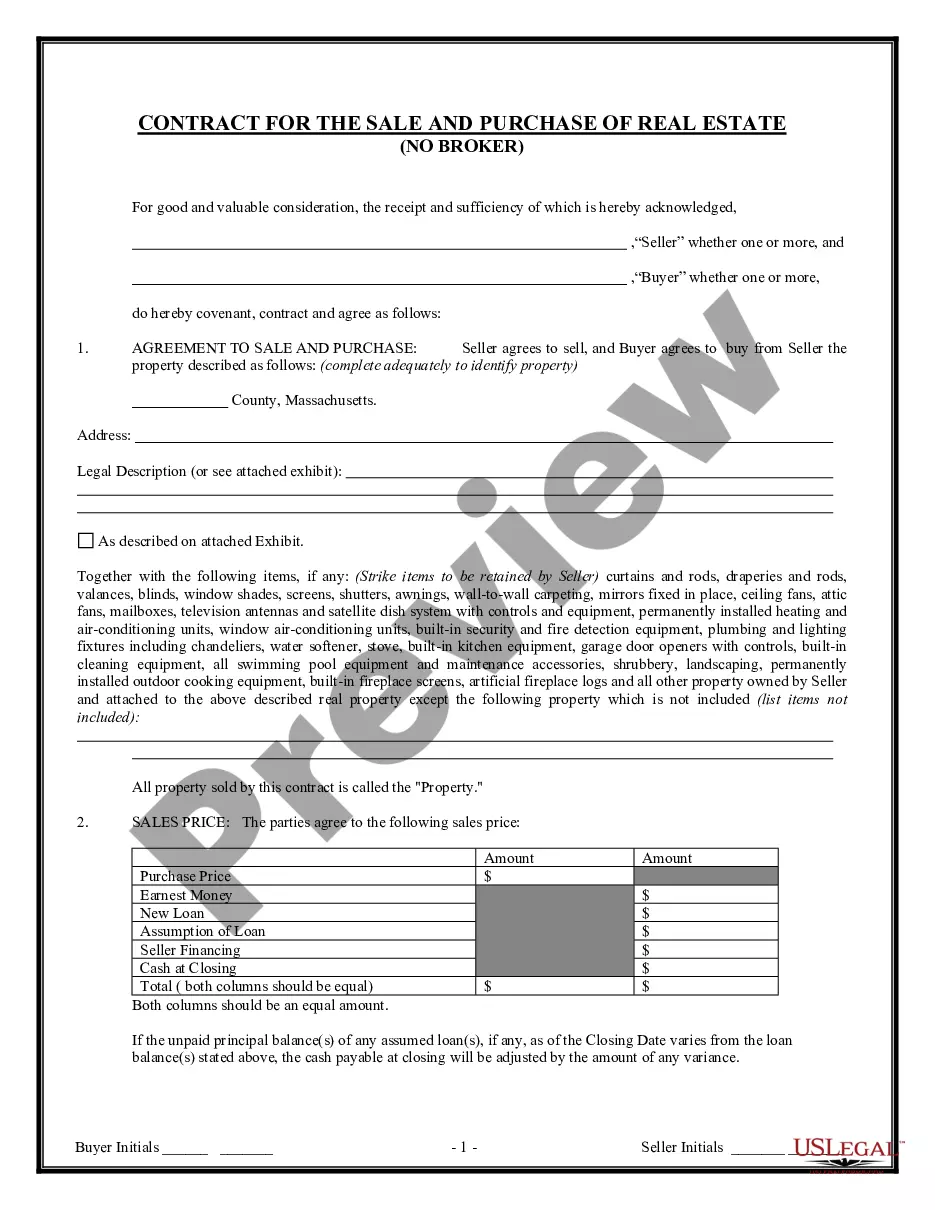

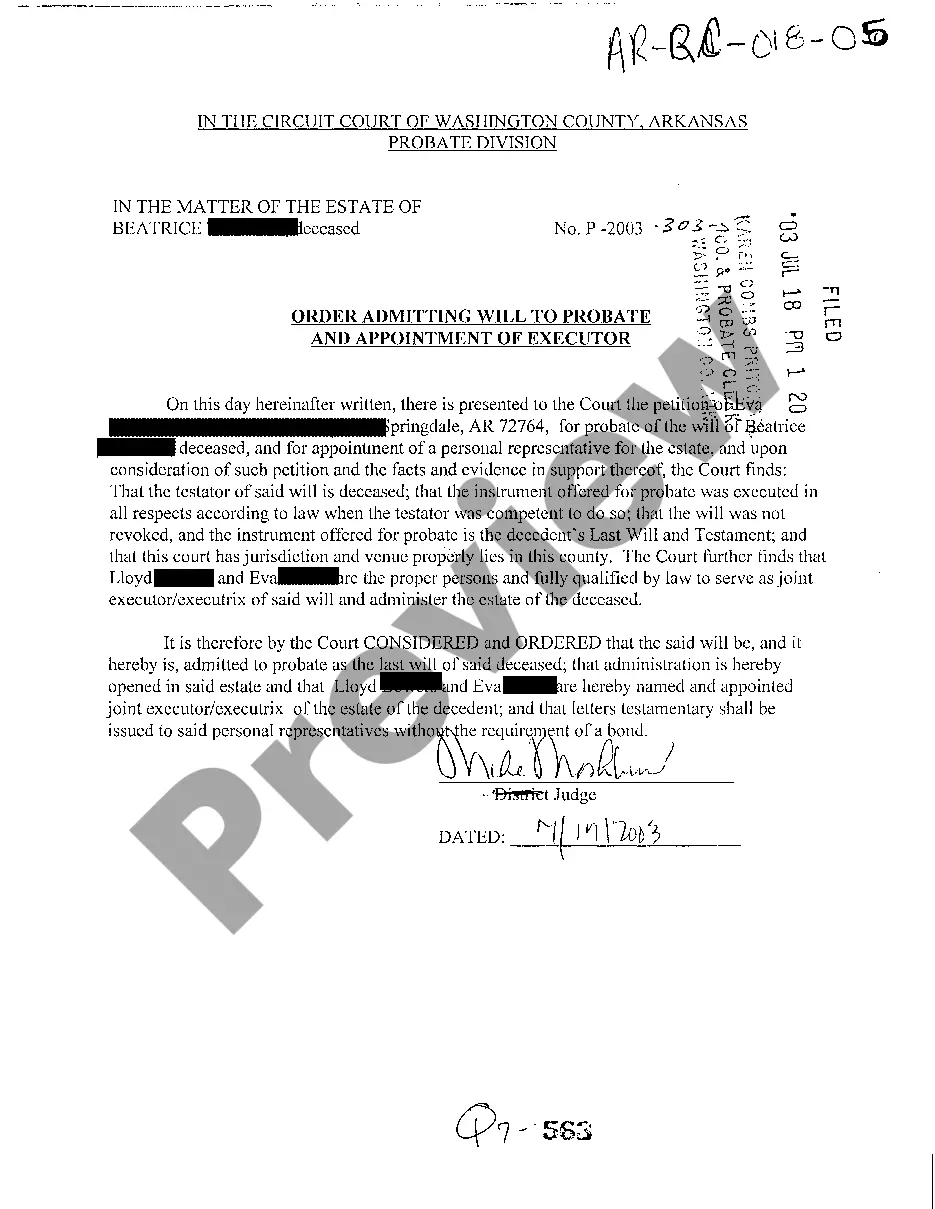

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search feature to find the Uniform Transfers With No Fee template you need.

- Obtain the template if it fulfills your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the suitable pricing option.

Form popularity

FAQ

Because money placed in an UGMA/UTMA account is owned by the child, earnings are generally taxed at the child's?usually lower?tax rate, rather than the parent's rate.

The minor does have to pay taxes, as they are the owner of the UTMA account. However, there are some benefits of the account belonging to the child and not the custodian.

Cons Greater impact on financial aid. Because they're held in the name of the child, UTMA/UGMA accounts hurt financial aid eligibility more than comparable 529 plans. Money becomes the child's at majority. ... Transfers are irrevocable.

First, for a UTMA account, the parents and other contributors can add any type of assets, such as stocks, bonds, art, and other financial and physical assets. The greater range allows the child to receive varying returns on their financial assets, which diversifies their risk and maximizes their potential for profit.

Anyone can contribute to a UTMA account, but their contribution is considered an irrevocable gift. This means only the custodian has the right to withdraw funds, and it has to be for the child's benefit. The custodian has a fiduciary duty to act in the child's best interest.