Uniform Transfers To Minors Act Florida

Description

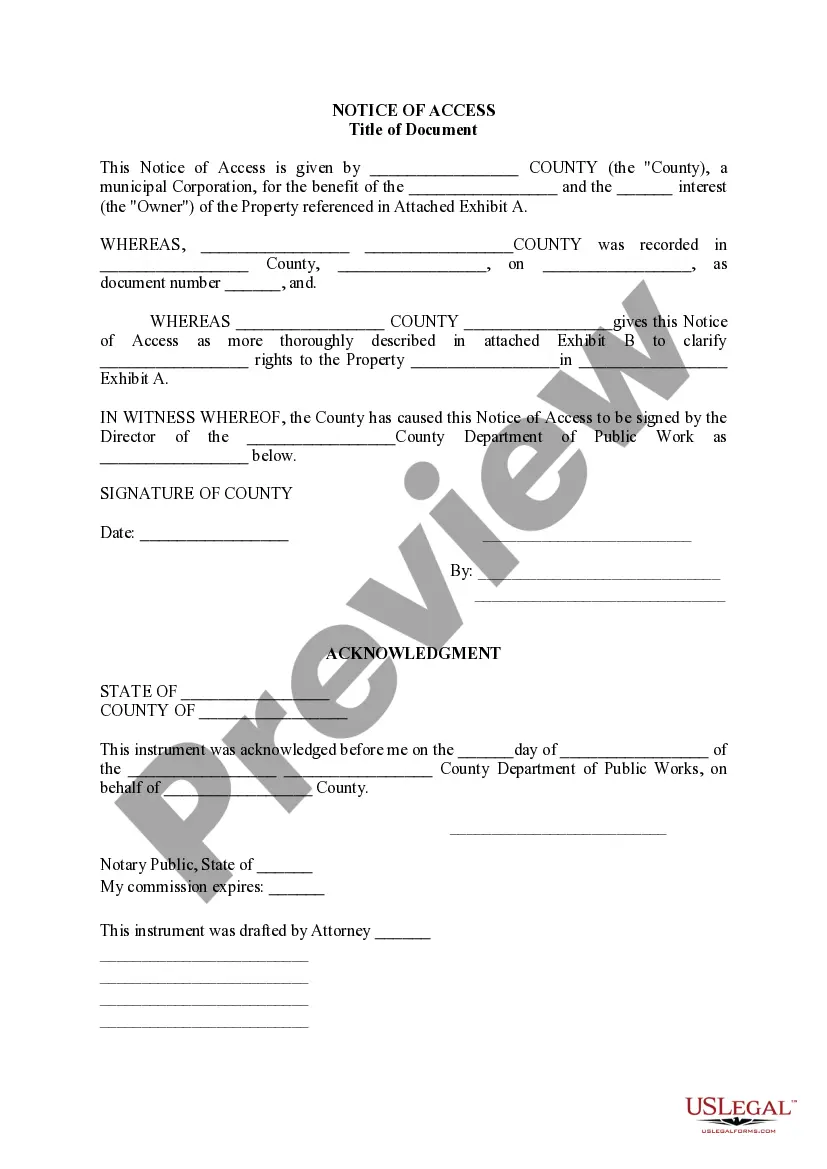

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

Drafting legal paperwork from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more cost-effective way of creating Uniform Transfers To Minors Act Florida or any other documents without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual catalog of over 85,000 up-to-date legal documents covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-specific templates carefully prepared for you by our legal specialists.

Use our website whenever you need a trusted and reliable services through which you can easily find and download the Uniform Transfers To Minors Act Florida. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes minutes to set it up and explore the library. But before jumping straight to downloading Uniform Transfers To Minors Act Florida, follow these tips:

- Review the form preview and descriptions to ensure that you have found the document you are searching for.

- Make sure the template you select complies with the requirements of your state and county.

- Choose the right subscription option to purchase the Uniform Transfers To Minors Act Florida.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us now and transform form completion into something easy and streamlined!

Form popularity

FAQ

B or 1099DIV should be received at the end of the tax year from the financial institution handling the UGMA/UTMA account to report any interest or earnings on the account.

Transferring a UTMA account to a child is simple. You can do so with most financial or investment institutions. You can also consult a tax or business lawyer to help you set up the legal structure, although most financial institutions can do this for you.

Under the UTMA, the minor is precluded from making any withdrawals until reaching the age of 21, not 18. Once the minor has reached the age of 21, the custodian should transfer ownership of the account to the minor.

UGMA/UTMA account assets can be transferred into a new account established by the now adult beneficiary as a sole or joint owner.

Effective July 1, 2015, Florida Statute 710.123 allows the custodian of a UTMA account to delay effective control of the assets until age 25 rather than the automatic transfer of control when the beneficiary turns 21.