Uniform Transfers To Minors Act

Description

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

Whether for business purposes or for personal matters, everybody has to deal with legal situations sooner or later in their life. Filling out legal papers demands careful attention, beginning from choosing the correct form template. For example, when you select a wrong edition of a Uniform Transfers To Minors Act, it will be rejected when you submit it. It is therefore important to have a reliable source of legal papers like US Legal Forms.

If you have to get a Uniform Transfers To Minors Act template, stick to these simple steps:

- Find the sample you need using the search field or catalog navigation.

- Look through the form’s description to make sure it fits your case, state, and county.

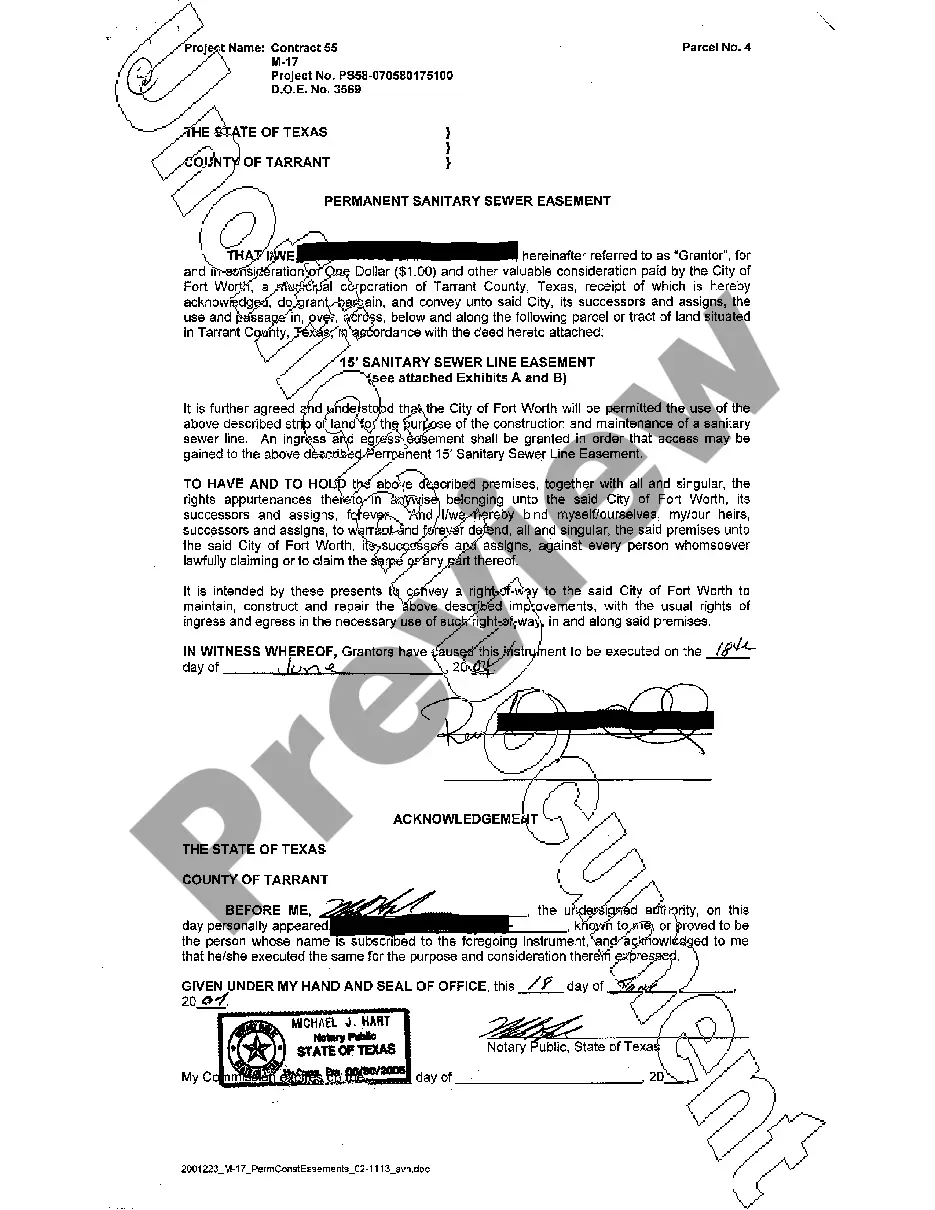

- Click on the form’s preview to view it.

- If it is the wrong document, go back to the search function to find the Uniform Transfers To Minors Act sample you need.

- Get the template when it meets your needs.

- If you have a US Legal Forms profile, click Log in to access previously saved files in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Choose the document format you want and download the Uniform Transfers To Minors Act.

- When it is downloaded, you can complete the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you don’t need to spend time looking for the right sample across the web. Utilize the library’s simple navigation to find the right form for any situation.

Form popularity

FAQ

UTMA allows the property to be gifted to a minor without establishing a formal trust. The donor or a custodian manages the property for the minor's benefit until the minor reaches a certain age. Once the child reaches a specified age set by the state, the child will have full control over the property.

UGMA/UTMA account assets can be transferred into a new account established by the now adult beneficiary as a sole or joint owner.

B or 1099DIV should be received at the end of the tax year from the financial institution handling the UGMA/UTMA account to report any interest or earnings on the account.

Transferring a UTMA account to a child is simple. You can do so with most financial or investment institutions. You can also consult a tax or business lawyer to help you set up the legal structure, although most financial institutions can do this for you.

Because money placed in an UGMA/UTMA account is owned by the child, earnings are generally taxed at the child's?usually lower?tax rate, rather than the parent's rate. For some families, this savings can be significant. Up to $1,050 in earnings tax-free. The next $1,050 is taxable at the child's tax rate.