Oil Gas Royalty Purchase Format

Description

How to fill out Oil, Gas And Mineral Royalty Transfer?

Finding a go-to place to take the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Finding the right legal documents demands accuracy and attention to detail, which explains why it is vital to take samples of Oil Gas Royalty Purchase Format only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You can access and view all the information about the document’s use and relevance for the situation and in your state or county.

Consider the listed steps to finish your Oil Gas Royalty Purchase Format:

- Make use of the catalog navigation or search field to find your template.

- Open the form’s information to check if it suits the requirements of your state and region.

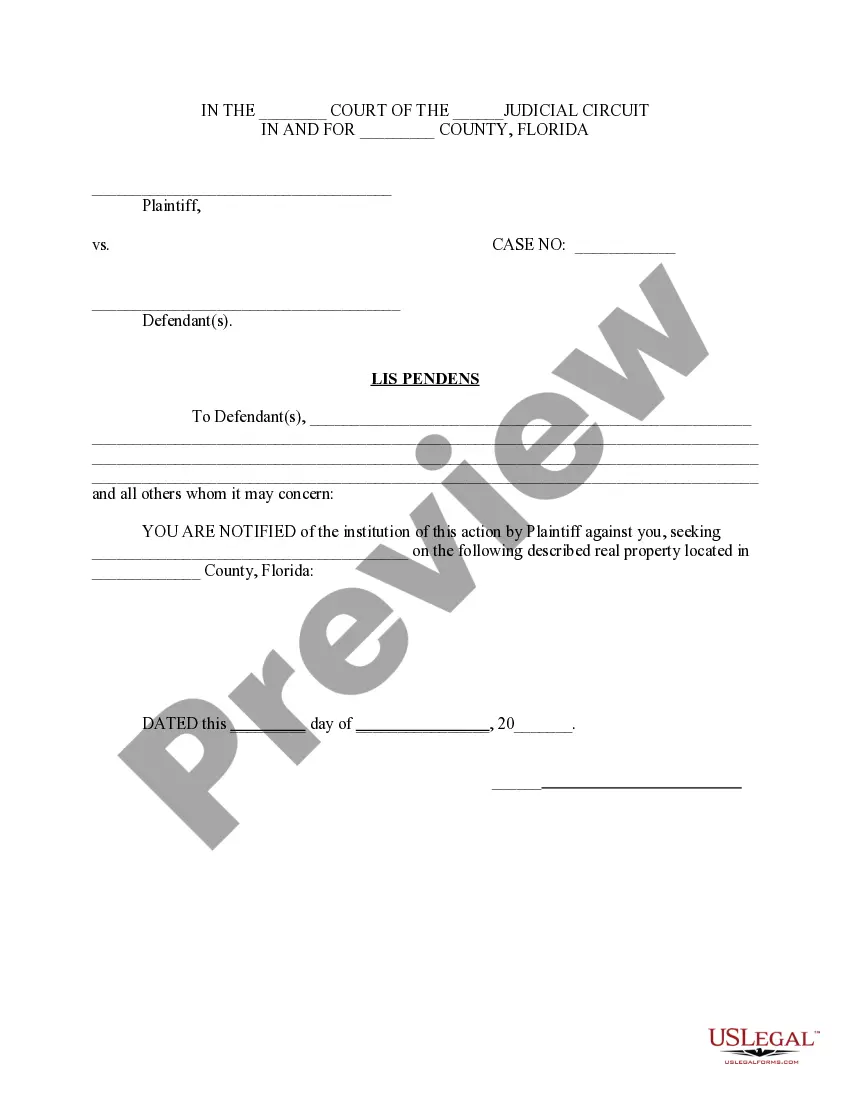

- Open the form preview, if available, to make sure the template is definitely the one you are interested in.

- Return to the search and look for the proper document if the Oil Gas Royalty Purchase Format does not suit your requirements.

- If you are positive regarding the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Choose the pricing plan that suits your needs.

- Proceed to the registration to complete your purchase.

- Complete your purchase by choosing a transaction method (bank card or PayPal).

- Choose the file format for downloading Oil Gas Royalty Purchase Format.

- When you have the form on your gadget, you may alter it using the editor or print it and finish it manually.

Get rid of the hassle that comes with your legal documentation. Check out the extensive US Legal Forms catalog where you can find legal templates, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

You generally report royalties in Part I of Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss. However, if you hold an operating oil, gas, or mineral interest or are in business as a self-employed writer, inventor, artist, etc., report your income and expenses on Schedule C.

The easiest way to invest for royalty income is by purchasing shares of a royalty trust. These are publicly traded corporations that acquire ownership of rights to leases and deposits of oil, gas and minerals. The income generated from royalties is distributed to shareholders as dividends.

It is calculated as follows: Volume X Price ? Deductions ? Taxes X Owner Interest = Your Royalty Payment. Whether you are a mineral owner receiving royalty checks or just wanting to know what your minerals are worth, LandGate knows what they are worth and can market your minerals to get you the most money.

The base formula for royalty calculation is royalty revenue = sales x royalty percentage. You can choose to keep things old school, and do the math for each and every SKU.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.